GBP, EUR flows: Weaker UK PMI triggers GBP decline

UK PMI dips, triggering GBP losses, but data is unreliable. Year's high in EUR/GBP at 0.8763 should hold

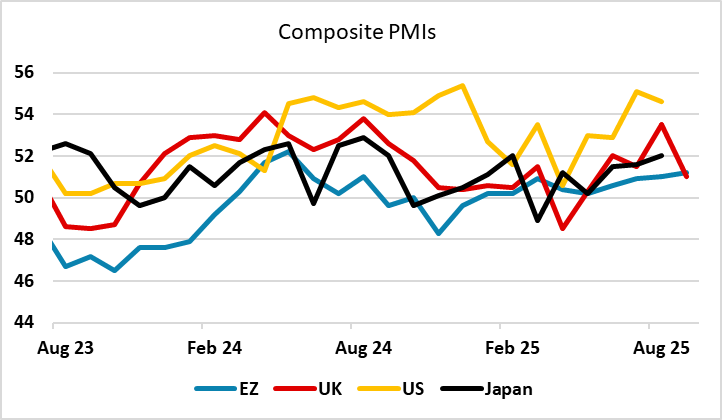

Weaker UK PMI has seen EUR/GBP gain 20 pips after trading lower for much of the morning. Eurozone PMI has come in broadly in line with consensus due to the strength of German services, but there are weak aspects. New orders failed to maintain the growth seen in August and were unchanged over the month. Employment was also kept unchanged as business confidence dipped to a four-month low. Meanwhile, inflationary pressures softened, with both input costs and output prices increasing at weaker rates at the end of the third quarter. Still, for now the decline in the UK PMI will be taken as GBP negative and the EUR will hold firm due to the marginal improvement in the headline EZ PMI index. The UK PMI is not a reliable indicator so we would not ascribe too much significance to the numbers, and the year’s high in EUR/GBP at 0.8763 from July should hold.