U.S. December Housing Starts and Permits - Singles positive, Multiples mixed

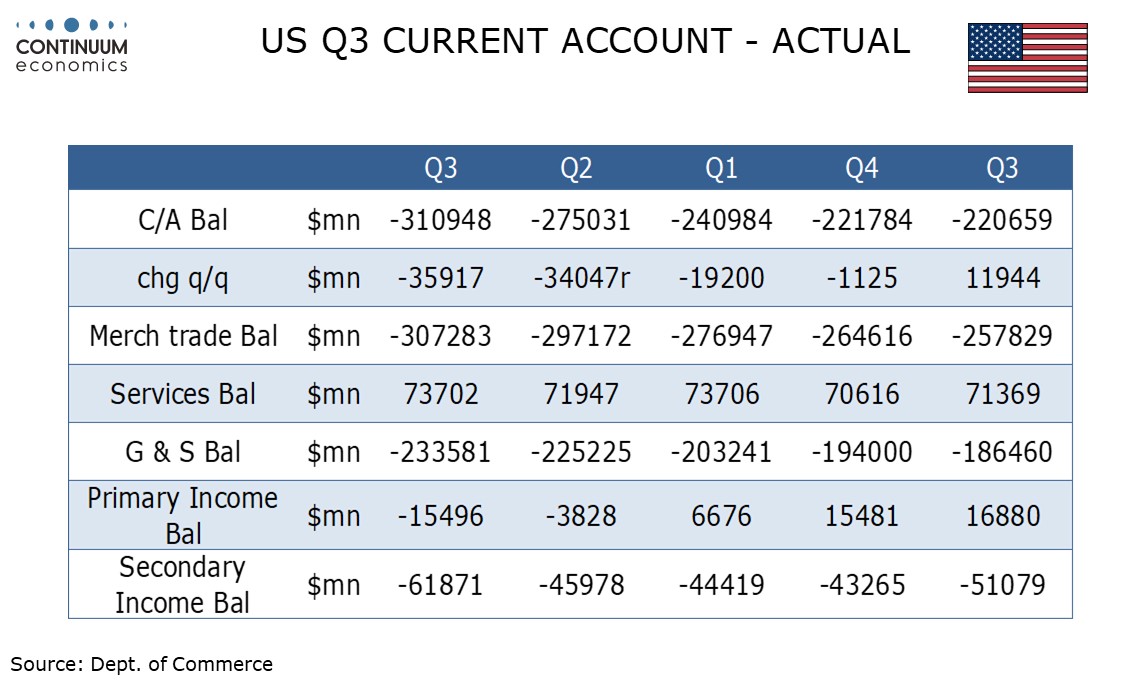

November housing starts are weaker than expected with a 1.8% decline to 1289k while permits are stronger than expected with a 6.1% rise to 1505k. The contrast between the two series comes largely because multiple starts were weak and multiple permits strong.

