FX Weekly Strategy: Asia, February 5th-9th

USD/JPY may slip lower on consensus employment data

EUR/JPY vulnerable if equities slip

EUR/USD needs relative US equity weakness to make gains

GBP still vulnerable despite modest post-BoE recovery

Strategy for the week ahead

USD to hold firm after strong employment report

European yields to fall back to justify USD gains

JPY’s fortunes may key off labor cash earnings data on Tuesday

Still scope for NOK/SEK to rally

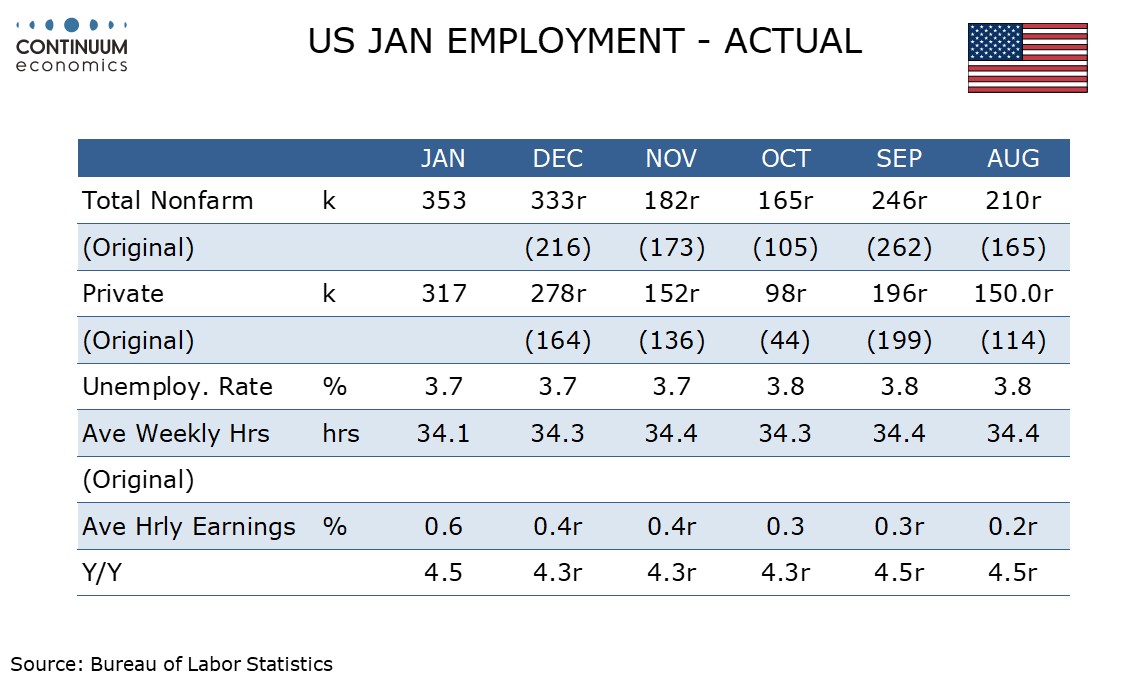

This week in the markets is likely to be less about this week’s events and more about the events of the last week, specifically the US employment report and the reaction to it. The employment report was unequivocally strong, with a much stronger non-farm payrolls rise in January plus significant upward revisions to previous months, while the average earnings rise of 0.6% m/m equaled the highest since May 2021. While it is possible that the rise in earnings was affected by the fall in the workweek, it’s hard to argue that the money market reaction was incorrect. Indeed, even with a near 20bp decline in 2 year US yields, there are still 5 25bp rate cuts priced in for the year, starting in May, taking the Fed funds rate down to 4%. Given the strength of the data, following on from a very strong H2 GDP performance, there must be potential for further declines in rate expectations. While Powell did indicate after the FOMC meeting that rate cuts are likely this year, they may not be on the scale that he market is pricing in. One factor that may moderate inflation concerns is the low unit labour cost data seen in the last two quarters, with productivity growth preventing earnings growth from feeding into costs. But the strength of the employment report nevertheless makes it very difficult to see any decline in US yields in the coming week.

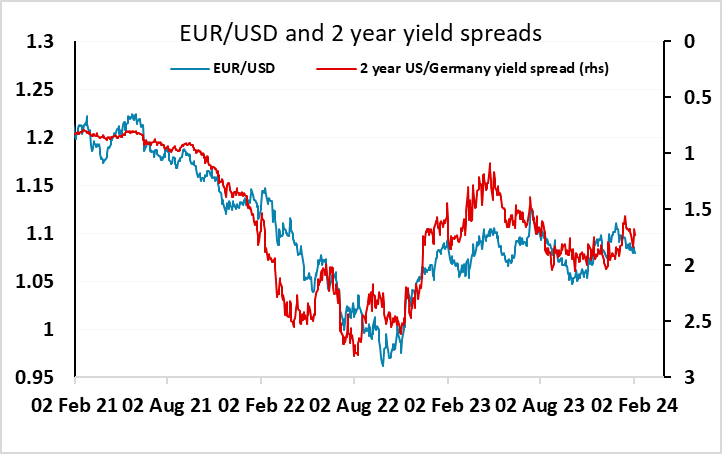

For FX markets, this suggests USD strength will be sustained this week, but it may not be extended. It was noticeable that European yields almost matched the rise in US yields seen after the employment data, there is nothing in the Eurozone or UK data that justifies the sort of increase in yields we have seen in the US. We consequently wouldn’t expect the rise in European yields to be sustained, and would expect some widening in spreads in favour of the USD in the coming week. However, this would only really justify the USD gains already seen, so we are only likely to see modest progress in EUR/USD below 1.08.

