FX Weekly Strategy: Asia, February 2nd-6th

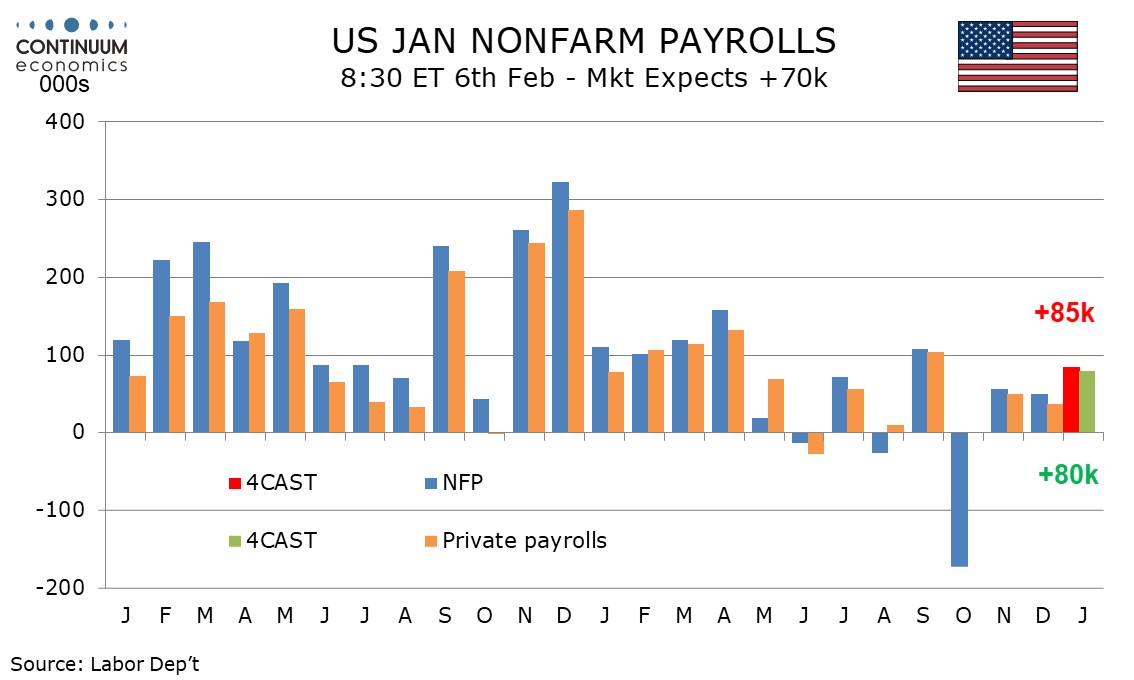

U.S. January Non-Farm Payrolls To be Above trend

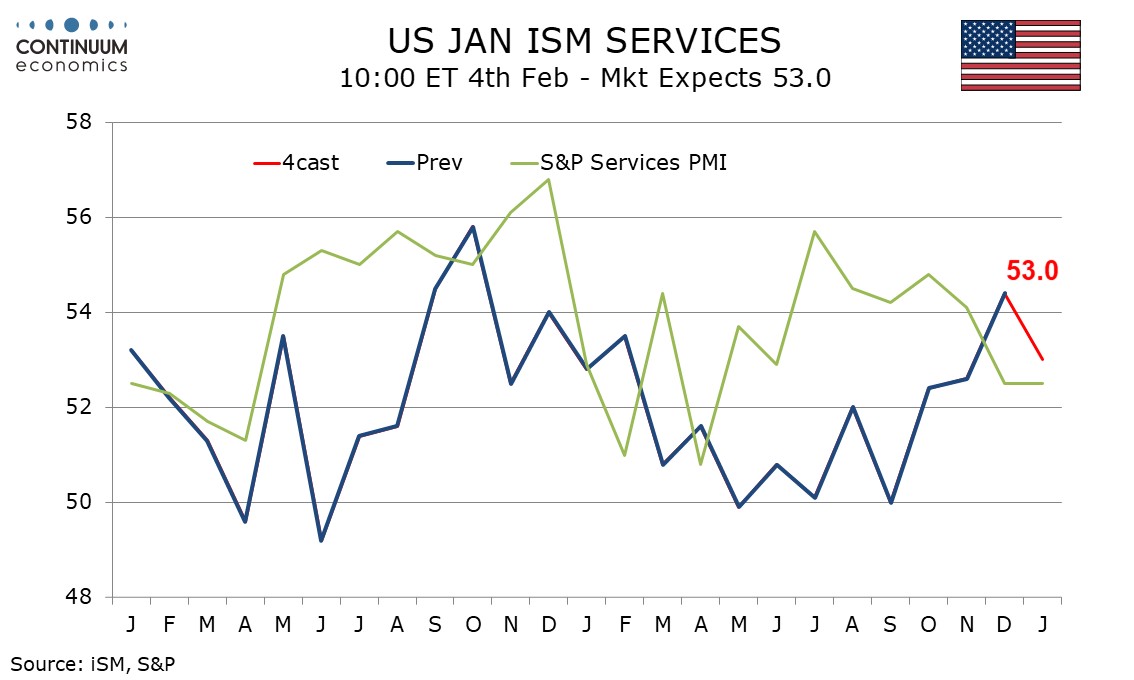

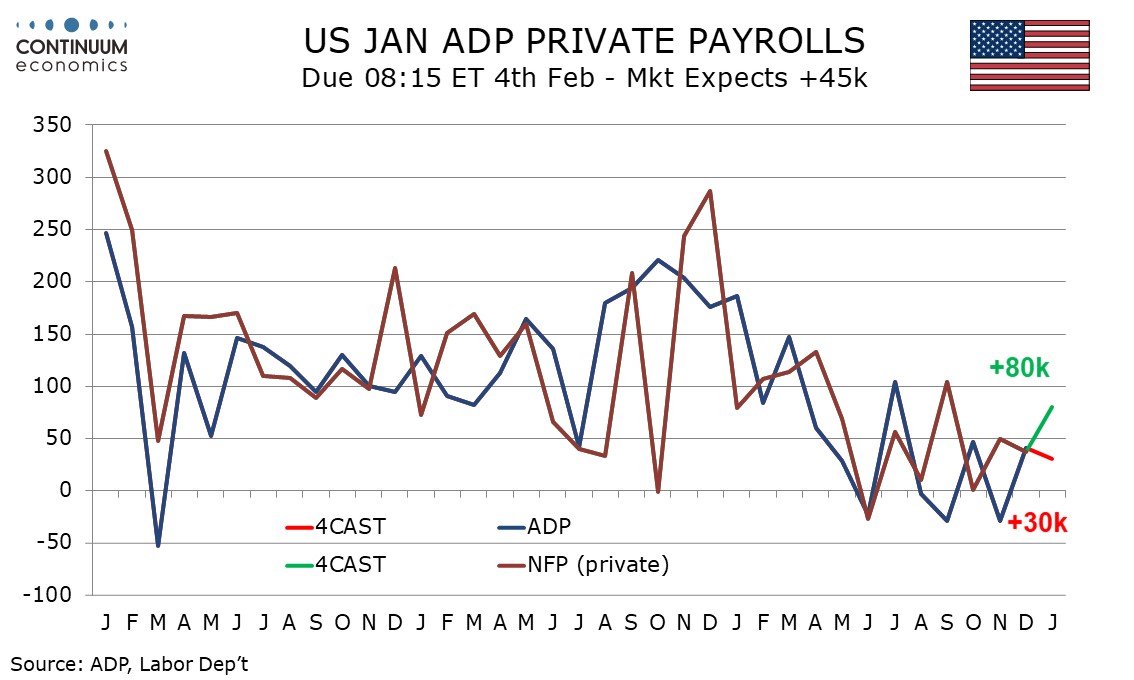

And Other Major U.S. Economic Release

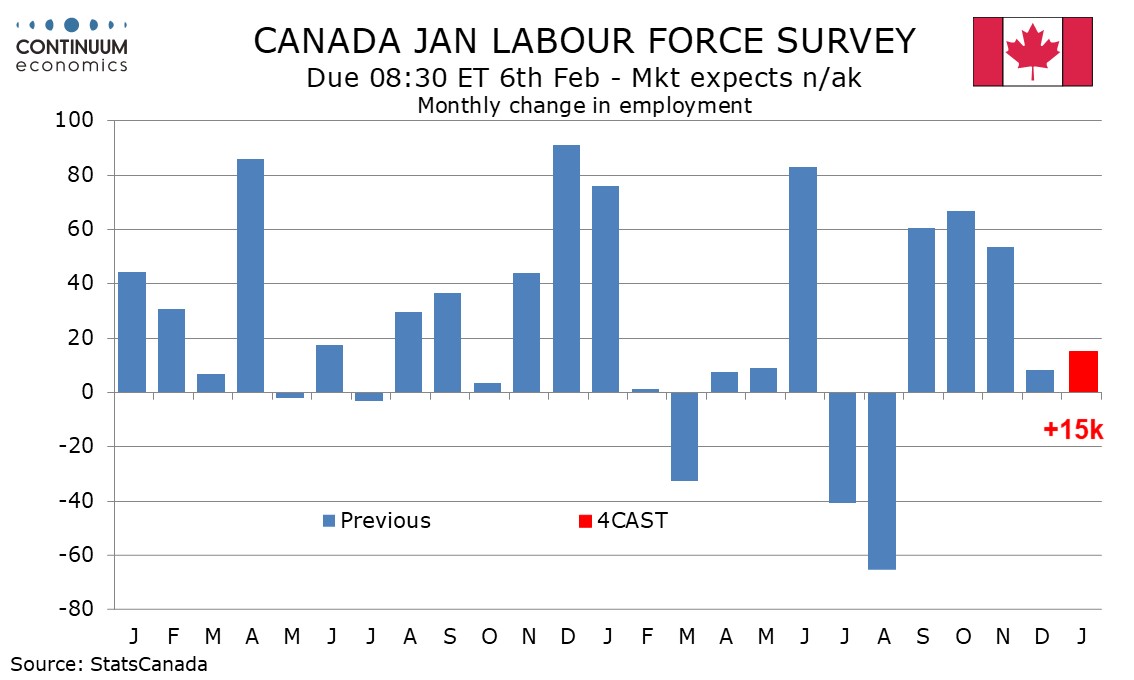

Canada Employment A second straight subdued month

RBA To Keep Rates Unchanged, Slim Chance to Change Forward Guidance

We expect January’s non-farm payroll to rise by 85k overall and by 80k in the private sector, which would be on the firm side of trend and could be even more so after what could be substantial negative historical revisions. However, we expect unemployment to rise to 4.5% from 4.4%. We expect average hourly earnings to rise by 0.3%, in line with recent trend. Initial claims remained low in January’s payroll survey week, suggesting layoffs remain limited too. While signals on hiring are also weak January is a month in which before seasonal adjustment payrolls fall sharply, meaning that a low level of layoffs could be more significant than a low level of hirings in seasonally adjusted data.

A sector to watch this month is retail. We have seen three straight declines of near 20k in this sector, despite retail sales holding up well. Limited seasonal hiring before Christmas may mean fewer layoffs than the seasonals assume in January. We expect private services to rise by 70k in January, the strongest since September, the last month in which retail employment increased. An improvement from a 58k increase in December private services will be more than fully explained by the swing in retail.

