U.S. May ISM Services - Marginally below neutral

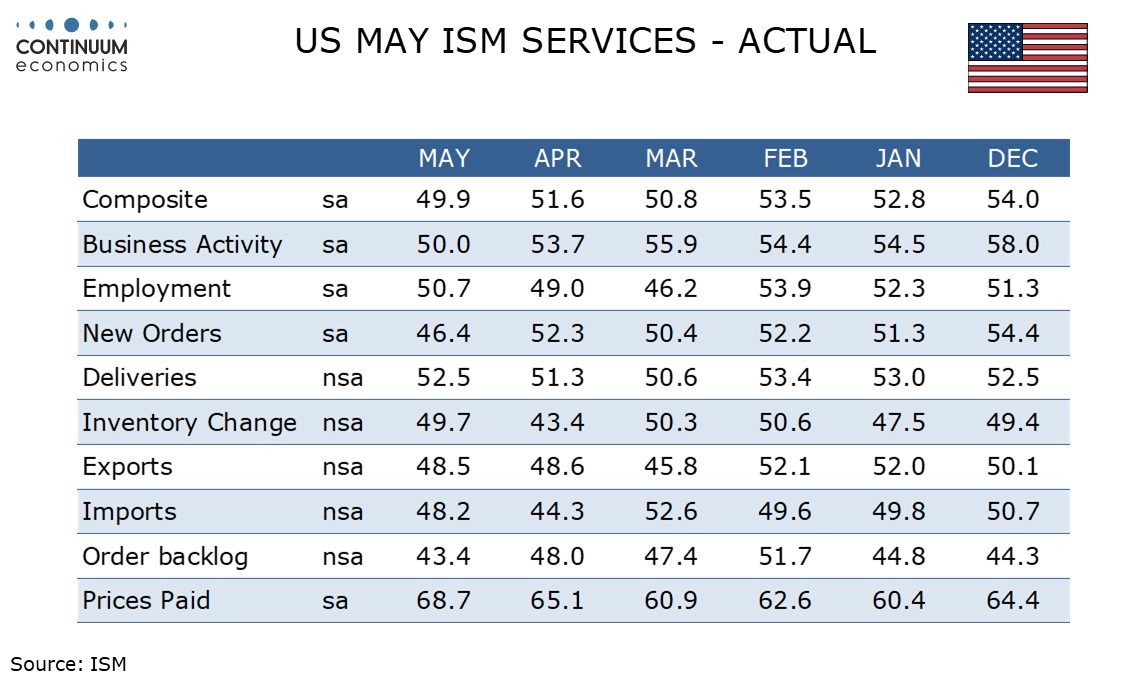

May’s ISM services index of 49.9 from 50.8 unexpectedly weakened, moving marginally below neutral for the first time since a far from distant June 2024. This contrasted a rise in the S and P services PMI to an upwardly revised 53.7, from a 52.3 preliminary and 50.8 in April. Most regional service sector surveys however remained weak in May.

