FX Daily Strategy: APAC November 1st

Focus on US employment report but weather and strikes may limit reaction

USD and higher yielders vulnerable to safe havens if equity weakness continues

CHF strength unlikely to reverse much ahead of the US election

GBP post-budget weakness can extend further

Focus on US employment report but weather and strikes may limit reaction

USD and higher yielders vulnerable to safe havens if equity weakness continues

CHF strength unlikely to reverse much ahead of the US election

GBP post-budget weakness can extend further

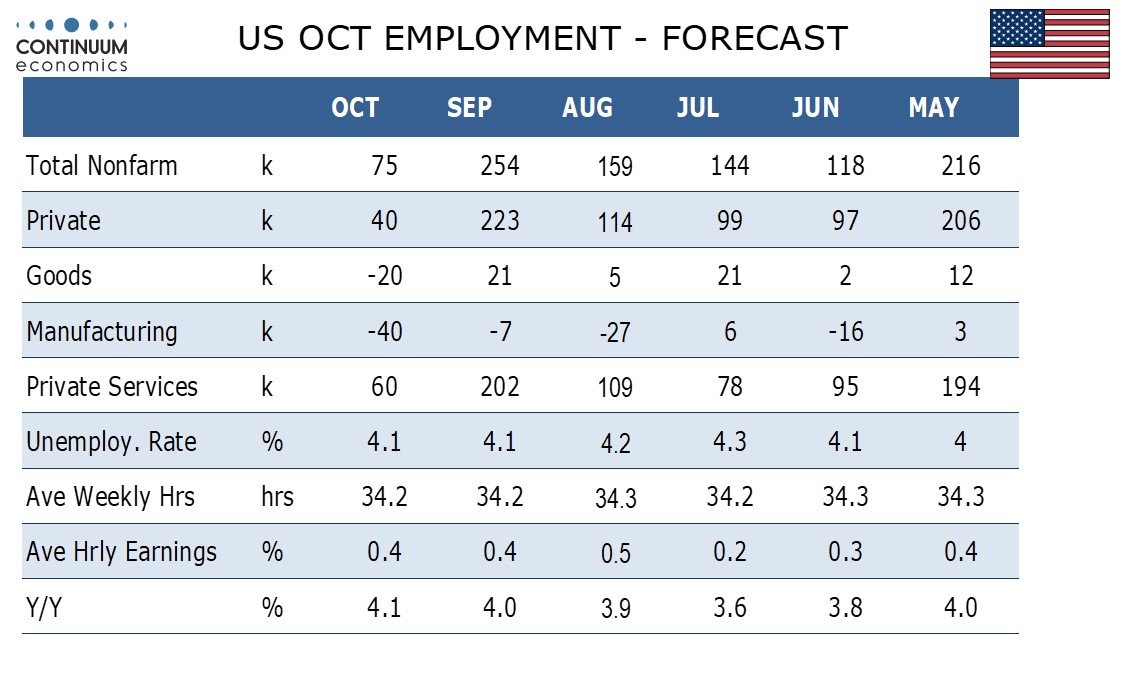

The US employment report is the main focus on Friday, although this time around the reaction may be muted because the data is affected by the impact of hurricanes Helene and Milton and a strike at Boeing. We expect a below trend 75k non-farm payroll increase in October, with only 40k in the private sector. This would follow above trend gains of 254k and 223k respectively in September. While payrolls will be below trend, we expect unemployment to be unchanged at 4.1% and average hourly earnings to be on the firm side of trend with a rise of 0.4%.

