FX Daily Strategy: N America, December 3rd

ADP the focus with downside risks for the USD

JPY ought to be the biggest beneficiary of weak data

AUD looks attractive despite Q3 GDP miss

CHF weakness is welcome for the SNB

ADP the focus with downside risks for the USD

JPY ought to be the biggest beneficiary of weak data

AUD looks attractive despite Q3 GDP miss

CHF weakness is welcome for the SNB

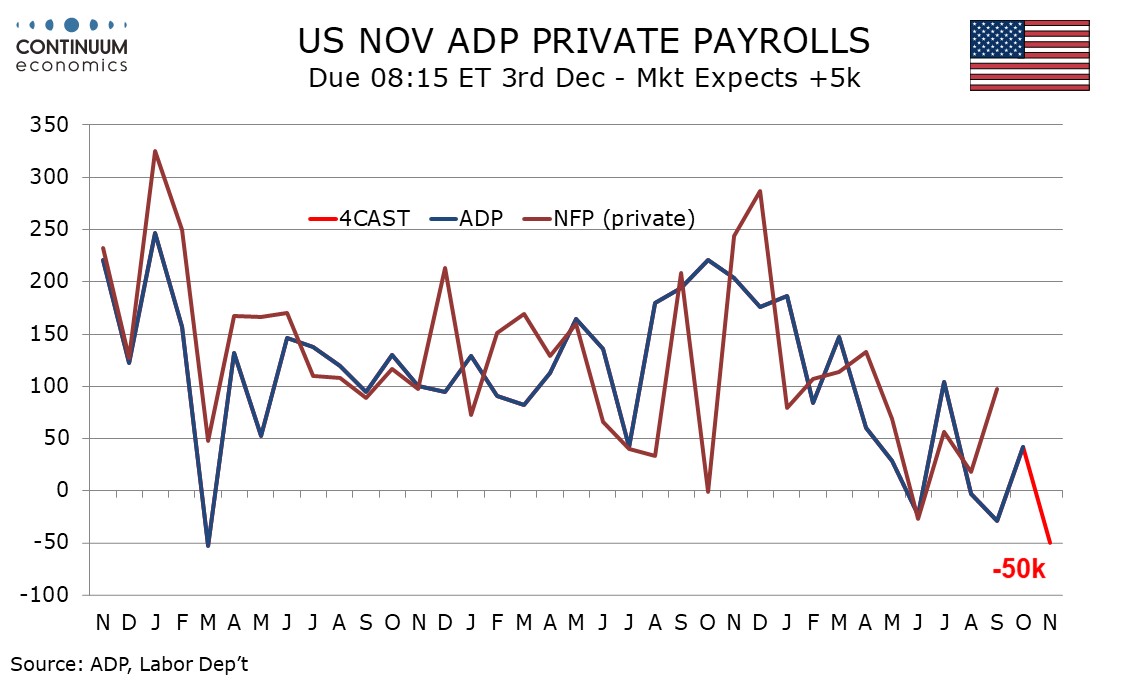

US ADP employment will be the main market focus on Wednesday. Weekly ADP data, showing an average weekly job loss of 13.5k in the four weeks to November 8, suggests a weak monthly report from ADP, covering the four weeks to November 15. We expect a decline of 50k. ADP data covers only the private sector. Weekly initial claims have been fairly stable but continued claims have been trending higher, which together can be seen as consistent with a slight decline in employment, with limited layoffs slightly exceeding limited hiring. Our forecast is notably weaker than the market consensus which looks for a 7k rise, and could be expected to trigger a significant USD dip. Even though the ADP report isn’t fully trusted as an indicator for the official employment report, it is of greater significance given the delays to official data.

The USD impact will likely favour the risk negative currencies, as a weaker employment picture would typically be associated with weaker real activity. However, a decline in US yields that is likely to result will provide some support for equity markets and the risk positive currencies are also likely to gain. In recent years the movement in the US equity risk premium has been a guide to cross FX reactions, with lower US yields usually favouring the safer havens because they typically mean a higher risk premium, even if equities manage a small rally on the back of lower yields. However, the JPY has recently failed to benefit from the rise in the US equity risk premium, so the reaction is less reliable.

