FX Weekly Strategy: Sep 22nd-26th

Limited impact likely from S&P PMIs, though weaker US numbers seen

JPY may manage a small recovery, but turn in equities needed to reverse weak trend

SEK could be vulnerable to Riksbank rate cut

Little chance of SNB action, but EUR/CHF may have found a near term base

Strategy for the week ahead

Limited impact likely from S&P PMIs, though weaker US numbers seen

JPY may manage a small recovery, but turn in equities needed to reverse weak trend

SEK could be vulnerable to Riksbank rate cut

Little chance of SNB action, but EUR/CHF may have found a near term base

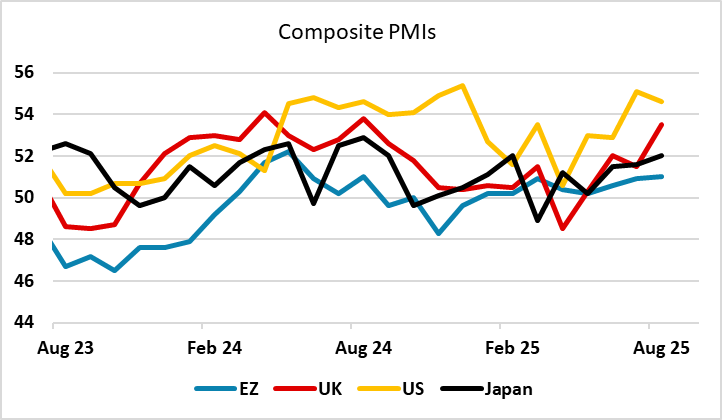

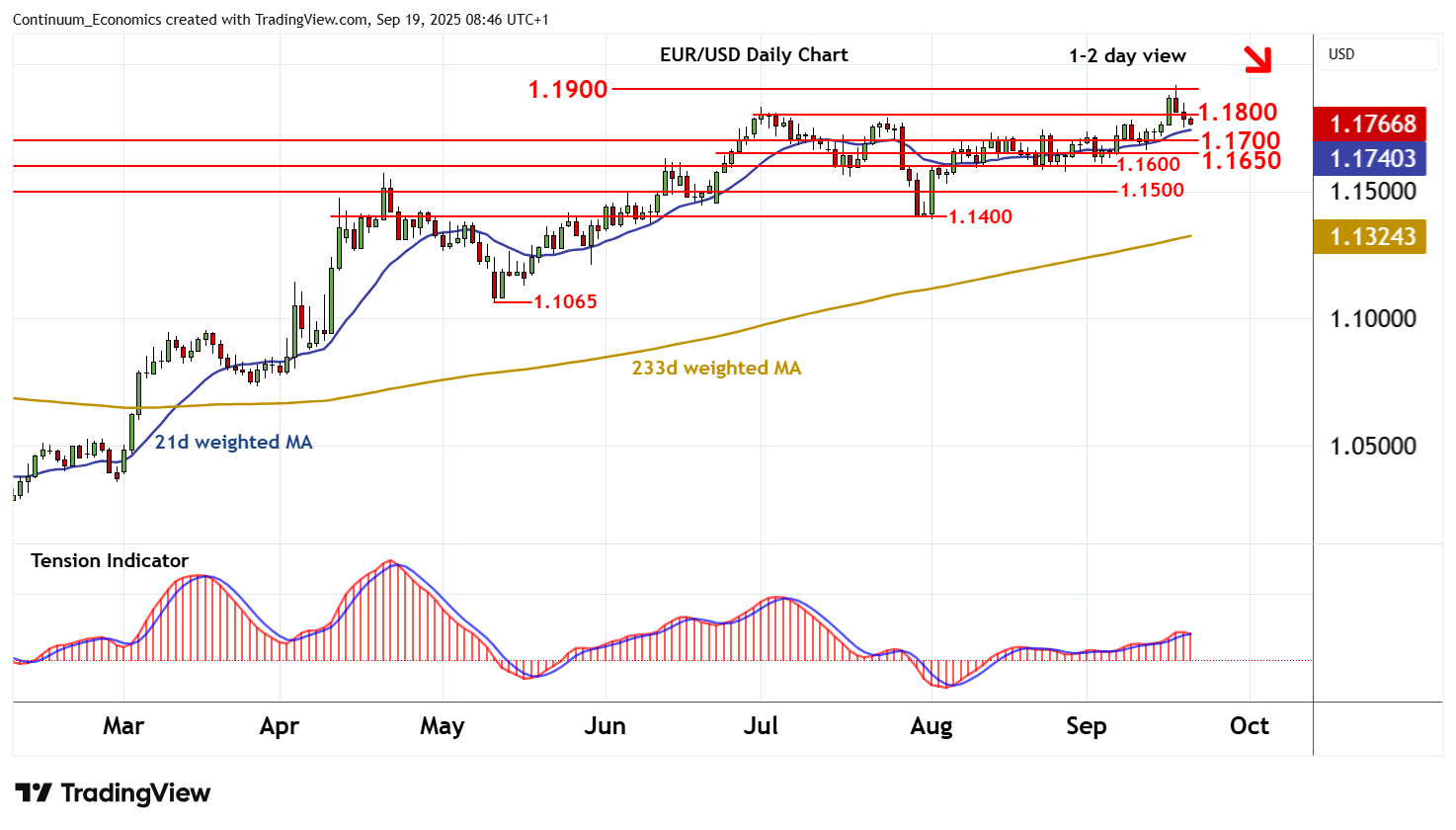

A relatively quiet week for data with the S&P PMIs likely to be the primary data focus. We expect a slightly larger decline in the US PMIs than the consensus, while we see little change in the Eurozone PMIs, in line with consensus thinking. The numbers seem unlikely to reverse the recovery in US yields seen at the end of last week following the stronger US data on Thursday, and with