FX Weekly Strategy: January 13th-17th

Hard for USD/JPY to extend higher from current levels

US equities and yields struggling to rise further in concert

EUR/USD downside also limited as yield spreads move in EUR’s favour

GBP has more potential downside with expectations of BoE cuts too conservative

The US employment report on Friday came in significantly stronger than expected and led to higher US yields and, initially at least, a higher USD. But the negative impact of higher yields on equities meant that although the USD sustained gains against the riskier currencies, it fell back against the JPY by the end of Friday’s trading. This is going to be an important aspect of the market this year.

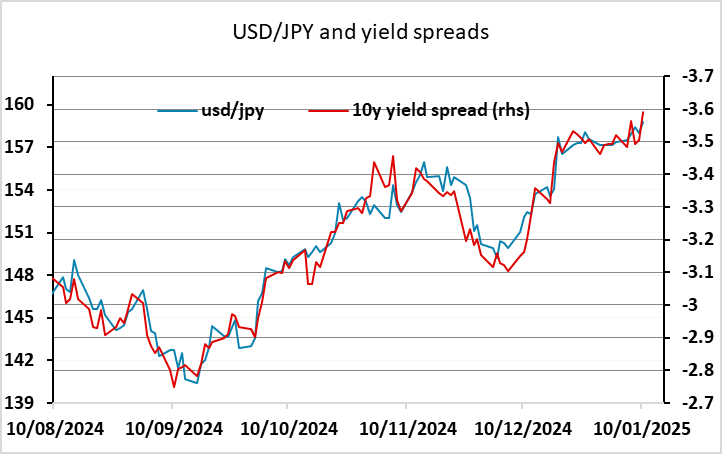

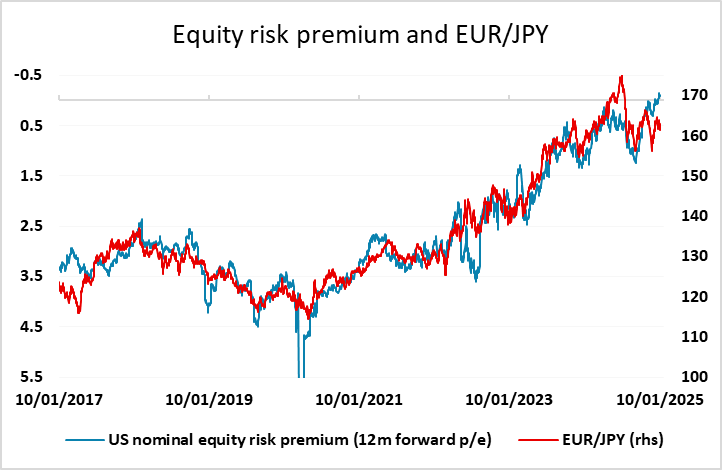

The JPY remains at extremely weak levels, in part because of its correlation with yield spreads, but also because of its correlation with risk premia, which has been a consistent theme for many years. We are approaching a likely peak for US yields, with the market now only pricing one Fed rate cut this year, and are also at extreme lows for US equity risk premia. While these may be maintained if the US economy remains on an even keel, it is hard to justify such low risk premia at the peak of the cycle, as there is very limited scope for above trend earnings growth. Any above trend growth will tend to generate higher yields, weakening growth, and undermining equities, as we saw on Friday. While continued strong US data may sustain current yield and equity levels, it is now hard for yields and equities to rise together, and that suggests the JPY is close to a bottom. This is also supported by the threat of higher Japanese rates and Japanese official intervention near 160.

