FX Daily Strategy: N America, May 2nd

US employment report the main focus

Mild upside risks relative to consensus suggesting a positive USD bias

USD strength nevertheless starting to looked stretched against the JPY

GBP strength may also be close to its peak

US employment report the main focus

Mild upside risks relative to consensus suggesting a positive USD bias

USD strength nevertheless starting to looked stretched against the JPY

GBP strength may also be close to its peak

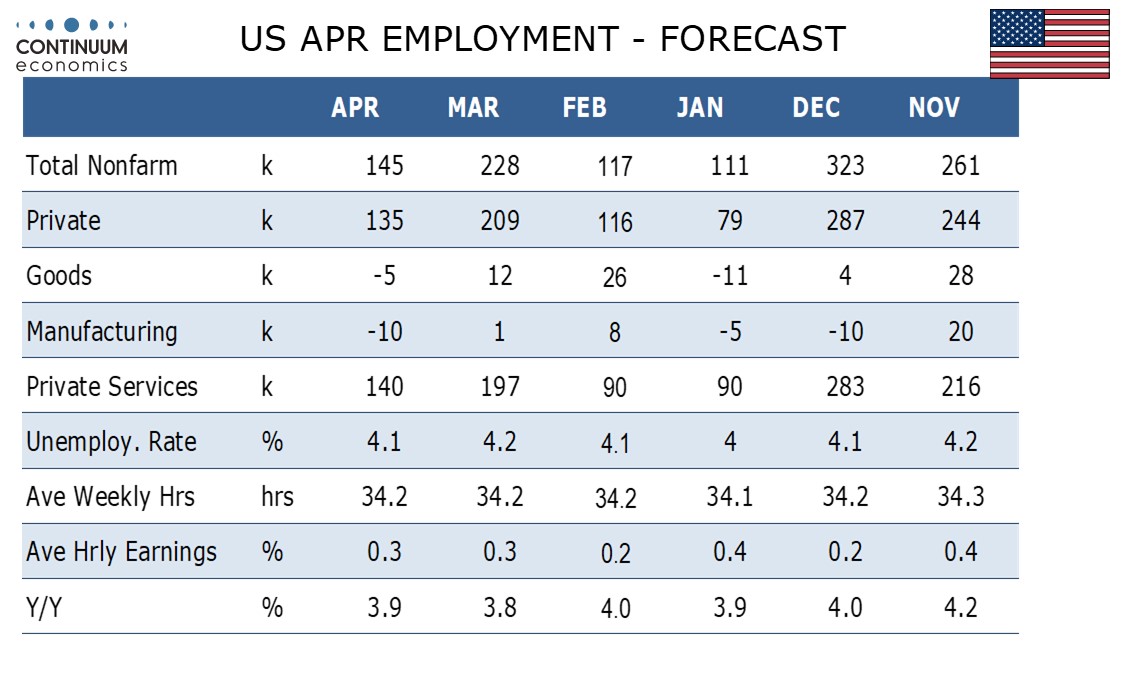

The US employment report dominates Friday’s calendar. We expect a 145k increase in April’s non-farm payroll, with 135k in the private sector, the latter equal to the Q1 average. Initial claims were showing no signs of labor market weakness in the payroll survey week, with a bounce in the latest week not yet a clear change in trend. We expect unemployment to correct lower to 4.1% after a March rise to 4.2%, and an in line with trend 0.3% increase in average hourly earnings.

Our forecast is marginally stronger than consensus, with the decline in the unemployment rate the main difference, but suggests that the report should be strong enough to sustain the recent USD recovery. This has been built on some solid earnings reports from the Tech giants, a generally calmer tone in both the equity and bond markets and data that has not, as yet, shown clear weakness, although there are some signs of weakness in the surveys and the latest claims numbers. We see this period as a calm before the storm, as the tariffs have not yet had time to have real impact on either the data or corporate earnings. The tendency to buy the dip in equity markets has become a reflex in the uptrend of recent years, so in the absence of clear negative news the equity market and USD recovery can extend, although we see the 5800 level in the S&P as the top of the recent range, so scope for gains is becoming less substantial.

