EUR flows: Little impact on EUR from smaller rise in German unemployment

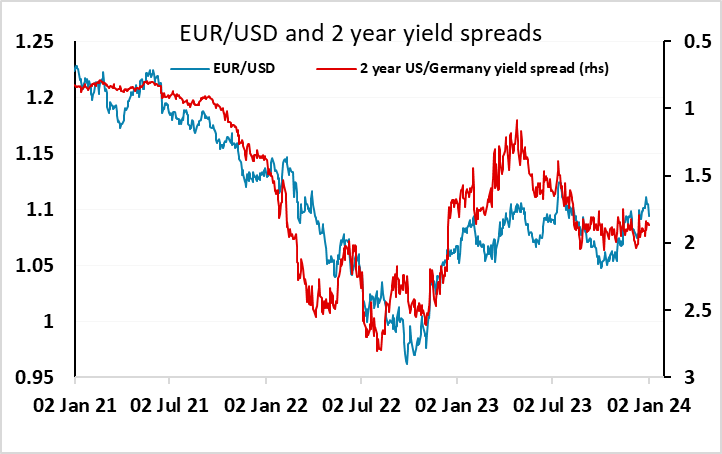

EUR remains steady near 1.0950, but in the absence of evidence of increasing weakness in the Eurozone ecnomy, current rate cut expectations may prove too aggressive, supporting the EUR

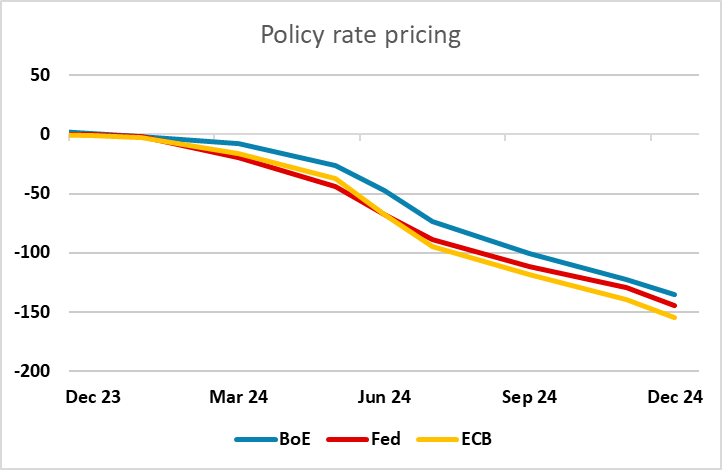

A smaller than expected 5k rise in German unemployment in December has had little initial impact, and won’t significantly change the market’s view of the underlying rising trend. But the trend has been modest, and these sort of rises wont make the ECB feel any real urgency to ease policy. There are currently 154bps of easing from the ECB priced in for the next year, greater than the easing priced for the Fed or BoE. The justification is the relative weakness of the Eurozone economy relative to the US, and the relative persistence of UK inflation. But the ECB is starting from a much lower level of rates, and unless there is evidence of more significant weakness in the real, the market pricing may prove too aggressive.

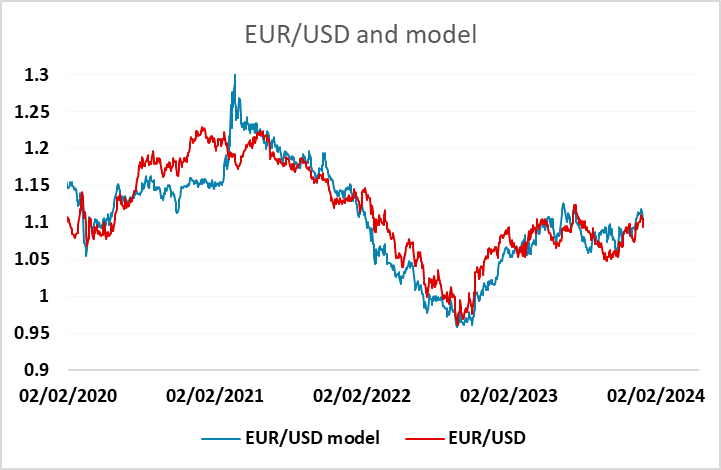

EUR/USD remains fairly closely correlated with short term yield spreads, so if the market does start to scale back expectations of ECB tightening, the EUR is likely to see some benefit. However, there is a caveat that the EUR has also benefited from positive equity market performance, and if this is curtailed by declining expectations of rate cuts, the EUR may not benefit much, or even at all if the market also reduces expectations of Fed easing. EUR benefits may be clearer on the crosses against the riskier currencies, which would suffer more from declining risk sentiment.