FX Daily Strategy: N America, November 29th

JPY biased higher medium term with Tokyo CPI supportive

Still some downside risks for EUR on Eurozone CPI data…

…with widening Germany/France spread also a concern

CAD may extend recovery on GDP

JPY biased higher medium term with Tokyo CPI supportive

Still some downside risks for EUR on Eurozone CPI data…

…with widening Germany/France spread also a concern

CAD may extend recovery on GDP

While the US is likely to be only partially involved on Friday after the Thanksgiving holiday, there is important data in Japan and Europe which could have an impact.

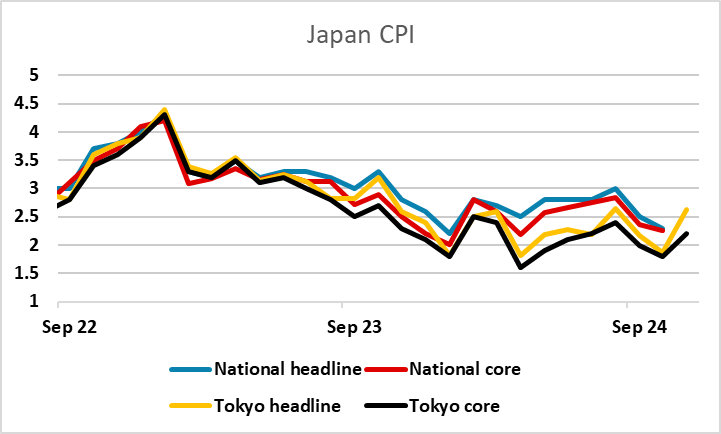

In Japan we had the Tokyo CPI data for November, which is effectively the preliminary CPI data for the month, and is probably the most significant data ahead of the December 19 BoJ meeting. A 25bp rate hike was priced as around a 50% chance ahead of the data. The consensus was for the core rate to rise to 2.1% from 1.8%, but it came in stronger than expected at 2.2%, pushing the JPY higher. Even so, there was only a marginal increase in the market pricing of the probability of a December rate hike, with around a 57% chance of a 25bp move priced after the data.

