FX Daily Strategy: Asia, August 7th

Labour Market Softness to Trigger Further BoE Cut

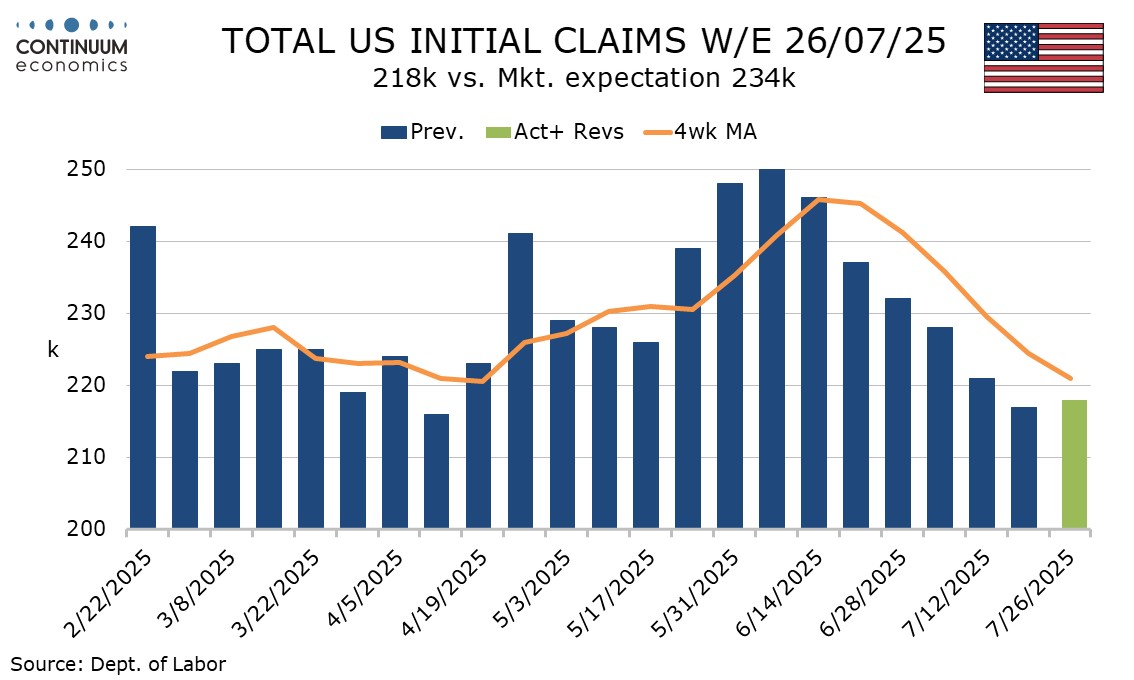

U.S. Jobless Claims May still be low

Japanese Household Spending Should See Modest Growth

Could see some JPY Weakness

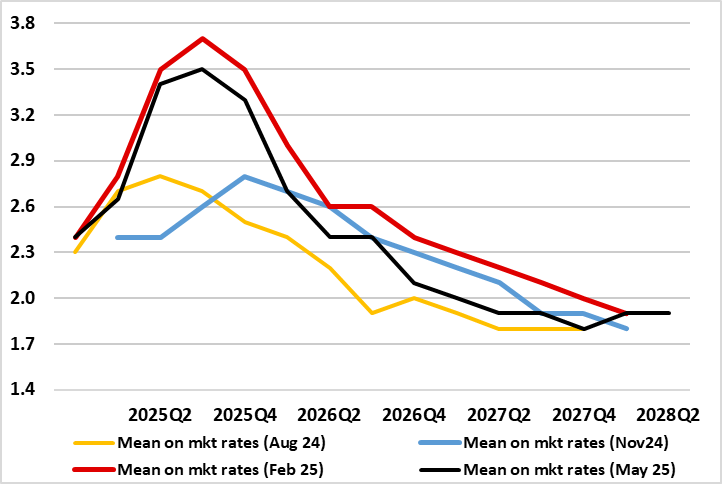

Figure: BoE Projections to Suggest Still-Deferred Inflation Back Below Target

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision. Likely to discuss its two alternative scenarios still, it is clear that previous MPC concerns about a ‘tight’ labor market have been diluted. But the hawks may stress a possibly slightly less unfavourable trade outlook given the ‘deal’ with the U.S. as well as higher CPI inflation numbers. Even so, beyond even softer labor market numbers (Figure 2), there are other concerns that the BoE will have to consider, not least signs of consumer dissaving (Figure 3) and a likely further and possibly marked fiscal tightening. The problem is that neither, because of a lack of detail, can be incorporated into the updated BoE projections. Thus, the message from those projections, likely still to show inflation below target perhaps only from 2027 (Figure) may be misleading although likely to mean that ostensibly the Monetary Policy Statement will still repeat the need for policy to be framed carefully as well as gradually.

It is also likely to see the MPC repeating that monetary policy will need to continue to remain restrictive for sufficiently long – the question being whether those recent dissenters reject this line of thinking – and there may be a three-way split this time around. Back in June, partly based on what was seen as a ‘material further loosening in labour market conditions’, Dep Governor Ramsden (as he did twice in 2024) dissented in favor of a 25 bp rate cut, thereby adding to the more longstanding such demands from his colleagues Taylor and Dhingra. But the issue of what constitutes restriction is also important (recently, the lower BoE policy rate has not stopped there being tighter financial conditions) as it should help determine how much further and when the BoE eases.

