FX Weekly Strategy: APAC, July 8th-12th

US CPI the main focus, some USD downside risk

JPY weakness continues to defy fundamentals

EUR upside limited by weak data and French politics

GBP may soften on BoE comments

Strategy for the week ahead

US CPI the main focus, some USD downside risk

JPY weakness continues to defy fundamentals

EUR upside limited by weak data and French politics

GBP may soften on BoE comments

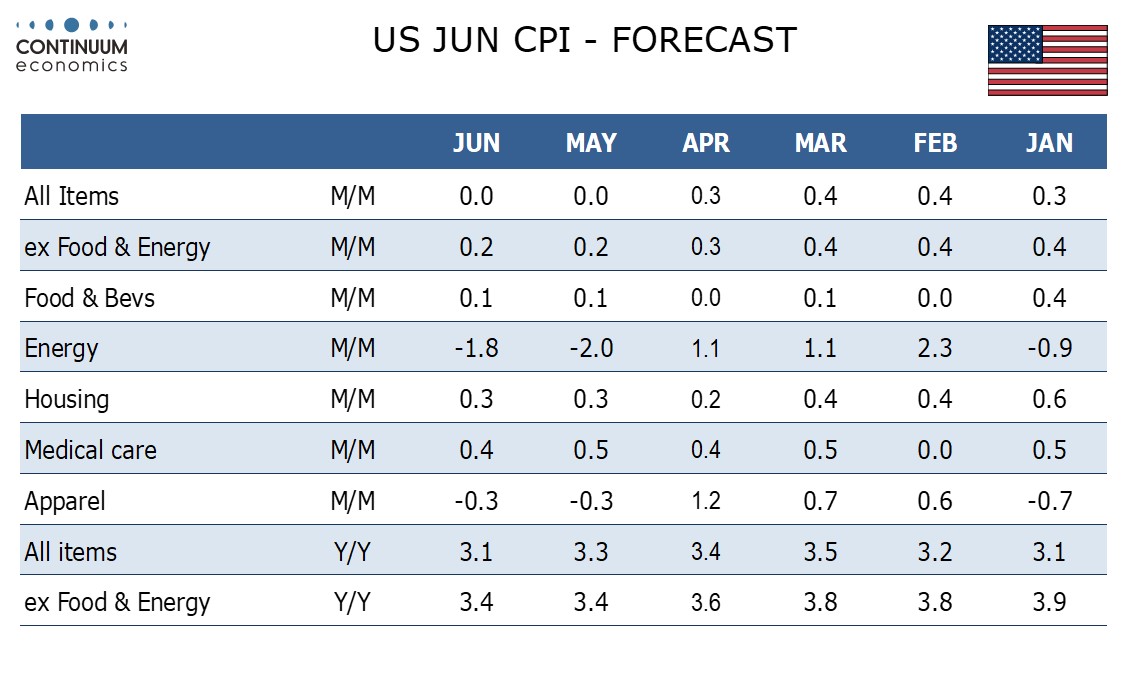

The US June CPI data will be the main data focus of the week. The comments from Powell last week suggested a slightly more dovish attitude, and US yields moved lower in response helped also by increasingly soft data including the employment report, claims and ISM services which have resulted in some downgrading of Q2 GDP forecasts. The Atlanta Fed GDPNow nowcast has fallen to 1.5%b for Q2, and the employment report is consistent with sub-trend growth. Lower inflation is needed as the last piece of the puzzle to justify Fed easing. We expect June’s CPI to look similar to May’s, with an unchanged outcome overall and a 0.2% increase ex food and energy. Before rounding we expect gains of 0.04% overall and 0.19% ex food and energy, up from 0.01% and 0.15% respectively in May, but both May and June would still be softer than any month in 2023 in each series. Our forecasts are marginally below the consensus, and should support a more dovish Fed view. It is hard to see the market pricing in a July Fed ease, but September, currently priced as around an 80% chance, still has scope to move closer to being fully priced.