the central bank meetings now behind us, it seems likely that we settle back into a range, with EUR/USD holding in the 1.17-1.18 area, as there is little on the calendar that looks likely to spark volatility.

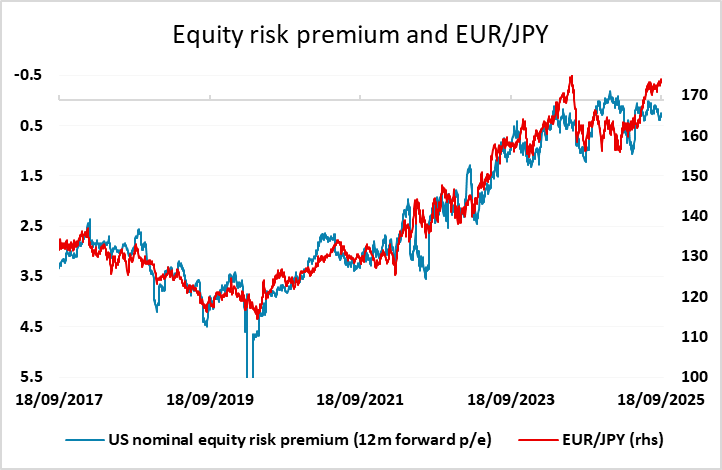

For USD/JPY, there will be interest in Tokyo CPI at the end of the week, but the key factor will be equity and bond market performance. The JPY has weakened on the crosses in the last couple of weeks as equities have gone to new highs. This has mostly come on the back of lower US yields, although the rise last Thursday was accompanied by higher US yields, and consequently implied a further decline in the US equity risk premium, which remains highly correlated with movements in JPY crosses. CHF/JPY recorded another new all time high while EUR/JPY hit its highest since the all time high on July 2024. We suspect equity markets are due at least a pause at this stage, which may allow the JPY to make a small recovery, but without an equity market correction, it’s hard to see any significant turn in the weak JPY trend.

