USD, JPY flows: JPY firmer o/n helped by Ishiba comments

JPY recovers helped by Ishiba announcing economic package to escape deflation, but quiet market likely ahead of the US employment report.

A fairly quiet overnight session saw some modest gains for the JPY and CHF but little other movement of note. The JPY may have been helped by the latest comments from new PM Ishiba, who announced a comprehensive economic package to ensure a complete exit from deflation. This included an objective of raising the average minimum wage by 40%. The comments go a little against Ishiba’s image as a fiscal hawk, just as his previous comments went against his image as a monetary hawk, but a more fiscally expansionary stance would pave the way for more monetary tightening. JGB yields are up around 6bps overnight, and the JPY has gained more than half a figure. That the CHF is also stronger looks to be more of a sympathetic move with the JPY than any new risk aversion, as equities are generally firmer overnight.

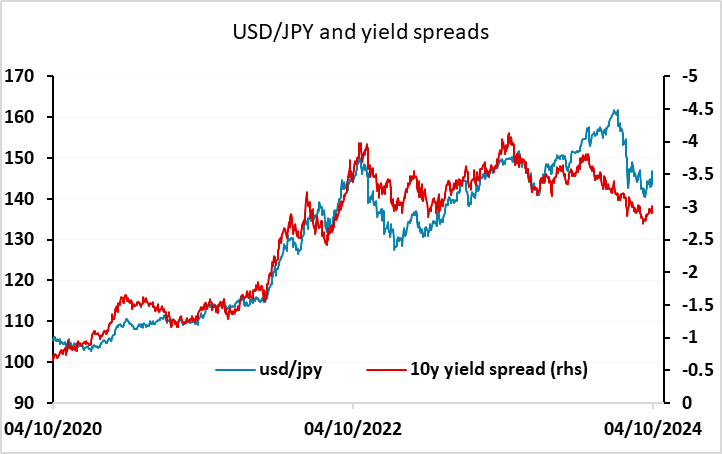

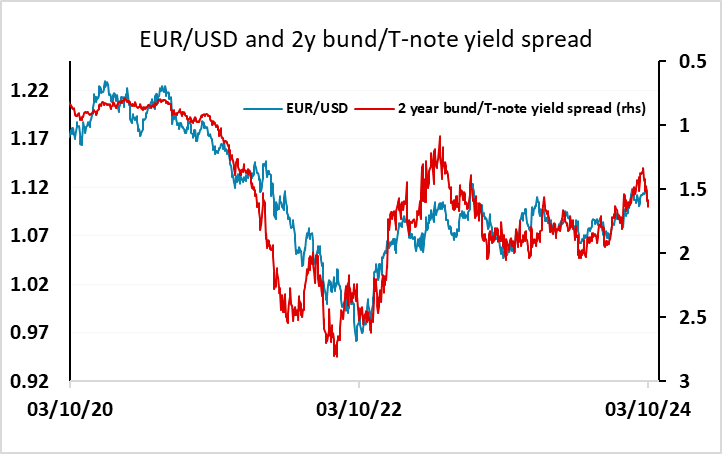

For today there isn’t a great deal on the calendar ahead of the US employment report, and FX trading is likely to be fairly quiet. The USD looks slightly extended relative to recent yield spread movements (especially against the JPY), so there may be scope for long USD positions to be pared back slightly, although we see the risks as being towards a stronger employment report, and the market may take a similar view with recent US data tending to be on the stronger side, so the bias mat still be to take a USD positive view into the data.