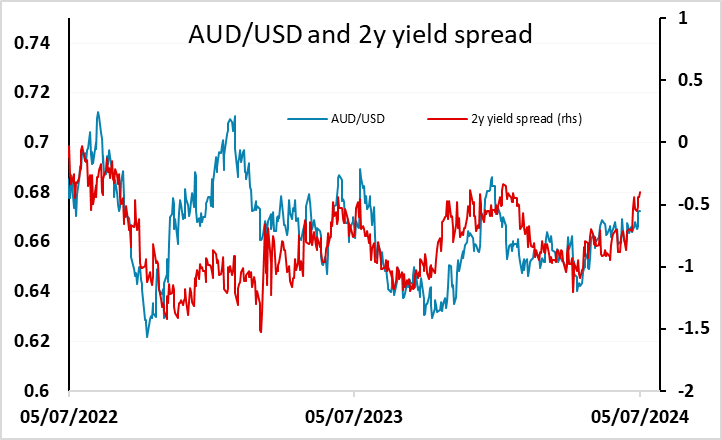

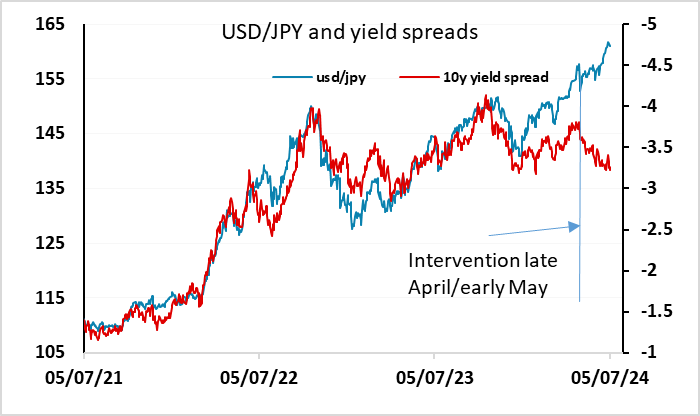

All this suggests some downside risks for the USD, particularly against those currencies where there is less scope for easing. The most obvious of these ids the JPY but the JPY remains a different animal to the rest, with the market unwilling to abandon the big uptrend we have seen in recent years even though the rising US yields that triggered it are going into reverse. Yield spreads have been suggesting a lower USD/JPY for more than a month, but it remains close to the highs. The story is complicated by weak Japanese data, the lack of tightening in June from the BoJ and uncertainty about the prospects for intervention. But despite all this it remains very hard to find a fundamental justification for extreme JPY weakness. Nevertheless, in the absence of BoJ intervention it is hard to forecast a convincing turn lower in USD/JPY. The AUD may therefore be a more favoured vehicle for USD bears, with less reason to expect RBA easing and attractive yields. The year’s highs above 0.68 may be achievable if US CPI is on the weak side.

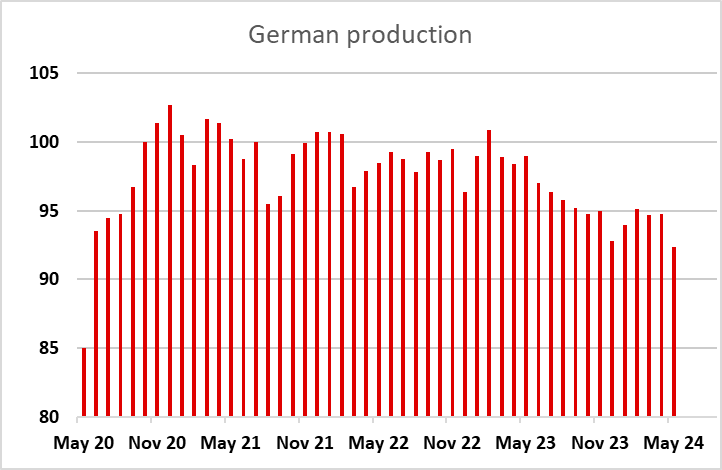

The other main focus of the week may be politics, with the second round of the French elections on July 7 potentially triggering some reaction on Monday. Currently the market is not expecting any party to achieve a majority, or even to manage to form a government in coalition. However, RN are likely to be the largest party, and may attempt to form a government even though many thought they would not. If they do, this could cause some problems for the EUR. The EUR in any case performed better in the last week than might have been expected given the weak data, with orders and production in Germany both hitting the lowest levels since the pandemic. We doubt there is much scope for EUR/USD to advance beyond 1.08 in this environment.

There could also be some impact from political developments in the US, with increasing speculation that Biden could bow out of the presidential race. But even if he does, it’s not obvious what the market impact will be, as the market is still likely to expect a Trump victory as it does now. There wasn’t much impact from Biden’s weak performance in the last debate, so even if the probability of a Trump win increases, we wouldn’t expect a significant USD effect.