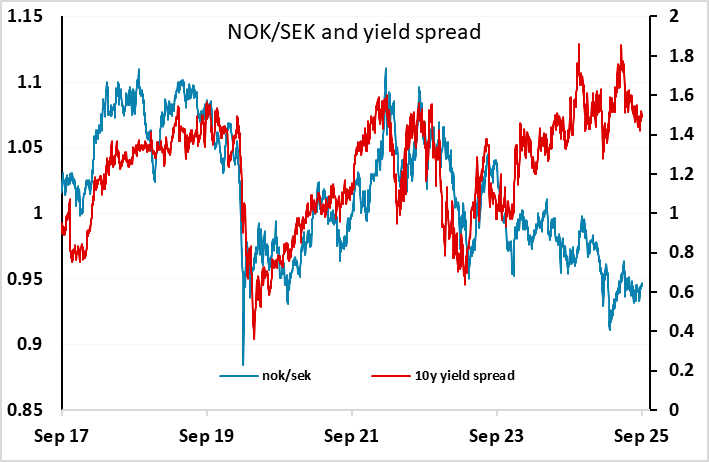

After the major central bank meetings last week, we have the SNB and Riksbank this week. The Riksbank is seen as a vary close call, with forecasters split 50-50 over whether they will cut rates again, while then market is pricing in just a 30% chance of a cut. We slightly favour a cut this time, which would suggests the SEK could come under pressure. The SEK has outperformed yield spreads against the EUR and particularly the NOK this year, and after the more hawkish Norges Bank tone last week that accompanied their expected cut in rates, we would expect to see a strong positive NOK/SEK reaction if the Riksbank cuts rates again.

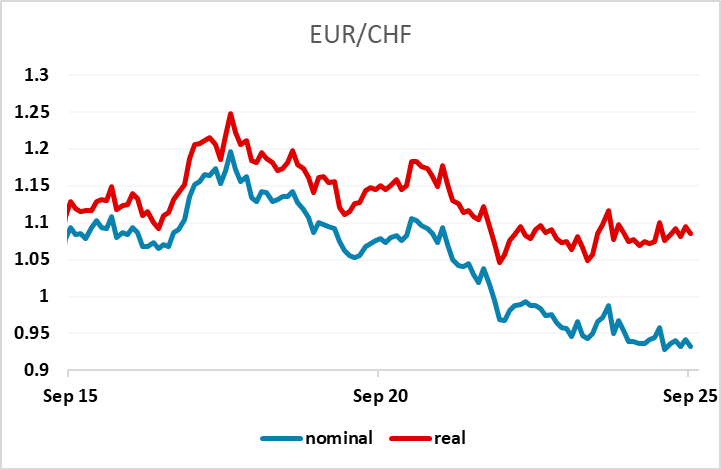

Few expect any action from the SNB, who have made it clear that they have set a very high bar for a move to negative rates. While the CHF has been the second only to the SEK as the strongest of the G10 currencies this year, EUR/CHF hasn’t risen significantly in real terms due to relatively low Swiss inflation, so for the moment the SNB aren’t inclined to react to the strength of the currency, even though the strong currency combined with the high US tariff of 39% on Swiss exports creates significant competitiveness issues. We wouldn’t rule out a statement that indicates a preference for a weaker currency and suggests a willingness to intervene, but while this might have a short term negative impact on the CHF, intervention is not something that scares the CHF bulls having failed to prevent the rise in recent years. Nevertheless, the 0.93 level in EUR/CHF is acting as strong support and in the absence of shocks we see upside risks.