We expect January’s ISM services index to correct lower to 53.0 after a surprisingly strong December index of 54.4 that contrasted a slower S and P services PMI of 52.5 in December. January’s S and P services index did not rebound, remaining at 52.5. While we expect a less positive ISM services index, Fed services sector surveys from the Philly, Richmond, Dallas and Kansas City Feds, as well as the Empire State, were all improved from December, though none were strongly positive and three remained negative. We do not look for a full reversal of December’s ISM services improvement. 53.0 would be the strongest reading, bar December’s, since February 2025.

We expect a 30k increase in January’s ADP estimate for private sector employment, which would be a slowing from 41k in December. We expect the ADP report to significantly underperform January’s non-farm payroll, where we expect a rise of 80k in the private sector, and 85k overall. Weekly ADP data, showing an average weekly job increase of 7.75k in the four weeks to January 3 looks to be on a slowing trend, with the four weeks to December 13, December’s payroll survey week, showing an average gain of 10.5k, which was consistent with December’s 41k ADP outcome. The latest weekly data is still two weeks prior to the survey week for January’s monthly data, and low initial claims suggest no further deterioration, while bad weather in late January came after the survey week. However it is likely that January’s ADP data will show a slower rise than December’s.

We expect Canadian employment to increase by 15k in January, a second straight moderate increase following December’s 8.2k that followed three straight strong gains averaging close to 60k. We expect unemployment to remain at December’s rate of 6.8%, but to fall before rounding. Three strong gains in employment followed steep declines in July and August, and with Q4 GDP shaping up to be significantly slower than Q3’s 2.6% annualized gain we would expect employment growth to enter 2026 with limited momentum. December’s breakdown contained no standouts by industry that imply significant corrections in January. We expect full-time employment to rise by 10k in January with part-time rising by 5k. December saw full time employment leading as do the six month and twelve month averages, though on a three month average part time is ahead, suggesting it is not due for a bounce despite December’s dip.

Our baseline scenario see the RBA to keep rates unchanged in their February meeting. Despite recent uptick in CPI has sway market participant's anticipation of a hike from the RBA, we do not see the urgency of changing rates. The uptick in inflation still needs time to prove whether transitory factors and base effect have boosted the number and how much is left to be sticky. The RBA's forecast expects CPI to be above target range in 2026 and should signal their elasticity in seeing inflation to be above target range briefly. If there is a change in their forecast, we will likely first see a change in forward guidance in the February meeting, before expecting rate change next.

Week Ahead

USA

If a US government shutdown is avoided, the US calendar highlight will be the January non-farm payroll on Friday. Here we expect an above trend rise of 85k with 80k in the private sector but with an increase in unemployment to 4.5% from 4.4%. We also expect an on trend 0.3% increase in average hourly earnings. We expect payrolls to outperform a 30k increase in Wednesday’s ADP estimate of private sector employment, data that is not dependent on the government staying open. Other government labor market indicators come from December’s JOLTS report on job openings on Tuesday, and weekly initial claims on Thursday.

For January’s ISM surveys, we expect the manufacturing index on Monday to increase to 49.0 from 47.9, and Wednesday’s services index to fall to 53.0 from 54.4. The preliminary February Michigan CSI is due on Friday, and may see downside risk given the political situation. Fed speakers include Bostic on Monday and Thursday, and Bowman on Tuesday.

CANADA

Canada’s data highlight is February’s employment report on Friday, where we expect a moderate 15k increase with an unchanged unemployment rate of 6.8%. The S and P releases February PMI data with manufacturing on Monday and services on Wednesday. February’s Ivey manufacturing PMI follows on Friday.

UK

Coming alongside final PMI data, earlier in the week (Mon, Wed), Thursday sees the first MPC decision of the year. No change is widely seen from the BoE, with the individual member submissions likely to suggest still clear divides about the policy backdrop and outlook. No new forecasts are due but a more telling reaction to the fiscal picture may be offered alongside the usual annual update of supply side matters. We see no change regarding the latter despite some suggestions being made that productivity may have bucked of late (we think this is more aberrant).

