FX Weekly Strategy:Asia, June 16th-20th

Geopolitics Remain in the Spotlight

Slate of U.S. Data will otherwise dictate sentiment

And Likely See Choppy DXY

Followed By Canada CPI and GDP

For the week ahead...

Heading into the new week, geopolitics will remain in the spotlight. U.S. seems to have contradicted previous report on a Saturday strike and likely giving Iran two weeks for a potential negotiation. It has tilted market sentiment towards a more positive note, yet the history of talks with Iran on nuclear technology has been tricky and could see little result imminently. Israel is another wildcard as they may not wait for Trump to order another major strike, further complicating the potential negotiation for ceasefire. All eyes remain on the magnitude of U.S. involvement and Iran retaliation next week.

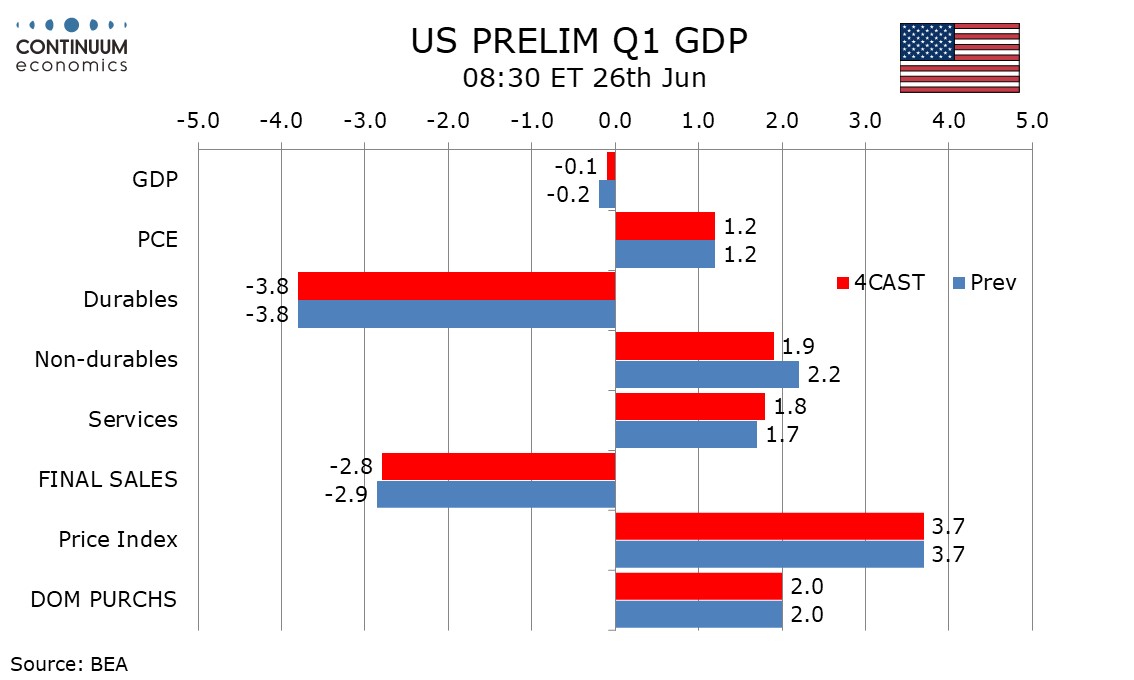

We expect the third (preliminary) estimate of Q2 GDP to be revised marginally higher to -0.1% from the second (preliminary) estimate of -0.2%. This would follow an upward revision from the first (advance) estimate of -0.3%. The upward revision in the preliminary estimate was more than fully explained by inventories and business investment from already strong levels, helping to explain where the surge in imports (which more than fully explained the decline in GDP) went, and we expect further upward revisions in these sectors. While inventories will make the largest contribution to the revision, we also expect an upward revision to final sales (GDP less inventories) to -2.8% from -2.9%. We expect final sales to domestic buyers (GDP less inventories and net exports) to be unrevised at a positive 2.0%.

