EUR/GBP flows: GBP edges lower after soft labour market data

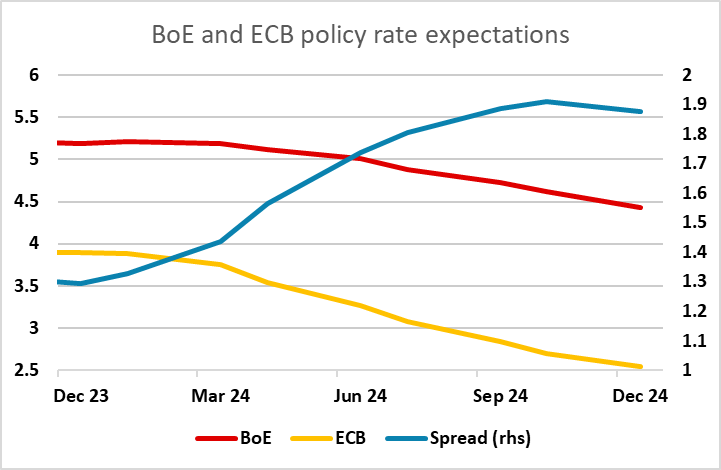

UK labour market data is all modesly on the soft side, weakening the case for the current wide spread between expected BoE and ECB policy trajectories, suggesting GBP risks are on the downside.

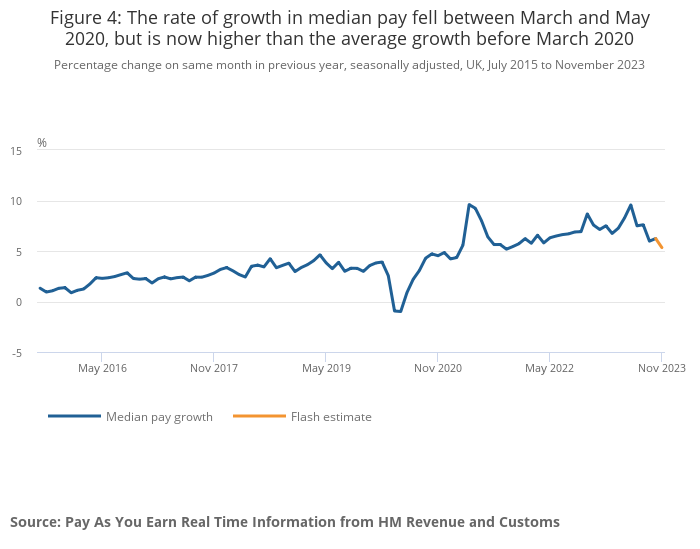

The UK labour market data is modestly on the weak side of expectations. Average earnings growth was below expectations both excluding and particularly including bonuses. The claimant count rose again, and the more up to date HMRC data showed a decline in employment and a further decline in pay growth, as well as a small m/m drop in payrolled employment.

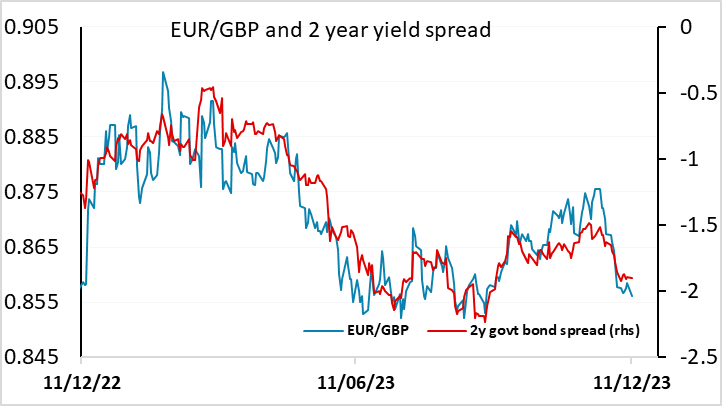

GBP hasn’t shown much reaction, but the numbers may convince one or two of the three hawkish MPC members that a further rate hike is not necessary given these declining trends in employment and pay. We have October GDP data tomorrow which may also have an impact on thinking. But the current pricing of policy expectations through 2024 already has a big widening in the policy rate spread between the BoE and the ECB, and it is hard to see this widening further, We consequently see the EUR/GBP risks as weighted to the upside unless tomorrow’s UK GDP data show a significant upside surprise.