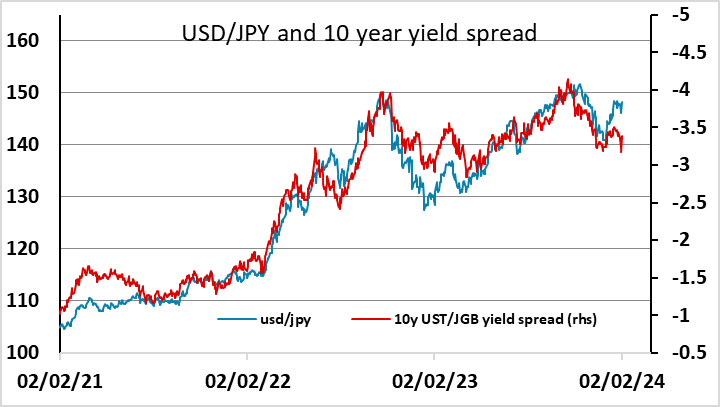

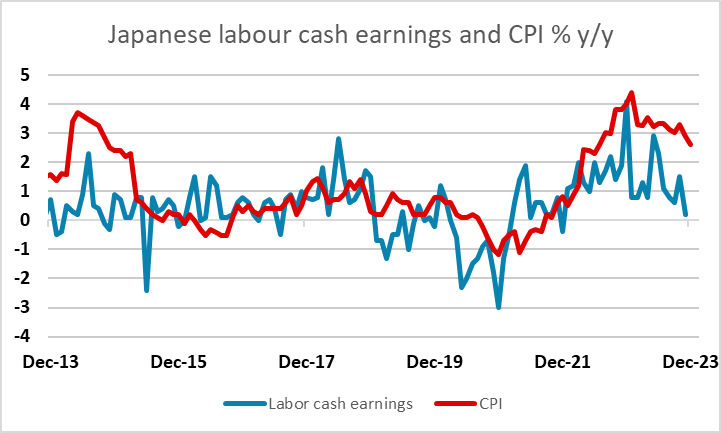

For USD/JPY, there was a big rise in yields spreads in favour of the USD on Friday, but this followed two days of sharp declines in spreads, so that the 10 year UST/JGB spread was only back to Tuesday’s level by COB on Friday. Furthermore, USD/JPY had not really followed yield spreads down earlier in the week, and was starting from a level that already looked a long way above that suggested by recent correlations. It is likely that JGB yields will rise a little on Monday in response to the rise in US and European yields on Friday, reducing the spread move a little. This week will also see important Japanese data in the form of labor cash earnings on Tuesday. The JPY has proved more sensitive to Japanese yield moves and Japanese policy this year than to the moves in spreads, and the weakness of the labor cash earnings data in November was a significant factor behind JPY weakness. We favour a stronger performance in December, and combined with the low JPY starting point relative to current spreads this suggests there is scope for some JPY recovery this week. But there may be more reason to look for JPY gains on the crosses than against the USD.

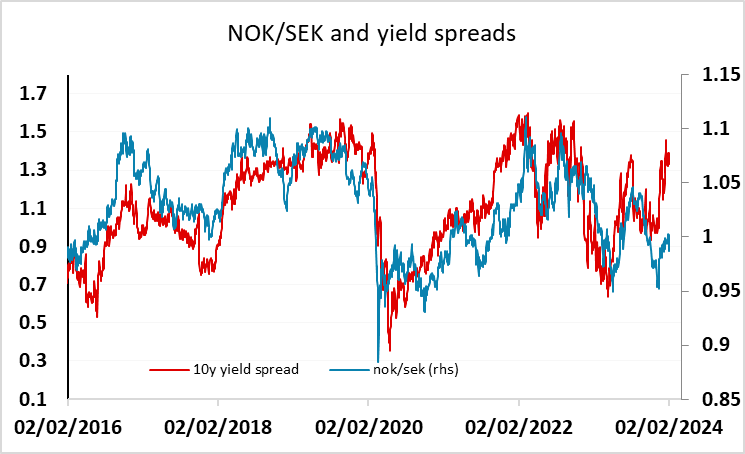

There is an RBA meeting this week, but it looks likely to be something of a non-event for the currency, with the AUD still likely to key very much off global equity market sentiment. Elsewhere, we still see scope for NOK/SEK to make progress above parity following the Riksbank meeting last week which showed a more dovish tone. Norwegian inflation data and comments from Riksbank council members this week could be triggers for such a move.