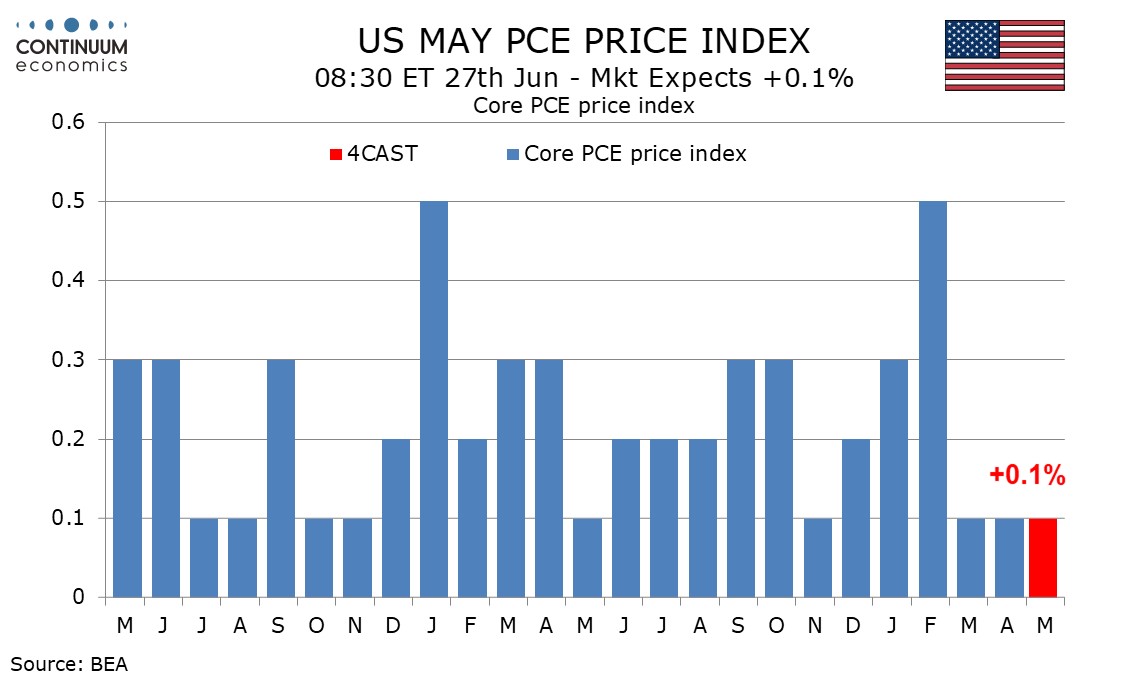

We expect a 0.1% rise in May’s core PCE price index, matching to core CPI, continuing to show limited tariff pass-through. Subdued data are also likely from personal income, which we expect to be unchanged, and personal spending, where we expect a 0.1% decline. Core CPI was up by 0.13% before rounding, suggesting that while core PCE prices are usually marginally softer than core CPI, core PCE prices will be close to 0.1%. Overall CPI prices rise by only 0.08% before rounding, but with PCE prices less sensitive to gasoline than CPI we expect overall PCE prices to also rise by 0.1%. The yr/yr core PCE price index would then remain at April’s 2.5% pace, which was the slowest since March 2021, while the overall pace will move closer to the core, rising to 2.3% from 2.1%.

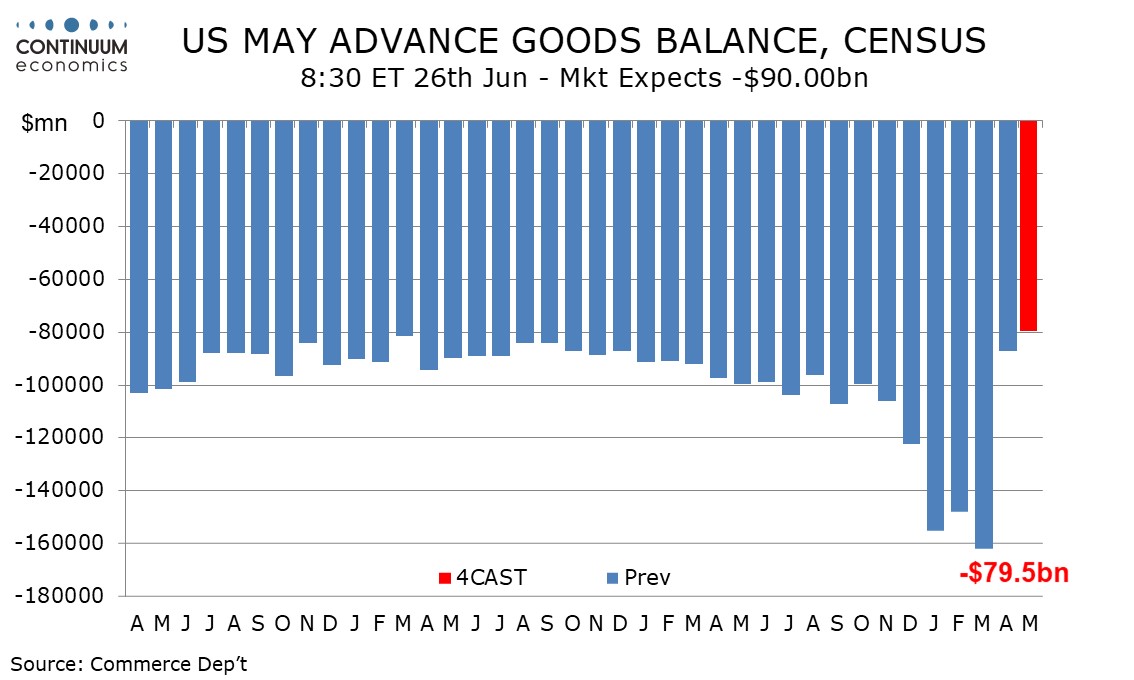

We expect May’s advance goods trade deficit to fall to $79.5bn from $87.0bn in April, extending the sharp correction from the record $162.0bn deficit seen in March as imports surged ahead of the April 2 tariff announcement. We expect a 6.5% fall in imports after a 19.9% plunge in April, with the fall coming entirely on volumes with import prices unchanged in May. Imports will be further depressed by an escalation of tariffs with China with the reduction on May 12 likely to have not seen imports from China recovering until June. Chinese data showed exports to the US falling further in May.