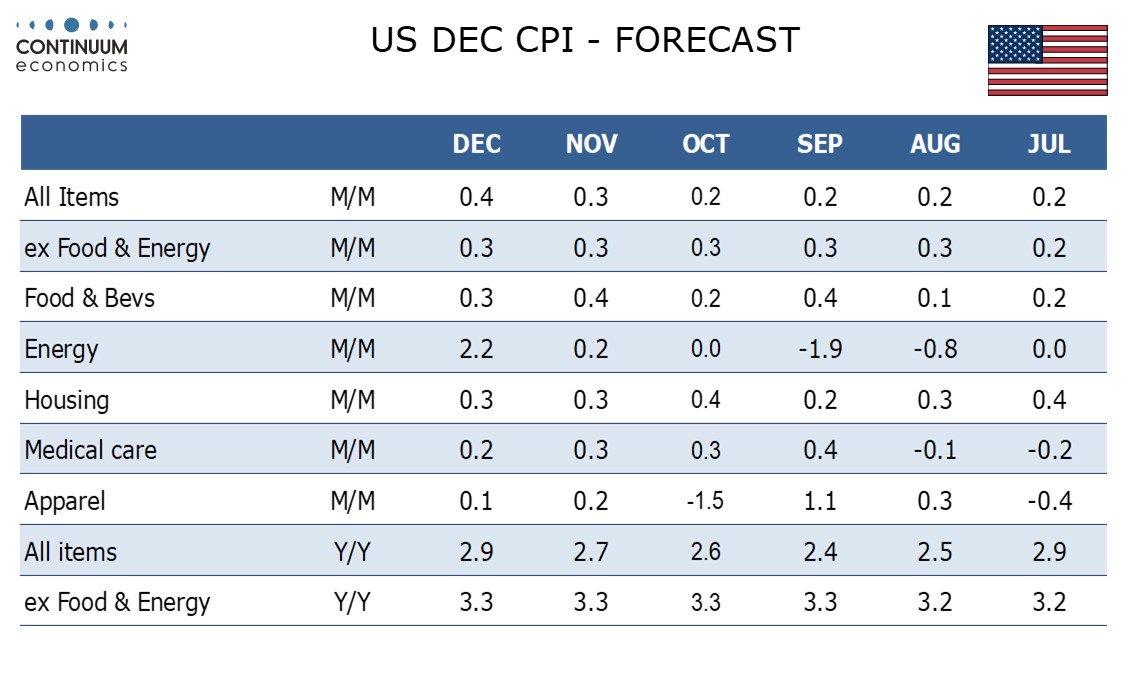

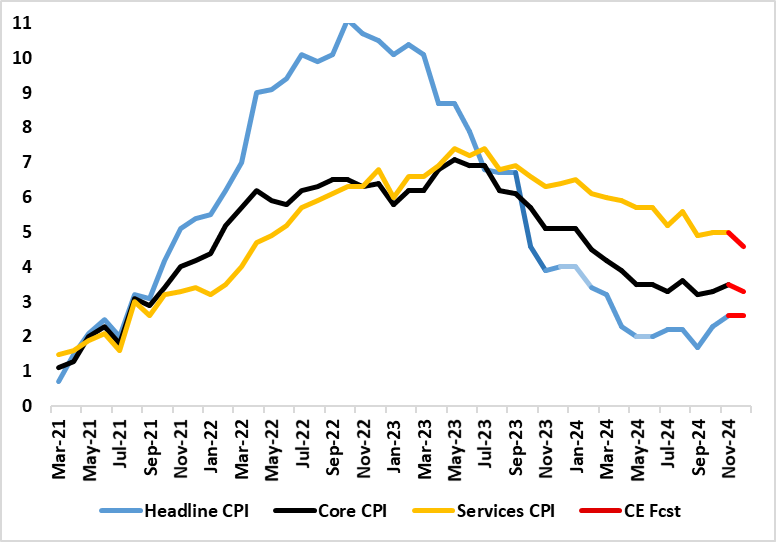

For this week, the main focus will be on the US CPI data, with the UK CPI data also being potentially market moving. Our forecasts are in line with consensus for the US CPI data, so this shouldn’t disturb the status quo. Within the employment report, the average earnings data were in line with consensus at 0.3%, so this was one aspect of the report that wasn’t notably strong. However, the University of Michigan survey showed a slightly worrying rise in the 5 year median inflation expectation to 3.3% - the highest since 2008. This still has to be confirmed in the final data, but is another reason to expect Fed easing to be restrained. But it will be hard to bring market expectations down much below the 29bps currently priced in for the whole year, so we may be approaching the upside limits for US short term yields, at least until we have more certainty on the detail of Trump’s policy programme.