Data and events for the week ahead

USA

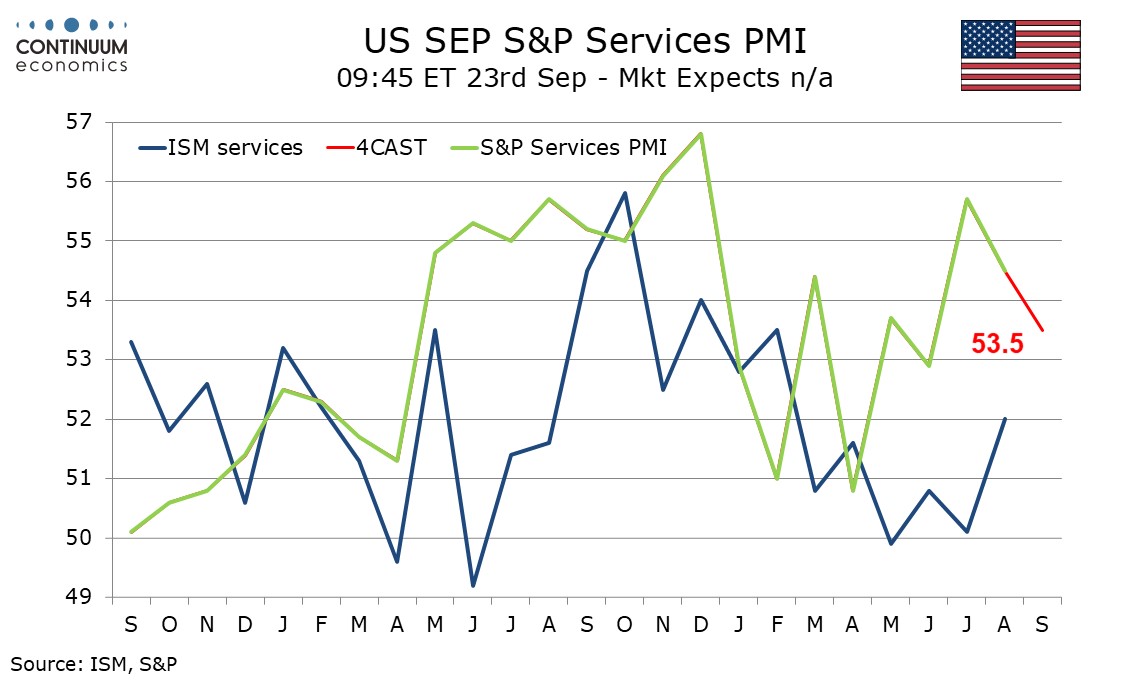

Monday sees no significant US data, but several Fed speakers, with Williams, Musalem, Hammack and Barkin due. On Tuesday we expect the Q2 current account deficit to fall to $256bn from Q1’s record pre-tariff deficit of $450.2bn. We also expect slippage in the S and P PMIs for September, manufacturing to 51.5 from 53.0 and services to 53.5 from 54.5. Also on Tuesday we expect August existing home sales, by 2.5% to 3.91m. On Wednesday we expect August new home sales to fall by 4.1% to 625k, while Fed’s Daly is due to speak.