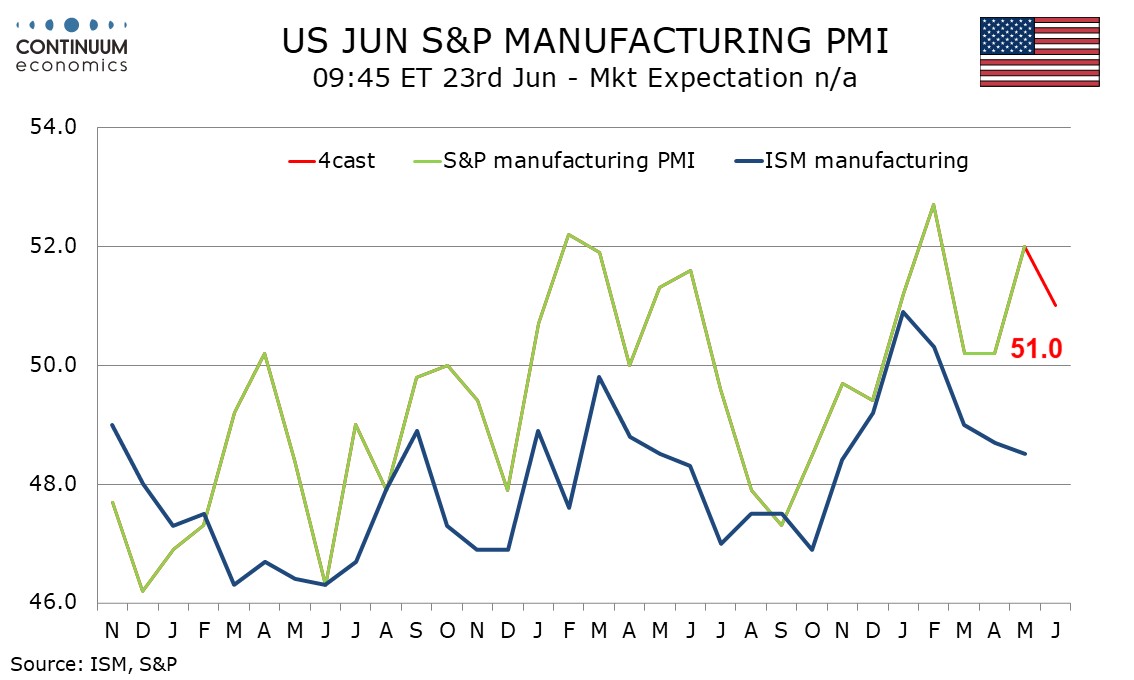

The yr/yr core PCE price index would then remain at April’s 2.5% pace, which was the slowest since March 2021, while the overall pace will move closer to the core, rising to 2.3% from 2.1%. We expect June’s S and P PMIs to show modest corrections lower to correct May improvements, which contrasted weaker data from the ISM surveys in May. However the corrections, manufacturing to 51.0 from 52.0, and services to 53.0 from 53.7, should be moderate enough to suggest scope for gains in June’s ISM indices. Tariff fears eased after the sharp reduction in tariffs on China which may have lifted the May S and P data, though that makes the weakness in the ISM surveys, which came later, somewhat surprising. Still, the May ISM manufacturing survey had some improvement in the details, outside a sharp slide in inventories, and some regional manufacturing surveys were less weak. We expect June’s S and P manufacturing index, while slipping to 51.0 from 52.0, to remain above neutral, and also the near neutral 50.2 outcomes seen in March and April.

We expect June’s S and P PMIs to show modest corrections lower to correct May improvements, which contrasted weaker data from the ISM surveys in May. However the corrections, manufacturing to 51.0 from 52.0, and services to 53.0 from 53.7, should be moderate enough to suggest scope for gains in June’s ISM indices. Tariff fears eased after the sharp reduction in tariffs on China which may have lifted the May S and P data, though that makes the weakness in the ISM surveys, which came later, somewhat surprising. Still, the May ISM manufacturing survey had some improvement in the details, outside a sharp slide in inventories, and some regional manufacturing surveys were less weak. We expect June’s S and P manufacturing index, while slipping to 51.0 from 52.0, to remain above neutral, and also the near neutral 50.2 outcomes seen in March and April.

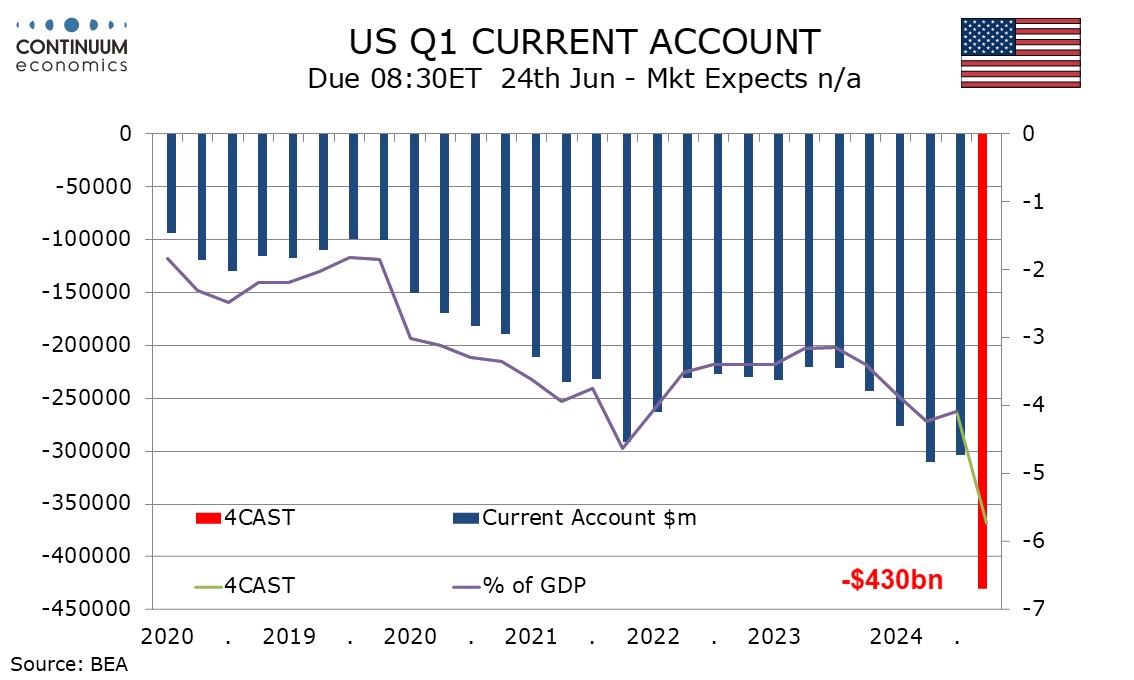

We expect a record Q1 US current account deficit of $430bn, up from $303.9bn in Q4, which will probably be revised a little lower. The rise in the deficit will be largely on a pre-tariff surge in goods imports and is likely to be reversed in Q2. As a proportion of GDP the deficit would be 5.7%, up from 4.1% in Q4 and the highest since Q3 2006. Monthly trade data on goods and services has already been released. The Q1 goods deficit increased to $466.0bn from $328.9bn (revised from $326.1bn in the Q4 release). The Q1 services surplus slipped to $75.4bn from $78.0bn (revised from $76.1bn in the Q4 release).