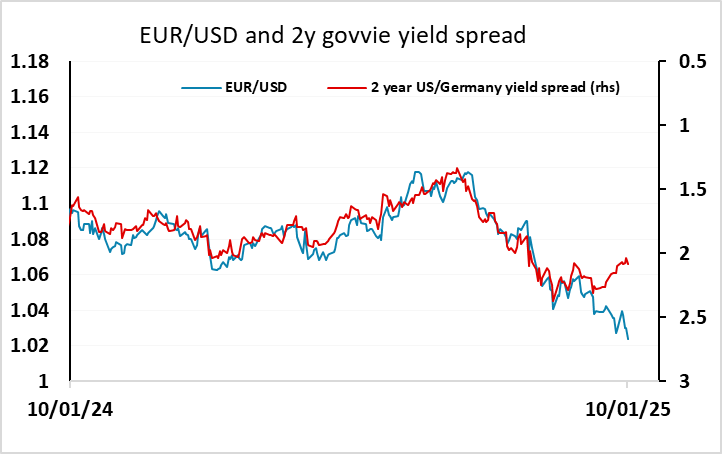

This being the case, it also looks hard to argue for much more weakness in EUR/USD. We may be seeing a change in the trading behaviour seen in 2024, when EUR/USD moved very closely with 2 year yield spreads, as EUR/USD has fallen at the beginning of the year even though USD/EUR yield spreads have moved in the EUR’s favour. There is plenty of negative sentiment towards European currencies, but the European data is mixed, with some signs of recovery in consumer spending, and EUR yields have risen more than US yields this year. So unless we see US CPI come in above expectations, we may see some recovery in EUR/USD. There is also a case for a EUR/JPY recovery, as the dip on Friday exceeded the modest rise in equity risk premia. But valuation arguments still favour the JPY.

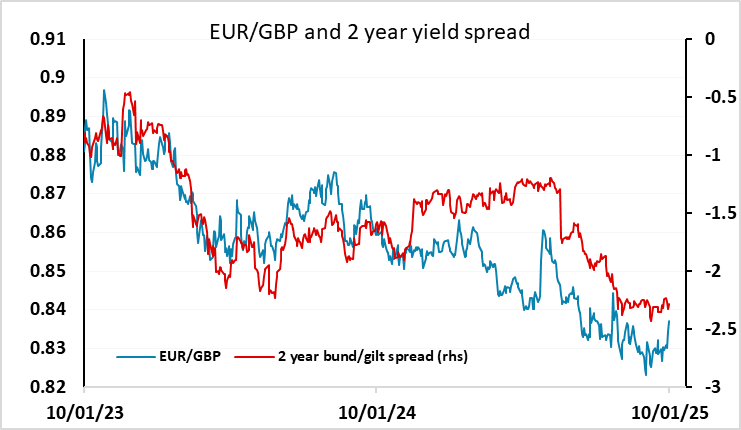

There has been a lot of talk about the weakness of GBP and the rise in UK yields in the last week, with some comparisons being made to the brief Truss administration in 2022 when GBP fell sharply as yields rose. While the last week did see a weaker pound and higher UK yields, the moves were much smaller in scale than the Truss period events, and some of the rise in yields may have been catch-up with the global rise in yields seen in recent weeks. GBP, although weaker, and hitting 1 year lows against the USD, remains at historically very high levels against the EUR and is close to its post-Brexit referendum highs on a trade-weighted basis. There were comments from MPC member Breeden last week suggesting there is still scope for plenty of UK rate cuts this year, making the current pricing of less than 2 25bp cuts look a little too conservative. While UK CPI may hold at 2.6% y/y headline, we suspect there may be some softening in the core that could allow UK yields to fall. There is still plenty of scope for GBP to decline, given high levels against the EUR. EUR/GBP may be a good proxy buy for EUR/USD for those who don’t want to oppose USD strength directly.