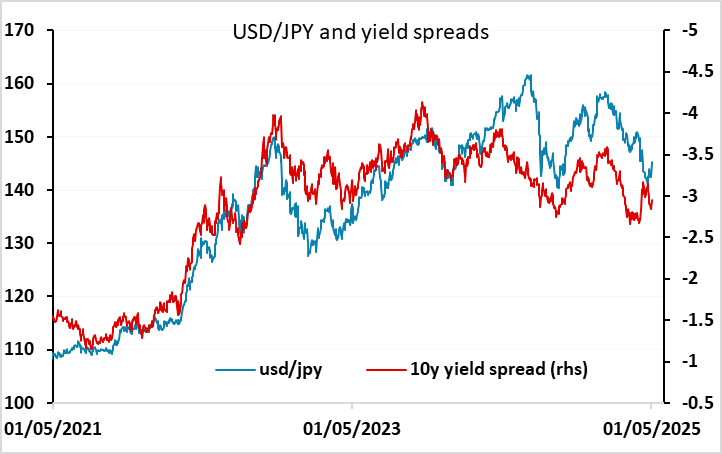

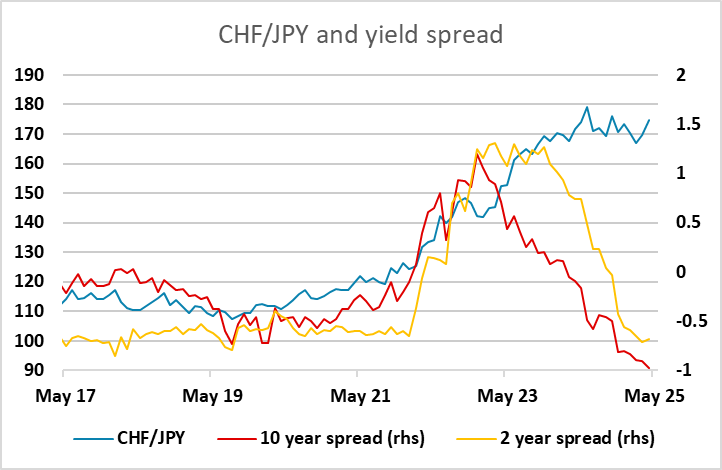

The JPY has suffered the most from the equity market and USD recovery, but is also approaching the bottom of recent ranges, particularly on the crosses. The case for JPY weakness against the CHF is hard to make given the current JPY yield advantage and the huge move higher in CHF/JPY in the last few years. While the latest leg down in the JPY owed something to the downgrade in growth expectations from the BoJ, this downgrade was due to the impact of tariffs which will impact other countries as much or more than Japan. Typically, a uniform slowdown due to the tariff increase would be positive for the JPY, particularly against the commodity as it could be expected to adversely impact risk sentiment. CAD/JPY looks especially vulnerable with Canada likely to suffer as much as any of the G10 countries from the impact of tariffs.

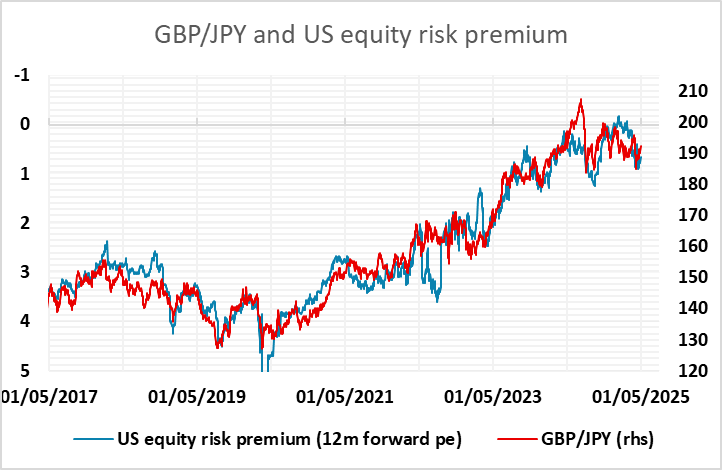

The USD has made much less progress against the riskier currencies as equity markets have recovered, as is typically the case in a positive risk environment. GBP/USD remains close to 3 year highs, helped to some extent by expectations of relatively tight BoE policy. But in spite of the better than expected UK growth numbers in Q1, the prospects for Q2 and beyond look much less positive. While this may be the calm before the storm, GBP and the other risky currencies are vulnerable if and when the storm arrives, and all the more so having performed well in the last few weeks.