The DXY has been treading lower steadily but the latest escalation in the geopolitical front has seen a rebound on haven bids. Going forward, the DXY will likely chop around on Trump's remark on a daily basis but it is unlikely to see a sustained rebound significantly on Fed's trajectory mostly unchanged.

On the chart, cautious trade around resistance at 99.00 has given way to a pullback, as intraday studies turn down, with prices currently trading around 98.65. Intraday studies are under pressure and overbought daily stochastics are ticking down, suggesting room for still further losses. Support is at congestion around 98.00. But the positive daily Tension Indicator and improving weekly charts are expected to limit any tests in renewed consolidation. Meanwhile, a close above 99.00, not yet seen, will open up congestion around 99.50. Bearish longer-term charts should limit any tests above here in selling pressure towards 100.00.

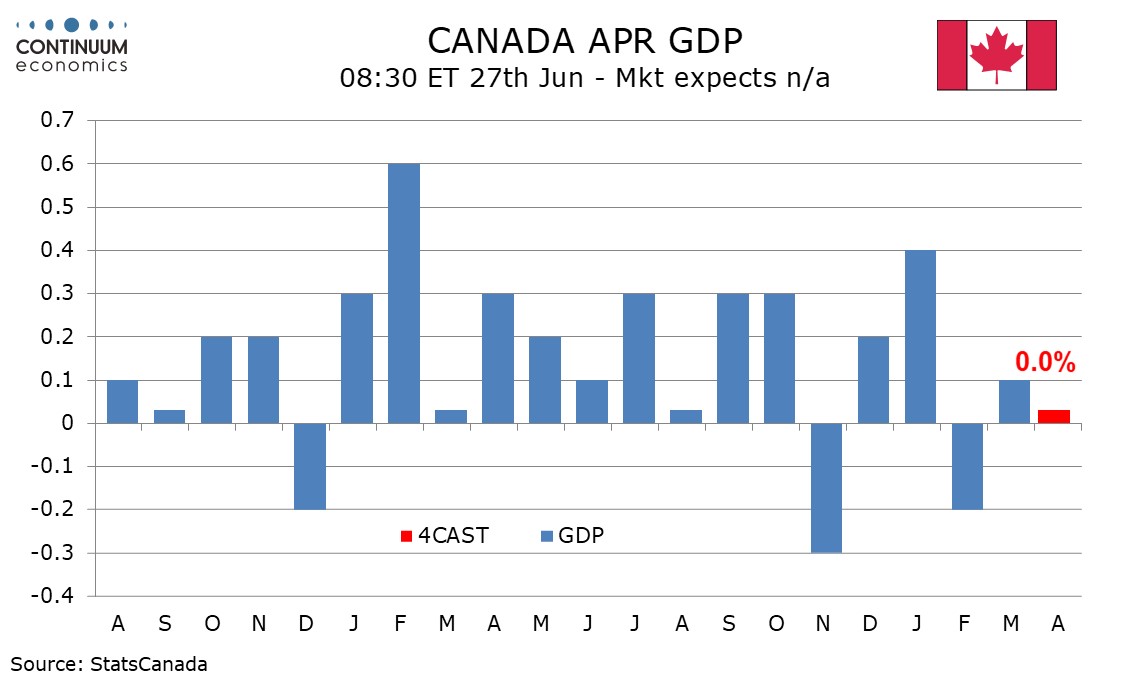

We expect Canadian GDP to be unchanged in April, slightly below a preliminary estimate for a 0.1% increase made with March’s report. Tariffs are likely to be a restraint on the economy through Q2 and beyond. A strong April 2024 will see yr/yr growth slip to 1.3%, the lowest since March 2024, from 1.7%. We expect goods and services to both be unchanged in April. Goods will see weakness in manufacturing, which is particularly sensitive to tariffs, offset by a rise in mining. Services are expected to see weakness in wholesale but gains in finance and insurance. Arts, entertainment and recreation will get a lift from Canadian participation in the National Hockey league playoffs