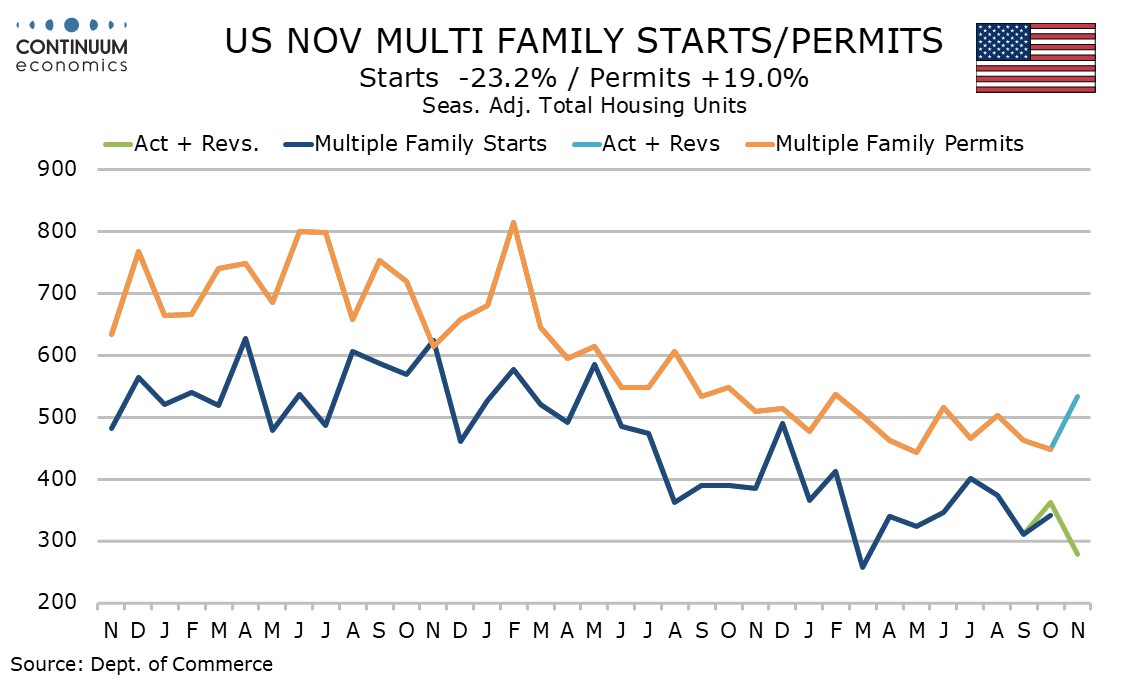

The single family sector shows starts up by 6.4% while permits rose by only 0.1%. The single starts rise follows a 9.1% decline in October while the single permits rise follows a 0.8% gain in October. Underlying trends look modestly positive.

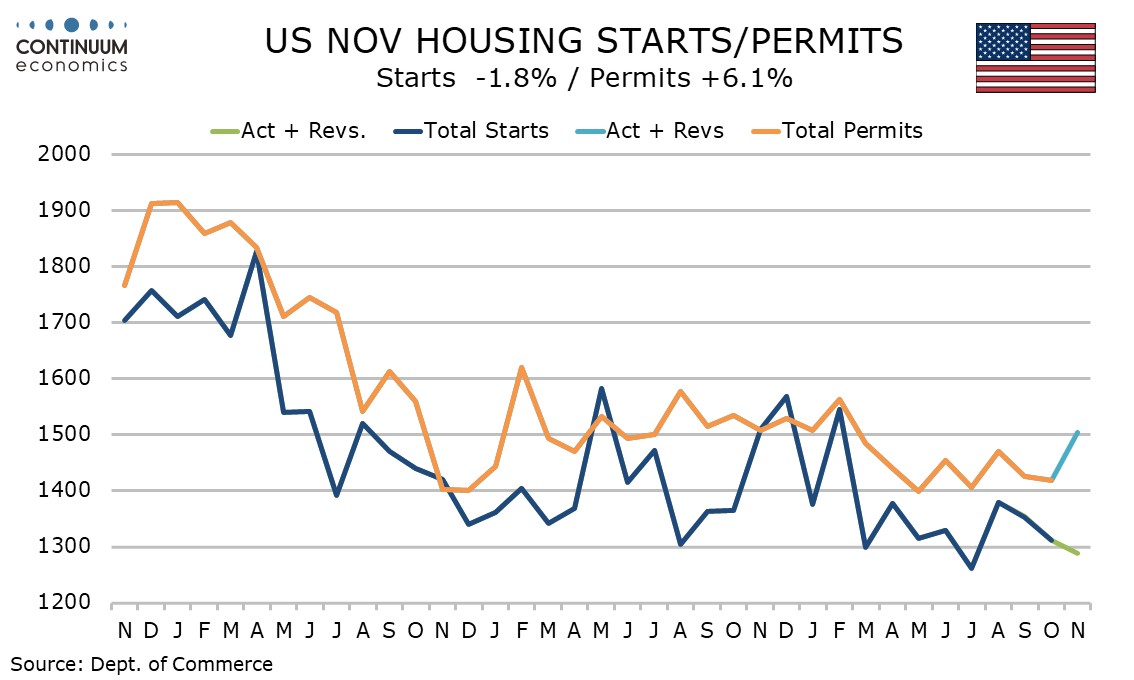

The volatile multiples sector saw starts falling by 23.2% after a 16.8% October rise but permits increasing by 19.0% after a 3.0% October decline. Neither of these moves is likely to be sustained.

Starts rose in the Northeast and South after October declines but fell in the Midwest and West after October increases. Permits increased in all four regions.

