FX Daily Strategy: Europe, July 18th

What the Tariff Man Will be Up To

National CPI May Move BoJ

USD/JPY Northbound

U.S. June Housing Starts and Permits Start to correct higher

After Trump's letter and all the verbal jabs, he will likely push forward more trade negotiation with some countries while hitting the rest with higher than baseline tariff on the 1st of August, no "TACO" this time likely. Later this week, Trump will likely brag about progress with India as the deal seems to be close, or at least the framework. It wouldn't be much surprise if the tariff man demand more tariffs but unless it brings a significant impact, market participants are wary of the cry of wolf and unlikely to have lasting impact. His fixation for Powell is unlikely to stop for he will need to have a scapegoat in case his tariff policy backfires.

On Friday, we will kick start the calendar with Japanese National CPI. The headline and core CPI has been elevated above 3% for the past quarter and piling pressure on the BoJ to further tighten. The inflationary pressure has been watered down by the BoJ as transitory factors, especially temporary rocketing rice price. Yet, it is impossible to fully attribute such inflationary pressure with widespread inflation across items. For the coming CPI figure, we are unlikely to see a significant downward traction if not another flare up. The sustained high inflation may be enough to shake BoJ and cause their to change their forward guidance before the trade conflict being solved between U.S. and Japan. If not, USD/JPY risk being further northbound. We have begun to heard verbal intervention from Japanese officials but those will not stop JPY's weakness until BoJ echoes the support with action.

Japan June National CPI remain above 3%, with headline at 3.3% y/y, ex fresh food also 3.3% while ex fresh food and energy at 3.4%. With such core-core data continue to point higher, the BoJ will have a difficult time shifting the blame to transitory factor. The BoJ is also expected to revise their inflation forecast higher but unlikely to change forward guidance nor rates.

