FX Daily Strategy: APAC, November 20th

US September employment report finally due, USD upside risks

JPY weakness increases, intervention looking necessary

Equity bounce suggests scope for AUD recovery

US September employment report finally due, USD upside risks

JPY weakness increases, intervention looking necessary

Equity bounce suggests scope for AUD recovery

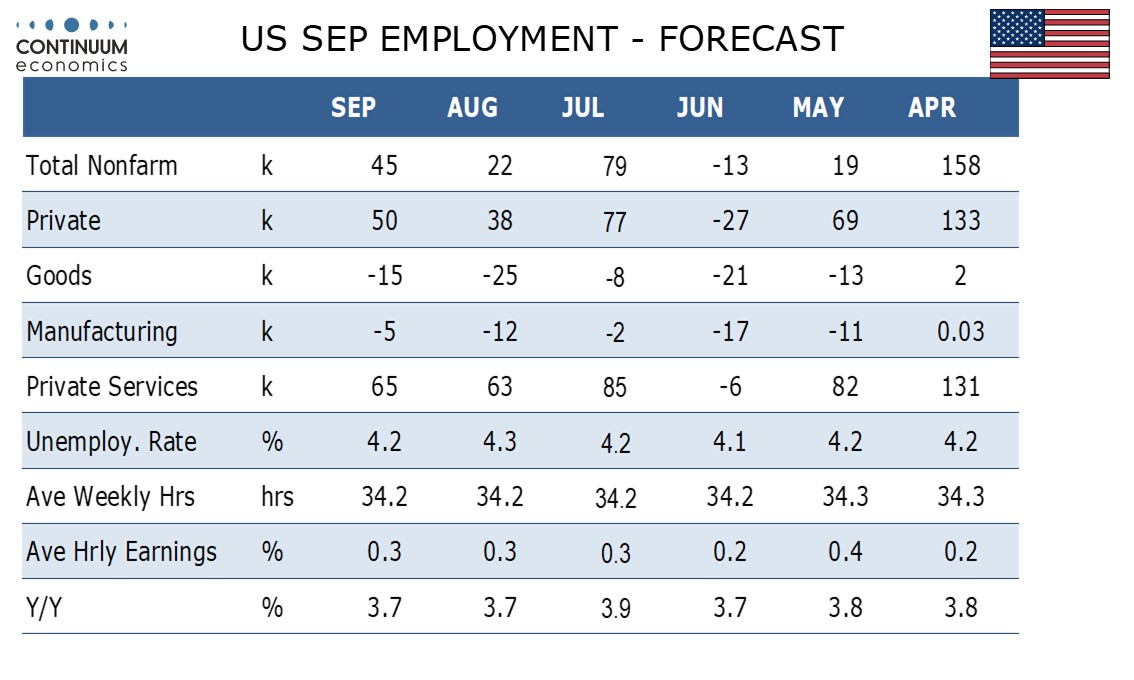

The delayed September US employment report will be the main focus on Thursday. We expect it show another subdued rise of 45k in non-farm payrolls, with 50k in the private sector, marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while average hourly earnings maintain trend with a rise of 0.3%. While we are forecasting a decline in the unemployment rate and a slightly lower rise in payrolls, our numbers are essentially in line with the consensus and shouldn’t have much impact on market expectations of Fed policy. Having said this, the risk is that an as expected number will lead to a further decline in the market expectation of a December Fed ease. The recent comments from FOMC members, even from some doves, have suggested they favour no change in the absence of significant news, so some evidence of significant weakness in payrolls may be needed to maintain the current pricing of a 42% chance of easing. So although we wouldn’t expect a major reaction to data that comes in in line with our forecasts, the risks may be slightly to the USD upside.