Last week's initial claims with a 1k rise to 218k may have marginally broken a string of six straight declines but are lower than expected, suggesting easing of labor market downside risks as tariff fears fade. Despite a marginal rise, it is still close to the four month low. Continued claims were also lower than expected, with previous revision lower. An uptrend in the 4-weeka average appears to have peaked though we have seen less of a reversal than is the case in initial claims. Continued claims cover the week before initial claims.

Japan's June Overall Household Spending will be released by the ending hour of the day. It is expected for household spending to continuously grow after a strong May. We believe it is unlikely to see a similar magnitude of growth despite strong wage growth as real wage remain negative. Private consumption should increase gradually as Japanese residents adapt the higher prices and resume consumption on higher nominal wage. Household spending is also crucial in BoJ's interest rate decision. Its dynamics with inflation needs to remain favorable for the BoJ to hike further. If we see a contraction in household spending, it would points toward a lower likelihood of an imminent hike from the BoJ.

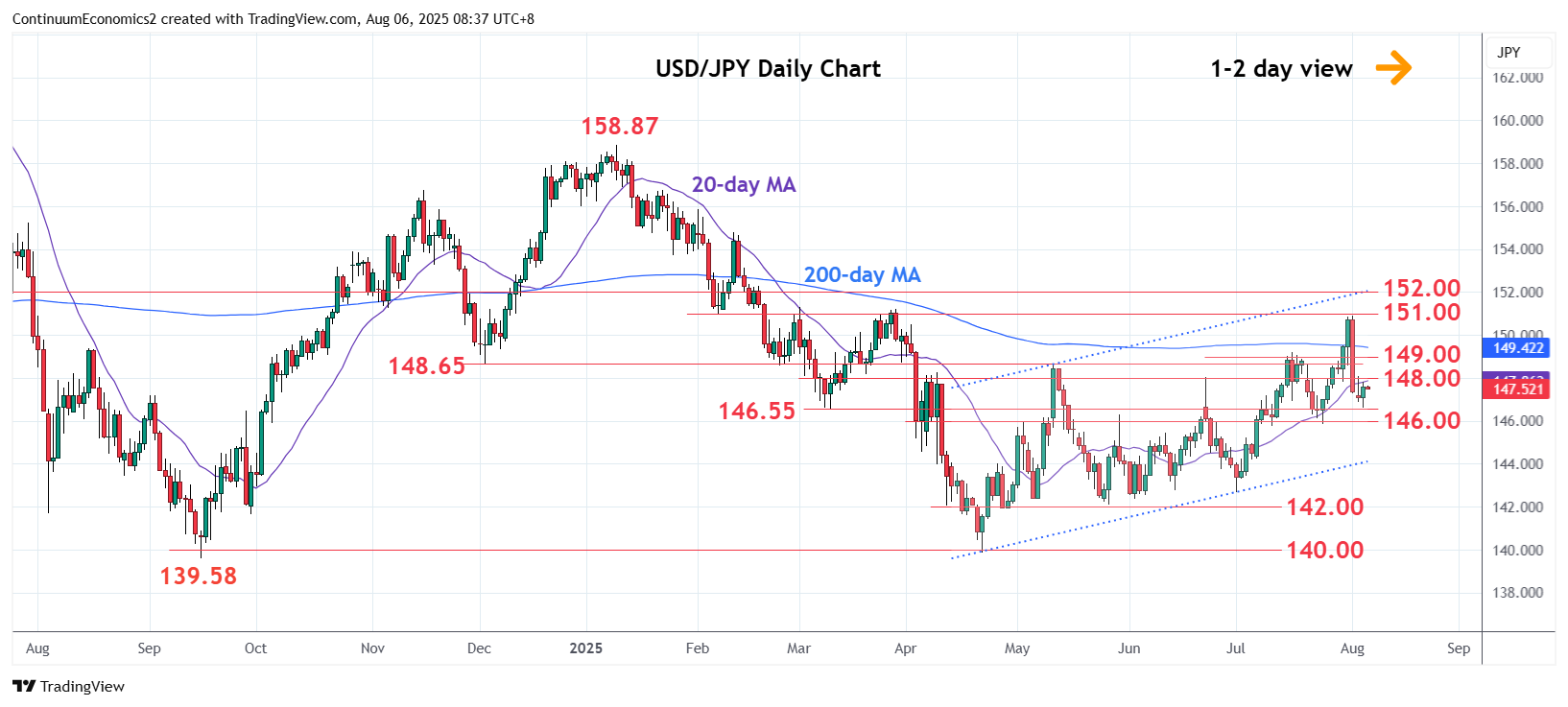

The USD/JPY has corrected from over 150 figure on broad USD weakness. There seems to have a lack of impetus for JPY to strengthen sustainably, given the ambiguous stance of BoJ and uncertainty regarding the details of U.S.-Japan trade agreement. Looking forward, if we do not see any solid remarks from the BoJ, it seems inevitable USD/JPY will be at th mercy of USD movement.

On the chart, there is limited on break of the 147.00 level as prices turned up in consolidation from the 146.55 support to unwind oversold intraday studies. However, the daily and weekly studies are unwinding overbought readings and suggest consolidation to give way to renewed selling pressure later to further retrace the April/August gains. Nearby see strong support at the 146.55/146.00 area. Break here will see further extension to the 145.00 congestion and 144.00, April channel support. Meanwhile, resistance is lowered to the 148.00 congestion which is expected to cap and sustain losses from 150.90 high.