FX Daily Strategy: APAC, September 25th

SEK vulnerable if Riksbank turns more dovish

NOK/SEK has most potential for gains

Risk positive tone may start to fade, helping the JPY

GBP strength starting to look excessive

SEK vulnerable if Riksbank turns more dovish

NOK/SEK has most potential for gains

Risk positive tone may start to fade, helping the JPY

GBP strength starting to look excessive

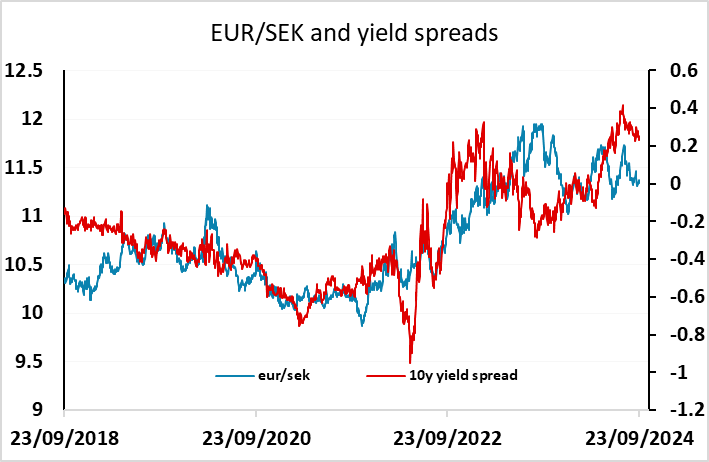

Wednesday is another relatively quiet day for data, but it does include the Riksbank monetary policy meeting and rate decision. A 25bp cut is more than fully priced, with the market pricing of a 27bp cut suggesting a minor (less than 10%) chance of a 50bp cut. A bigger cut would be expected to have a significant negative impact, but it looks very unlikely, and the 25bp cut shouldn’t have any noticeable effect. There will be more focus on the projections for the rest of the year and into 2025. Updated forecasts are likely to more formally validate the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which now seem all but certain and are fully priced in. Indeed, the new projections in the fresh Monetary Policy Report may highlight that while lower inflation has provided the scope to ease policy in this speedier manner, the rationale is increasingly that of a weak economy. If anything this may mean even more easing into 2025 tan the market expects, and suggests some downside risks for the SEK.

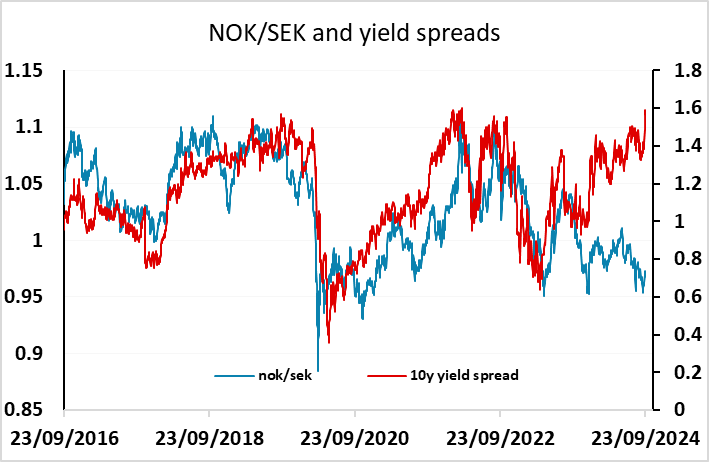

The SEK looks somewhat expensive relative to historic yield spread correlations against both the EUR and the NOK, but particularly the NOK. In view of the much tighter Norges Bank policy stance, highlighted by the unchanged rate decision at last week’s Norges Bank meeting (albeit with a slightly less hawkish outlook), there remains plenty of scope for NOK/SEK to make more upside progress towards parity (and beyond).

In general, Tuesday’s trading reflected a generally positive risk tone mainly due to the announcement of further Chinese stimulus. This supported Chinese equity markets in particular and equity markets in general. But we don’t see the Chinese stimulus as a game changer, and while it may marginally boost GDP growth, the overhang of the ongoing property bust will be with us for some time. We still view the US equity market as overvalued here, and with equity risk premia falling in the last couple of weeks both due to strong equities and rising US yields, we are likely approaching a short term peak. The USD lost a little ground on Tuesday after weaker consumer confidence data, and the US slowdown still seems likely to weigh on the equity market in the coming weeks and months. The recent rally in the risky currencies may therefore start to fade with any USD losses now more likely to come against the lower yielders, particularly the JPY.

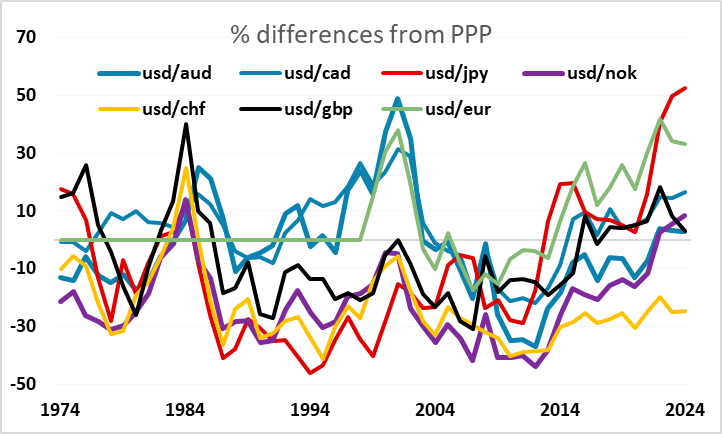

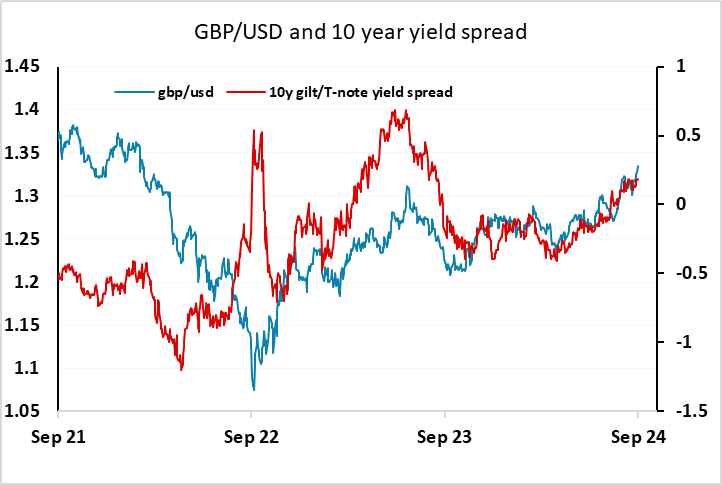

GBP has continued to be one of the strongest performers, reaching its highest against the USD since March 2022. As we pass the 2 year anniversary of the infamous Truss/Kwarteng budget that triggered the GBP/USD dip to a low of 1.03, market sentiment has gone full circle. While sentiment then was likely excessively negative, we now may be getting too positive. Although long term correlations with yield spreads suggest GBP/USD may yet have more upside, this is true of almost all the major currencies against the USD. On the crosses, the attraction of GBP is less clear, especially with a fairly austere budget on the way next month which may lead the market to increase the expected pace of BoE easing. Of the G10 currencies only the CHF is now higher relative to PPP against the USD than the pound.