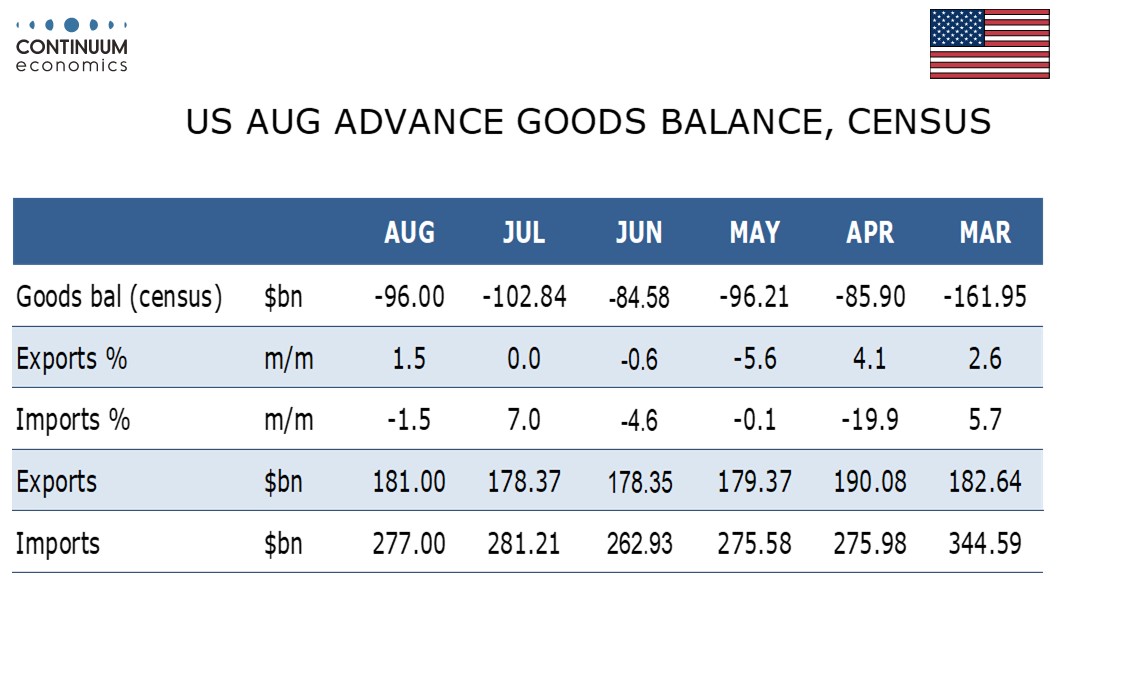

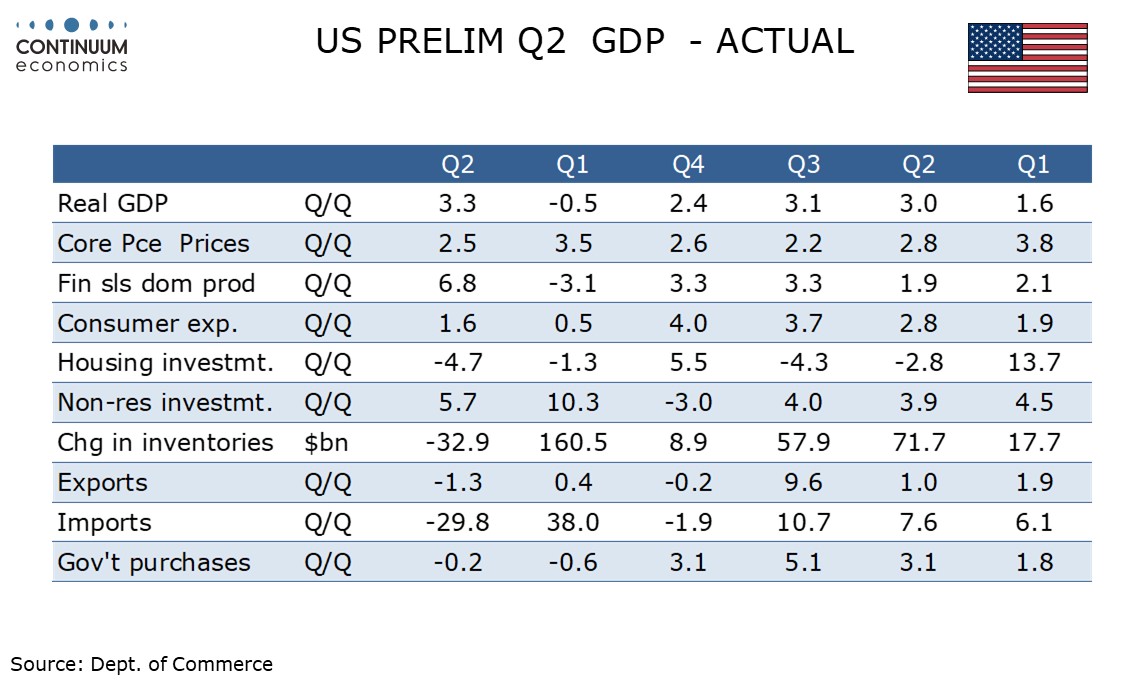

On Thursday the final Q2 GDP report will see historical revisions which should be closely watched with risk they will be negative, though we do not expect any revision to the preliminary 3.3% Q2 estimate. We expect August durable goods orders to fall by 1.0%, with a 0.5% fall ex transport, and August’s advance goods trade deficit to fall to $96.0bn from, $102.8bn in July. Weekly initial claims data are also due, while Fed’s Goolsbee, Williams, Barr and Daly will speak. On Friday we expect August core PCE prices to rise by 0.3%, with a 0.3% rise in personal income and a 0.4% rise in personal spending. Final September Michigan CSI data is due, while Fed’s Barkin and Bowman will speak.