Eurozone

The ECB decision (Thu) is obviously one of no change either in terms of current rate setting and of a still data determined outlook. But given the added uncertainties thrown up in and around Europe, with Trump threats adding to both political and economic risks (the latter on the downside), it will be interesting to see how this is incorporated into ECB thinking. But there is also the Bank Lending Survey (Tue) as an added consideration, not least given the signs of bank unwillingness to lend last time around NB; this survey will have been taken well before recent global tension accentuated. The Council may also discuss supply side development having perhaps, drawn too much on the positive side from recent data.

Data wise seen January HICP (Wed) which may see a fall to 1.9% on a headline basis, driven down largely by energy but with the core possibly easing a notch. There are also PPI data (Wed)and retail sales (Thu) as well as services production data which have been losing momentum of late despite volatile business survey suggestions. In regard to the latter final PMI data (Mon, Wed) may offer little new.

Rest of Western Europe

Sweden sees the minutes to the last Riksbank meeting which was far from contentious. Friday sees what are likely tom be more friendly CPI data, this time for January.

JP

Little critical release next week for Japan, perhaps except Household spending on Friday. Household spending has been improving for the past months despite choppy real wage. Private consumption has long been the key drive in Japan economic growth and the BoJ would definitely love to see it gaining further traction, to prove the current wage/price setting and consumption behaviour is in a sustainable state.

AU

The RBA interest rate decision will be announced on Tuesday and while the probability of a hike has been increased substantially on stronger Q4 inflation, e believe the RBA will not be in a rush to hike rates. Base effect and transitory factors are not to be neglected, still underlying inflation is also crystal clear. If the RBA to going to hike rates, it is likely they will do so after changing their forward guidance first in the February meeting. Elsewhere, we have private inflation data on Monday, PMIs on Wednesday and Trade data on Thursday.

NZ

The critical release of NZ Labor market is on Tuesday. There shouldn’t be any big surprises to either side as no new shock to the Kiwi labor market has been indicated recently.

Recap of the Week

Trump’s Problems

FOMC Pauses With Risks Seen Diminished

USD Hurt by Hedging More than Asset Outflows

Stable Policy Rates for Sweden Riksbank 2026

Bank of Canada Rate Level Still Appropriate But Uncertainty Heightened

Overall, the Trump administration’s hyperactive start to 2026 is unlikely to achieve success on the number one issue for voters in the shape of cost of living concerns. Meanwhile ICE’s immigration tactics in Minnesota are causing concerns among swing voters, though Trump geopolitical adventurism is not causing a voters backlash as it overshadowed by domestic issues. Domestic political pressure will likely cause Trump to slowdown and become more focused on trying to actually achieve moderate successes to help the GOP in November mid-terms.

