FX Daily Strategy: N America, August 15th

US retail sales may keep downward pressure on the USD

GBP to remain supported by strong UK growth numbers

JPY unlikely to be much affected by Japanese GDP

AUD gains on strong Australian employment data

US retail sales may keep downward pressure on the USD

GBP to remain supported by strong UK growth numbers

JPY unlikely to be much affected by Japanese GDP

AUD gains on strong Australian employment data

Thursday is a busy day for data, with US retail sales and industrial production, the Philly Fed and NY Empire manufacturing surveys and the usual jobless claims numbers.

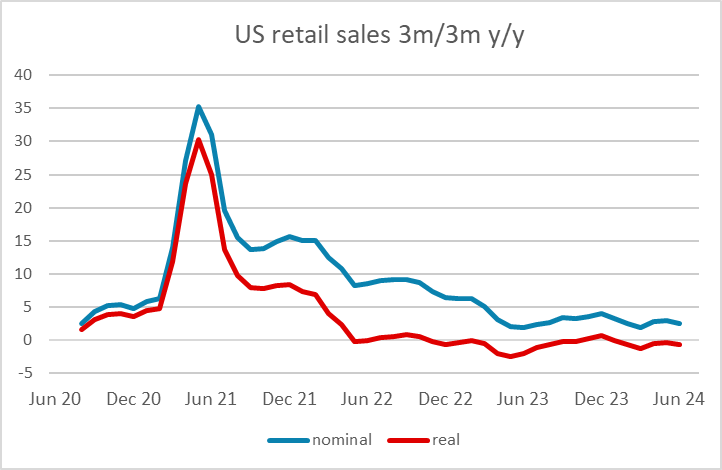

The US retail sales data is unlikely to make any real difference to Fed policy, as the trend has been very steady for a long time, especially in real terms, and it would take a big deviation this month to significantly impact the trend. However, the market is sensitive to any sign of slowdown, so our forecasts could prove mildly negative for the USD and risk sentiment, as they are modestly below consensus. We expect a 0.2% increase in July retail sales after a flat June, but 0.2% declines both ex autos and ex autos and gasoline. The Philly Fed survey has been showing some improvement of late, but the consensus expects a drop back after strong July numbers, while the Empire numbers are expected to be relatively steady in what has been a choppy series. The data may therefore be slightly on the USD negative side.

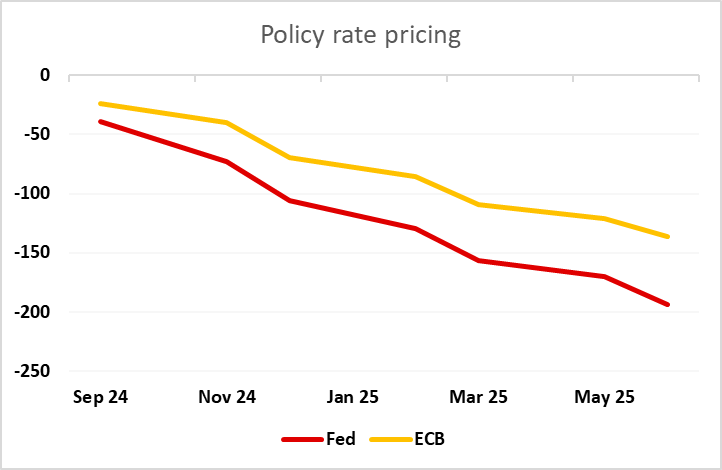

However, with the USD softer this week and the market already pricing in a 45% chance of a 50bp Fed cut in September, there is a fair bit of negative news already priced in, so the risks may be shifting towards stronger data being more USD positive. Unless we see significantly weaker data and/or weakness in equities, it is hard to see the Fed cutting 50bps in September. The closer we get to the September meeting without renewed equity market weakness or clearly weak data, the harder it will be for the market to continue to price a high risk of a 50bp rate cut.

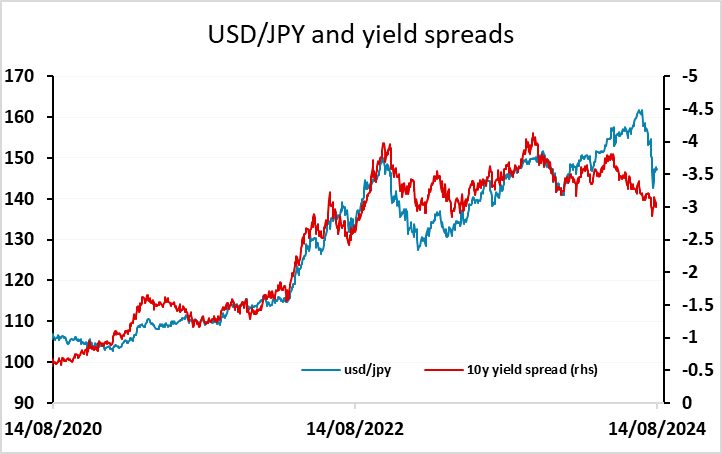

The Japanese GDP data doesn’t typically have a big impact on the JPY, which is generally driven more by yield moves elsewhere and general risk sentiment. Thus teh slightly better 0.8% Q2 GDP had little impact.

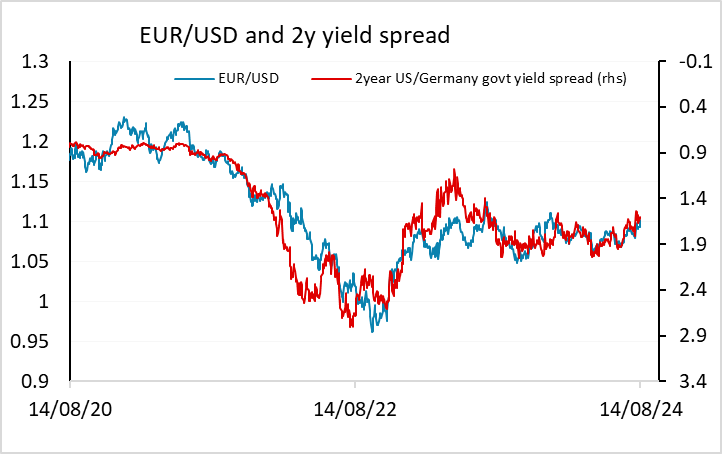

There is more scope for reaction to UK GDP data. Amid weaker retail sales, property transactions and car production data, June came out at flat. But this still left Q2 GDP numbers showing a 0.6% q/q rise. This is in line with consensus, and underlines that UK growth has been much stronger than expected in H1. EUR/GBP rose on Wednesday after softer than expected CPI data, but these numbers should emphasise that the BoE is unlikely to be in a hurry to cut rates aggressively, and prevent a EUR/GBP move back above 0.86.