CHF flows: EUR/CHF bounces on SNB comments

EUR/CHF back above opening levels after SNB chair Schlegel indicates potential for negative rates. But scope for CHF losses against the UR remains quite limited. CHF/JPY and CHF/NOK much more vulnerable

EUR/CHF has bounced back above opening levels as SNB chair Schlegel said the SNB were prepared to implement negative rates if needed. The policy rate is currently at 1% and the market is pricing around a 30% chance of a 50bp cut at the December 12 meeting. This looks too cautious in view of Schlegel’s comments, especially given that the market is pricing a 50% chance of a 50bp ECB rate cut on the same day. EUR/CHF remains at low levels just above 0.93, and if we do see aggressive action from the SNB, it has potential to rally further.

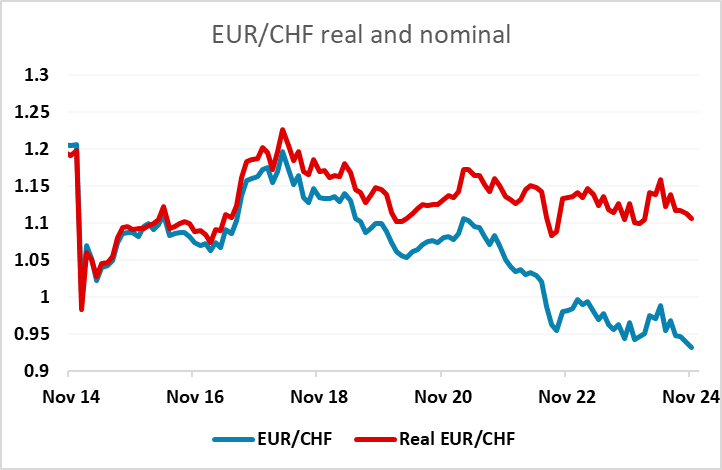

However, it should always be recognised that the CHF is much less strong in real terms than it is in nominal terms. The low level of Swiss inflation means that some of the appreciation we have seen is justified from a value perspective. The CHF has been strengthening since May in both real and nominal terms, and EUR/CHF today hit its lowest since the 2015 spike. But in real terms it remains broadly middle of the range since the 2015 revaluation. So while the SNB would prefer not to see further strength, largely because it puts more downward pressure on inflation which is already below target, we are not significantly out of line with historic values seen in the last 10 years. And while negative rates might sound scary, there has rarely been much CHF reaction to yield spreads with the EUR.

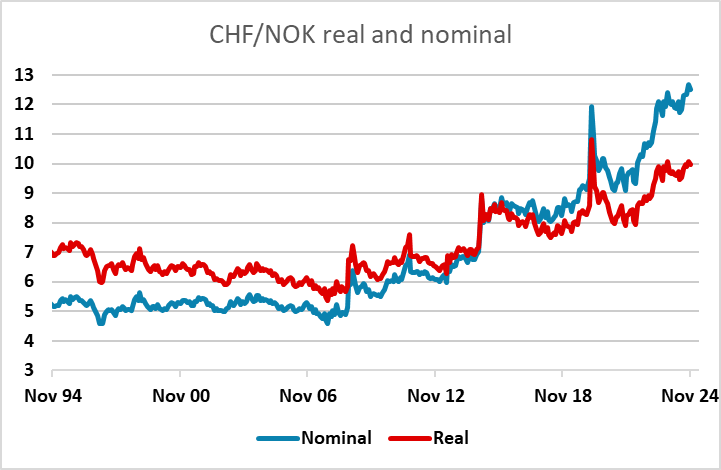

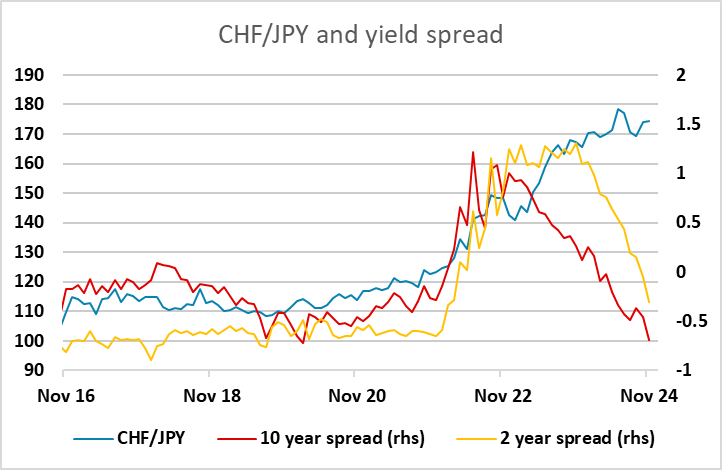

CHF bears should therefore probably look somewhere other than EUR/CHF. CHF/JPY is the most obvious value trade, as similar inflation rates mean that the nominal strength of the CHF against the JPY in the last few years has also been real strength. The CHF is more than 50% higher against the JPY in the last 4 years in both nominal and real terms. For those who take a more risk positive view, CHF/NOK may be the best alternative, given the NOK’s weakness in recent years and the potential for the NOK to retain some safe haven characteristics given Norway’s big current account surplus.