FX Daily Strategy: Asia, December 5th

Canadian employment may be slightly CAD positive

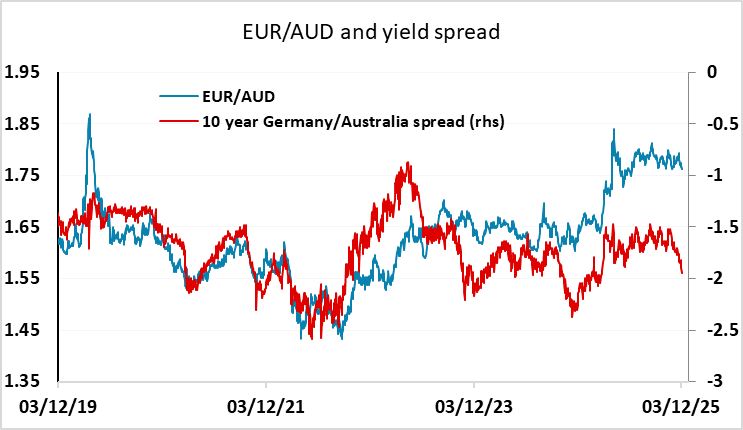

EUR looks a little extended on the crosses

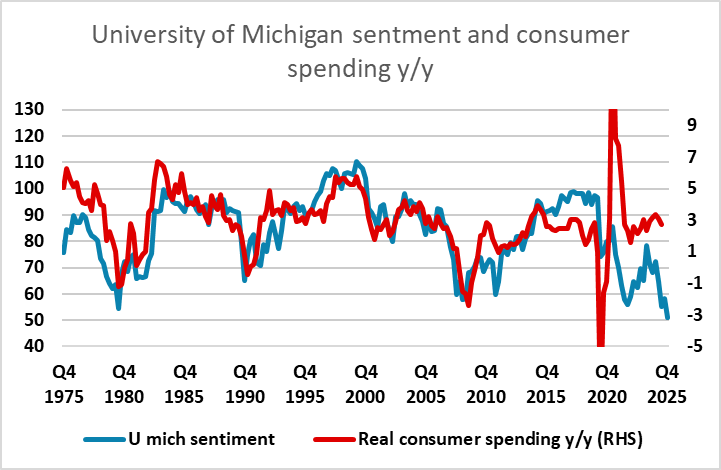

University of Michigan survey of some interest given extreme weakness

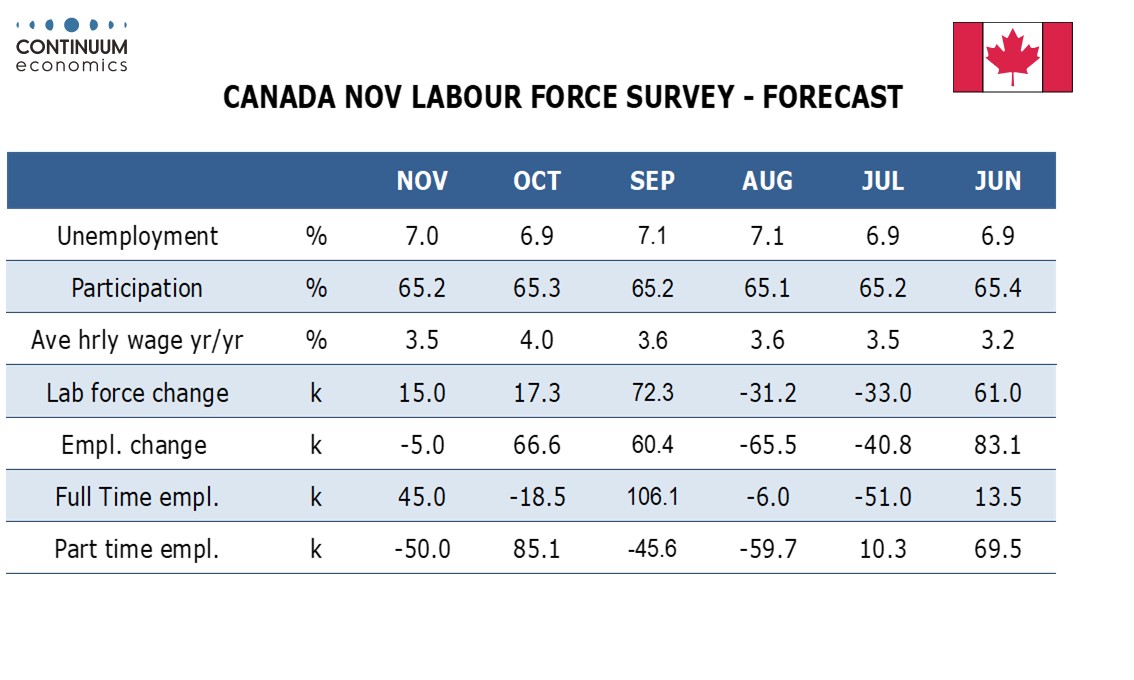

Canadian employment may be slightly CAD positive

EUR looks a little extended on the crosses

University of Michigan survey of some interest given extreme weakness

We won’t get the November US employment report until December 16 when it will be released together with the October data, but we do get the Canadian November report on Friday. Canadian employment data has been volatile in recent months. The underlying trend still seems modestly positive, but after two strong gains in excess of 60k we expect a modest decline of 5k in November. This would lift unemployment to 7.0% from 6.9% in October, still below the 7.1% seen in August and September.

Our forecast is slightly stronger than the surveyed consensus of a 7.6k decline in employment, but the difference is small compared to the volatility of the data in recent months. USD/CAD is broadly back in line with the yield spread relationship that has been in place since the pandemic, after a period of USD weakness following the announcement of reciprocal tariffs in April, so we don’t expect much CAD reaction to the numbers. However, even the market expectation of a small decline would suggest that the employment picture is starting to improve a little after the weakness seen over the summer, so we would continue to favour the USD/CAD downside.

