FX Daily Strategy: Europe, July 3rd

Plenty of US data ahead of the July 4 holiday

ADP may be the main focus

Powell on the dovish side

Some risk of position squaring ahead of the holiday

Plenty of US data ahead of the July 4 holiday

ADP may be the main focus

Powell on the dovish side

Some risk of position squaring ahead of the holiday

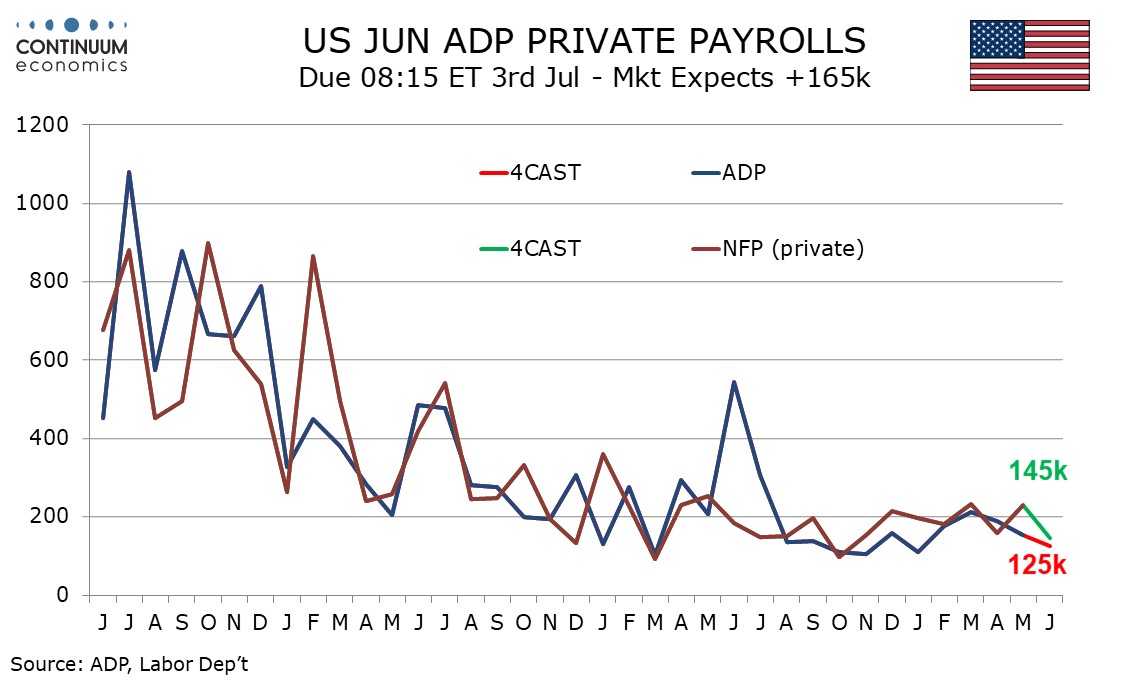

With the July 4 US holiday on Thursday, there is a fair bit of data crammed into the Wednesday calendar, with the jobless claims data as well as the ADP employment numbers and the ISM services data. The ADP data may be the biggest focus, even though they haven’t tended to be a reliable indicator for the official employment data.

We expect a 125k increase in June’s ADP estimate for private sector employment growth, which would be the slowest since January and softer than the 145k increase we expect for private sector non-farm payrolls. We expect overall payrolls including government to rise by 185k. Most recent months have seen ADP data underperform the non-farm payroll, though April was a rare exception outperforming by 30k, corrected by an underperformance of 77k in May. The 20k underperformance we expect in June would be in line with recent trend. A number in line with our forecast would probably have no market impact, as it is broadly consistent with market consensus for the payroll number, and we would probably have to see something less than 100k or more than 200k for any market effect.