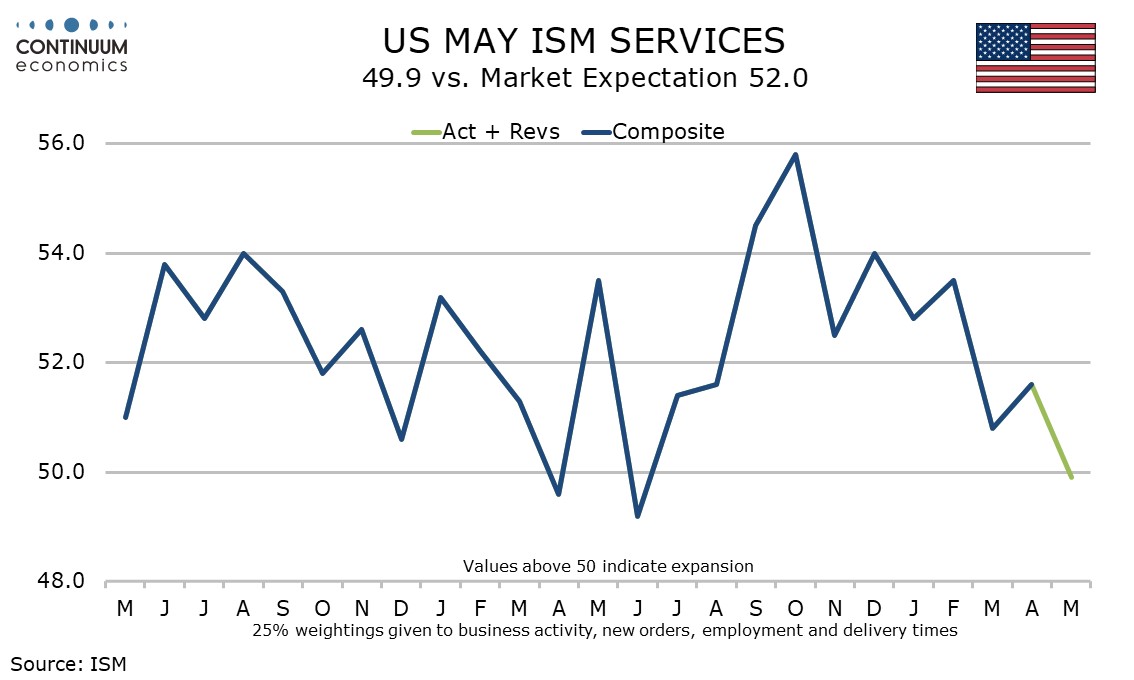

The details of the ISM services data showed business activity falling to 50.0 from 53.7 and new orders at their weakest since December 2022 at 46.4 from 52.3. Employment however was resilient at 50.7 from 49.0. A rise in delivery times to 52.5 from 51.3 completed the breakdown of the composite.

