FX Daily Strategy: N America, August 20th

NZD slump on dovish RBNZ

SEK downside risks on Riksbank

EUR/GBP biased higher on UK CPI

Rangebound market needs evidence of US labor market weakness to break ranges

NZD slump on dovish RBNZ

SEK downside risks on Riksbank

EUR/GBP biased higher on UK CPI

Rangebound market needs evidence of US labor market weakness to break ranges

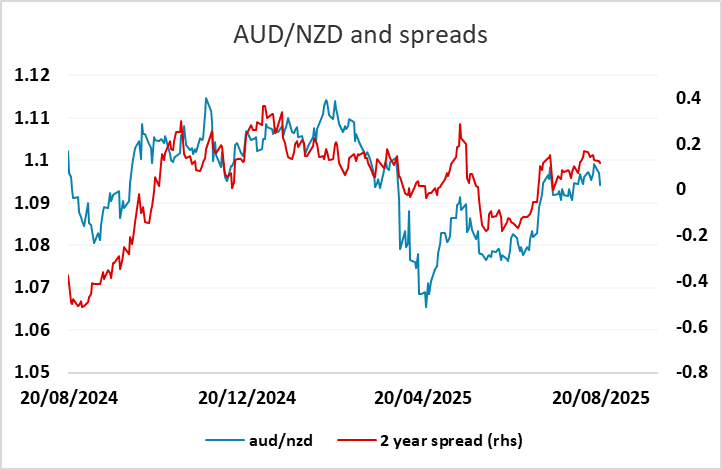

Wednesday sees policy meetings from the RBNZ and Riksbank as well as UK CPI data. The RBNZ meeting is first up, and was expected to deliver a 25bp cut in the policy rate. This was more than 90% priced into the market, so the focus was more on what the RBNZ signalled about the potential for a further rate cut this year. The market was pricing around a 60% chance of another rate cut before year end. The RBNZ cut as expected by 25bps but signalled more cuts to come as OCR forecast is being revised lower. It came as a dovish surprise and sunk Kiwi along with it. The biggest surprise, perhaps, was the fact that 50bps was considered in this meeting, showing the magnitude of concern in RBNZ's eyes. NZD/USD fell 60 pips or more than 1% on the news.

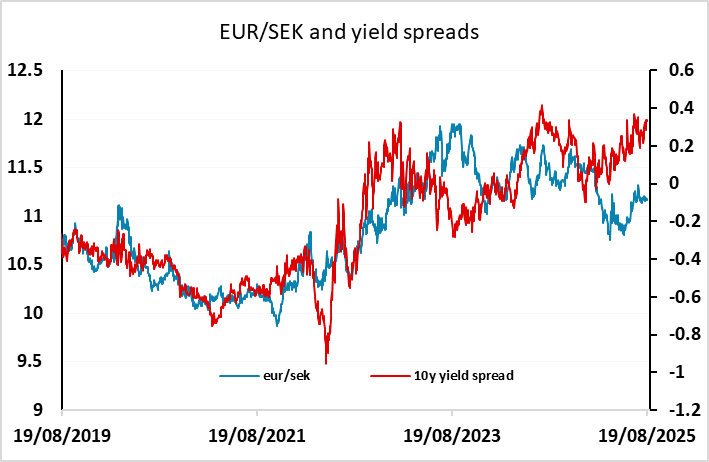

The Riksbank, in contrast, were priced as unlikely to cut rates with a cut priced as less than a 20% chance. There was therefore little reaction to the Riksbank decision to leave rates unchanged, with the Riksbank continuing to indicate that there is scope for a further cut this year, in line with the June monetary policy report. The statement notes that “The Riksbank considers that the outlook remains largely unchanged, even though inflation and economic activity have deviated somewhat during the summer from the Riksbank’s forecast in June”. The market is currently pricing in another 20bps of easing by the end of the year, taking the policy rate to 1.8%, which is broadly consistent with the June Monetary Policy report. We still see scope for some further EUR/SEK gains, given the SEK’s outperformance this year, but this may require some evidence of a weaker EUR against the USD as the SEK tends to act as a super-EUR in USD negative environments.

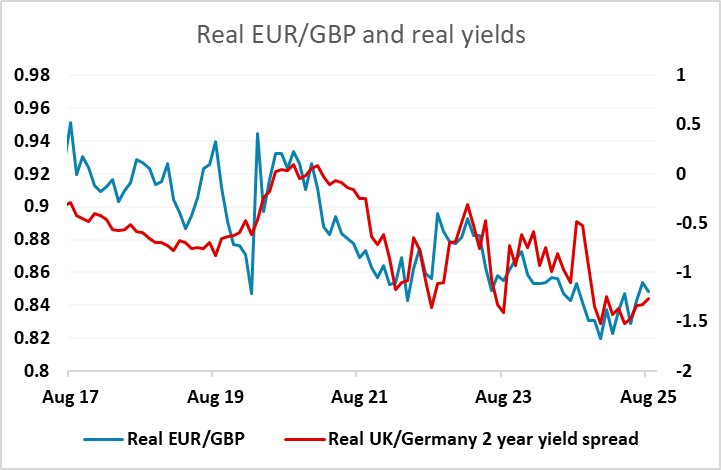

UK CPI came in higher than expected in July at 3.8% y/y both for the healdine and the core. This renewed upward pressure on GBP, but it will still be difficult for EUR/GBP to break below 0.86, as there is already very little easing priced into the UK curve, with less than 50bps expected by the end of 2026. The rise in CPI was due in large part to the strength of air fares, which is unlikely to persist, reducing the implications for policy. Also, the weaker equity markets overnight may reduce the attraction of GBP and the other riskier currencies, so we doubt that GBP will be strong enough for EUR/GBP to break convincingly below 0.86.

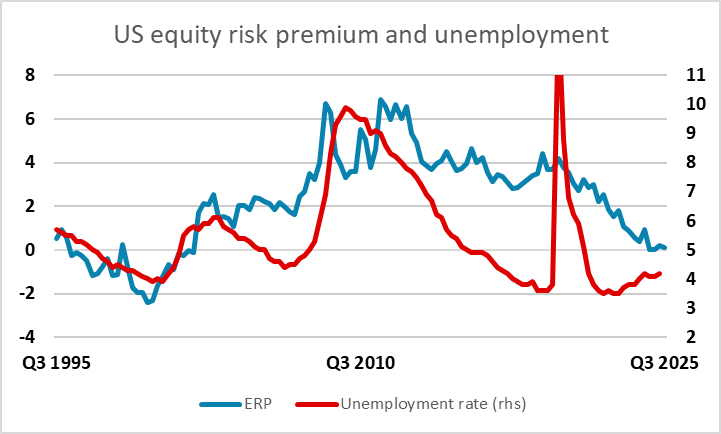

In general, FX markets remain largely rangebound, and it’s hard to see a breakout in either EUR/USD or USD/JPY without some clear economic news out of the US, or a surprise statement from Fed Chair Powell at Jackson Hole on Friday. Bigger picture we still see the high level of the US equity market as unsustainable, but evidence of weakness in the US labour market looks necessary to trigger a significant correction. If this were to come, the JPY would be the main beneficiary, with the USD possibly even holding its own against the riskier currencies. The US jobless claims data on Thursday relates to the employment report survey week, so has potential to have some impact.