FX Daily Strategy: N America, November 13th

GBP has further downside risks

AUD well supported on solid employment data

SEK well bid but expensive against EUR and NOK

CHF strength on trade hopes shouldn’t lead to new highs

GBP has further downside risks

AUD well supported on solid employment data

SEK well bid but expensive against EUR and NOK

CHF strength on trade hopes shouldn’t lead to new highs

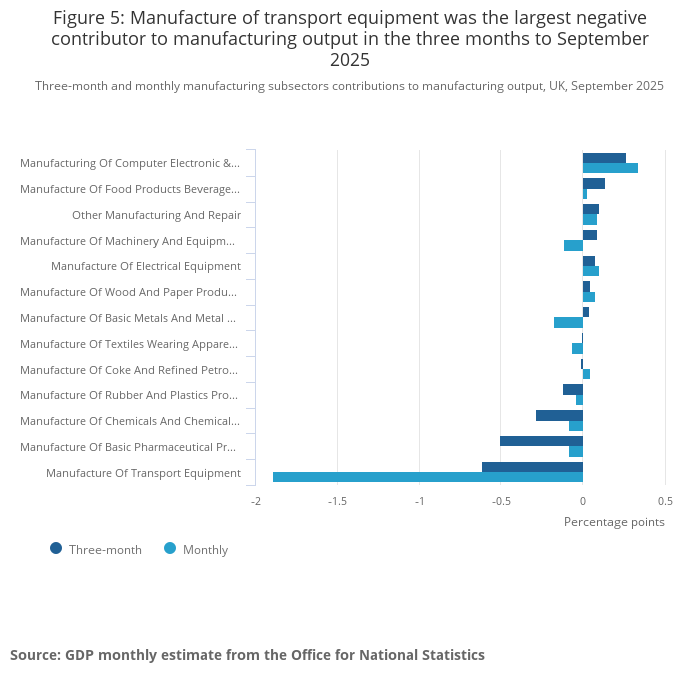

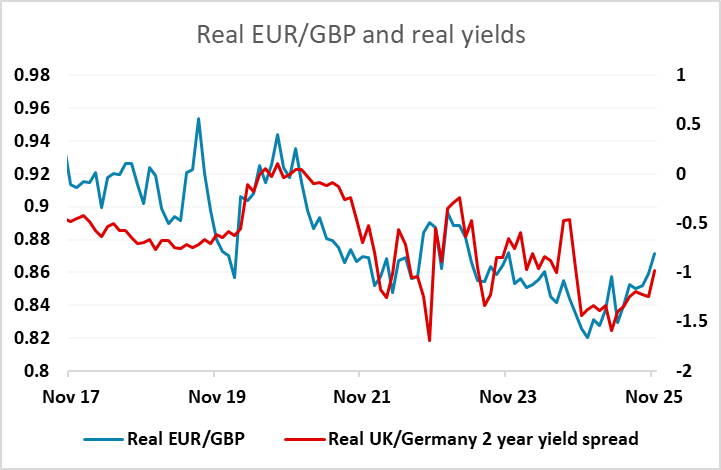

GBP initially fell back in response to the weaker than expected GDP data seen this morning. However, the weakness looks to have been almost entirely due to the auto sector, where Jaguar Landrover suffered a shutdown due to a cyberattack. This has now been dealt with, so a sharp rebound is likely in October. The decline in auto production in September led to a 2.0% decline in manufacturing output on the month and a 0.1% decline in GDP, so that Q3 recorded a slightly lower than expected 0.1% gain.

In practice, this is unlikely to make much difference to BoE policy, so we wouldn’t expect it to have a persistent impact on GBP, and GBP has recovered its initial losses. But the GBP tone remains weak, with the upcoming Budget expected to introduce significant fiscal tightening and likely leading to a BoE rate cut in December. The political picture is also unsettling, with the rumours of a leadership challenge to PM Starmer now triggering calls for resignations of senior aides. Even so, we wouldn’t expect any sharp GBP decline, as a tight Budget, while likely leading to easier monetary policy, might also calm some of the nerves about the UK fiscal position. So while we favour the GBP downside, EUR/GBP gains through 0.8850 are likely to prove difficult near term.

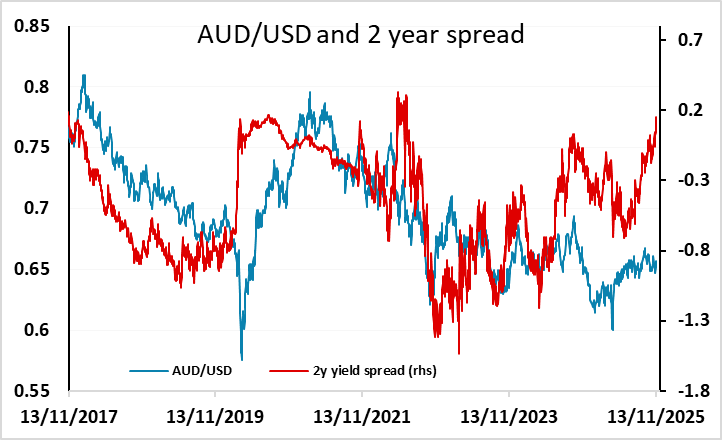

The October Australian labor report was solid with unemployment rate tread lower from 4.5% to 4.3% with participation rate unchanged. Headline employment change also beats at 42.2K with strong full time employment. The AUD gained 20 pips in response, and has gained another 10 pips this morning in Europe. The AUD has underperformed yield spreads recently and we would see scope for a retest of the top end of its recent range above 0.67 as long as any equity market weakness remains mild.

Final Swedish CPI data showed no revision from the preliminary CPI release, but the SEK still gained ground, with EUR/SEK falling 3 figures to 10.92. The SEK still looks expensive relative to yield spreads against the EUR, and particularly against the NOK, but sentiment is positive helped by solid recent data. We still prefer the NOK, but EUR/SEK looks capped at 11.

CHF strength on Wednesday related to expectations of a trade deal with the US which could see the tariff on Swiss goods reduced from 39% to 15%, according to chatter after Trump’s comments on Monday. The 0.92 level has been an effective floor for the CHF in the last year, despite being tested several times, and while there is no conclusive evidence of FX intervention, the mild pick up in sight deposits and FX reserves in recent months suggests there may be some modest SNB support going on. While a trade deal is good news for Switzerland, the CHF never weakened significantly on the rise in tariffs and remains close to all time highs against the EUR, and at extreme levels of valuation in general, so it’s hard to argue that such a deal would justify a break to new CHF highs, and we would expect support at 0.92 to hold.