FX Daily Strategy: N America, January 23rd

NOK steady as Norges Bank leave rates unchanged

Still scope for NOK recovery

Risk appetite to remain strong as long as US jobless claims remain subdued

Market on watch for BoJ leaks. JPY has modest upside scope on the expected 25bp hike

NOK steady as Norges Bank leave rates unchanged

Still scope for NOK recovery

Risk appetite to remain strong as long as US jobless claims remain subdued

Market on watch for BoJ leaks. JPY has modest upside scope on the expected 25bp hik

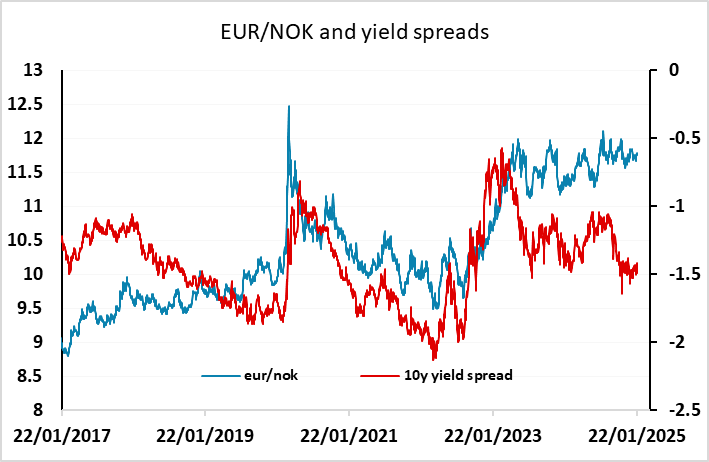

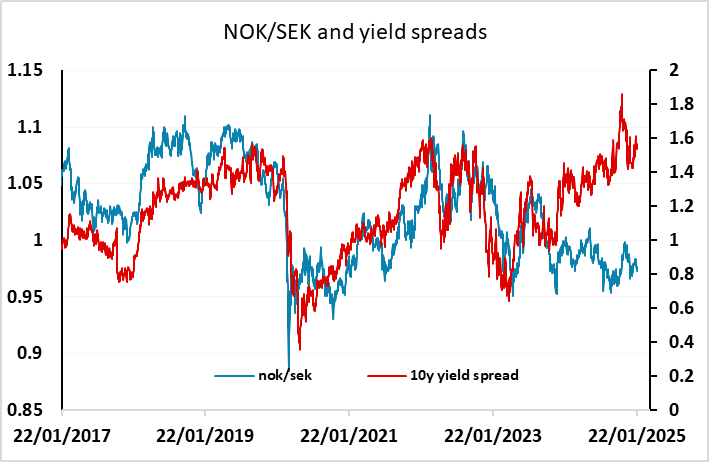

There’s nothing particularly surprising in the Norges Bank statement. EUR/NOK is little changed on the announcement, and we continue to see potential for a NOKrecovery given its major underperformance over the last year. Norges Bank continue to indicate that they are likely to cut rates in March, encouraged by lower than expected CPI inflation, even though fewer rate cuts abroad are now expected than before. This might normally mean that Norwegian rate cuts would lead to a weaker NOK, but in the current circumstances, the NOK hasn’t shown much inclination to follow moves in yield spreads. A modest decline in yield spreads would still leave the NOK looking very cheap relative to the normal relationships which held in previous years. The statement also highlights the potential for a rise in tariffs to dampen global growth – an aspect of Trump’s policies that isn’t currently bothering the equity markets, but could do so in the future if tariffs are implemented rather than being used as a negotiating tool.

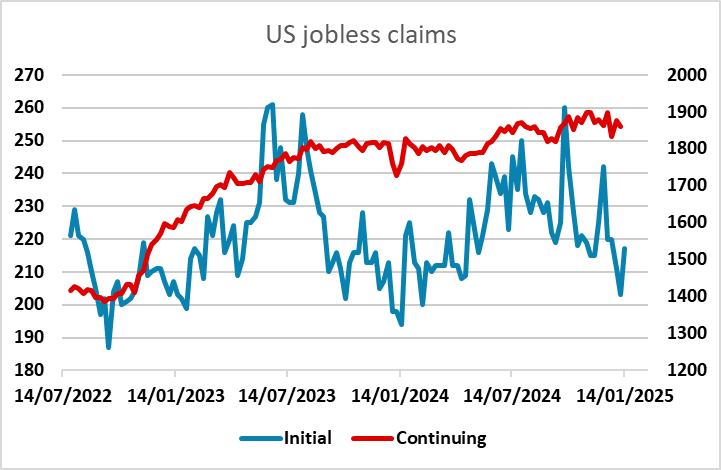

Otherwise, the US jobless claims numbers are probably the main focus datawise, with Canadian retail sales unlikely to be market moving. There is still no evidence of any rising trend in initial claims, although continuing claims have risen in the last couple of years and are holding at higher levels. Until we see some evidence of a trend increase in initial claims, the market is likely to remain comfortable that the US labour market is in a healthy state, and consequently sustain the positive risk tone that supports the current high equity market valuations. From an FX perspective, the riskier currencies should continue to do well as long as the US labor market remains healthy.

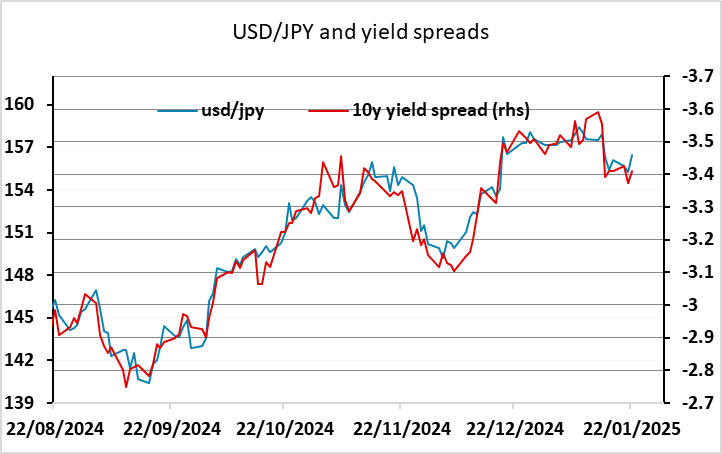

Late on Thursday there is Japanese national CPI data, but this has been well trailed by the Tokyo CPI data already released, and is unlikely to have any influence of the BoJ interest rate decision on Friday. But the market will be on watch for any late leaks from the BoJ ahead of Friday’s rate decision. The JPY has underperformed this week as riskier currencies have rallied, but USD/JPY now looks a little too low given current yield spreads, and there should be scope for the JPY to rise if the BoJ delivers a 25bp rate hike. This is now 88% priced in, so the JPY could be expected to decline on anything less than a 25bp rate hike.