FX Daily Strategy: N America, December 11th

US CPI key for the next Fed decision

Slight downside USD bias if data is as expected

JPY looks to have the most potential to rally

CAD focus on the BoC but limited upside scope

US CPI key for the next Fed decision

Slight downside USD bias if data is as expected

JPY looks to have the most potential to rally

CAD focus on the BoC but limited upside scope

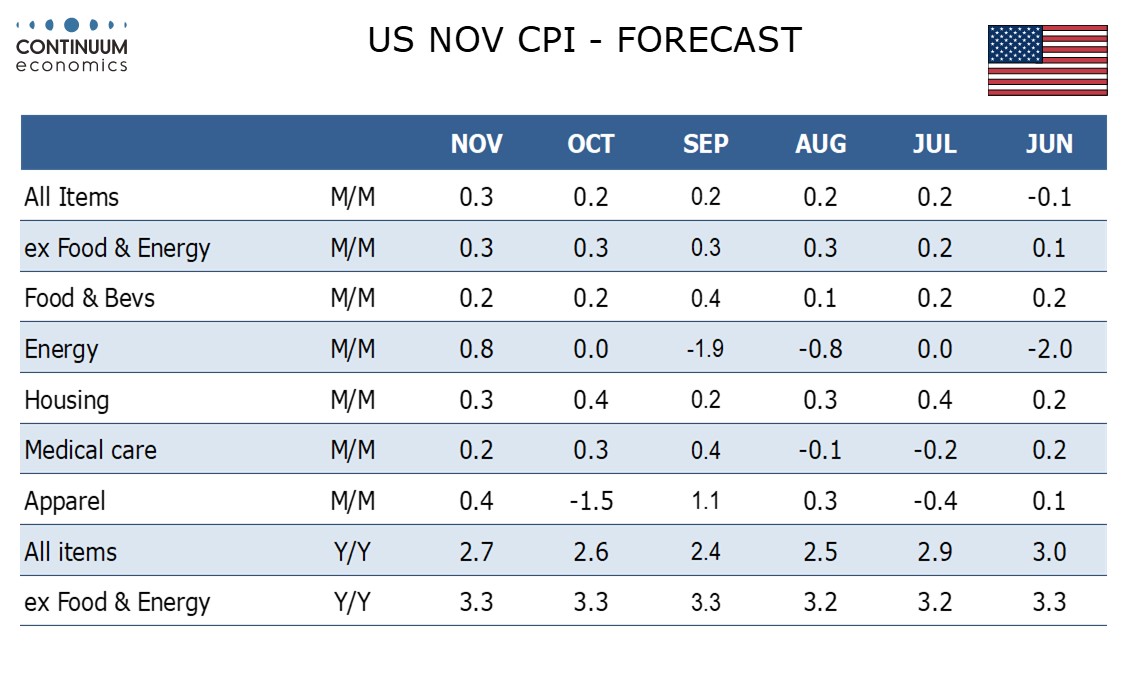

Wednesday sees the key release of US November CPI and the BoC monetary policy decision. As it stands, the market is pricing a 25bp Fed rate cut on December 18 as an 82% chance. This is the last significant data before then. We expect November’s CPI to increase by 0.3% overall, in line with the market consensus, after four straight gains of 0.2%, while the ex food and energy rate increases by 0.3% for a fourth straight month. Such an outcome would support concerns that progress in reducing inflation is stalling, but would probably not be enough to prevent a Fed rate cut. If the Fed are to leave rates unchanged, we will likely have to see CPI come in above expectations at 0.4% for the core.

However, the USD risks are nevertheless broadly balanced. Fed comments this week, even from the usually dovish Goolsbee, suggested that we will only get one cut in the next two meetings, but this is essentially priced into the market, with 27bps of cuts priced by January. If we see a cut this month, the market will still price in a higher chance if a January cut. While the statement may suggest a slow pace of easing, the Fed can’t indicate no change in January is close to certain when they are still on a medium term easing trajectory. If we don’t see a cut front end yields will rise, but a January cut will still likely be seen as better than a 50/50 chance. Under the most likely scenario the USD may therefore move a little lower.

