Published: 2024-01-05T07:48:09.000Z

EUR/USD, USD/JPY, CHF/JPY flows: USD and CHF firm on geopolitical tension, EUR unmoved by German retail sales

-

USD and CHF firm on geopolitical tension, EUR unmoved by German retail sales

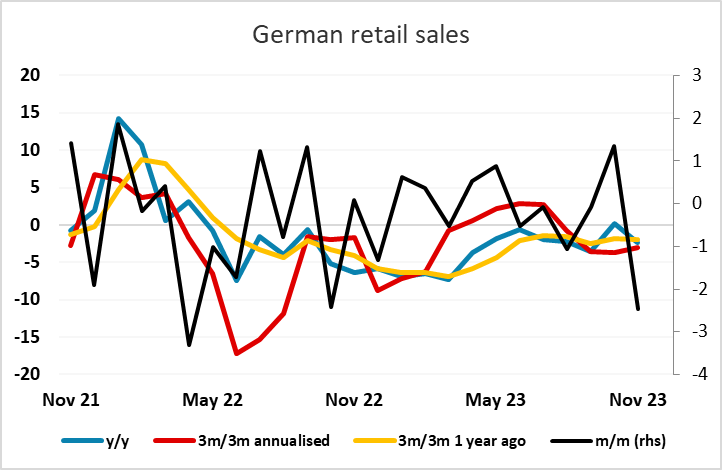

The sharp drop in German retail sales in November hasn’t had much impact on the EUR, with the market well used to the volatility in the series. Trend measures like the 3m/3m annualised change or the 3m/3m change y/y are little changed from October, running at -3% and -2% respectively. Even so, the data is a reminder after the positive reactions to the services PMI this week that the German economy is hardly booming. Consumer demand remains quite soft, and there is every reason to expect the ECB to cut rates fairly aggressively if inflation falls back to target in the coming months.

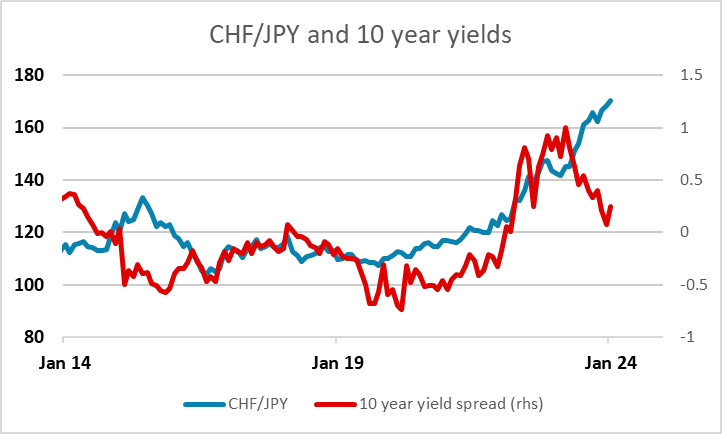

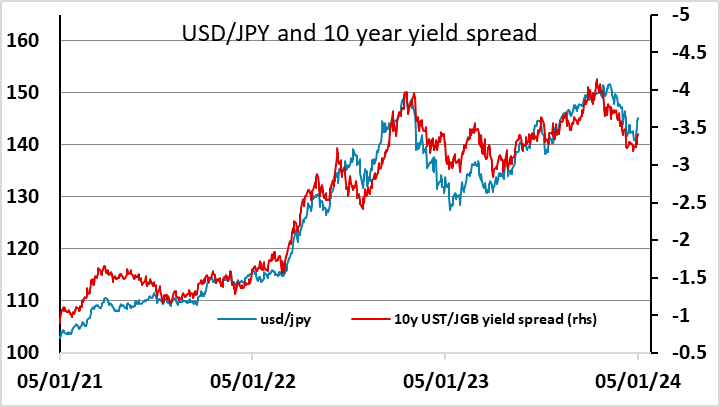

Overnight, the trends seen on Thursday continued, with the JPY staying weak and the USD firm. The USD is gaining some benefit from rising geopolitical tension, and this also seems to be helping he CHF. EUR/CHF continues to hover just above historic lows, and CHF/JPY hit another all time high overnight at 170.70. The JPY’s status as a safe haven may to some extent be being undermined by the tension in the Korean peninsula, but CHF/JPY looks overdone at these levels.