Data and events for the week ahead

USA

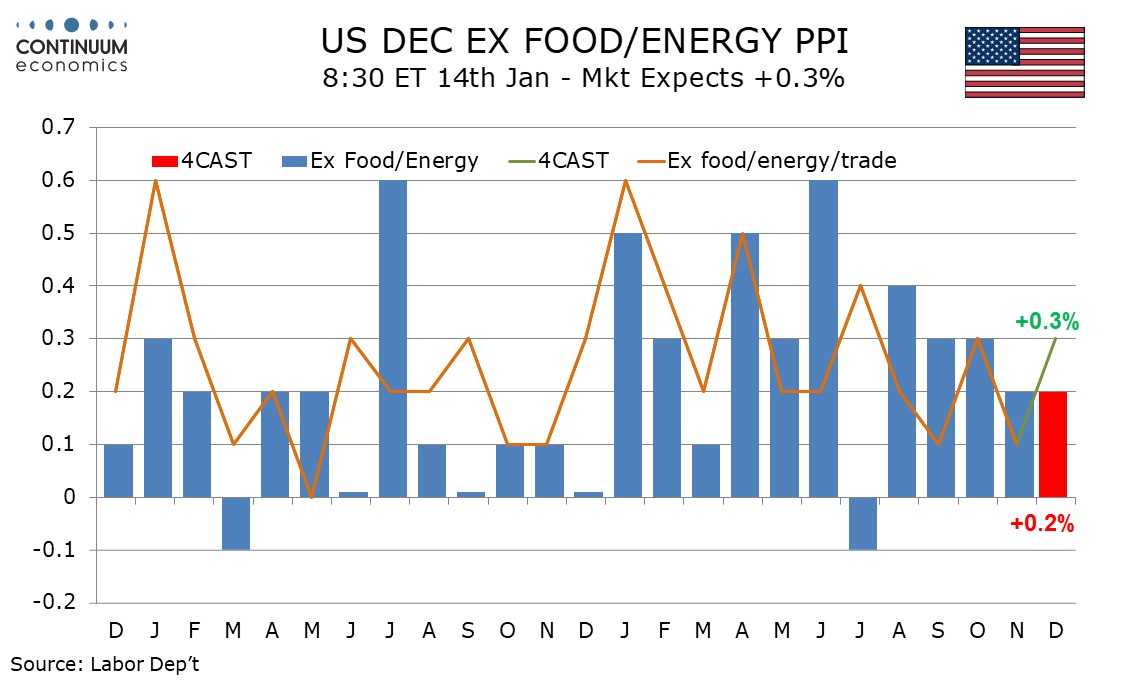

Monday sees December budget data. Tuesday sees December’s NFIB small business optimism index, which is likely to show some post-election optimism. We also expect a 0.3% increase in December PPI, with a 0.2% rise ex food and energy. Fed’s Schmid and Williams will speak on Tuesday.

The week’s key release comes on Wednesday, where we expect a stronger 0.4% rise in December CPI with a fifth straight 0.3% increase ex food and energy. Wednesday also sees January’s Empire State manufacturing index while Fed’s Barkin, Kashkari, Williams again and Goolsbee are due to speak.

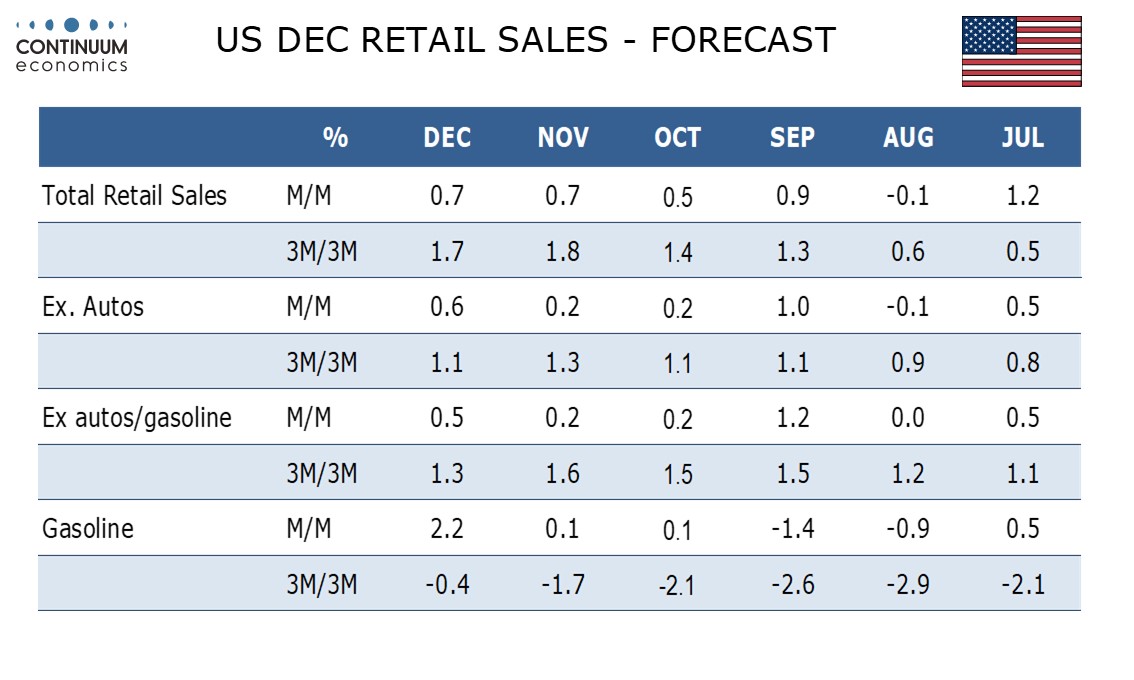

On Thursday we expect retail sales to finish Q4 on a strong note, with a 0.7% December rise, 0.6% ex autos and 0.5% ex autos and gasoline. Weekly initial claims, December import prices and January’s Philly Fed manufacturing survey will be released with the retail sales data. Later January’s NAHB homebuilders index and November business inventories are due, with existing data implying a 0.1% increase in the latter. Friday sees December housing starts and permits, followed by December industrial production.