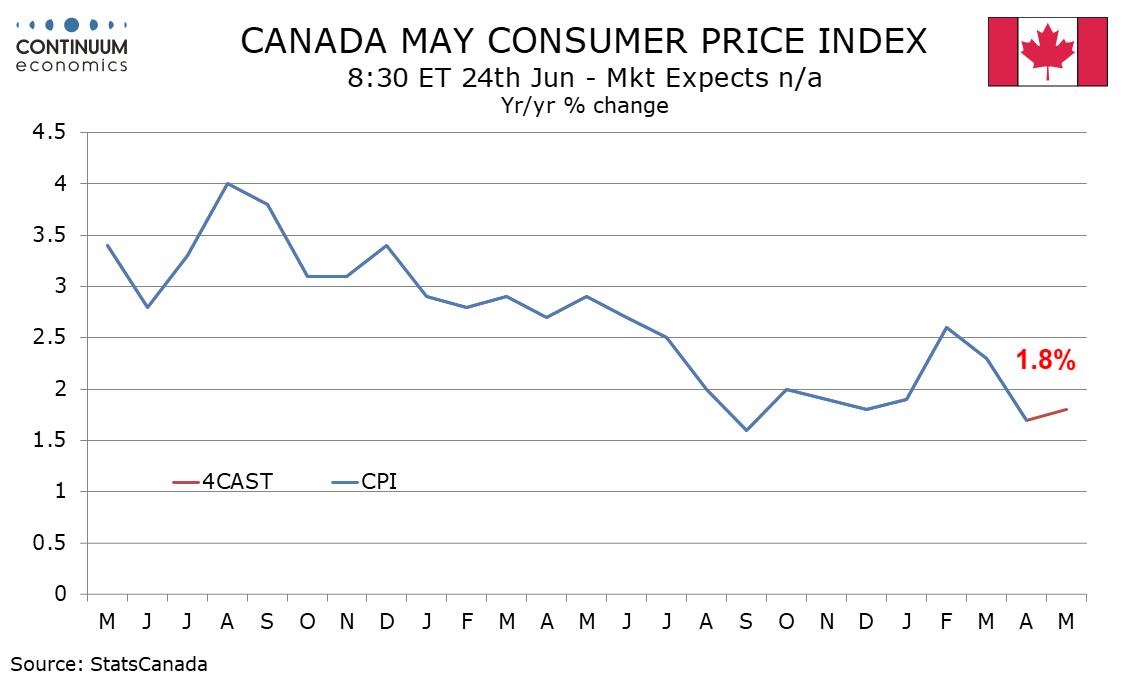

We expect May Canadian CPI to see a marginal rise to 1.8% yr/yr from 1.7% in April, correcting a fall from 2.3% in March that was fully explained by the abolition of the consumer carbon tax. However, after an acceleration in April, we expect some slowing in the Bank of Canada’s core rates in May. On the month we expect a 0.1% seasonally adjusted increase ex food and energy to follow a 0.3% increase in April, with a stronger CAD providing some restraint. We expect gasoline to lift overall CPI to a 0.2% seasonally adjusted increase. Before seasonal adjustment we expect seasonal increases to lift overall CPI to a 0.6% rise on the month with ex food and energy CPI rising by 0.4% unadjusted. This would see yr/yr ex food and energy slipping to 2.4% from 2.6%, reversing an April acceleration.

USA It is a busy week for US data but the highlight may be semi-annual testimony from Fed Chairman Powell to the House on Tuesday. On Monday we expect May existing home sales to fall by 1.3% to 3.95m. We also expect June’s S and P PMIs to correct lower after May increases, manufacturing to 51.0 from 52.0 and services to 53.0 from 53.7. Fed’s Goolsbee speaks on Monday.On Tuesday we expect a record current account deficit of $430bn in Q1 from $303.9bn in Q4. June consumer confidence will be closely watched and may see less of a bounce than did June’s preliminary Michigan CSI. In addition to Powell, Fed’s Hammack and Williams speak on Tuesday. On Wednesday we expect a 12.5% fall in May new home sales to 650k to follow a 10.9% increase in April.On Thursday we expect May’s advance goods trade deficit to extend a sharp decline in April, falling to $79.5bn from $87bn in April and a record $162 bn in March. We expect a 6.7% rise in May durable goods orders to be led by aircraft, with ex transport orders to rise by only 0.1%. We also expect a marginal upward revision to Q1 GDP to -0.1% from -0.2%, Weekly initial claims are also due with May pending home sales following. Thursday’s Fed speakers are Barkin, Hammack again and Barr.On Friday we expect a subdued 0.1% increase in May core PCE prices, unchanged personal income and a 0.1% decline in personal spending. The final June Michigan CSI is also due. Fed’s Williams and Hammack will both speak again.

CANADA Canada sees two significant data releases, May CPI on Tuesday and April GDP on Friday. We expect CPI to edge up to 1.8% yr/yr from 1.7%, but we expect the Bank of Canada’s core rates to correct lower after accelerating in April. We expect GDP to be unchanged in April, slightly weaker than a preliminary estimate for a 0.1% increase made with March’s report.

UKTuesday sees an array of MPC speeches/appearance, most notably Governor Bailey before a parliamentary Committee but with Greene and Breeden also due to speak and Lombardelli appearing on Wednesday, they possibly discussing the relevance of recent MPC split votes. But the main interest will be the flash PMI on Monday this coming the day before CBI industry survey data. As for the PMI, at 50.3 in May, it was up from 48.5 in April, but still the second-lowest since October 2023. Higher levels of service sector output contrasted with a solid reduction in manufacturing production and total new business decreased for the sixth consecutive month in May. This contributed to another solid fall in staffing numbers and we see a small correction back in June.

The week ends with final Q1 GDP data and the first stab at the Q1 current account. No revision is seen for the former and for the latter, after a deficit of 2.9% of GDP in Q4 2024, we see a narrowing having occurred last quarter.

EurozoneMore ECB insight arrive via a keynote speech from Chief Economist Lane (Tue). Datawise, the week’s focus is on the flash PMI data (Mon). The Composite PMI fell to 50.2 in May, from 50.4 in April. Although this marked a fifth successive monthly reading in alleged expansion territory, it pointed to an upturn that was only fractional overall and the softest since February. Manufacturing was better but (somewhat worryingly) services activity decreased in May for the first time since last November. We see little change in the overall PMI in the June numbers with more signs of disinflation alongside. Alongside French and German consumer confidence updates (Wed and Thu) respectively, there are other business survey updates including the German IFO (Tue) and the European Commission numbers (Fri). Friday also sees the first insight into June inflation with French CPI data which we see unchanged.

Rest of Western EuropeThere are a few key events in Sweden, with minutes to the Riksbank meeting due (Wed) and the Economic Tendency Survey (Thu), the latter very staying below par.

JP Tokyo CPI tops the Japanese calendar next Friday. National CPI in May remains red hot at 3.5% with ex fresh food jumping higher. It is unlikely to see significant rotation lower in the Core Tokyo CPI, but headline wise there maybe a temporary cooling from rice price drop after emergency reserve released.

AU Slae of PMIs on Monday to kickstart the week but monthly CPI on Wednesday would be critical. The monthly CPI has rotated below the midpoint of target range and is expected to tread further lower in a short run.

NZTrade Balance on Tuesday and Consumer Confidence on Thursday will unlikely be target moving.

