Preview: Due November 14 - U.S. October PPI - Subdued on the month but yr/yr rates edging higher

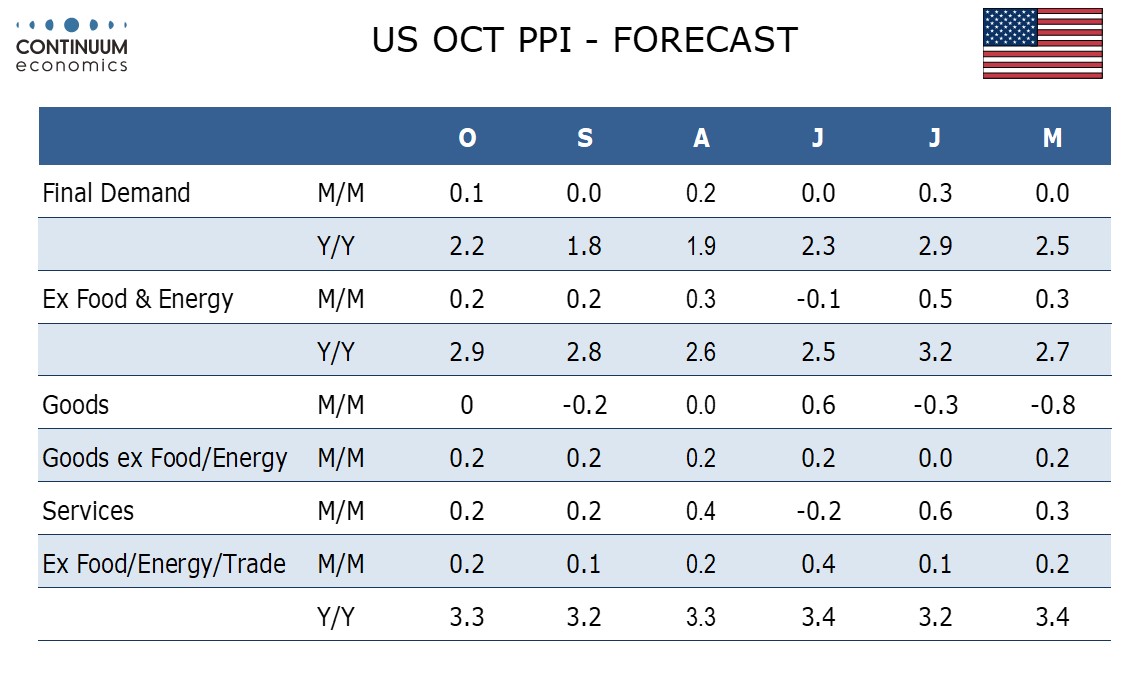

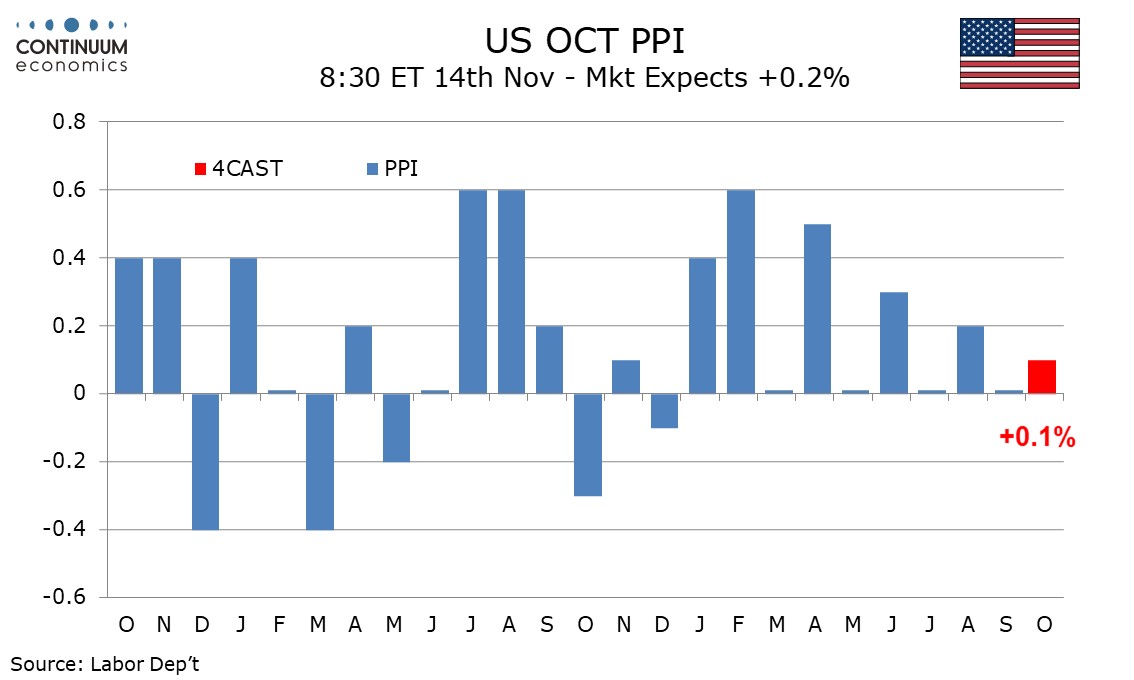

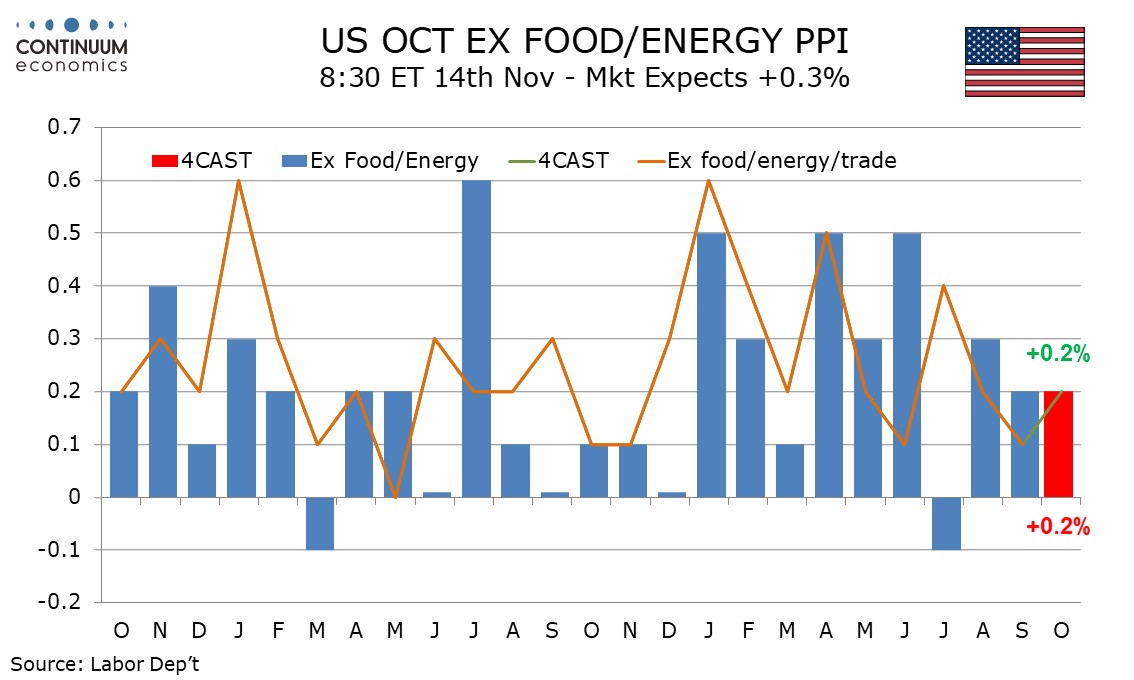

We expect October PPI to maintain a subdued profile, rising by 0.1% overall and by 0.2% in both core rates, ex food and energy and ex food, energy and trade. This would be in line with recent trend but slower than seen in the first half of the year.

Gasoline prices are likely to lead a third straight decline in energy though there may be some upside risk in food as a consequence of recent hurricanes. We expect a limited impact from the hurricanes on the core rates though a modest boost is not to be ruled out. There is however little suggestion in recent price surveys for any renewed strength.

Gains of 0.2% in the core rates would be in line with the picture seen through Q3 and in the case of the ex food, energy and trade series, late Q2 as well. Apart from a firm January trends were subdued through 2023 but did show some strength in early 2024.

Our forecast suggests yr/yr data will pick up to a 3-month high of 2.2% overall from 1.8%, while ex food and energy at 2.9% yr/yr from 2.8% would be a 4-month high, with weakness a year ago dropping out. The ex food and energy rate has been narrowing its underperformance of ex food, energy and trade PPI, where we expect a marginal gain to 3.3% yr/yr from 3.2%, reversing a modest September dip.