FX Daily Strategy: Asia, April 29th

Spanish GDP could provide some EUR support ahead of the major data on Wednesday

Swedish GDP could allow some corrective weakness in the SEK

GBP strength could extend modestly

JPY to move higher longer term, but may range trade short term

Spanish GDP could provide some EUR support ahead of the major data on Wednesday

Swedish GDP could allow some corrective weakness in the SEK

GBP strength could extend modestly

JPY to move higher longer term, but may range trade short term

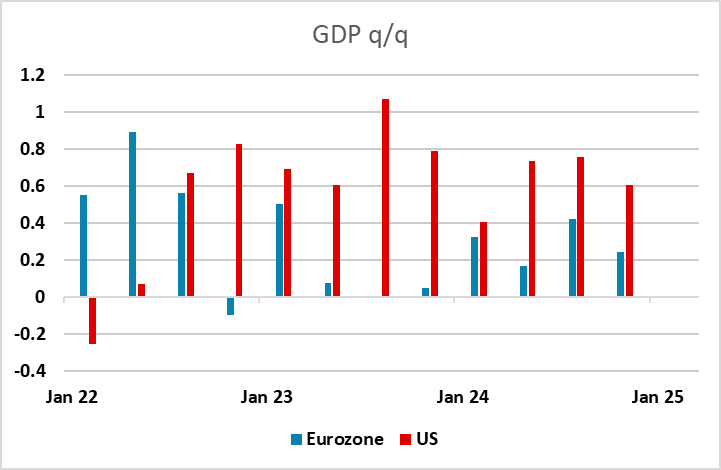

The US GDP and employment data are the main focuses this week, but we also have European GDP data, and Tuesday sees Swedish and Spanish Q1 GDP. The market consensus is for a 0.2% rise in the volatile Swedish GDP data, and a 0.7% rise in the Spanish data. Spain has been one of the best performers in the Eurozone, helped by substantial immigration, and another set of solid numbers could provide some support for the EUR, although the German, French and Italian numbers due on Wednesday will be the main focus. The market consensus for the Eurozone as a whole is for a 0.2% q/q rise, while the US is expected to only manage 0.1% (although our forecast is for a small negative). If so, this would be the first time Eurozone GDP has exceeded the US since the pandemic affected Q2 2022. This background suggests that the market will be inclined to favour the EUR this week ahead of the data, unless we see a downside surprise from Spain.