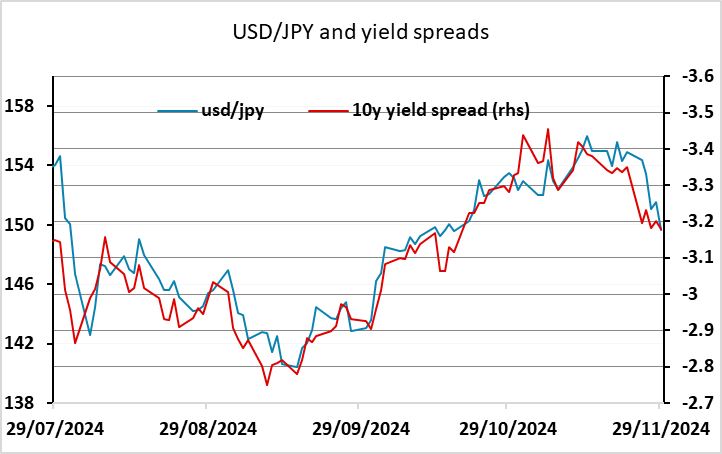

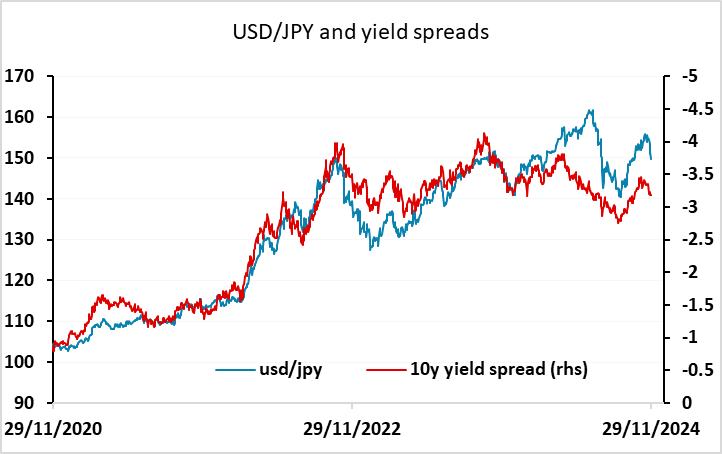

As it stands, USD/JPY still looks slightly expensive relative to the recent yield spread correlation, and more significantly expensive if the correlation is looked at from a longer term perspective. Any consideration of real values makes USD/JPY look more expensive still, so we continue to see the main risks as being on the downside. However, short term the direction will be determined by expectations of BoJ and Fed policy decisions in December, and developments in equity market sentiment. Major JPY gains continue to look much more likely in a more risk negative environment. As it stands, equities have been resilient to higher yields and risk premia are low. As long as this remains the case, JPY gains will likely be gradual and depend on narrowing of US/Japan yield spreads, but much sharper JPY gains are possible on a turn in risk sentiment.

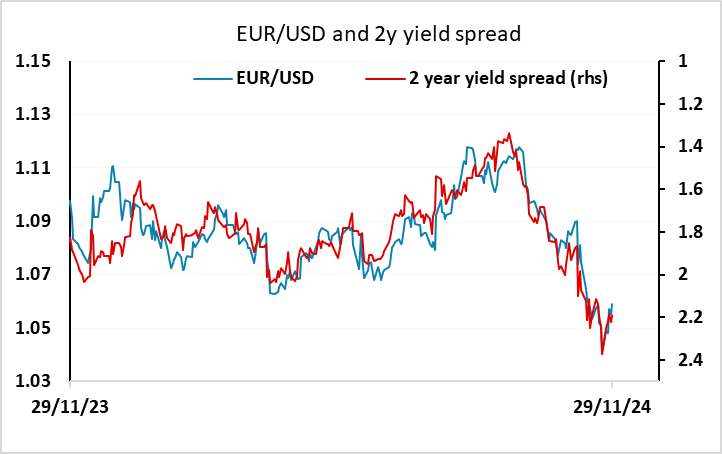

In Europe, the preliminary French, Italian and Eurozone November CPI data have been released. Following the weaker than expected German CPI on Thursday, the risks were weighted to the downside for the Eurozone CPI relative to the market consensus expectation of 2.3% headline, 2.8% core, and we did see core come in slightly below expectations at 2.7%. However, the market is still pricing less than a 20% chance of a 50bp ECB rate cut in December. We also dont see the CPI data as weak enough to trigger a 50bp move. 2 year yields are consequently likely to hold close to current levels, with a mild upside risk on a 25bp cut. But this looks consistent with the current EUR/USD range of 1.05-1.06.

There is the additional issue of widening intra-Eurozone spreads, with the 10 year France/Germany spread at post-2012 highs. While this largely reflects deteriorating French budget maths, there is a danger that we see further sharp widening if there is more evidence of weakening growth in the Eurozone in general and France in particular. The ECB may want to consider heading off this possibility with more aggressive easing. If they don’t they may be forced into more aggressive easing by markets in any case. The final Q3 French GDP data looked solid enough at 0.4%, but the recent PMI data suggests this isn’t continuing in Q4. So while it still looks like an outside chance that he ECB will cut 50bps in December, we see the risks as being towards more rapid easing than the market is pricing in, and the risks around France suggests the main short term risks for EUR/USD (and EUR/CHF) are on the downside.