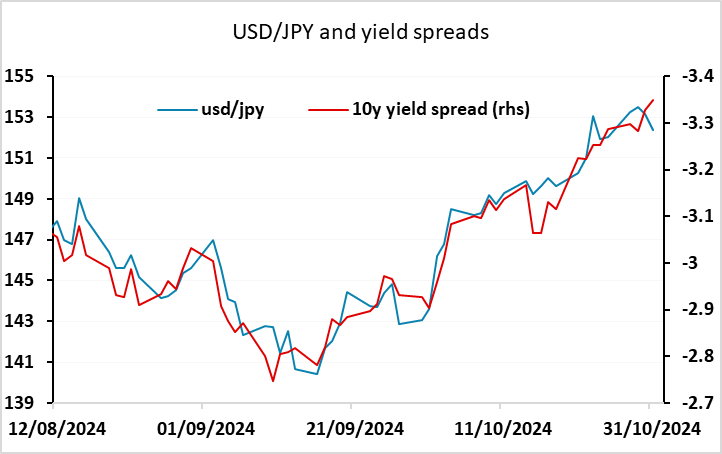

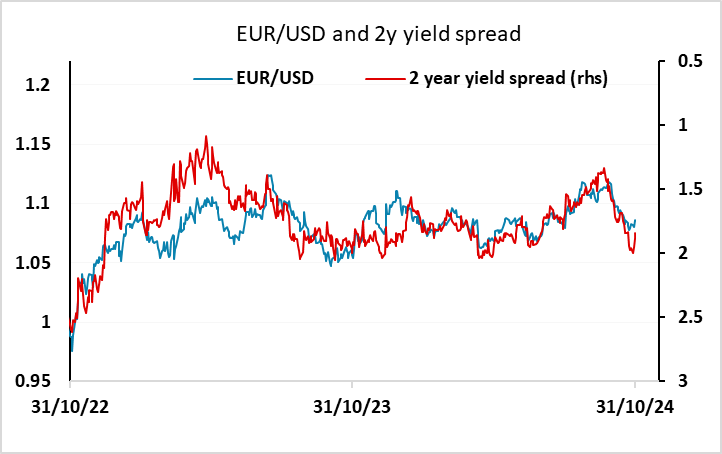

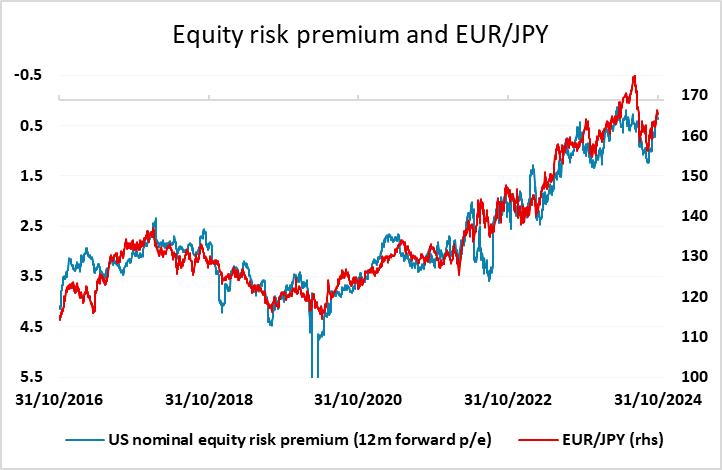

Given the special factors, market reaction should be less dramatic than it would otherwise be, but the decline in the equity market on Thursday after the disappointing Microsoft and Meta results means the momentum favours equity bears and risk aversion. The equity impact of the disappointing results was compounded by a continuing rise in US yields, with 10 year yields up to their highest since early July. The driver for higher yields may have been the decline in jobless claims in the latest week, but seems unlikely to stick if equities continue to weaken and the employment report shows weaker than expected payroll growth, even if it is affected by strikes and the weather. The USD should therefore be vulnerable against the safe havens if our forecasts are correct, while the higher yielders may also come under pressure. But this would require US yields to fall as well as equities. As it stands, equity weakness has not been sufficient to create a significant rise in the equity risk premium, and recent experience suggests that without this, the JPY will remain weak on the crosses.

Ahead of the US data there is Swiss CPI for October which is expected to remain at 0.8% y/y – well below the desired rate. While this argues for more SNB easing and/or intervention to weaken the CHF, the CHF remains is unlikely to weaken much if equities are soft, particularly ahead of the US election given the uncertainty that engenders. The CHF in any case doesn’t tend to react much to domestic news or yield moves. Nevertheless, the extremely high level of the CHF against the JPY means that we prefer the JPY as a safe haven in these circumstances.

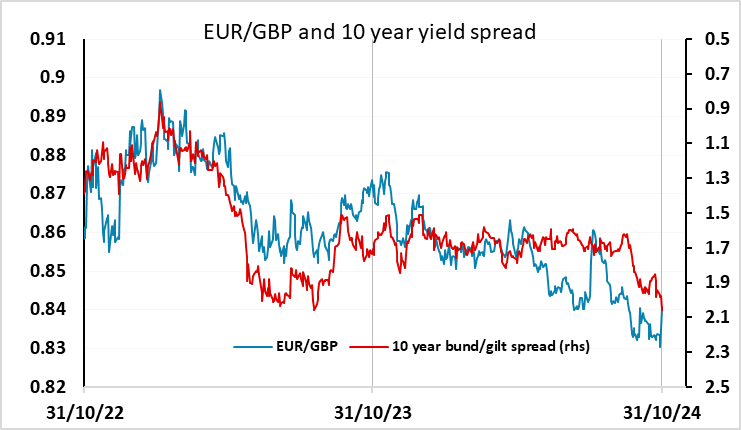

Among the higher yielders, GBP was the worst performer on Thursday, falling back at the same time as UK yields rose sharply. This indicates the GBP move represents a loss of confidence rather than a reaction to expected policy moves. Monetary policy is expected to be eased slightly less than was expected pre-Budget due to the big stimulus planned for next year, but the decline in the pound suggests that the FX market sees the Budget echoing the Truss budget of 2022, with too much spending and too much debt. There is little the UK authorities can do to prevent the GBP decline – the Budget isn’t going to be abandoned a la Truss. But the decline was to some extent overdue, as GBP has gained in recent weeks even though yield spreads have been steady. Bigger picture, it can still be argued that GBP is cheap relative to historic yield spread correlations, but from a pure valuation perspective the pound is already at high levels against the EUR, so we see risks towards 0.85 in EUR/GBP in the short term.