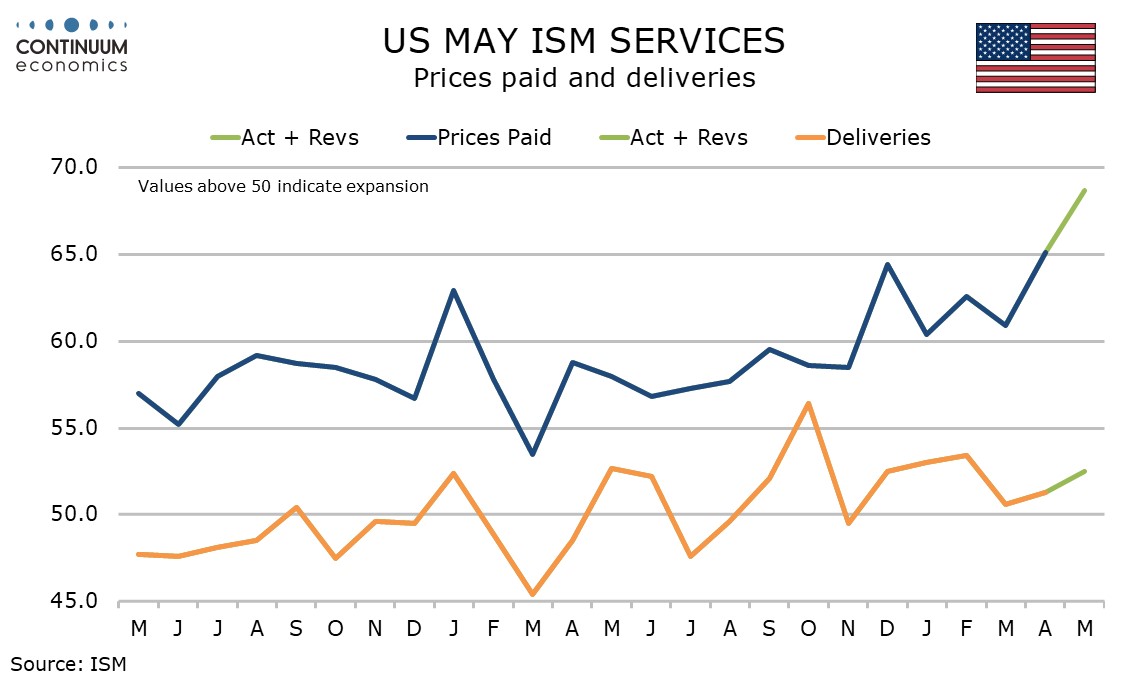

The rise in delivery times could be seen as a sign of supply problems but is still modest. Prices paid do not contribute to the composite but at 68.7, the highest since November 2022, from 65.1 in April, give a more serious inflationary warning.

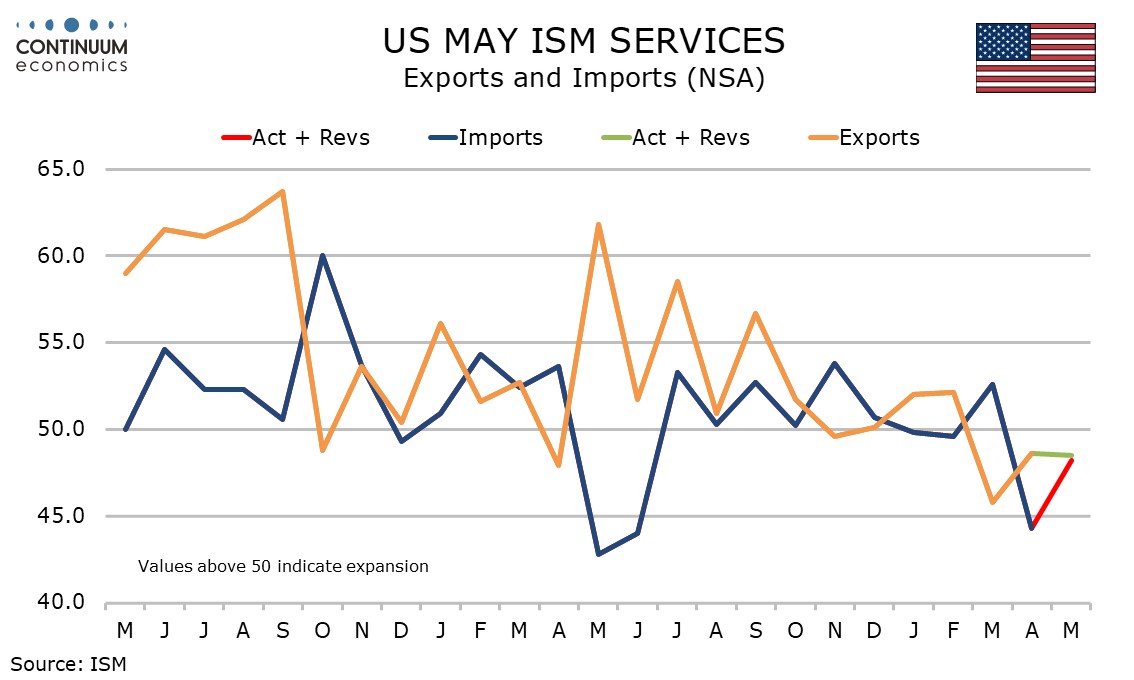

Export and imports also do not contribute to the composite and are not showing the very weak levels near 40.0 seen in the ISM manufacturing survey. Exports at 48.5 were almost unchanged from 48.6 in April and up from 45.8 in March, while imports at 48.2 were up from 44.3 in April but still below March’s 52.6.

Services unlike goods are not the focus of Trump’s trade war, with the US having a surplus in services. However by raising prices the tariffs do appear to be undermining service activity, consumer spending in particular. Still, one marginally negative month, somethings seen twice in 2024, is not a clear signal of recession.