Recap for the week

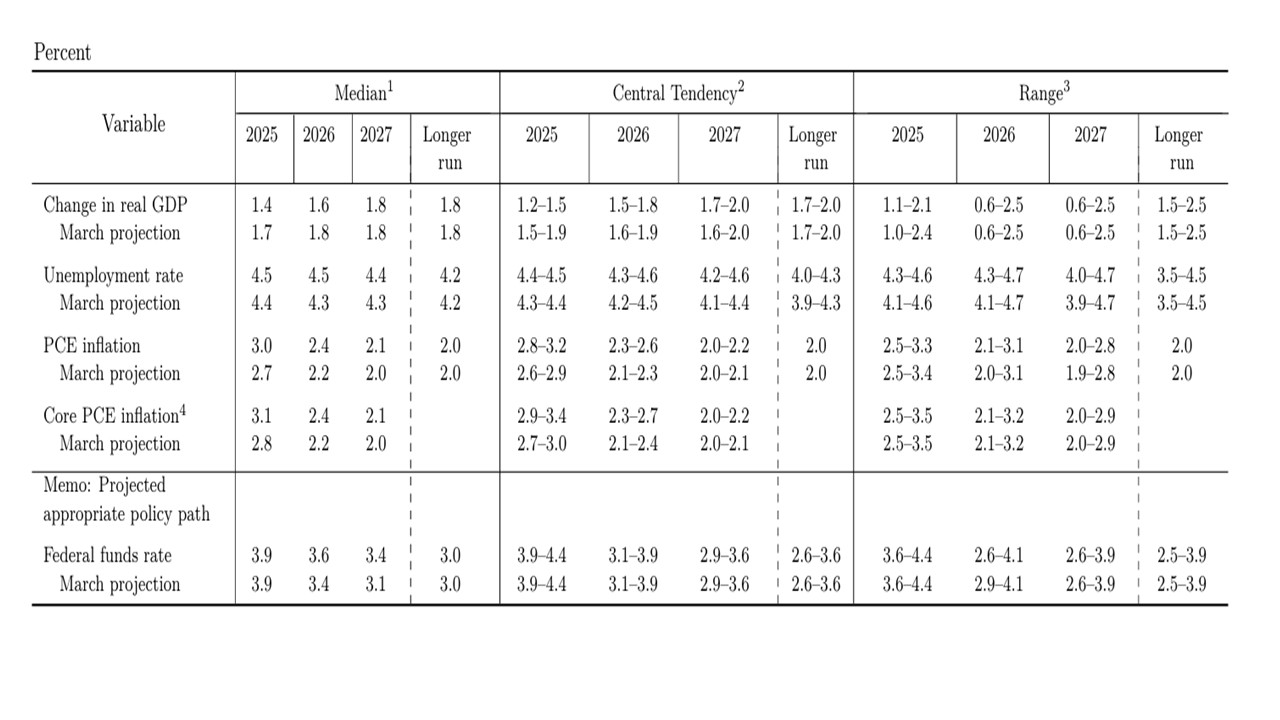

Figure: Fed June Summary of Economic Projections (SEP)

Though the SEP reduced growth forecasts and boosted inflation, the guidance from the Fed remains that policy is on hold in the coming meetings. Though the FOMC median still has two 2025 cuts, the breakdown shows that this was a close call and a lot of members see no cut or only 25bps. We look for a 25bps Q4 cut and then three 25bps cuts in Q2-Q4 before the Fed delivers one final cut in 2027.

The June FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation and growth uncertainties. The SEP (Figure 1) saw the net tariff effect of the last 3 months since March boost core CPI projections for 2025-26 and reduce GDP for the same two years. This is measured rather than aggressive in nature on both GDP and inflation. The 2.4% median projection for 2026 core PCE inflation would also still represent progress towards target, but also crucially FOMC officials view that the tariff inflation effect will largely be 1 round effects and not persist. The FOMC statement also noted that uncertainty about the economy had diminished but remains elevated. We agree with this, as the Trump administration actions have been curtailed by markets and supply chain concerns and we see the end average tariffs rate being 13-15% (here). Fed chair Powell echoed this view as well in the Q/A.

· Guidance on Interest rates. The SEP medians still show two 25bps rate cuts for 2025, but 2026 has been trimmed to one 25bps cut. The breakdown of the FOMC members view shows that 7 out of 19 see no cut this year from the current 4.25-4.50% and for 2026 the split show two major groups at 3.75-4.00% and 3.25-3.50% -- with the 2026 median happening to be in between. This underlines that the FOMC members have diverging views for 2025 and 2026 and that the median of two cuts for 2025 is not high confidence. Fed Powell also tried to temper the 2026 and 2027 Fed Funds medians and focus more on 2025. Powell during the Q/A was reluctant to be drawn on hints on timing and once again showed a patience on maintaining current policy rates.

· 2025/26 rate prospects. The Fed is not sufficiently worried about the economy at the moment to overlook what it anticipates will be a temporary boost to inflation. This argues for policy to remain on hold in the coming meetings in July and September, unless the real sector data deteriorates sharply. October is possible, but we still prefer a 25bps cut at the December meeting. After a solitary move in Q4 2025, we expect the Fed to pause in Q1 2026 before delivering 25bps moves in Q2, Q3 and Q4. This reflects our view that core PCE inflation will move towards target, with the Fed likely to focus on monthly changes into the winter and spring. Additionally, we see easing driven by the desire to get growth back up towards trend. That would leave the upper bound of the Fed Funds target range at 3.5% at the end of 2026, still slightly above the 3.0% that the Fed currently sees as neutral. We suspect that in a less globalized word, the long-term neutral rate will edge slightly above 3.0%.