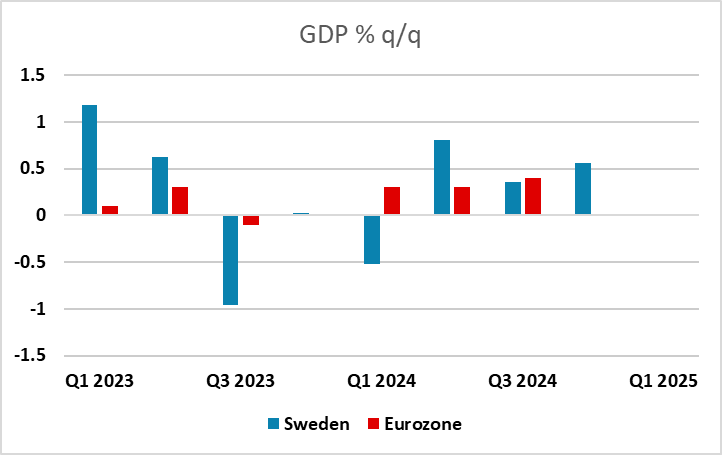

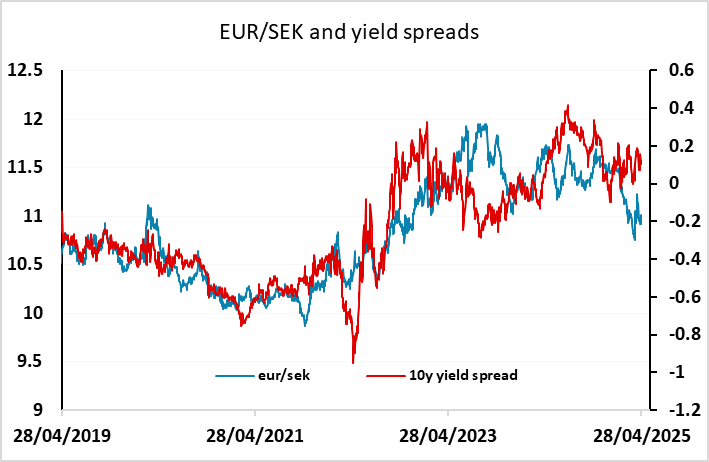

The SEK has continued to perform strongly, and Swedish GDP has been on a clear upward trend through 2024, generally outperforming the Eurozone. But we may see similar Swedish and Eurozone growth in Q1, which might be a reason for recent SEK strength to moderate. EUR/SEK has declined somewhat further than yields have suggested, and the SEK certainly looks expensive versus the NOK as well as the EUR.

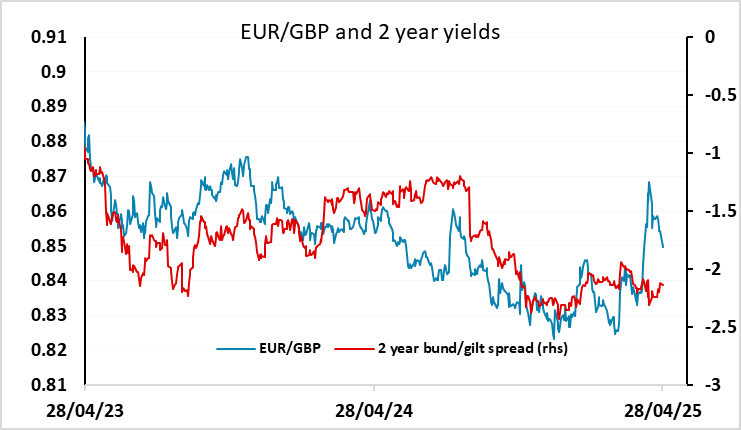

In general, the markets were fairly quiet on Monday but the USD did show a negative tone, particularly against the JPY and GBP. GBP lost ground in the immediate reaction to the tariff sell off, but as markets have calmed there is scope for EUR/GBP to move back towards the level suggested by yield spreads. While GBP is still likely to be vulnerable to any renewed risk aversion, we doubt that GBP will suffer against the EUR as much as it did in the first sell off. The prospect of a new deal with the EU being discussed at the May 19 meeting should mean that GBP holds steadier against the EUR in the short run.

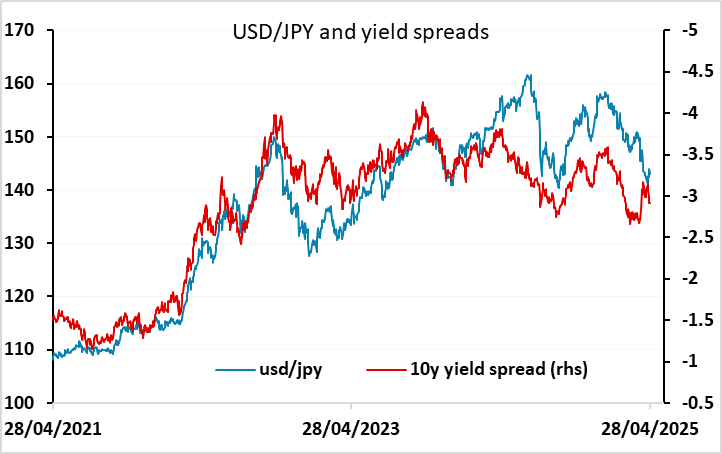

JPY strength on Monday suggests that the correction seen through the last week is now close to complete, but it will still take another period of risk aversion if USD/JPY is to break below 140. This could be seen after the US GDP data on Wednesday, but for now we are likely to see a period of consolidation in the 140-144 range.