Canada

Canada releases November manufacturing shipments and wholesale sales on Wednesday. Respective preliminary estimates were for a rise of 0.5% and a fall of 0.7%. December housing starts are due on Thursday.

UK

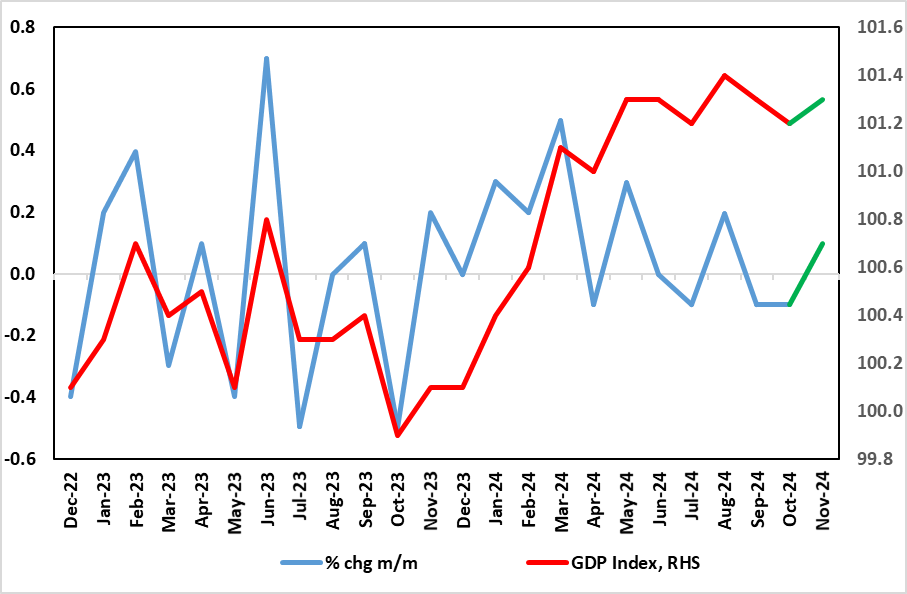

GDP Momentum Ebbing – Amid Continued Downside Risks?

Source: ONS, green line(s) are CE forecasts

The focus data wise will be on Wednesday’s CPI numbers. Markets are looking for the headline rate to nudge up a notch, although we look for a stable 2.6% outcome and with downside risks towards BoE thinking of a 2.5% figure. But the December figure will be driven by higher petrol costs and the headline may mask a drop in both the core and services inflation of around 0.2-0.3 ppt. Amid current bond market ructions, which some are suggesting reflects stagflation worries, GDP data (Thu) may accentuate such concerns. Thus the 0.1% m/m rise we envisage for November must be seen in a weak and pared –back context and the likelihood remains that Q4 2024 may have seen a small q/q contraction. Retail sales data (Fri) may show a small rise nonetheless while a speech from recent MPC recruit Taylor (Wed) may show his policy thinking more explicitly

Divergent Inflation Picture?

Source: ONS, Continuum Economics

Eurozone

The week sees little in terms of data although German annual GDP figures for 2024 (d) will give clues as to whether the economy slid again last quarter – we think it did. Otherwise, ECB minutes (account) of the December Council meeting will detail the extent to which a deeper and or faster easing was considered.

The BoE will release its Decision Maker’s Survey on Thursday, while the following day sees the first MPC speech of the year from Dep Gov Sarah Breeden. Final PMI data (Mon) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Tue) may reveal.

Rest of Western Europe

There are few events this week but, in Sweden, Riksbank Governor Theeden gives key speech which may address the weaker than expected December CPI numbers seen of late.

Japan

A moderate week for Japanese data. Trade balance on Tuesday, and PPI on Thursday would be the only relevant ones.

Australia

We have the labor data from Australia next Thursday. The Australian labor market continues to surprise to the upside and see little cooling signs. However, the key remains on wage, which has been disproportionately with the tight labor market. We also have the TD inflation data on Monday.

NZ

Business PMI on Friday only.