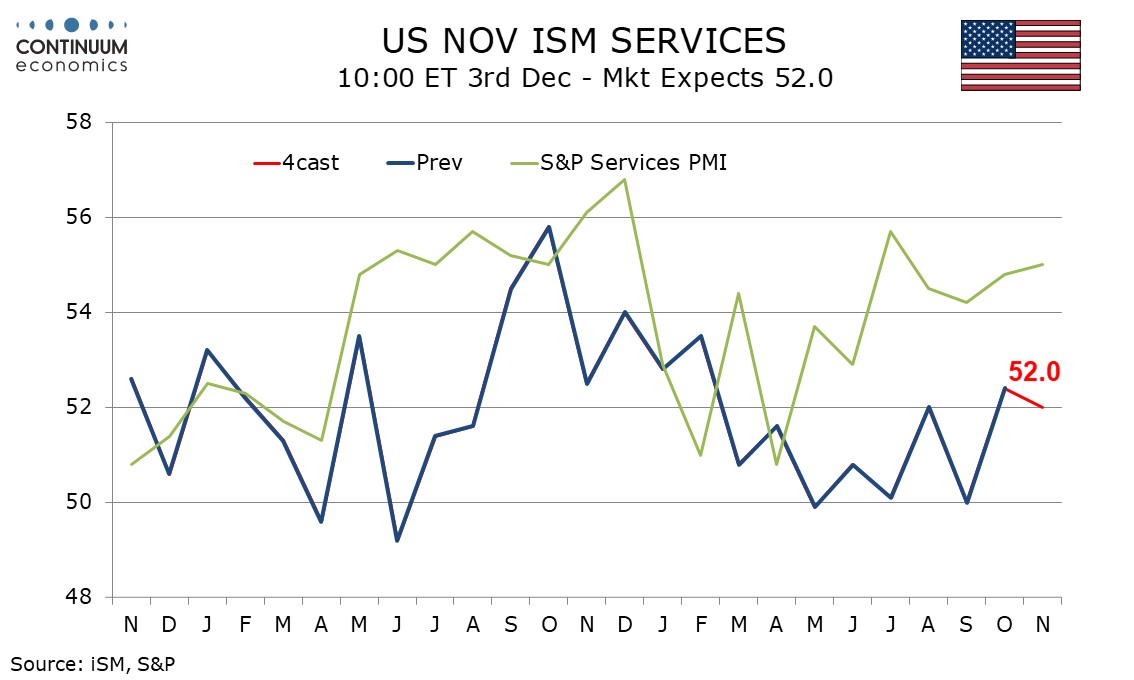

There is also the ISM services survey, which is typically seen as more significant than the manufacturing index, given the relatively large size of the services sector. We expect November’s ISM services index to correct lower to 52.0 from 52.4 in October which was the highest reading since February. The last twelve readings have seen the index move in the opposite direction to the preceding month. However, this is in line with the consensus and is less likely to have an impact than the ADP data.

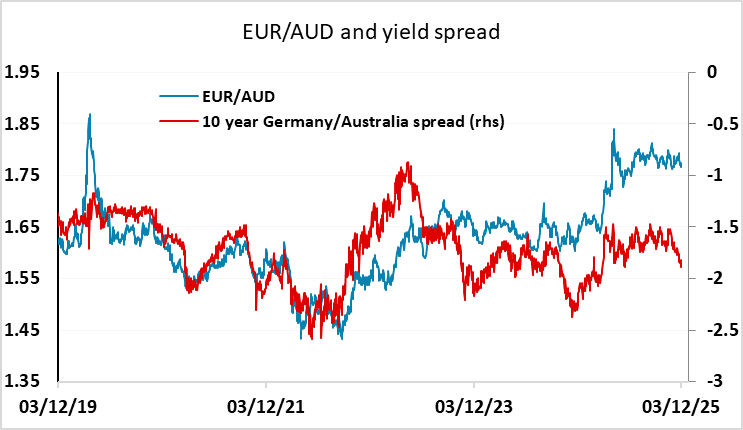

Earlier in the day we had Q3 Australian GDP which was expected to show a very solid increase of 0.7% q/q, following 0.6% in Q2. While GDP only rose 0.4% q/q, weakness was due to lower inventory accumulation, and domestic final demand rise 1.1% q/q. AUD/USD and AUD yields initially dipped but quickly recovered above pre-data levels. While the AUD can be held back in periods of risk aversion, particularly if they are specific to China, it’s hard to make arguments against further AUD gains unless we see a very significant turn lower in global sentiment/global equities. The 0.64 handle has provided very good support on the occasions we have dipped below 0.65 since June, and we expect the top end of the year’s range above 0.67 to be tested by the end of the year.

