FX Daily Strategy: APAC, May 21st

Canadian CPI risks slightly on the downside

USD/CAD risks consequently on the upside

CHF and JPY under pressure, CHF the preferred funding currency

GBP gains to fade ahead of UK CPI

Canadian CPI risks slightly on the downside

USD/CAD risks consequently on the upside

CHF and JPY under pressure, CHF the preferred funding currency

GBP gains to fade ahead of UK CPI

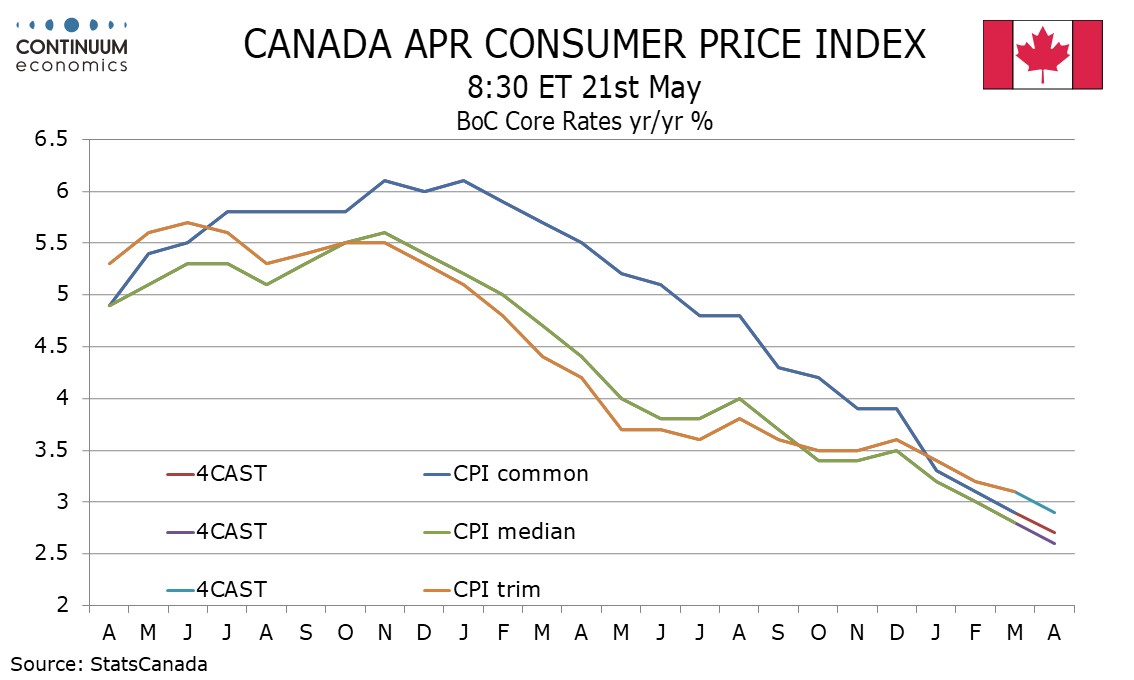

Canadian April CPI is the main data on Tuesday in what is generally a quiet data week. The data will be closely watched as it is the last CPI release before the June 5 Bank of Canada meeting. Currently, the market is pricing a 37% chance of a 25bp rate cut at the meeting, so it is clearly seen as a close call. We expect the yr/yr pace to be unchanged from March at 2.9%, which was also the pace in January before February saw a brief dip to 2.8%. However we expect continued steady downward progress in the BoC’s core rates. While we expect the yr/yr ex food and energy rate, like the headline, to remain at 2.9% yr/yr this is not one of the BoC’s three core rates, which continued their steady trend lower in March despite the slightly firmer data on the month. We expect this to persist in April, with CPI-common falling to 2.7% from 2.9%, CPI-median falling to 2.6% from 2.8%, and CPI-trim falling to 2.9% from 3.1%. While the consensus also looks for these core rates to decline, our forecasts are looking for a slightly larger decline, and we see them as being sufficient to tip the BoC into a June 5 rate cut.

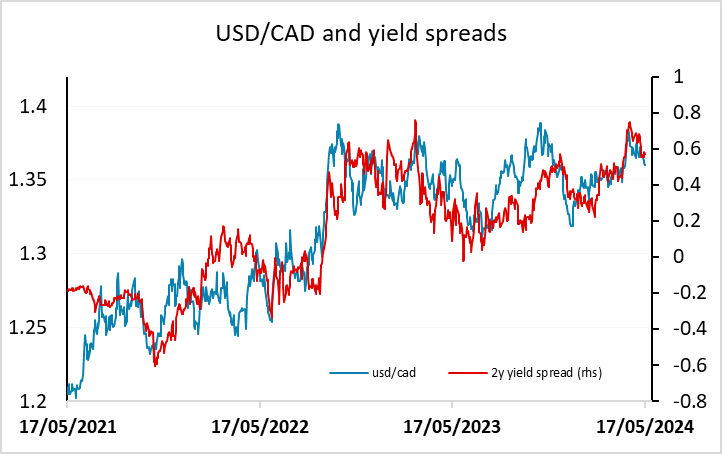

For USD/CAD, this suggests upside risks, particularly since USD/CAD has edged lower in recent session while front end yield spreads have moved in favour of the USD. There is currently support around 1.3590, and a break of this could lead to a further 50 pips on the downside, but our forecast of slightly softer data suggests a move back up towards 1.37 is more likely.

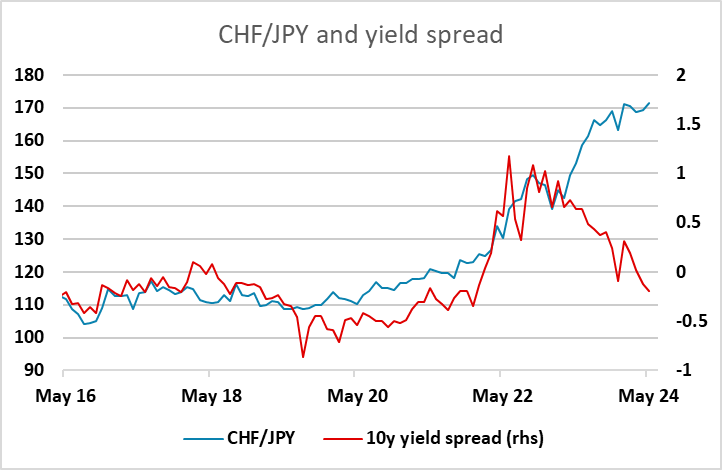

Otherwise, there isn’t much on the calendar. The main FX moves on Monday were risk positive, with the JPY and CHF both coming under pressure. This may reflect the general low volatility environment rather than any real change in risk perception, with the lack of a major news focus for the USD this week. For carry trades, we would still prefer the CHF as the funding currency, partly due to value, given the huge rise in CHF/JPY in recent years, but also because the risk of BoJ intervention is significant here. EUR/JPY has only been above here on the first intervention day of April 29, and although USD/JPY is further off its highs, it’s only a figure off the level seen when the BoJ intervened in NZ time on May 1. Intervention is a real danger for JPY shorts.

Elsewhere, EUR/GBP dipped below 0.8550 on Monday for the first time since May 2, in spite of a speech from BoE deputy governor Broadbent that sounded to us to be on the dovish side suggesting the possibility of a June rate cut is greater than the 44% chance currently priced. There is a speech from BoE governor Bailey due on Tuesday, which may give further signals on the potential for a June move. But the GBP market will be most focused on Wednesday’s CPI data, and we doubt there will be much movement away from 0.8550 in EUR/GBP before then.