FX Daily Strategy: Europe, June 18th

RBA to stay put, but some upside AUD risks

US retail sales unlikely to change the underlying USD picture

EUR stabilising but still some downside risks on French politics

JPY weakness extends but should fade

RBA to stay put, but some upside AUD risks

US retail sales unlikely to change the underlying USD picture

EUR stabilising but still some downside risks on French politics

JPY weakness extends but should fade

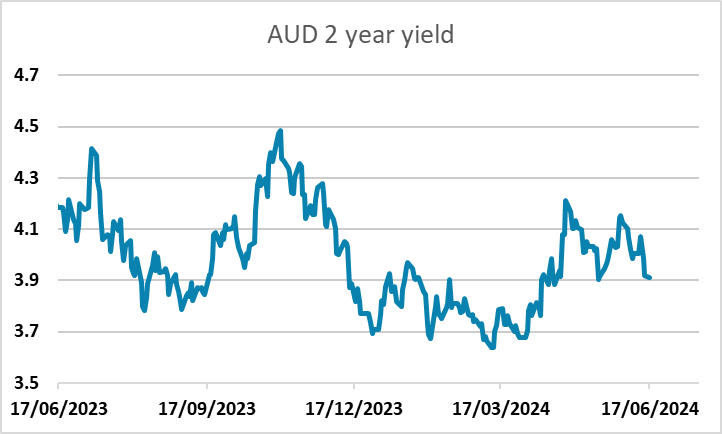

The RBA decision on Tuesday morning is not expected to produce any change in policy. There is nothing priced in, and 43 out of 43 forecasters are looking for no change in policy. So it would be a huge surprise if there was a change in the policy rate, but there could still be an impact if the RBA provides some guidance on future policy. The market is currently pricing 15bps of easing by year end, but was quite recently pricing nothing at all, so the risks may be for the current easing to be priced out rather than more easing to be priced in. The risks should therefore be slightly on the AUD upside.

The RBA has kept the cash rate on hold at 4.35% as per our forecast. The current inflation picture does not support any change of monetary policy from the RBA despite the latest quarterly and monthly CPI both showing a 3.6% y/y growth, eliminating the possibility of any early easing from the RBA . The key forward guidance statement of "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out." continue to points towards data dependency in future RBA's meeting. RBA continue to forecast inflation to be back in target range in mid 2025 but they have acknowledged that inflation is moderating at a slower pace than expected.

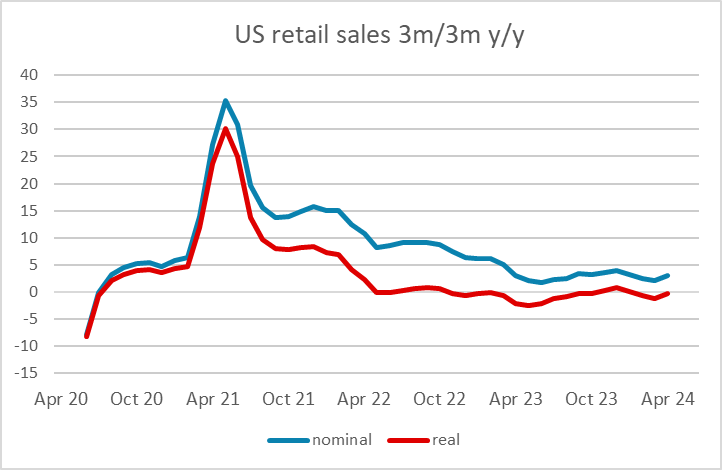

The main US data is retail sales. We expect a modest 0.2% increase in May retail sales with ex auto sales increasing by only 0.1%. The data will however be restrained by lower gasoline prices and ex autos and gasoline we expect an increase of 0.3%. Our forecasts is marginally weaker than the market consensus, but not enough to make a practical difference to the market. The retail sales trend is fairly flat, especially in real terms, with the real y/y rate hovering close to zero for the last couple of years. So while the volatility in the data means there is every possibility of a knee-jerk reaction, we doubt the data will be significant for policy or the USD in anything other than the very short term.

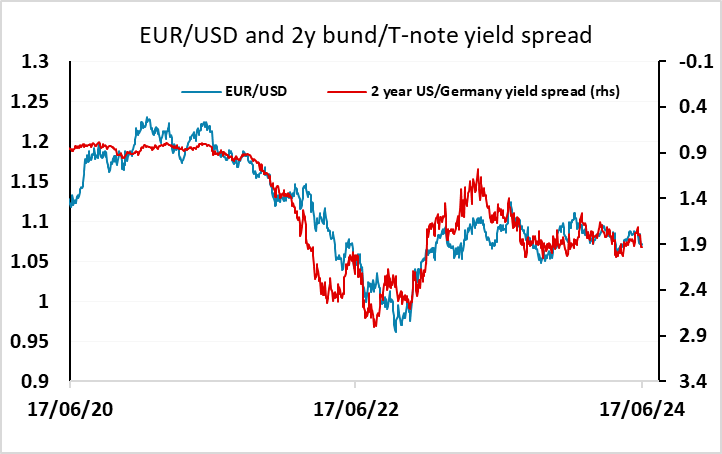

The EUR managed something of a recovery on Monday, particularly against the JPY, after a sell off at the end of last week on the back of political concerns surrounding the French elections. The outlook for the French election hasn’t changed – it still looks like the right-wing populists RN will win the largest proportion of the vote in the first round, but there seems to be little chance of any single party or even any realistic coalition managing to secure a majority. In practice this may mean deadlock and prevent the tightening of fiscal policy which had been intended, and this has undermined confidence in French debt and triggered a widening of the France/Germany spread. But there was no further widening on Monday, and it may be that the situation is now broadly priced in. German yields have fallen (as the France/Germany spread has widened) and at these levels suggest EUR/USD can stay stable close to 1.07, but risks still look to be on the downside short term.

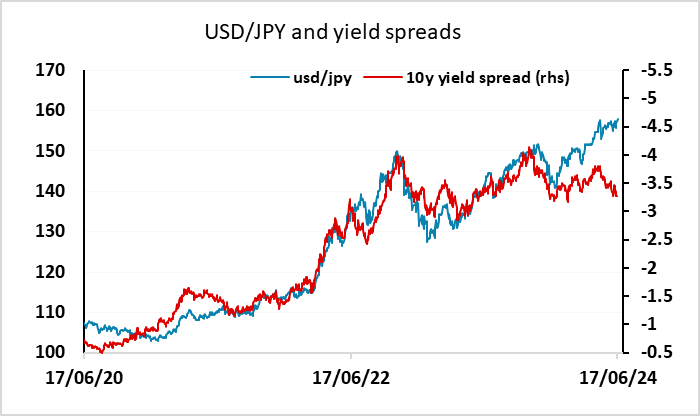

The JPY was once against the big loser on Monday, with USD/JPY pressing up against the 158 level and EUR/JPY back above 169, revering most of Friday’s losses. The JPY’s decline reflected a generally higher yield profile in the US and Europe, but this came about without any real news and looks like a technical correction to last week’s dip. In any case, USD/JPY continues to trade well above the levels suggested by yield spreads, and intervention risks rise above 158, so at this stage we wouldn’t look for any significant extension of JPY weakness. But a renewed deterioration in risk sentiment looks necessary to trigger any sustained JPY recovery.