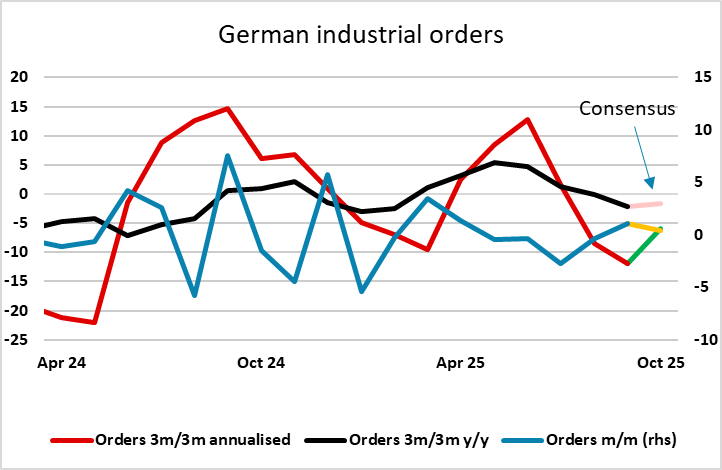

In Europe there is German factory orders data, which have been showing some deterioration in trend in recent months. However, the data is volatile, and the consensus rise of 0.4% would be enough to stabilise the trend. The risks for the EUR are, however, slightly weighted to the downside, as a weak number would provide further evidence of a slowdown in the German economy, while a stronger number would only slightly correct recent declines. We still see the EUR as a little vulnerable on the crosses as it has retained the gains seen after the reciprocal tariff announcement and has outperformed the usual yield spread relationship, while other currencies, notably the JPY and AUD, have underperformed. Updated Eurozone Q3 GDP data seem unlikely to have much impact

Most of the US data is still quite old and consequently of limited significance, and the PCE deflator from September is in that category. However, the December University of Michigan sentiment survey is bang up to date, so could have some impact, especially given the extreme weakness seen in November. The current conditions index is at an all time low, and the general sentiment index very close to the low seen in 2022. Historically, these indices had a good correlation with consumer spending, but this has broken down a little since the pandemic. Even so, persistent weakness on the current scale would be something of a concern. The consensus expects a small bounce from current levels, but even this would suggest risks of weakness going forward, so the USD risks on the data are on the downside.