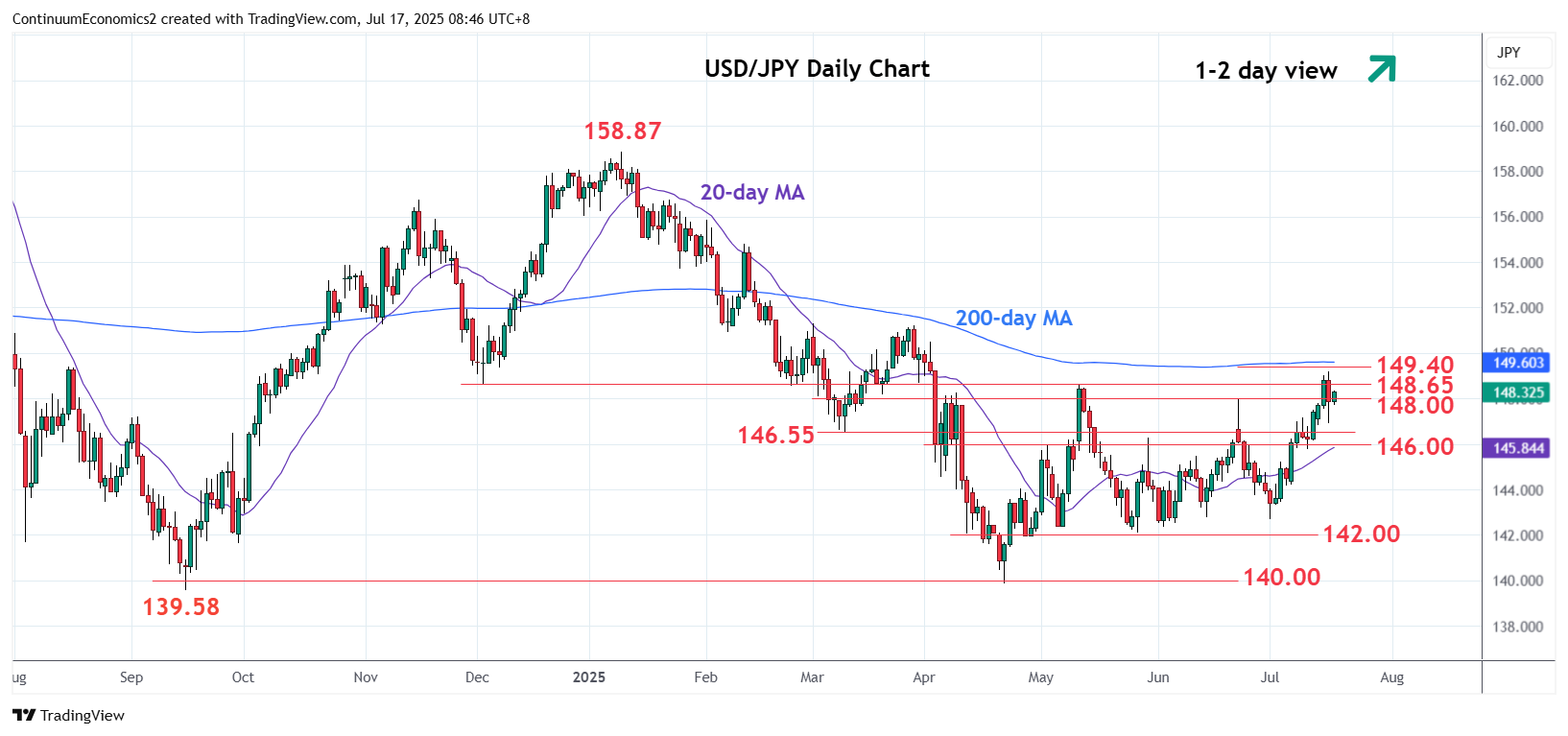

On the chart, the pair is limited on probes above the 149.00 level as prices unwind the overbought intraday and daily studies. Pullback see prices consolidating rally from the 142.68 low with support lowered to 147.00 congestion then the 146.55/146.00 area which is expected to underpin. Break here will fade the upside pressure and open up room for deeper retracement of the July gains. Weekly studies remains positive and suggest room for further gains cannot be ruled out. Above the 149.00 level will see room to the 149.40, 50% Fibonacci level, then the 150.00 figure.

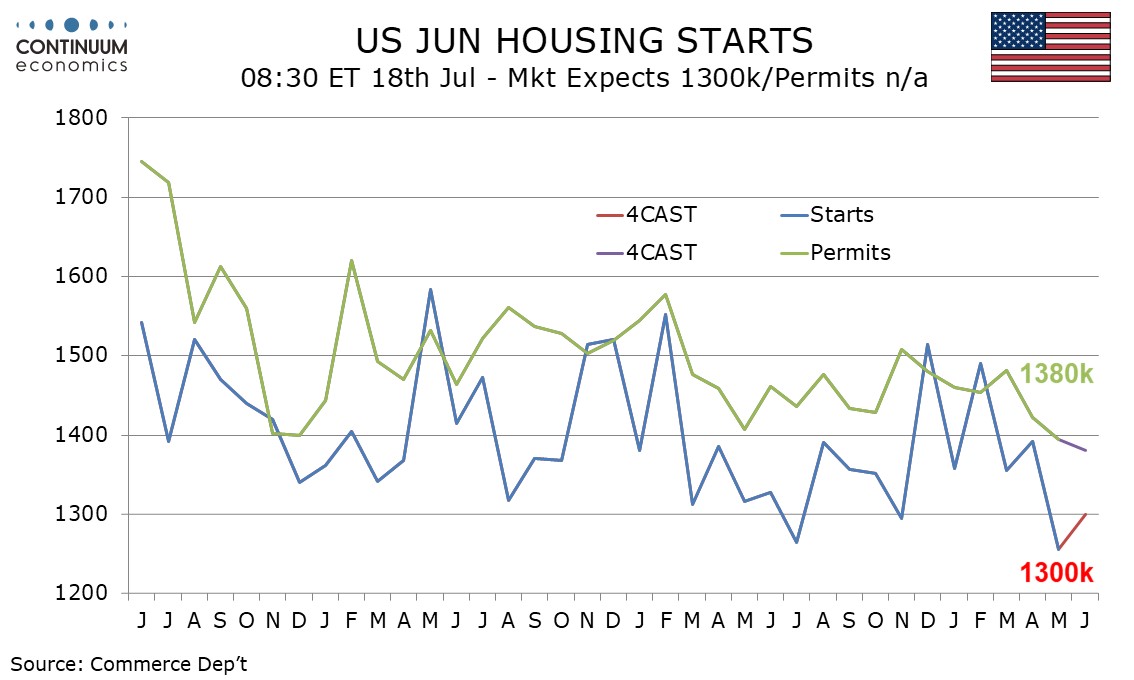

We expect June housing starts to rise by 3.5% to 1300k in a correction from a 9.8% May decline, but we expect permits to fall by 1.0% to 1380k, in what would be a third straight fall. Housing sector survey evidence is mostly quite subdued without declining sharply, with mortgage rates still high. June’s non-farm payroll saw a rise in construction employment but aggregate hours worked in construction slipped. Single permits have fallen for three straight months and we expect trend to persist with a 0.9% decline in June. We expect multiple permits to fall by 1.0% in a third straight modest fall which will still not erase a strong 10.2% increase seen in March. We expect single starts to resume a negative picture after a 0.4% increase in May, falling by 1.5%. However multiple starts look set for a bounce after falling by 29.7% in May, we expect by 17.5%.