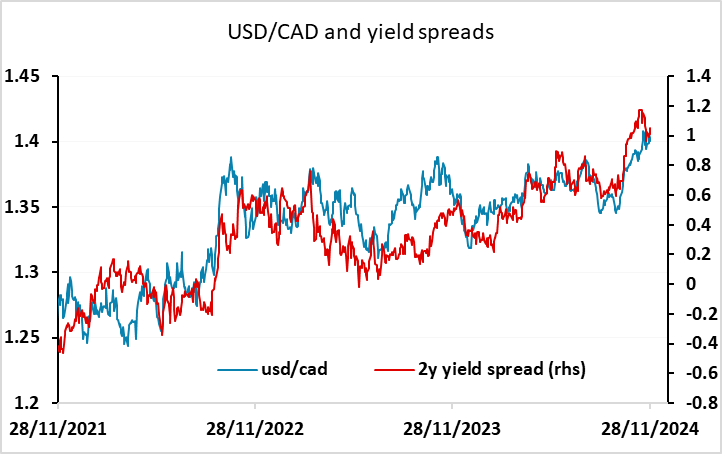

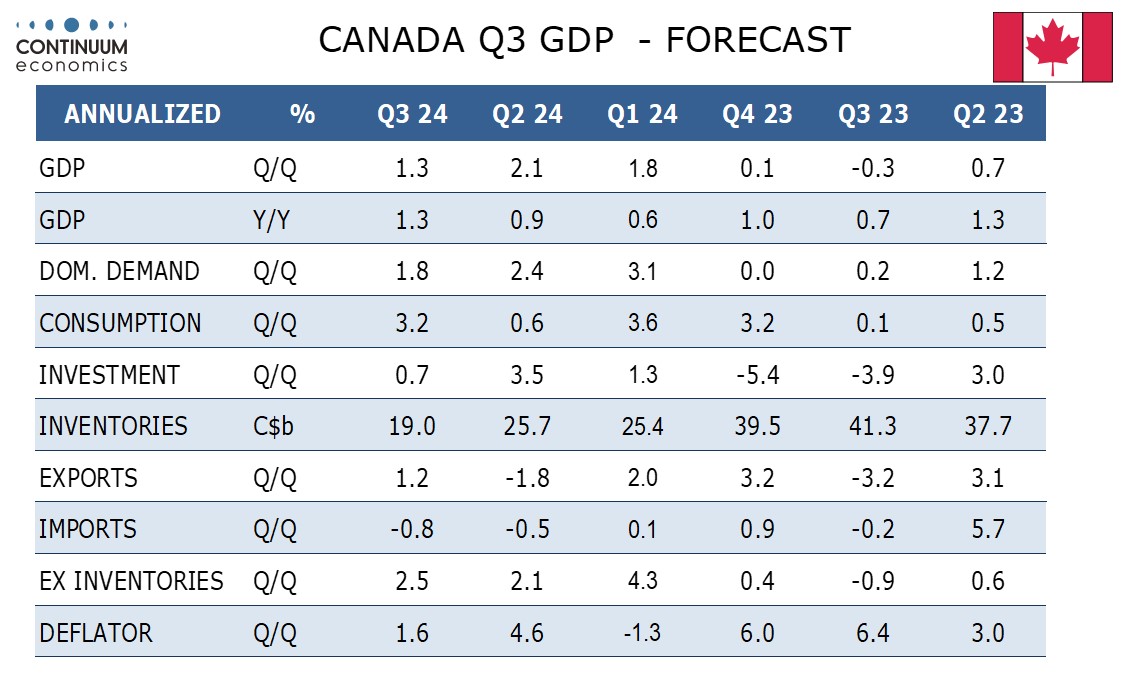

While there is nothing of much significance in the US, we do have the release of Canadian Q3 GDP. We expect this to rise by 1.3% annualized, a little below a 1.5% estimate made with the Bank of Canada’s October Monetary Policy Report and also slightly below the near 2% pace seen in the first half of the year. We do however expect the quarter to end with a stronger 0.3% rise in September GDP, in line with a preliminary estimate made with August data. Our forecast is slightly stronger than consensus, and suggests the CAD can extend to recovery from the Trump tariff remarks.