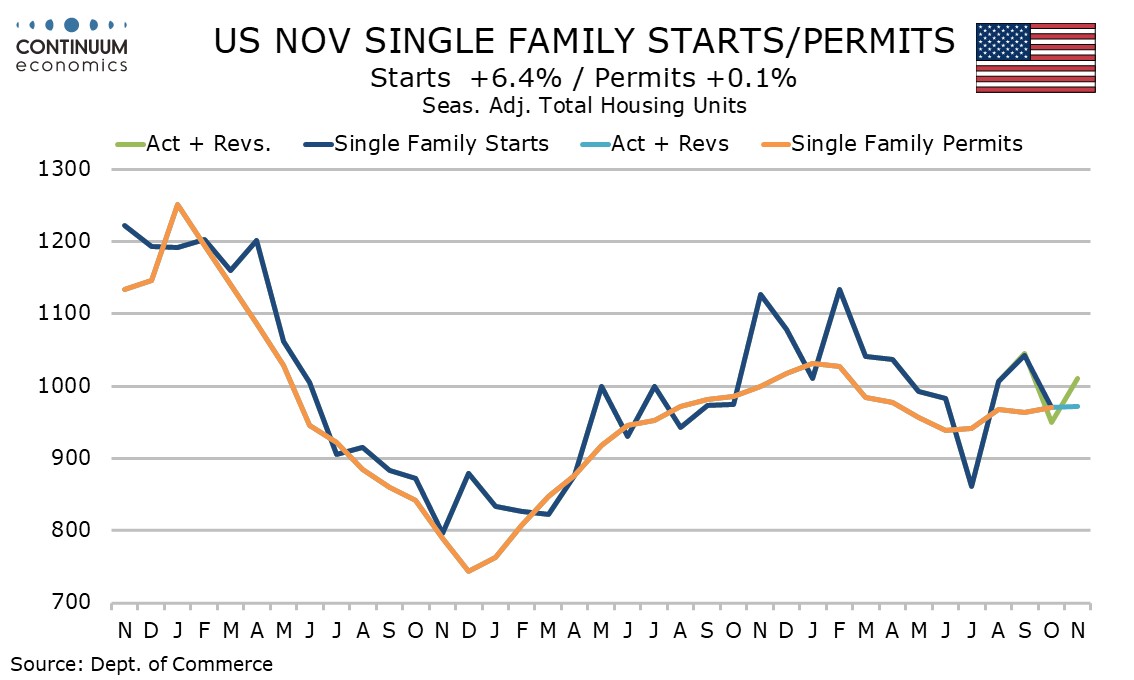

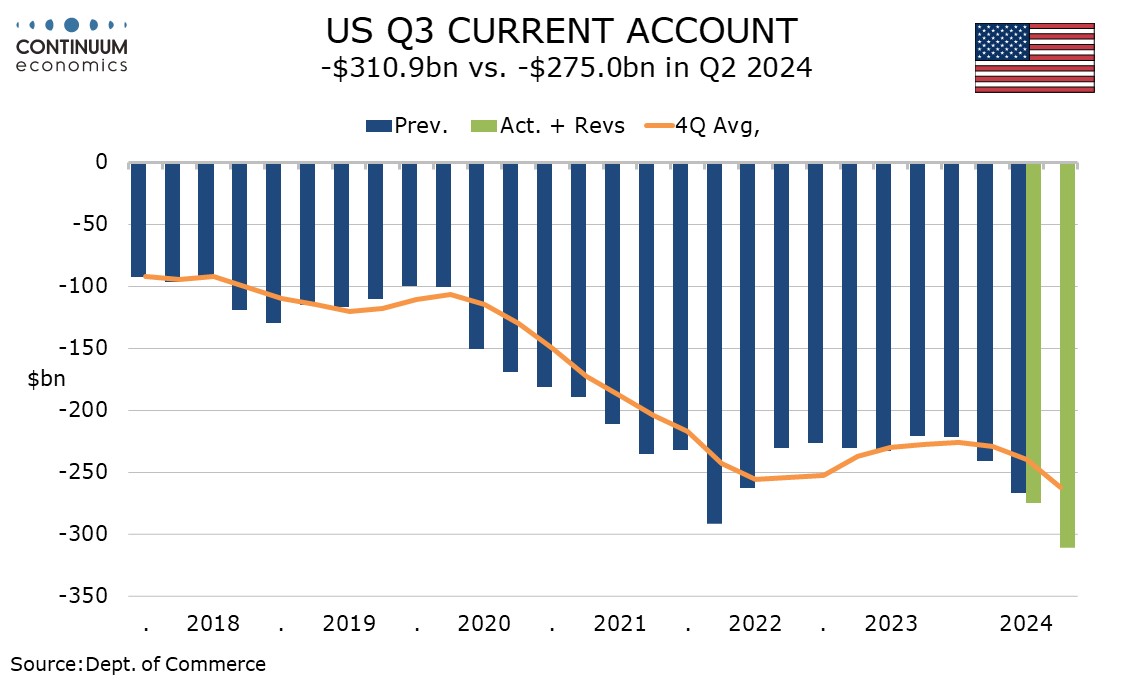

The Q3 current account deficit of $310.9bn was much wider than expected and Q2’s $275.0bn.

A deterioration in the trade balance had already been released, but was supplemented by sharp deteriorations in the balances on primary (investment) and secondary (transfers) income.