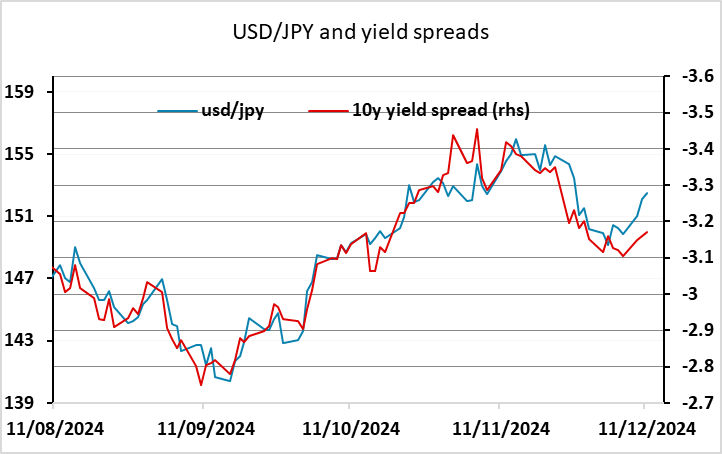

The JPY continues to look like the currency with then most potential for gains, having underperformed yield spreads in the last few days. Spreads are still suggestive of a USD/JPY level sub-150, and if CPI comes in in line with expectations, we would expect USD/JPY to retreat. However, USD/JPY has spiked higher on a Bloomberg report saying the BoJ see little cost in waiting for the next rate hike, and see less risk of a weak JPY pushing up inflation. While the report also says that some are not against a December rate hike, the JPY has fallen sharply, with USD/JPY up a big figure. The market is now only pricing 6bps of tightening for the December meeting, down from 10bps yesterday. However, there hasn’t been much impact on yields down the curve, and these are generally more correlated with the JPY in everything but the very short term. The short term correlation with 10 year yield spreads is still consistent with USD/JPY near 150, so we would be wary of the JPY move lower at this stage. Even if the BoJ don’t hike in December, spreads are likely to move in the JPY’s favour in the coming months, and already suggest scope for USD/JPY declines, with longer term spread correlations even more JPY positive.

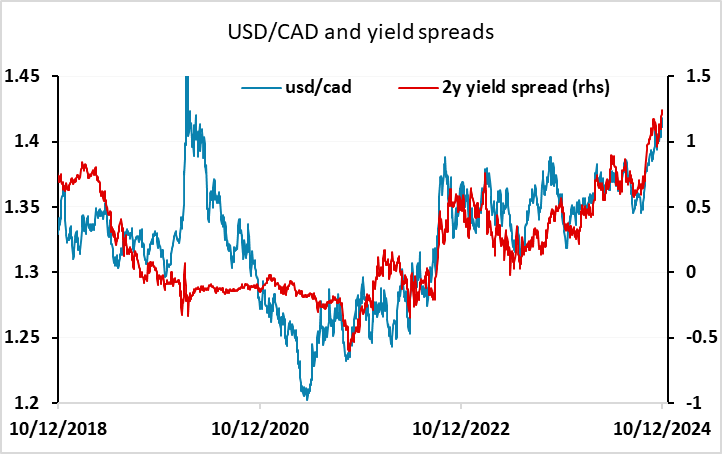

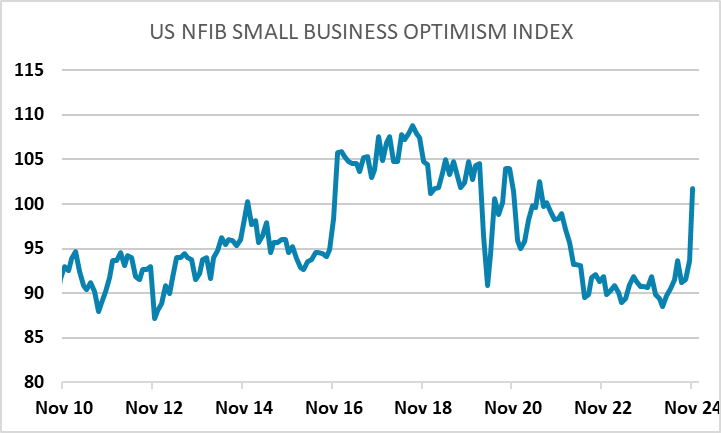

The BoC is priced as 90% certain to produce a 50bp rate cut, so it would be quite a major surprise if they were only to move 25bps. Tuesday saw USD/CAD hit its highest since June 2021, with the USD getting something of a boost from the very strong NFIB survey of small businesses. However, it is a little early to assume that this is going to prove an accurate assessment of business prospects, as it seems very likely to have been affected by the election. USD/CAD remains broadly in line with yield spread moves, so we wouldn’t expect a major move lower from here unless US CPI comes in well below expectations.