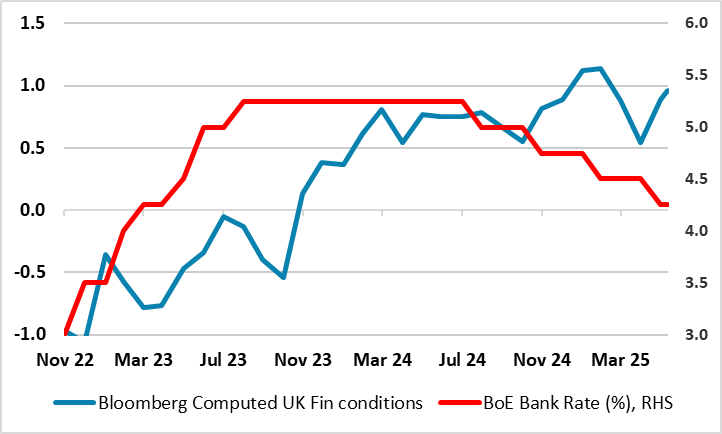

Figure: BoE Rate Cuts To Date Have Not Stopped Financial Conditions Tightening

A stable BoE policy decision was always the most likely (Bank Rate staying at 4.25%) as the MPC discussed its two alternative scenarios still, but possibly where hawks have been forced into diluting what were previous concerns about a ‘tight’ labor market. In fact, partly based on what was seen as a ‘material further loosening in labour market conditions’, Dep Governor Ramsden (as he did twice in 2024) dissented in favor of a 25 bp rate cut, thereby adding to the more longstanding such demands from his colleagues Taylor and Dhingra. Regardless, the Monetary Policy Statement still repeated the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long – the question being whether the dissenters also reject this line of thinking. But the issue of what constitutes restriction is also important (Figure shows the policy rate diverging from financial conditions) as it should help determine how much further and when the BoE eases.

We think that with the BoE regarding neutral policy rate as being well above 3%, two further 25 bp moves this year will be followed by another 50 bp in H1 2026. But we think the risks are for deeper and possibly faster cuts as we think the BoE is both over optimistic about growth prospects and over-estimating policy neutrality. One question here is if the BoE slows its QT program will this have any bearing on conventional policy; NB – we think that the MPC in September will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP 100bln pa to GBP 75bln. Internal differences within the MPC argue against a more aggressive slowing.

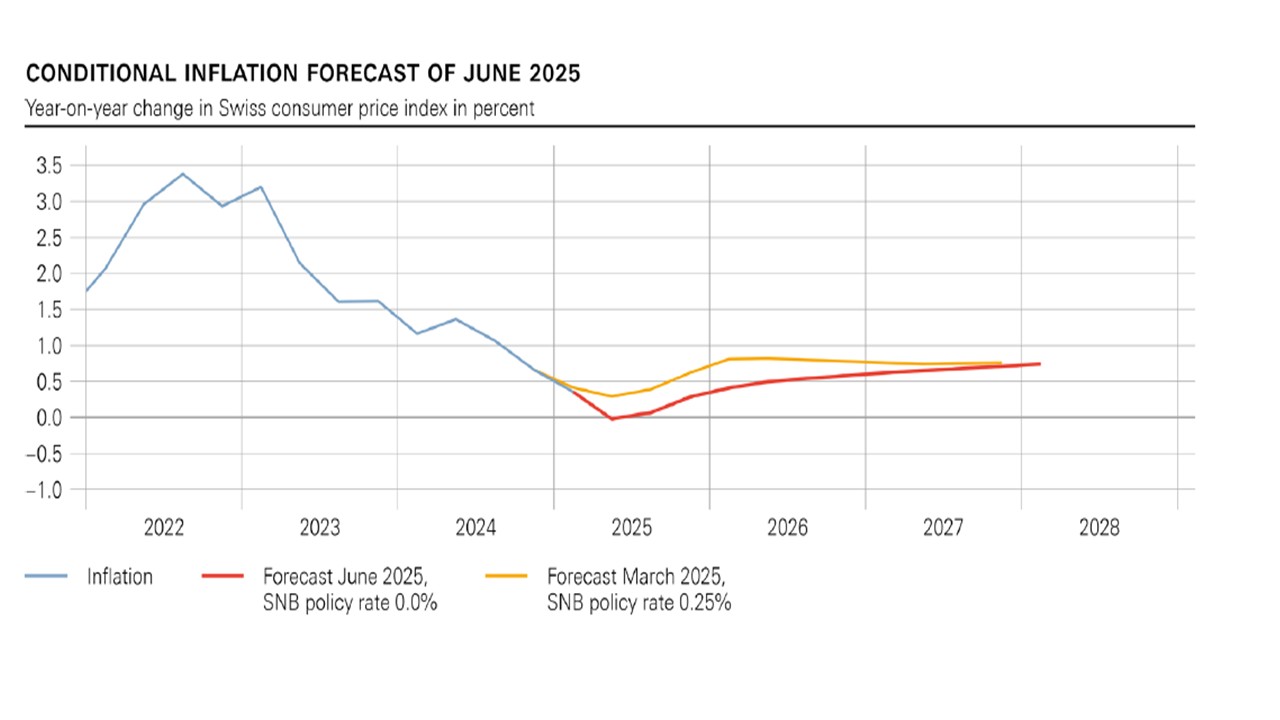

Figure: SNB CPI Inflation Projections

The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF strength and encourages banks to lend, though the FX market is more focused on USD momentum rather than a further rate cut threat.

As expected the SNB cut the policy rate from 0.25% to zero at the June meeting. Key points to note

· Inflation forecast. The short-term inflation forecast was trimmed, given the recent soft CPI inflation outcomes. GDP forecasts for 2025 and 2026 at 1.0-1.5% are consistent with market thinking. Though the medium-term forecasts were hardly changed (Figure 1), they still remain low with 2027 inflation at 0.7%. The SNB statement noted that these are consistent with price stability, but the SNB has been cutting with inflation forecasts this low. The SNB thus could have to cut back into negative territory and SNB officials will likely make clear that this is an option.

· Disinflation threat and negative rates. The SNB faces a three pronged disinflationary threat from tariffs imposed by the U.S., strong CHF and domestic disinflation. These all produce threats to the downside for the inflation forecast. The U.S. is likely to impose a 25% tariff on pharmaceuticals in the coming months, which would further hit Swiss exports and production. The USD is in a multi-year downtrend, with the CHF being one of the leading edges of the move. Finally, domestic inflation pressure is subdued, with domestic credit growth soft and consistent with low inflation (Figure 2). The SNB would probably prefer to consolidate the effects of previous rate cuts, but the low inflation forecast and downside risk to inflation means that a cut to -0.25% is feasible at the September or December meetings. The SNB will also hope that the threat of negative rates restrains the CHF strength, though the FX market is more focused on USD momentum rather than a further rate cut threat.