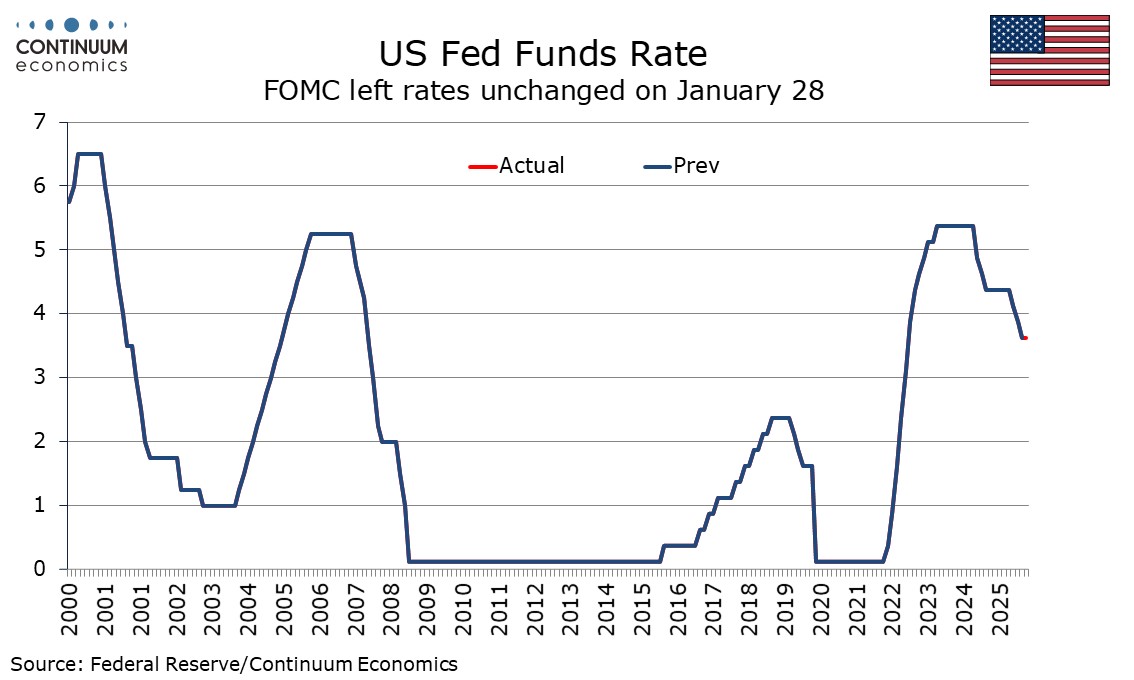

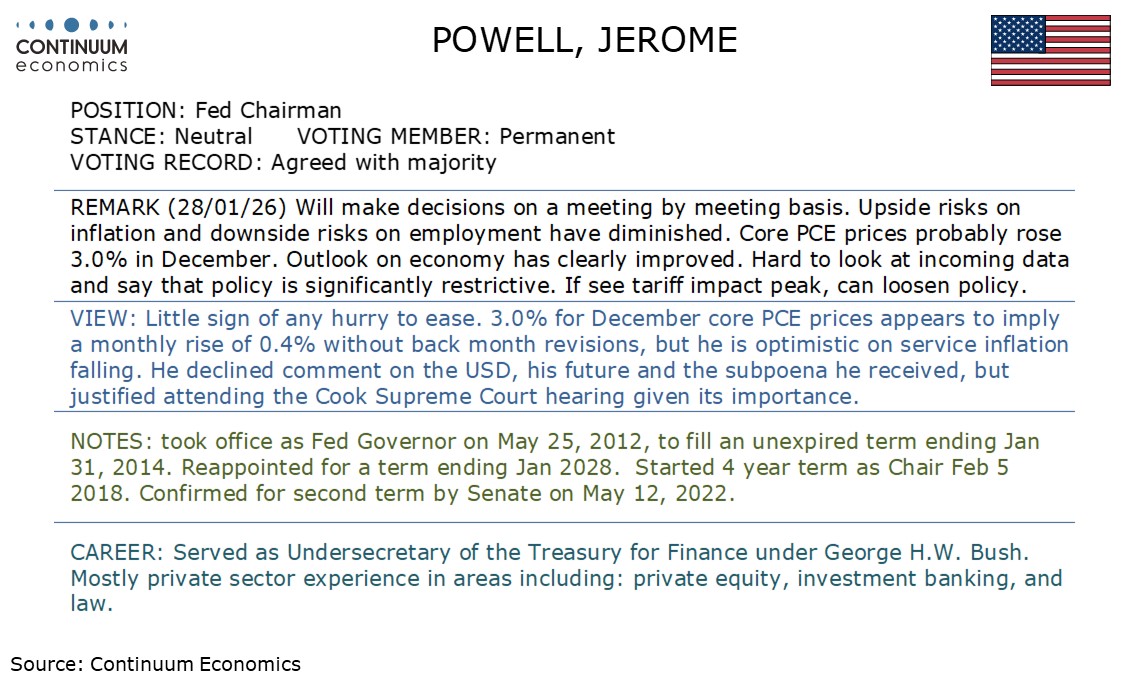

The FOMC has left rates unchanged at 3.5-3.75% as expected, with two dissents for a 25bps easing. The statement takes a slightly more optimistic view of the economy than the last one in December. We continue to expect two 25bps easing this year, coming in June and September. Economic activity is now seen as expanding at a solid pace rather than a moderate one, reflecting an upside surprise in Q3 GDP. the release of which came after December’s meeting, as well as positive signals for Q4. The unemployment rate, previously seen as edging up, is now seen as showing signs of stabilization, and a reference to downside risks to the labor market having risen is removed. They do however state that job gains have remined low, rather than having slowed. On inflation, a reference to it having moved up since earlier in the year is removed but it is still described as somewhat elevated. The change is likely to reflect softer CPI outcomes in Q4 as well as the start of a new year.

A dovish dissent from Stephen Miran was to be expected and it is notable that this time he only called for 25bps, with his previous dissents having been for 50bps. A similar dissent from Christopher Waller was less expected but not a major surprise given that he had shifted in a dovish direction in 2025. What is notable is that while Waller did dissent Michelle Bowman did not. We had felt that Bowman had taken a somewhat more dovish stance than Waller in 2025. Both had been seen as contenders for Fed Chair. It may be that Waller is still in the running, but Bowman is not.