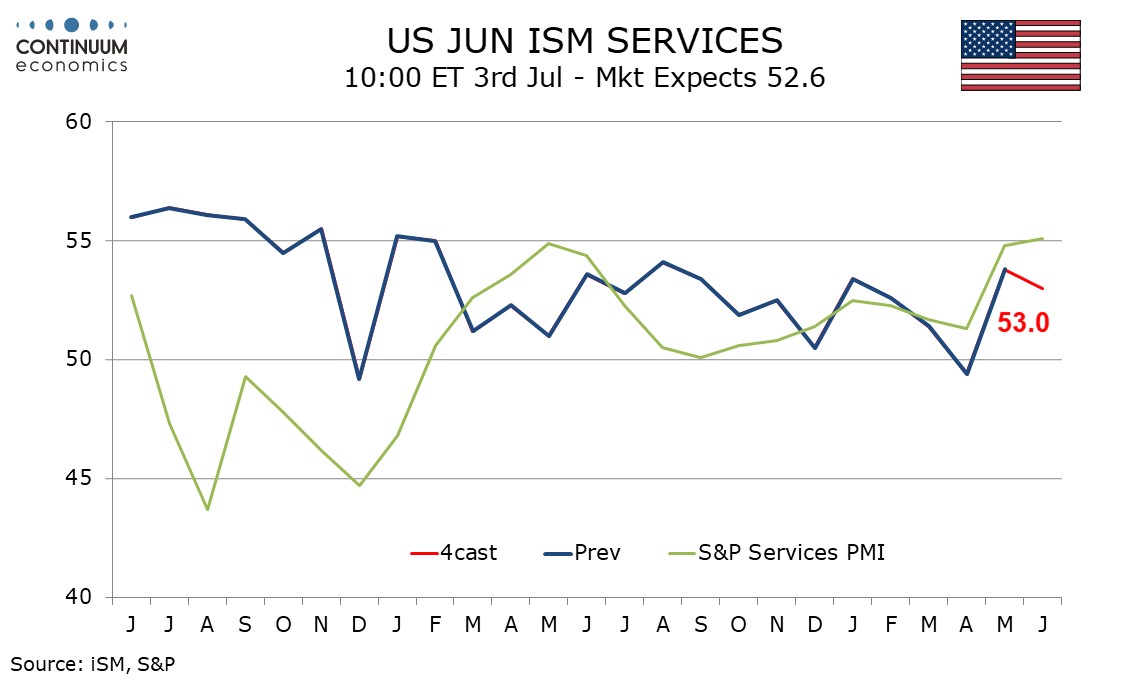

We expect June’s ISM services index to correct lower to 53.0 after rising to 53.8 in May, which was the highest reading since August 2023. While the historical correlation between the ISM services index and the S and P services PMI is not good the relationship has been stronger recently, and June’s S and P services PMI unexpectedly extended a strong May increase. Regional Fed service surveys however are mixed, and on balance still fairly neutral. But the relatively strong surveys in the US compared to Europe may provide the USD with some support.

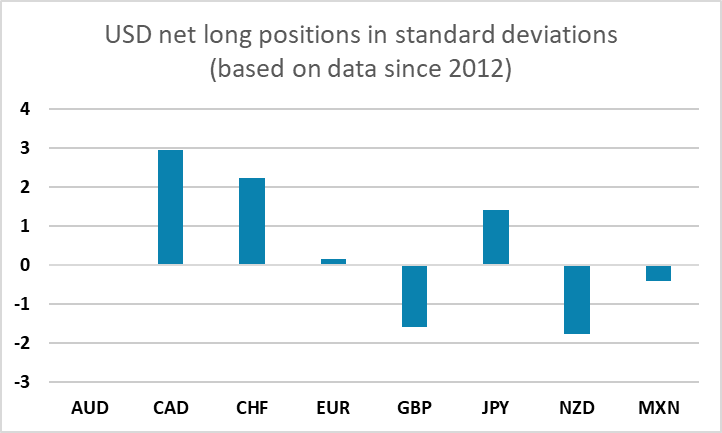

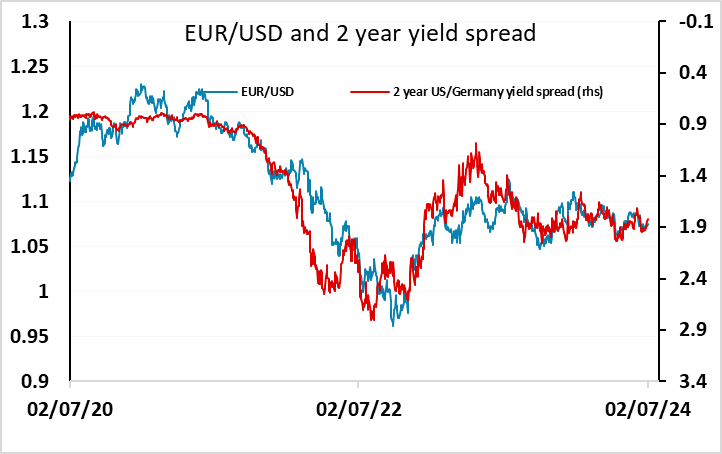

There isn’t a great deal on the European calendar, with the final services PMIs unlikely to have a major impact. The comments from Powell on Tuesday at the central bankers conference in Sintra did provide EUR/USD with some support as he sounded as if he was leaning a little more dovish, and US front end yields fell a few bps in response. While the EUR initially had gained a little after the first round of the French election, most of this was given back on Tuesday morning, but it’s hard to see a break from the 1.07-1.08 range head of the employment report. However, the fact that there is a US holiday on Thursday may mean there is some position unwinding. If so, the short CAD, CHF and JPY positions may be the most vulnerable.

IMM net speculative positioning