· As for the effective 'stealth' negative rate (as sight deposits held at the SNB will be remunerated at the SNB policy rate only up to a certain threshold) may be partly designed to encourage banks to lend given the weakness in private sector credit.

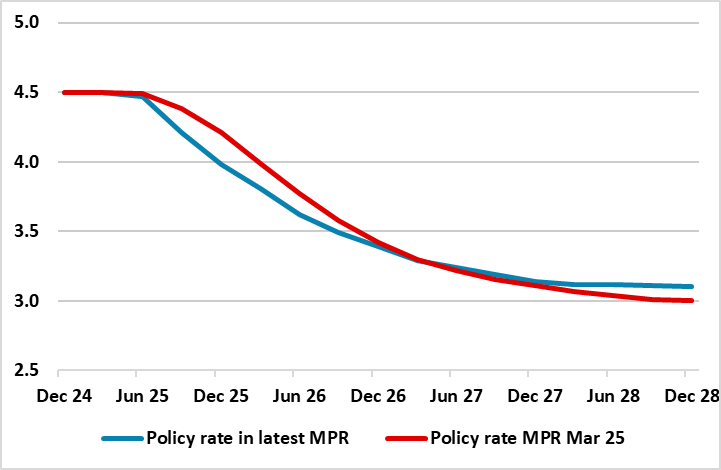

Figure: Earlier and Faster Easing?

Although we thought the Norges Bank would not start to ease until its next (Aug) meeting, we think the surprise 25 bp policy rate cut (to 4.25%) announced today is very much warranted, as are the further cuts (Figure) being flagged in the updated Monetary Policy Report (MPR) – ie two more such moves by end year. What is notable is that the Board actually upgraded its economic outlook, albeit largely a result of the strong Q1, which showed broad and far from aberrant gains. However, the Norges Bank is trying to suggest that it is merely reducing current policy restrictiveness, but it is clear that recent downside surprises in CPI data have changed the Board’s mindset, possibly helped by an array of its own survey data suggesting somewhat more spare capacity in the Norwegian economy than assumed in the previous Report. We see up to three moves this year and around a full ppt more in 2026!

The Norges Bank was the first DM central bank to start hiking and is now the last to start easing. The hawkish line being pursued by the Norges Bank – at least hitherto –still only helps bring inflation in its view back to target only 2-3 years hence. Obviously, it has been swayed by better CPI data (see below) and by a more stable exchange rate, and perhaps a realization that amid the downside risks facing the European economies it is better to take out policy insurance sooner than later.

Regardless, as for inflation, we think that the Norges Bank is still being too cautious, even though we would not disagree materially with its upgraded 1.6% and 1.4% GDP projections for the year and next rate. Even so, it does seem as if the Board now echoes our thinking in seeing a larger and earlier output gap (Figure 2). Indeed, we think the latter is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, May data shows that core inflation (CPI-ATE) fell 0.2 ppt to 2.8%, well below (again) Norges Bank thinking (it expected 3.1%). Looking at the details some of this softening may be calendar related but over the past couple of months, CPI inflation has been two to three tenths lower than Norges Bank’s expectations. Indeed, CPIF and core inflation (ie the former ex food) are running nearer zero on an adjusted and smoothed m/m basis.

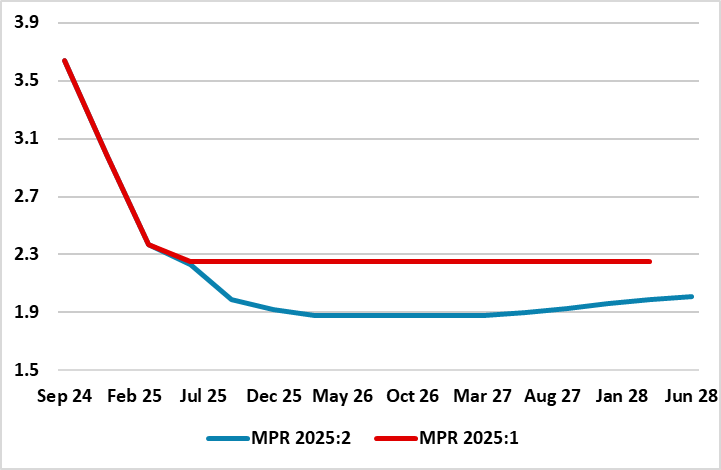

Figure: Riksbank Revised Policy Rate Outlook

As widely expected, the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0%. Moreover, as we hinted at, the Board even then suggest that a further move is possible (Figure). Given that even with substantial paring back of its growth forecast in its updated Monetary Policy Report (MPR) and with an ensuing revision that now sees an output gap of almost 2% of GDP we are puzzled that there was no appreciable downgrade to the inflation outlook. Instead, while we see CPIF inflation falling below target by next year we think the economy will under-perform the 1.2% and 2.4% GDP projections for this year and next and that this will make the Riksbank have to react and deliver the half-hearted rate cut it is flagging, probably next quarter, to 1.75% which we then see staying in place into 2027. Weakness in the economy has been evident both in official data as well as, a Riksbank business survey which now suggest that what green shoots had appeared have fizzled out while the latest CPI numbers suggest an absence of inflation.

A weak first quarter and revised national account numbers back for several years have prompted a marked downgrade to even our below consensus thinking, especially for this year. But, despite what seems to more of neutral fiscal policy but coming alongside Riksbank rate cuts, the growth outlook still seems weak – NB monetary policy easing should bite relatively quickly in Sweden given that mortgages are still largely flexible rate driven. Indeed, we now point to a below-consensus 2025 GDP outlook of 0.9% (0.6 ppt below what we envisaged three months ago) and only a moderate further pick-up to 1.8% next year, both partly a result of the U.S. tariffs that will very likely hit all EU countries. This may mean an even larger output gap emerges than Riksbank envisages now.