USD flows: USD down on ISM

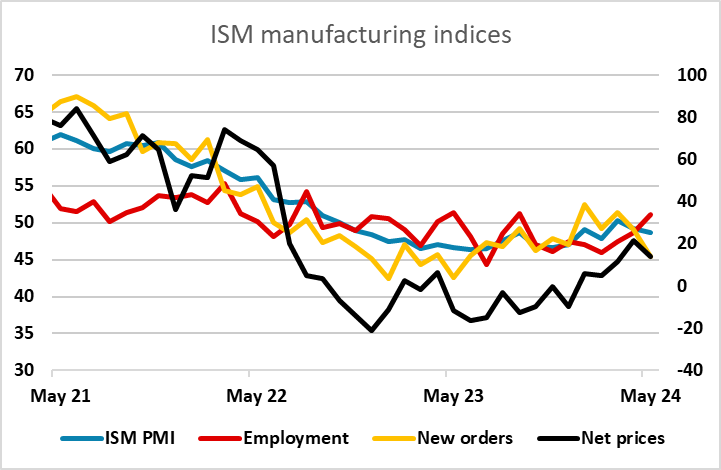

Weaker than expected manufacturing ISM, particularly orders, weighs on USD.

USD trading lower on significantly weaker than expected manufacturing ISM. Prices and orders indices both lower, as well as the headline ISM PMI, but the employment index was higher than expected, which may limit the negative impact given the focus on the employment report at the end of the week. In the end, the services ISM is more important, covering a much larger proportion of the economy, but the manufacturing sector is always seen as somewhat more significant than its weight in GDP suggests.

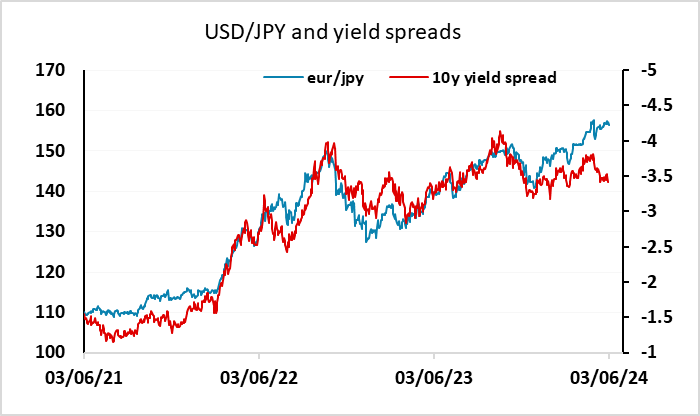

The USD ins consequently weaker across the board, with yields down along the curve. Given the decline in yields and the lack of a positive response in equities, we would expect the JPY to benefit the most, but thus far there has been a fairly even USD decline.