Published: 2026-02-02T20:03:33.000Z

Preview: Due February 10 (government shutdown may delay) - U.S. Q4 Employment Cost Index - Maintaining trend

3

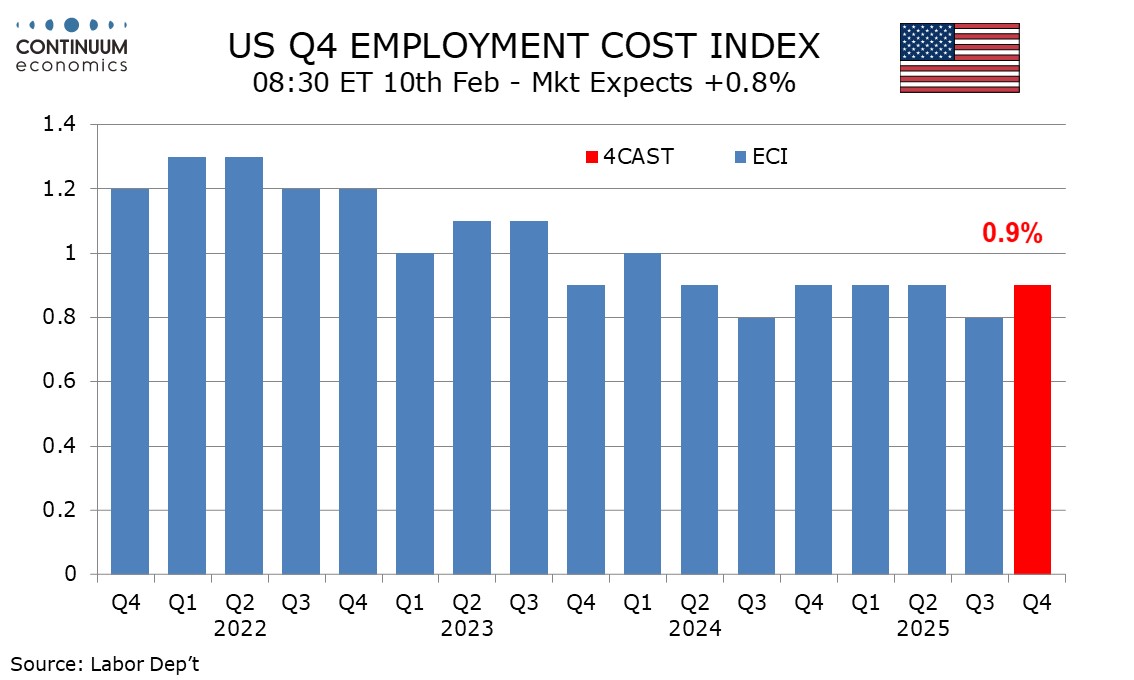

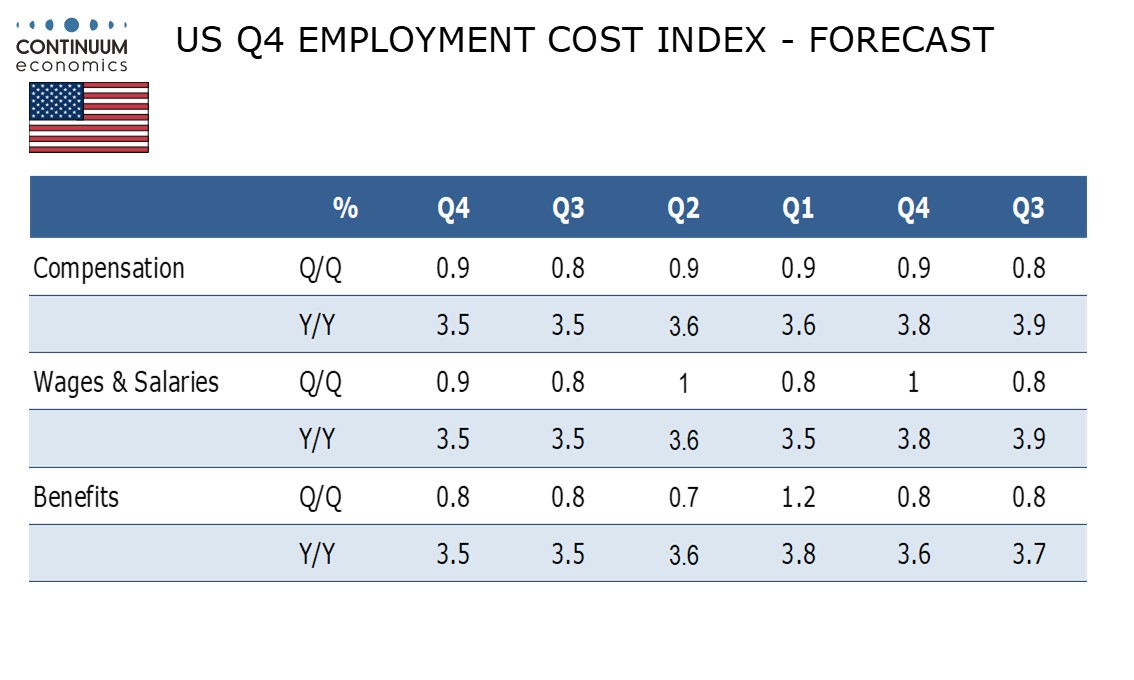

We look for the Q4 employment cost index (ECI) to increase by 0.9%, slightly firmer than the 0.8% seen in Q3 but matching the gains of Q1 and Q2, as well as Q4 2024.

We expect a 0.9% increase in wages and salaries, stronger than 0.8% gains seen in Q3 and Q1 but softer than gains of 1.0% in Q2 and Q4 2024. Non-farm payroll average hourly earnings increased by 1.0% in Q4, matching their increase of Q3.