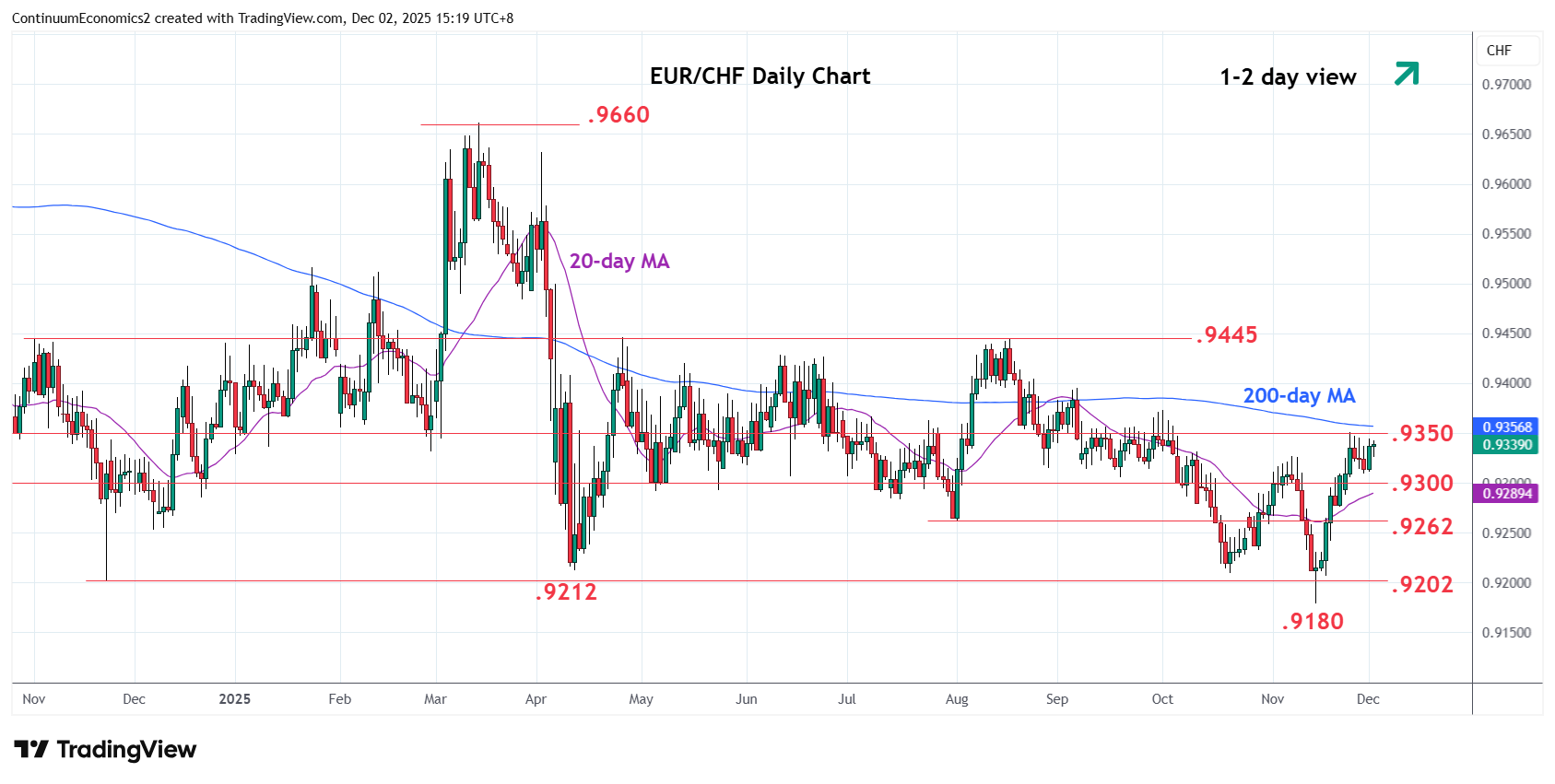

We also have Swiss CPI for November, with a 0.1% decline expected on the month and a 0.1% rise y/y. The CHF has fallen back against the EUR in the last couple of weeks after a brief EUR/CHF test below 0.92 on November 14, and still has potential to weaken further if EUR sentiment remains positive. The protection below 0.92 may be quasi-official, and the high level of the CHF is hard to justify given the lack of yield and the apparent strong support. A dip in y/y inflation into negative territory could yet trigger negative rates from the SNB once again, but this still looks unlikely. A weaker CHF would be a much preferred solution to excessively low inflation.