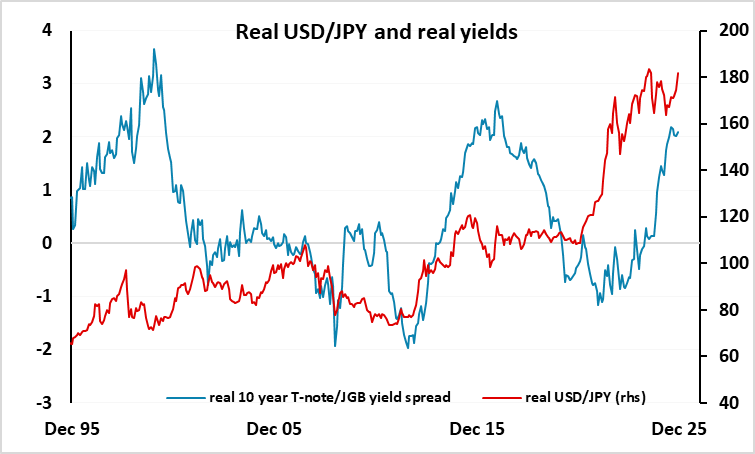

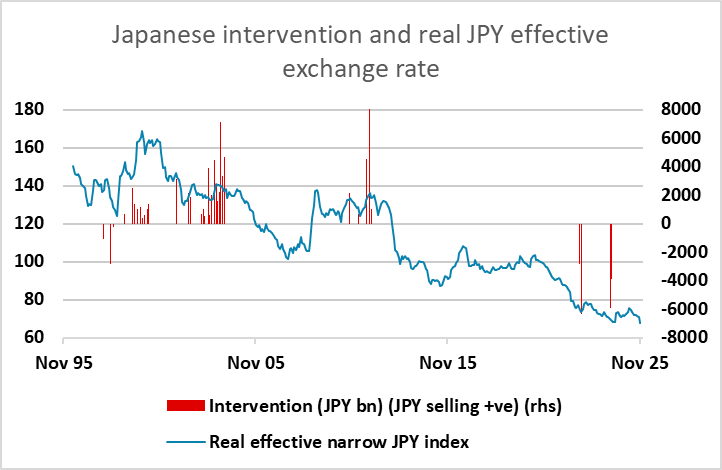

However, the main FX market story remains the weakness of the JPY, which extended substantially on Wednesday after the press conference from Finance minister Katayama which failed to suggest any plan for preventing further declines in the currency. While Katayama has indicated that she sees recent moves as “rapid” and “one-sided” the market remains unimpressed by talk. Unless we see a very weak US employment report to boost the JPY, actual FX intervention now needs to be seen to prevent an extension of JPY weakness. While some don’t expect this to come until nearer to 160, the real effective JPY traded at or below all time lows on Wednesday, and history suggests that these are levels where the MoF typically is prepared to intervene. A failure to intervene now risks a major loss of control and credibility.

The fundamental rationale for JPY weakness remains the low level of real JPY rates, although even on that basis the JPY looks too low based on the normal valuation impact of current yield spread levels. The alternative to intervention would be a rate hike from the BoJ, but there is no meeting until December 19, and that looks likely to be too late to prevent further substantial JPY losses. Having said that, an indication that a rate hike is likely in December would have a positive JPY impact, especially since part of the market’s concern relates to a belief that the BoJ will avoid raising rates as the new government favours continued easy monetary policy. But BoJ governor Ueda seems unlikely to commit himself at this stage. Initially, intervention would make sense to curb the current speculative excesses.

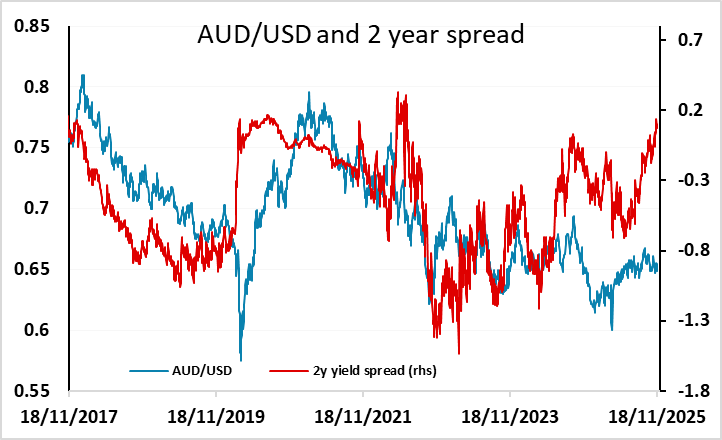

JPY weakness was exacerbated on Wednesday be a bounce in equities and general USD strength. The USD also gained ground across the board, but particularly against the JPY and CHF. Even so, the equity recovery only made a small dent in the losses of the last couple of weeks, and the Nvidia results after the close on Wednesday and the US employment report will be the focus for the next significant move. The AUD has dipped back below 0.65 due to the recent weakness in equities, but continues to look undervalued based on yield spreads and any equity rally would suggest scope for AUD to move strongly above 0.65.