There is some upside risk to benefit costs from rising health premiums, but this is probably more of an issue for Q1 2026 than Q4, which we expect to match gains of 0.8% seen in Q3 as well as Q3 and Q4 of 2024.

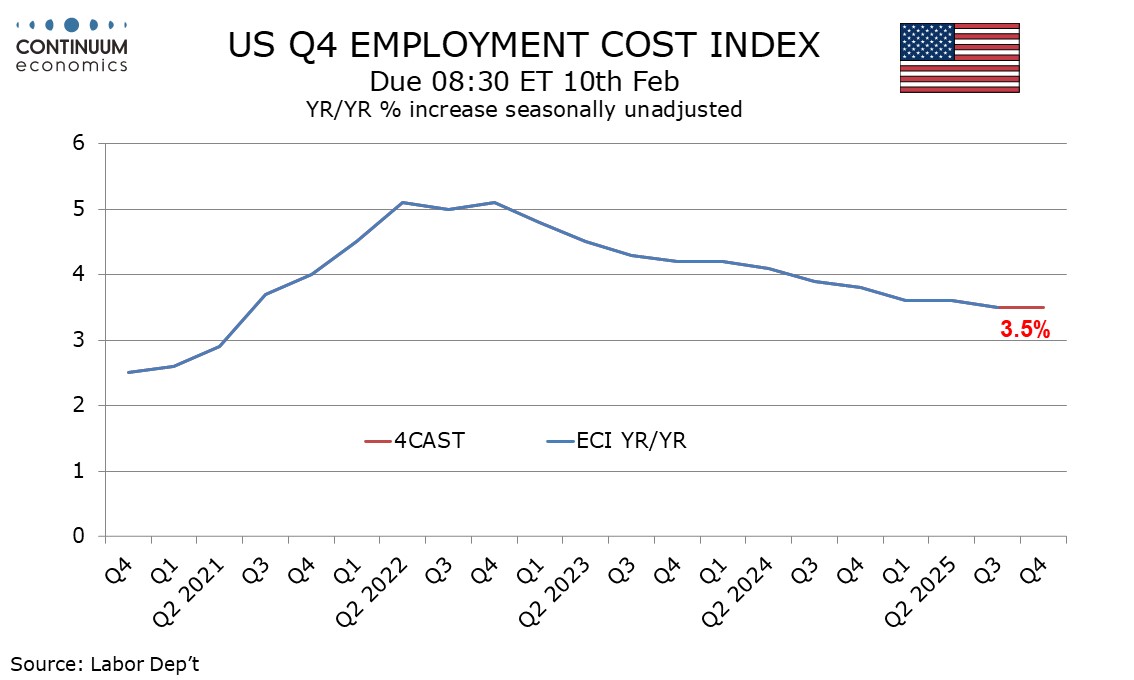

We expect yr/yr growth of 3.5%, matching Q3’s, with wages and salaries and benefits both matching the overall pace. A recent slowing in trend may be stabilizing above the pre-pandemic trend that was slightly below 3.0% on a yr/yr basis.