USD, JPY flows: USD softer on Powell/Trump rift, JPY still weak

The USD is softer overnight as Powell reveals threats of criminal indictment. JPY still weak as Japan snap election anticipated

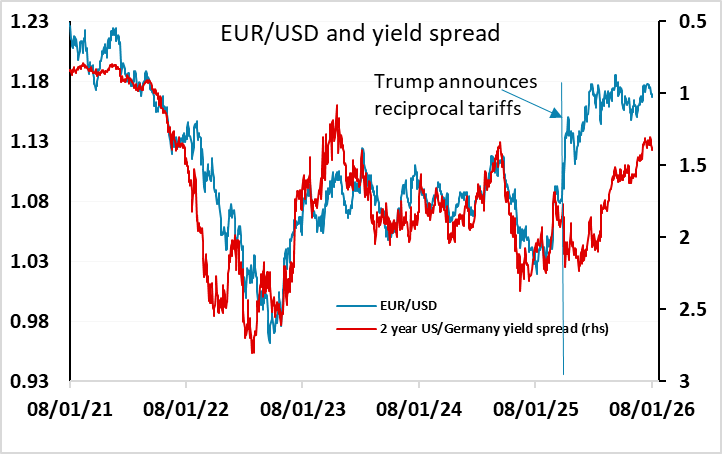

The USD is starting the day a little weaker against most currencies. The rationale for USD weakness looks to be the renewed tension between Fed Chair Powell and the Trump administration. On Sunday, Powell said the Trump administration had threatened him with a criminal indictment and served grand jury subpoenas over Congressional testimony he gave last summer regarding a Fed building renovation project, an action he called a "pretext" aimed at pressuring the central bank to cut interest rates. Powell’s term as Chair ends in May in any case, but the implication of a threat to central bank independence will be seen as USD negative, suggesting a politicised appointment of the next Fed Chair and potential for attempts at interference in policy from the administration. USD weakness may consequently extend, although at this stage the market hasn’t priced in any increased risk of policy easing.

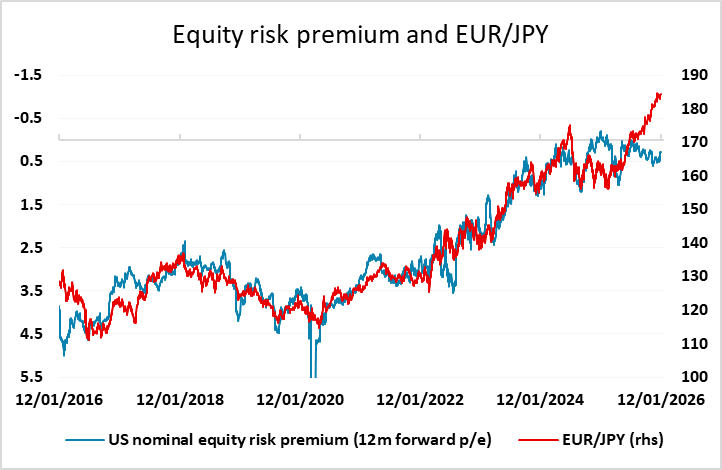

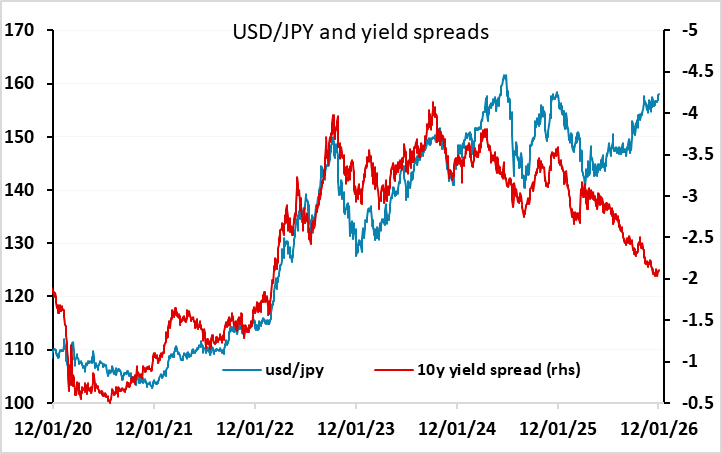

As well as USD weakness, the JPY lost ground overnight on the crosses, even though USD/JPY failed to break through the highs seen on Friday. The talk of a snap February election heard on Friday remains in the air, with the intention seen to be to allow a freer hand for the government to ease fiscal policy. In practice, we doubt this will make a large difference, and in any case more fiscal easing might well lead to more monetary tightening, so we struggle to see the rationale for JPY weakness. Nevertheless, the market remains primed to look for reasons to sell the JPY, and we continue to believe that it will require more BoJ intervention if the weak JPY trend is to turn.