FX Daily Strategy: Europe, February 6th

GBP risks on the downside as BoE may signal deeper cuts than are priced in

EUR/SEK risks two way on Swedish CPI, but NOK/SEK still cheap

JPY the main beneficiary of declining US yields…

…but AUD the most attractive of the riskier currencies

GBP risks on the downside as BoE may signal deeper cuts than are priced in

EUR/SEK risks two way on Swedish CPI, but NOK/SEK still cheap

JPY the main beneficiary of declining US yields…

…but AUD the most attractive of the riskier currencies

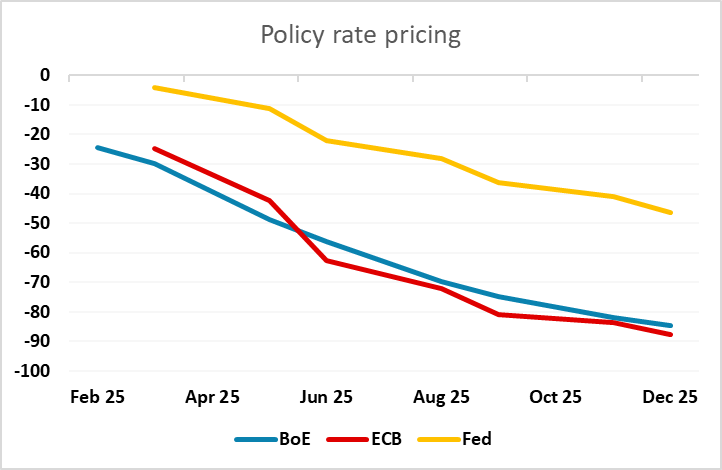

The Bank of England MPC meeting and Monetary Policy Report (MPR) is the main focus for Thursday. There is no longer much doubt that the BoE will be cutting rates by 25bps – this is now fully priced into the market. The question is whether the statement and MPR will lead to any change in the market pricing of the BoE’s easing path.

Back in early December, BoE Governor Bailey said very openly in an FT interview that the November forecast was conditioned on four rate cuts this year, this largely a result of inflation having come down “faster than we thought it would.” And while the BoE kept policy on hold later last month, there were three dissents in favor of cutting at that juncture. Since when other members of the MPC have suggested policy restrictiveness needs to be eased, making a further 25 bp move at the February 6 verdict very much a done-deal. But with weaker real economy and inflation data coming alongside market rate expectations still some half a ppt higher than in the previous projection it does seem likely as if the updated Monetary Policy Report (MPR) will be consistent with a series of cuts this year at least as large as in the last MPR – we think that five moves from the current 4.5% are on cards.

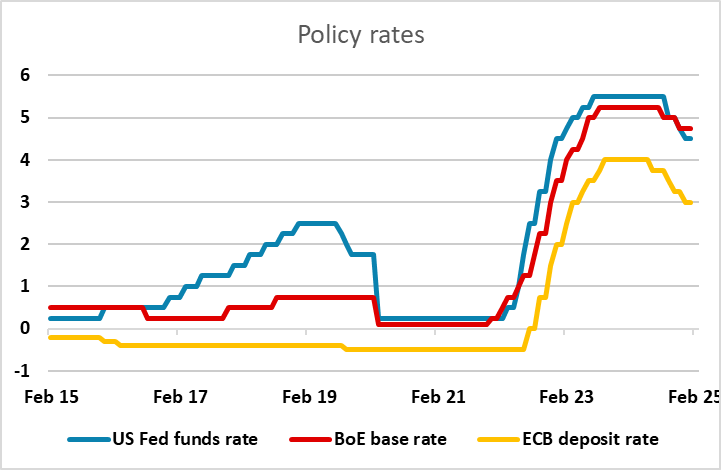

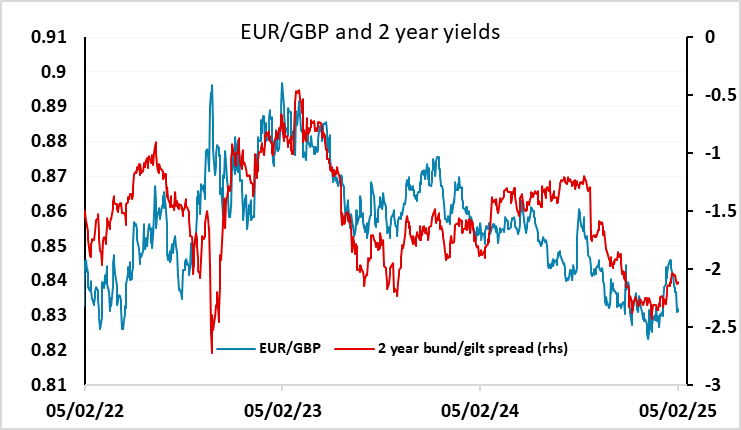

As it stands, the market is only pricing 3 ½ BoE rate cuts this year, the same as for the ECB. This would maintain the spread of the BoE base rate over the ECB deposit rate at record levels, a spread that doesn’t seem to be justified by fundamentals, with UK growth and inflation remaining much more similar to the Eurozone than the US. So we see risks to the downside for UK rates from here, and that suggests risks to the upside for EUR/GBP. Even at current yields, EUR/GBP looks to be low relative to recent yield spread correlations. To some extent, this reflects the UR being seen as the next target for US tariffs, with the UK less under threat, but with the tariff story extremely uncertain, and EUR/GBP very cheap here in fundamental terms, we would see most of the GBP risks as being on the downside.

