FX Daily Strategy: N America, May 28th

RBNZ may be more hawkish than priced in…

…but NZD risks against the AUD look to be on the downside medium term

JPY weaker on improving risk sentiment, but JPY upside still favoured medium term

GBP recovery likely to pause

RBNZ may be more hawkish than priced in…

…but NZD risks against the AUD look to be on the downside medium term

JPY weaker on improving risk sentiment, but JPY upside still favoured medium term

GBP recovery likely to pause

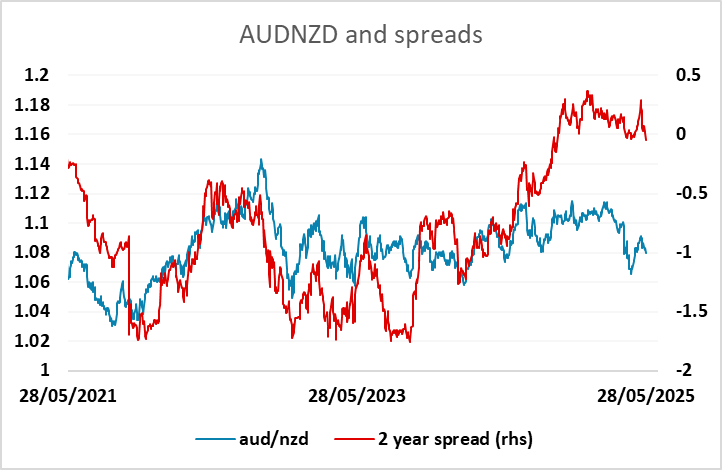

The RBNZ Cut by 25bps as expected to 3.25%. There was also a revision to their forecast with OCR to 3.12% in September 2025 and 2.87% in June 2026, both lowered from previous forecast. However, the market was pricing in a total of 65bps of easing over the rest of the year ahead of the meeting, including the 25bps this time around, which put the low in the OCR at 2.85%, so the projections were seen as hawkish relative to market pricing, and the NZD rallied strongly on the decision. Additionally, the RBNZ board voted 5 to 1 on the cut, with one vote for no change, and the market was further affected by RBNZ Gov. Hawkesby's words "Decision to hold vote on rates was healthy sign, not unusual at turning points".

The NZD made general gains of 1% on the meeting, including against the AUD. The AUD has generally been underperforming spreads in the last year, but with Asian equity markets looking better supported, and AUD/USD now finding strong support on any dip towards 0.64, we would see general upside risks for the AUD. So despite the initial move in the NZD to the upside, we favour AUD/NZD buying on dips.

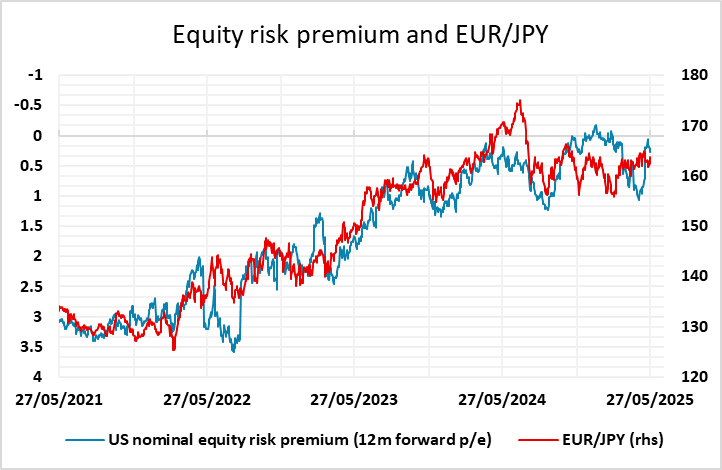

There is little data of note due on the US, while in Europe there is only second tier data. The USD and the European and commodity currencies have all performed solidly in the first part of the week, with the JPY the main loser and the CHF also on the back foot. This no doubt reflects the change in Trump’s stance on imposing 50% tariffs on the EU at the weekend, with the start date now delayed until July. Most now assume that something similar to the deal with China will be reached before then, so that tariffs will in the end only be 10-15%. In truth, this was always the suspicion when Trump announced the 50% tariff on Friday. But it still looks difficult for risk sentiment to improve much further from here, with risk premia now at very low levels. The S&P500 still looks likely to be capped at 6000 until or unless we see evidence that the US economy has been essentially unaffected by the tariffs, and this evidence will likely not be available until the end of the summer. This suggests some rangy trading near term, but we still see the major risks as being on the JPY upside, as risk premia are biased higher from the current very low levels.

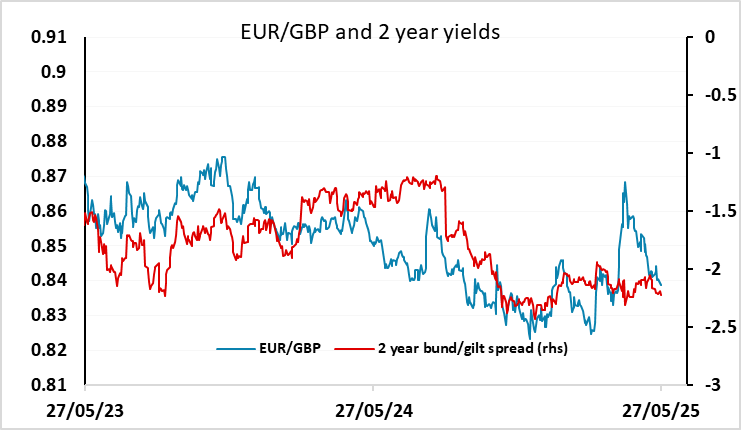

The EUR/GBP decline in recent weeks has been persistent and unusual. A lower close this week would mean the seventh consecutive week of declines. This is very rare. Depending a little on what open and close data is used, there isn’t a conclusive case of this in 20 years - since April 2005. Of course, this time around it is a reaction to the very sharp EUR/GBP rise in the 2 weeks from March 31 to April 11, triggered by the initial tariff announcement, which still hasn’t been fully retraced. But yield spreads no longer suggest there is any more significant downside. We would see risks as biased to the upside towards 0.84, although major gains look unlikely.