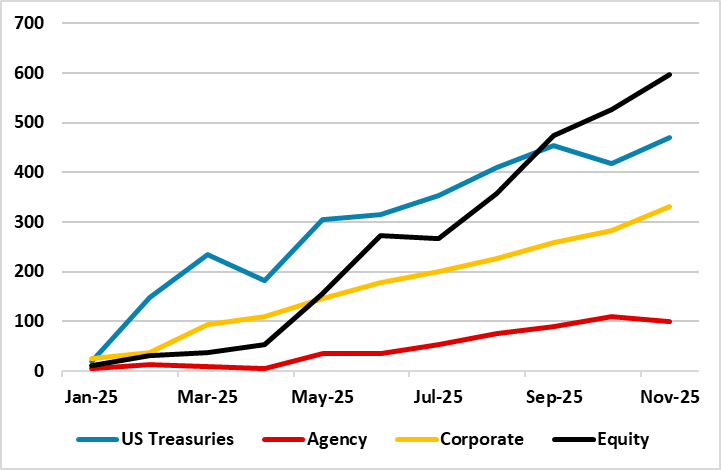

Figure: Cumulative Foreign Purchases of U.S. Assets (USD Blns)

The Greenland drama and fears of BOJ/Fed Intervention on USDJPY has put the USD under renewed downward pressure against DM Currencies. What happens next? Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue. We forecast 1.20 on EUR/USD by end 2026 and 140 on USD/JPY.

Overall, we see scope for further USD decline versus DM currencies in 2026 on more currency hedging; some diversification away from the U.S.; high trade and geopolitical uncertainty and the risk that the U.S. administration could jawbone the USD lower to substitute for any loss of reciprocal tariff revenue.

Once again the Riksbank kept policy on hold with the key policy rate left at 1.75%. The Riksbank Board remains pleased with the data flow since its last rate cut on Sep 23, though vigilant on both sides. The Board promise of no change for some time to come was repeated, though we feel that the Riksbank projections for GDP and unemployment are too optimistic. Regardless, we still do not see any looming policy reversal, as we see this current policy rate (1.75%) staying in place through 2027, i.e. a little longer than the Riksbank.

Meanwhile, the SEK has had a good start to the year appreciating against the EUR as well as a weaker USD. Part of the 2026 story is that some fund managers feel that undervalued currencies can catch up with the EUR/USD move last year. However, we continue to prefer the higher yielding NOK and forecast EURNOK to 11.00 by end 2026 and NOKSEK close to parity.

