FX Daily Strategy: N America, March 27th

US trade data likely to be the main focus

Lower deficit may still imply weaker growth and lead to a weaker USD

GBP resilient but still biased lower

US trade data likely to be the main focus

Lower deficit may still imply weaker growth and lead to a weaker USD

GBP resilient but still biased lower

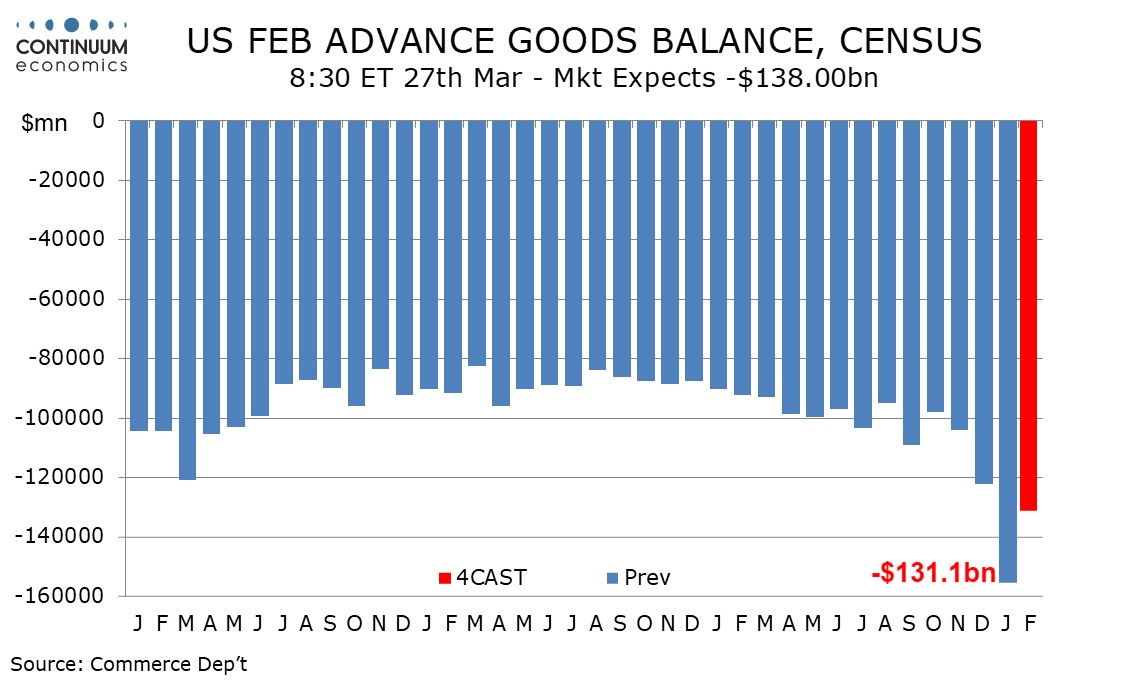

Thursday sees mostly second tier US data, but there will be more interest than usual in the trade balance. We expect a February advance goods deficit of $131.1bn, down from January’s dramatic import-led surge to $155.6bn, but still above December’s $122.1bn, which itself was a record high until January’s data was released. The focus is clearly on imports which surged in January in an attempt to beat threatened tariffs. February is likely to see a correction, particularly in fixed metal shapes which explained 57.5% of January’s rise, but with tariffs still threatened imports may remain above normal levels in February. Released with the advance goods data will be advance February retail and wholesale inventories, which if strong could offset downside GDP implications coming from the trade data. January inventory data however provided only a limited offset, with wholesale inventories up by 0.8% but retail inventories unchanged.

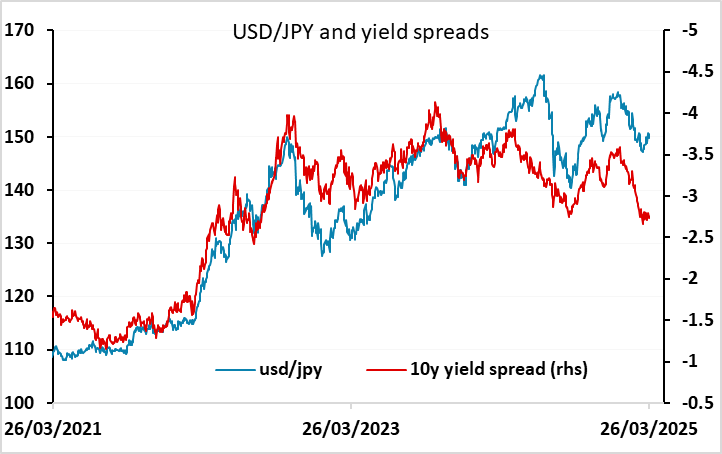

The consensus expectation for trade is for a slightly larger deficit than we expect, so the USD may not suffer despite these extremely wide goods trade deficits. However, USD strength on Wednesday following the better than expected durable goods orders data looked a little overdone, and trade and inventory data that suggests weak Q1 GDP numbers could still prove USD negative, with USD/JPY in particular looking very extended.

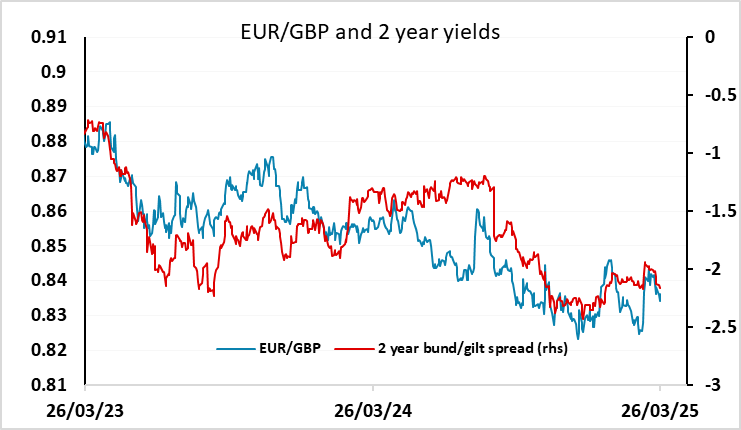

GBP was a focus on Wednesday but in the end showed relatively little reaction to the UK fiscal statement, although it did soften modestly after the weaker than expected CPI data. We still see downside risks for the pound, with the weaker UK growth forecasts and further fiscal tightening increasing the chances of greater BoE easing, helped also by the softer CPI data. A May rate cut looks to us more likely than the 45% chance currently priced in. MPC dove Dhingra speaks on Thursday, but given her dovish status, we doubt there will be much impact form her speech. GBP, along with the other higher yielders, remains most vulnerable to general weakness in risk sentiment, which looks more likely to come from US data.