Canada

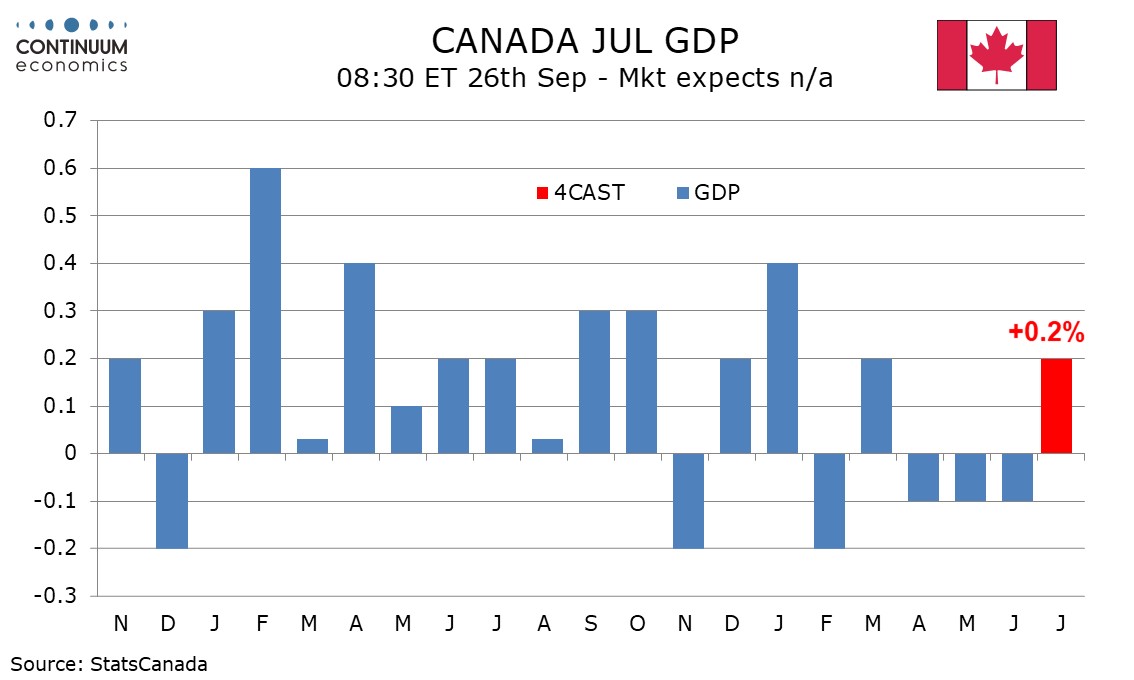

Canada releases August’s IPPI and RMPI on Tuesday. Friday sees July GDP, for which we expect a 0.2% increase, slightly stronger than a 0.1% estimate given with June’s data.

UK

Survey data are the main interest this week with flash September PMI numbers (Tue) which we see correcting back. At 53.5 in August, the Composite was up from 51.5 in July but the question is whether this is authoritative or not; after all, according to the CBI (also due Tue and Thu) activity across the services sector continues to weaken -(28 August 2025) while the PMI sees 'Steepest upturn in service sector output since April 2024. Otherwise, BoE Governor Bailey speaks on a panel on Monday while MPC hawks Pill and Greene speak on Monday and Tuesday.

Eurozone

More survey data arrives starting with consumer confidence numbers (Mon) and Tuesday’s flash PMI for September. In August, the Composite PMI ticked up to a one-year high of 51.0, from 50.9 in July. We see little change in what may be a further insight into how companies have actually reacted to the EU-U.S. trade ‘deal’ – the German ZEW update was mixed though. German IFO numbers (Wed) will offer little new but the ECB’s household expectations survey (Fri) may be interesting reading. Perhaps most interesting though will be the ECB money and credit update (Thu) where lending growth seems to have slowed of late – perhaps this may be something ECB Chief Economist Lane touches on in a speech (Mon).

Rest of Western Europe

There are no key events in Sweden over and beyond the Riksbank verdict (Tue) and what may be weak Economic Tendency Survey (Wed). We see the Riksbank delivering a further 25 bp rate cut, taking the policy rate to new cycle low of 1.75%. Although noting the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises, we adhere to our view that of what would be a final rate cut.

In Switzerland, the SNB verdict looms (Thu). Having the SNB cut the policy rate by 25 bp back to zero in June, as widely expected, we see no further change. Indeed, markets have priced out what was previously a good chance of rates turning negative, even against a backdrop of the punitive tariff scheme the Swiss economy faces and which will damage the real economy and also add to already weak price pressures. Mainly this fresh swing in market thinking has been a result of clear hints from the SNB Board itself suggesting that there is now a high bar for any return to negative borrowing costs because of the adverse impact on savers and pension funds.

Japan

Tokyo CPI on Friday will be important as we forecast a Oct hike from the BoJ. It is expected that headline will continue to moderate but core-core should remain elevated. It will be a dovish surprise to see core-core CPI dip below 3%. Else, BOJ meeting minutes is on Thursday but unlikely to tell us more about things we do not know.

Australia

Monthly CPI on Wednesday after PMIs on Tuesday for Australia next week. We believe the monthly CPI will stay below 3% and would be a hawkish surprise if it is higher.

NZ

Only consumer confidence on Friday for Kiwi next week.