Norges Bank Review: More Caution But Another Cut Flagged for This Year

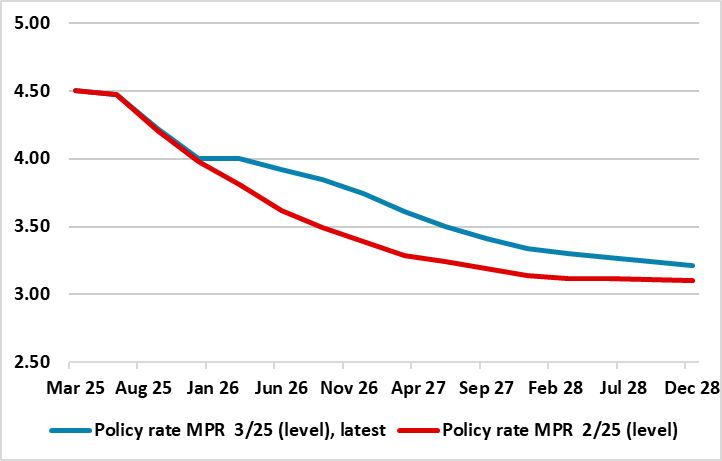

Despite the stronger than expected data seen of late (real and price-wise), as we expected, the Norges Bank cut is policy rate by a further 25 bp to 4.0%, an outcome markets had dithered over. But with a small cumulative upgrade to the real economy outlook and an ensuing reduction in the anticipated scale of an output gap, the Board pared back its projection for the policy rate in the coming years, albeit still flagging a third move for later this year. We think that the Norges Bank is being too cautious and that (on the basis of its own calculations), policy will be very restrictive through the projected timeframe out to 2028 and where we wonder why inflation only just approaches the 2% target by the end of that period, especially as m/m adjusted data already suggest the core rate is around target.

We are a little less confident about the extent of easing into 2026 but see another 25 bp cut likely in December and then every quarter through next year. That would still leave the policy rate roughly in the middle of the neutral rate range estimated by the Norges Bank. In other words, the Norges Bank will be merely taking its foot of the brake, rather than pressing on the accelerator.

Figure 1: Revised Policy Rate Outlook

Source: Norges Bank Monetary Policy Report (MPR)

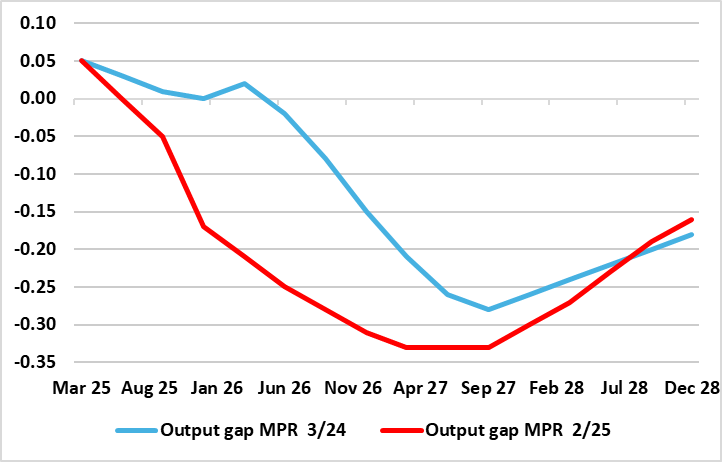

While still high, targeted (CPI-ATE) inflation is being boosted by stubborn services inflation, this partly offsetting ever softer goods and imported inflation, the latter coming in spite of the weak Krona backdrop that continues to influence Board thinking excessively. The hawkish line still being pursued by the Norges Bank still only helps bring inflation in its view back to target only 3 years hence, at least according to its updated MPR. As for this rate cut, which was apparently no formality, the Board may have been swayed by signs of a softer labor market in spite of a (justified) GDP upgrade given recent data) but where we doubt that there is much evidence to suggest an ensuing and clear reassessment of the still likely negative output gap.

Indeed, the economy (both real and nominal) has been strong so far this year. Admittedly the cumulative jump in GDP of around 1.8% does reflect a few volatile factors, namely swings in fisheries and power supply as well as easier fiscal policy. But the strength also comes alongside some signs of a possible stronger potential growth backdrop, this hinted at by both seemingly better productivity data and a further rise in activity, meaning that overall utilization may actually not be too far away from normal if not showing spare capacity.

Figure 2: Revised Spare Capacity Outlook

Source: Norges Bank Monetary Policy Report (MPR)

Thus, as for inflation, we think that the Norges Bank is still being too cautious, even though we would not disagree materially with its upgraded 2.0% and 1.5% mainland GDP projections for the year and next. In fact, we would contend that an emerging and earlier output gap is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, although seemingly suggesting price persistence, August data shows that despite targeted inflation (CPI-ATE) staying at 3.1%, chiming with Norges Bank thinking, the details, CPIF and core inflation (ie the former ex food) are running at rates more consistent with the 2% target on an adjusted and smoothed m/m basis.