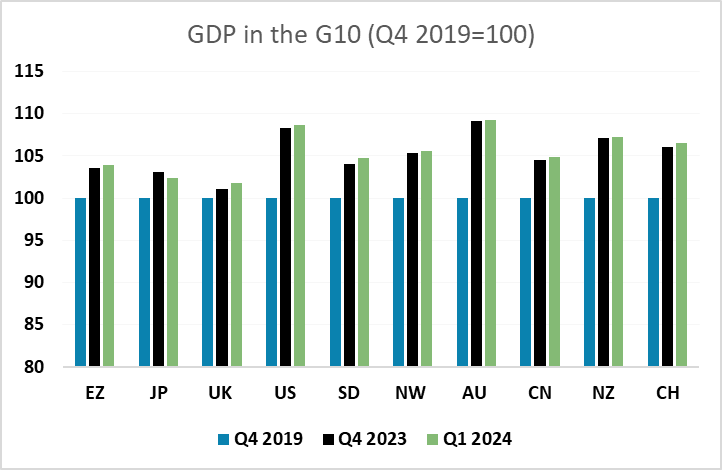

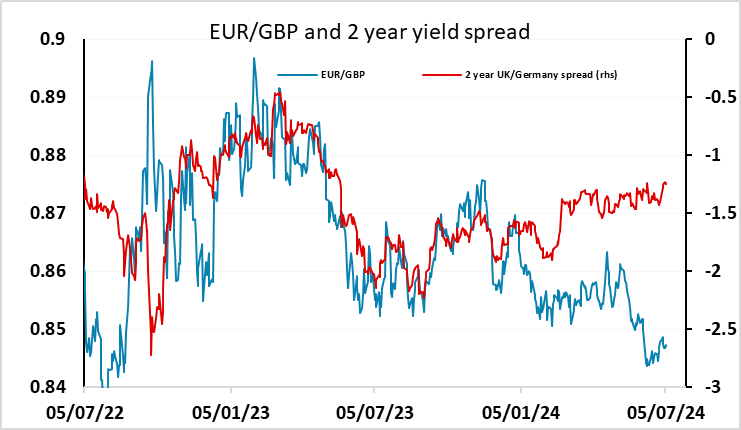

There is May GDP data for the UK due, which we expect to show a 0.1% m/m rise. There may be more focus on the UK data in the wake of the election, but in spite of the recent better numbers, it should be remembered that the UK is still the worst growth performer in the G10 in the period since Q4 2019 – the last pre-pandemic quarter. This hasn’t had a significant negative impact on the pound, partly because the supply problems in the UK have meant weak demand hasn’t prevented inflation rising and the BoE tightening. The BoE’s Pill and Haskel are set to speak this week, and we see some scope for them to increase market expectations of an August easing, currently seen as around a 60% chance. If they do, EUR/GBP could press up to 0.85 and beyond.

Data and events for the week ahead

USA

The highlights of the week ahead are likely to be Fed Chairman Powell’s testimony to the Senate Banking Committee on Tuesday and June’s CPI on Thursday. Powell is likely to express cautious optimism on inflation keeping hopes for rate cuts later in the year, if not in the near term, alive. Powell will repeat his testimony to the House Financial Services Committee on Wednesday. Other Fed speakers scheduled are Goolsbee and Bowman on Wednesday with Bostic and Musalem following on Thursday.

There is not much data scheduled before the CPI. May consumer credit is due on Monday. Tuesday sees June’s NFIB survey of small business optimism and Wednesday May wholesale trade. We expect Thursday’s June CPI to look similar to May’s encouraging data, unchanged overall and a 0.2% increase ex food and energy. Weekly jobless claims will be released with the CPI and June’s budget data follows. We expect June PPI on Friday to look similar to the CPI, unchanged overall with a 0.2% increase ex food and energy. Preliminary July Michigan CSI data is also due on Friday.

Canada

It is a quiet week in Canada, though May building permits and June existing home sales will be released on Friday.

UK

A medium busy week sees May GDP data (Thu) with a 0.1% m/m rise anticipated, which should accentuate an apparently solid picture of late, especially as it should encompass upward revisions to the Q1 backdrop. As a result, this would be consistent with a circa-0.3% Q2 q/q-plus outcome (Figure 1), building on the strong but possibly misleading Q1 jump but would also be below BoE thinking for the last quarter. Also on Thursday comes the BoE Credit Conditions Survey. It will help assess how the recovery is faring, not least in the housing market. Three months ago it pointed to the availability of secured credit to households having increased albeit this came, however, alongside no material change in credit supply for either unsecured lending or on the company side. What was also evident however, was a marked jump in demand for secured lending for house purchase and re-mortgaging increased in Q1, and both were expected to increase in Q2.

Otherwise, more positive housing market signs may be seen in the RICS survey (Thu) while contained outcomes may be evident in updated BoE compiled household inflation expectations. Now with the general election over, the BoE will come out of its self-imposed purdah and feel more open about talking policy, with MPC member Haskel speaking (Mon) and Chief Economist Pill (Wed)

Eurozone

The week is very quiet both in terms of data and comment. But Monday will see the full results of the second round of French parliamentary elections where we see no party gaining a working majority. The question is who and when Macron will offer the first chance to try and form a government and will they accept the challenge.

Rest of Western Europe

There are key data in Sweden, with CPI data (Fri) and where we see sharply lower reading for the key CPIF figure even with adverse base effects, actually falling clearly below 2%, but largely due to energy. Finally, CPI data in Norway (Wed) should may see these June numbers fall even further with the Norges Bank’s projections envisaging a drop to 3.6%% for CPI-ATE, which would be a 24-mth low.

Japan

Kickstarting the week with Labor cash earning on Monday. We had dismal household spending data in May, confirming our forecast that Japanese residents are unwilling to consume with continuously higher prices. A boosted labor earnings will be beneficial for the Japanese economy and support BoJ’s forecast. We also have PPI on Wednesday with other tier two data spread across the week.

Australia

Consumer inflation expectation maybe the only critical economic release for Australia on Thursday. Inflation expectations have been rising higher in the past month with the RBA confirming such. Any high read is not ruled out and it would be a surprise if it comes in lower. Home loans on Monday, Consumer confidence and business outlook on Tuesday.

NZ

The RBNZ interest rate will be decided on Wednesday and we are not forecasting any changes to interest rate with inflation outlook somewhat align with continuous moderation. Any movement will be a surprise to the market.