FX Daily Strategy: N America, December 18th

FOMC the focus, although a 25bp cut is nearly fully priced in

The dot plot looks likely to suggest more rate cuts than are currently priced in…

…so there are some USD downside risks

GBP slightly weaker after CPI

FOMC the focus, although a 25bp cut is nearly fully priced in

The dot plot looks likely to suggest more rate cuts than are currently priced in…

…so there are some USD downside risks

GBP slightly weaker after CPI

The FOMC meeting will be the primary focus on Wednesday, even though it looks a near certainty that the Fed will cut the funds rate 25bps to a 4.25-4.5% range. Fed commentary has generally suggested that rates are moving lower while cautioning against assuming easing at any meeting is a done deal. Absence of major surprises in recent employment and CPI data probably clears the way for a 25bps move, but the Fed is likely to suggest that the pace of easing is likely to be more cautious in 2025.

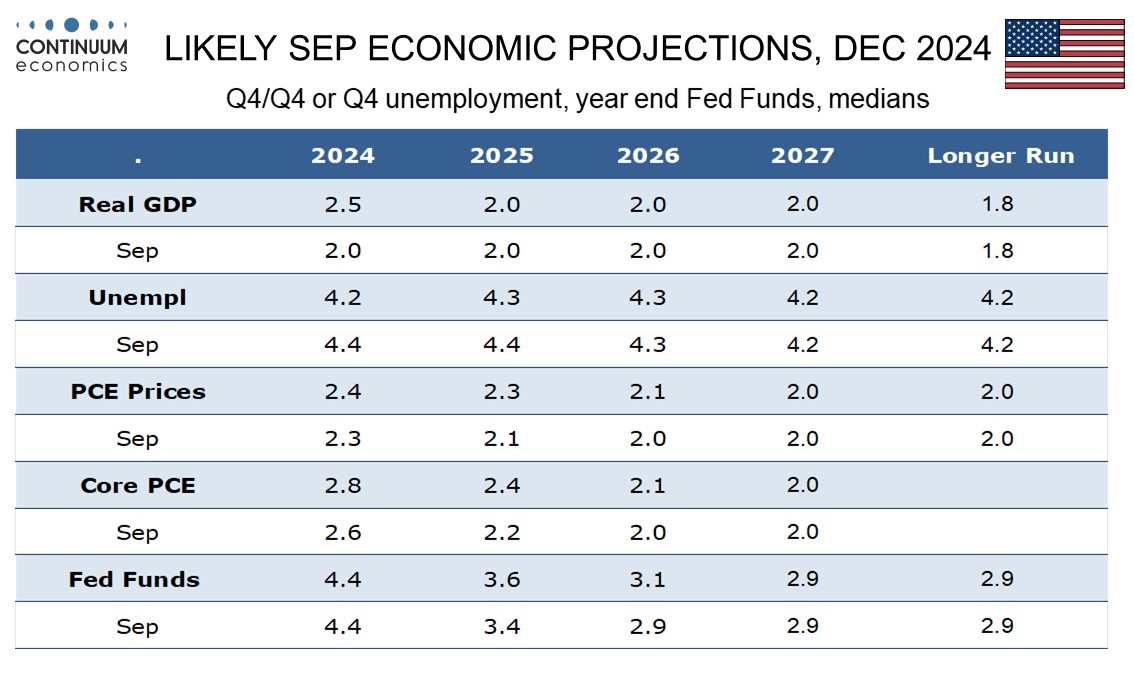

There will be a lot of focus on the “dot plot” of the FOMC’s projections for the funds rate. We expect the median dots for end 2025 and end 2026 policy to be revised marginally higher, by 25bps each to 3.625% and 3.125% respectively, thus implying 75bps of easing in 2025 and 50bps in 2026, while leaving 2027 and the long-run neural rate unrevised at 2.875%. Recent data suggests economic forecasts for end 2024 will look stronger than in September, GDP significantly so at 2.5% Q4/Q4 rather than 2.0%, while unemployment will be seen at 4.2% rather than 4.4%.

However, this more cautious stance is now well priced into the market. In the next three meetings in January, March, and May the market is only pricing in a total of 24bps of easing, with a further 25bps by December. In other words, the market is pricing in just two 25bp rate cuts over the course of 2025, taking the funds rate to a 3.75%-4.00% range. In mid-September, the market was pricing in a funds rate target of 2.75%-3.00% by the end of 2025. Most of this rise in front end yields came well before the election, so is more a function of the recent US data than the Trump election pledges to cut taxes and raise tariffs. The Fed will also not be making assumptions about future policy, so the market will probably hold onto the current view even if the dots indicate somewhat more easing is likely. But it’s hard to see a further rise in front end yields if the dot plot suggests 75bps of easing in 2025. The risks may therefore be slightly on the USD upside.

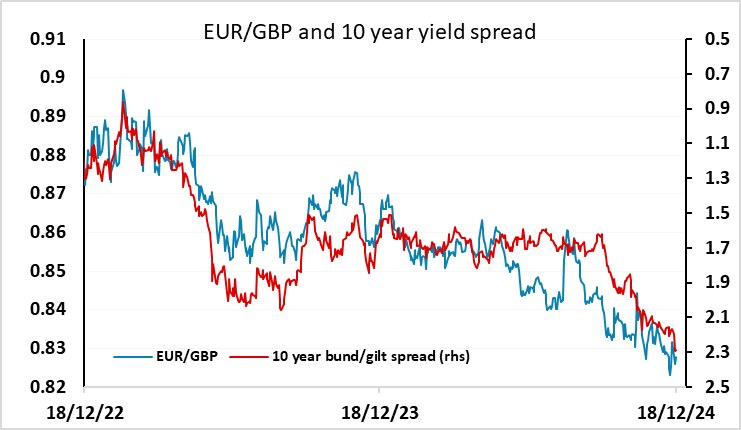

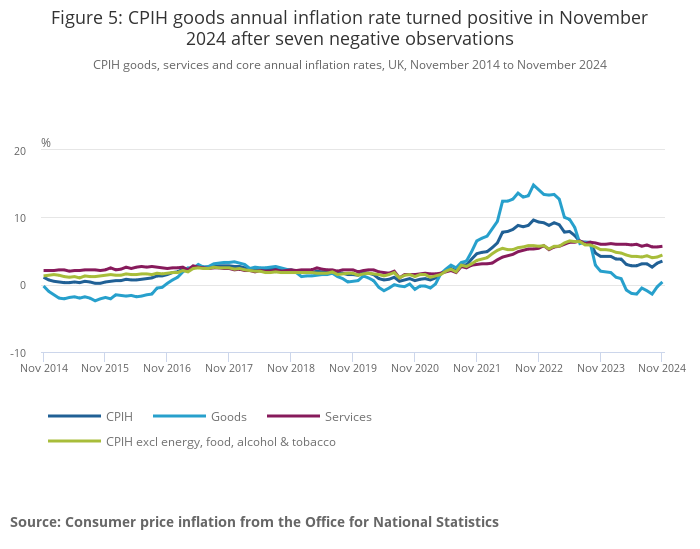

UK CPI has come in slightly above consensus, with the core at 3.5% y/y against a market expectation of 3.6%. But this is still a rise from 3.3% last month, and the headline number was as expected at 2.6% y/y, up from 2.3%, so it’s hard to see this as making much of a case for the doves on the BoE after yesterday’s strong average earnings data. EUR/GBP has popped slightly higher to 0.8275 from 0.8265, but we wouldn’t expect these gains to extend.