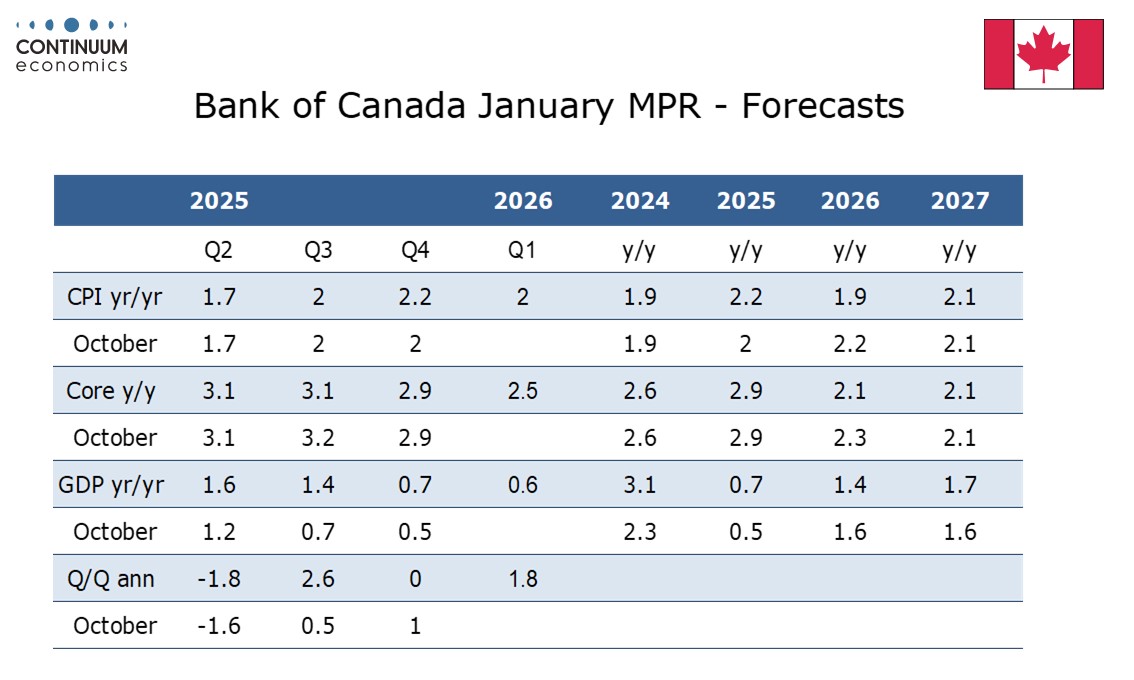

The Bank of Canada left rates unchanged at 2.25% as expected and continues to see the current policy rate as appropriate, Governor Macklem stating updated economic forecasts have not changed significantly since October. However in highlighting heightened uncertainty the statement appears to leave risks that the next move will be lower as somewhat higher, even if we do not expect that to be the case. This meeting contained the first quarterly Monetary Policy Report since October. A surprisingly strong Q3 GDP has not changed the projected GDP profile much though in forecasting a flat Q4 the BoC seems to be implying a positive December, while the 1.8% annualized forecast for Q1 is higher than we expected, and surprisingly stronger than the view for 2026 as a whole. The BoC does not seem concerned about a slightly firmer Q4 CPI, which came in part because of a year ago sales tax holiday. The statement was optimistic on its preferred measures of core inflation, stating they had eased to around 2.5% from 3.0% in October. The 2026 core CPI view has been revised down to 2.1% Q4/Q4 from 2.3%, only marginally above the 2.0% target.

The limited changes to the forecast allow the BoC to continue seeing the policy rate as appropriate though the main news in the statement was that uncertainty is now seen as heightened rather than elevated. This is presumably in response to Trump’s threat of a 100% tariff on Canada as well as the recent tension over Greenland, which like the US is a Canadian neighbor. We feel the risk of Trump imposing a 100% tariff on Canada is low, but the risk of him taking actions that while less extreme could do significant damage to Canada’s economic outlook is significant.