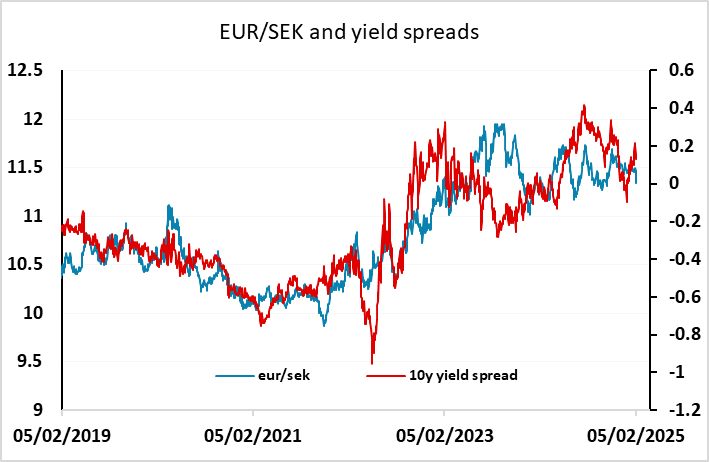

Before the BoE decision there is Swedish flash CPI data for January, following the weaker than expected numbers in December. The market is expecting another drop in the headline rate to 0.5% y/y, but the targeted CPIF rate us seen rising slightly to 1.6% y/y. The SEK has gained some ground against the EUR in recent days, in common with most other currencies, although some of the strength seemed to follow the latest Riksbank minutes. There hasn’t been a big change in rate expectations, but the consensus has the Riksbank only easing once more, and this will mean that yield spreads are likely to move slightly in the SEK’s favour from here. But EUR/SEK is already trading a little on the low side relative to yield spreads, so the risks on the data look evenly balanced, although we still see substantial upside potential for NOK/SEK.

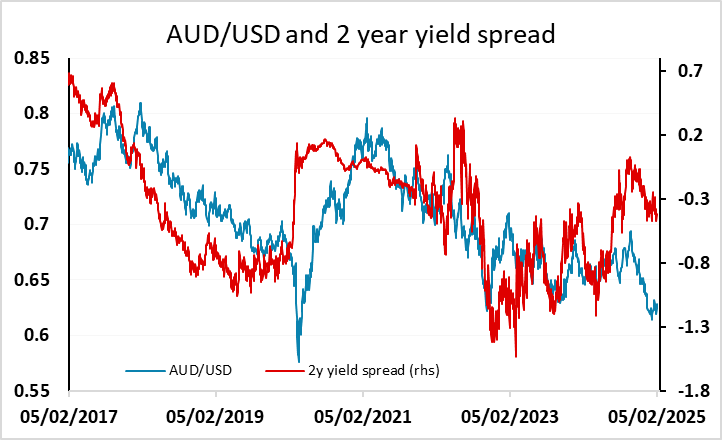

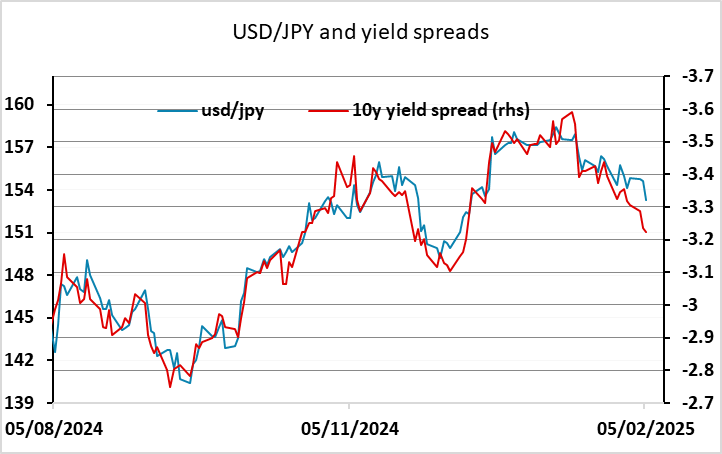

In the bigger picture, the USD has taken on a softer tone since the delay in the Canadian and Mexican tariffs was announced. The market is assuming they are cancelled rather than delayed, and although there is some expectation of tariffs on the EU at some point, likely in smaller size, the tariff issue is no longer seen as likely to be a significant USD positive. Yields are generally moving lower as well, in part because sentiment has been damaged by the tariff episode (and tariffs have of course been increased on China, although this was in line with expectations), and possibly in part because there is now more doubt about US tax cuts, while spending cuts may turn out to be more aggressive than expected. All this is USD negative, most notably against the JPY, which benefits the most form declining yield spreads in a less risk friendly environment. However, the AUD also looks better bid after the dip to new post-pandemic lows on the tariffs, and if risk sentiment stabilises may be the most attractive of the riskier currencies.