Data and events for the week ahead

USA

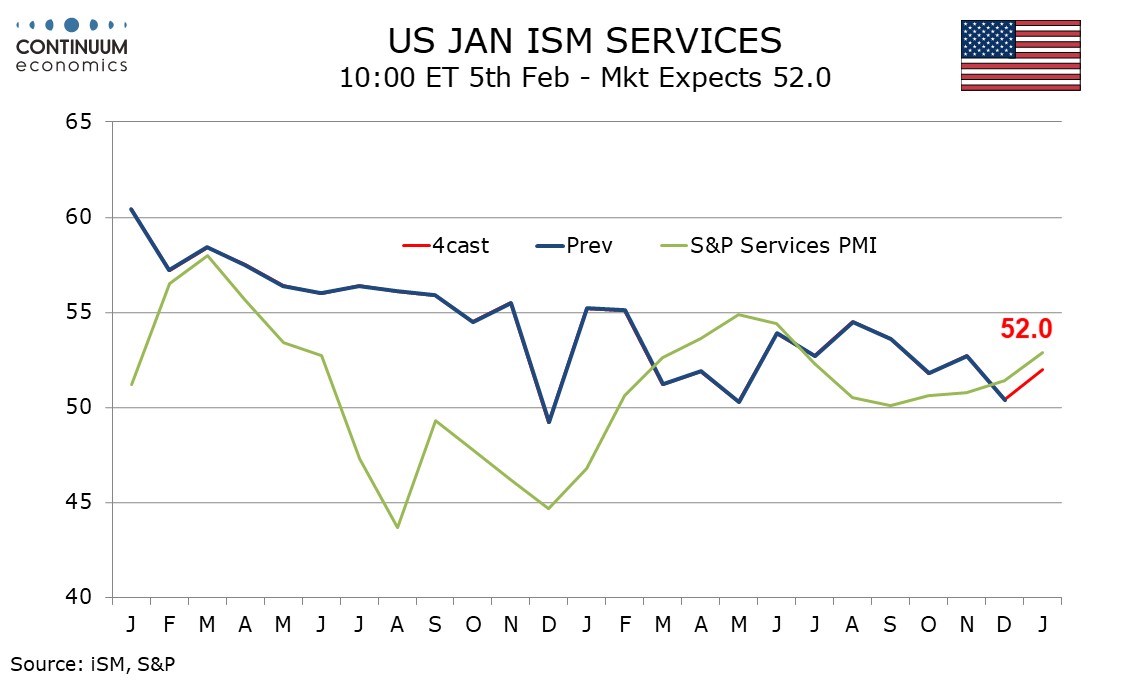

It is a quiet week for US data but Fed speakers are likely to be closely watched. On Monday we expect January’s ISM services index to rise to 52.0 from December’s weaker 50.6, while the Fed’s quarterly Senior Loan Officer Opinion Survey on bank lending will be closely watched. Fed’s Bostic is due to give opening remarks. Fed’s Mester speaks on Tuesday.

On Wednesday we expect December’s trade deficit to fall to a 4-month low of $60.8bn from $63.2bn. Fed’s Harker, Kugler and Barkin are due to speak. December consumer credit data is also due. Thursday sees weekly jobless claims and December wholesale trade released while Barkin will speak again. Friday’s calendar is quiet.

Canada

Canada sees December building permits and January’s Ivey PMI released on Tuesday, with December’s trade balance following on Wednesday. The key release of the week however is January employment in Friday.

UK

The obvious highlight this week is the array of BoE comments that will add to the message from this month’s MPC meeting. Thursday sees the MPC dove (Dhingra) vs (hawk) Mann) with both giving keynote speeches with recent recruit (Breeden) sharing her policy thoughts the day before. There will be final services PMI data on Monday, this coming just after the ONS publishes work that it has undertaken to improve labour market data, and will also publish LFS-based data from July to September 2022 up to the Sep-Nov 2023 data-point, with the full time series following on 13 February. Thursday also sees the RICS house market survey, this likely to highlight less downbeat signs, albeit as much to a shortage of homes for sales as from demand.

Eurozone

Data are less the focus this week, at least at the EZ level, although PPI numbers (Mon) may highlight an ever clearer disinflation backdrop while retail sales and the Construction PMI (both Tue) show more weakness, these both arriving on the same day as the ECB’s latest consumer expectations survey. ECB insights will come from the Bulletin and comments from Chief Economist Lane (Thu). But amid the recession-clad German economy, its data is taking on a higher profile. Tuesday may see more volatility in what has still been a very clear downtrend in manufacturing orders. The following day sees German industrial production numbers which may show the seventh successive m/m fall.

Rest of Western Europe

There are key events in Sweden, with the focus on the monthly private sector output and orders where a further correction back is seen. More insight into Riksbank thinking comes from a keynote speech from Governor Thedeen (Tue) followed by Riksbank minutes (Wed), both filling out the rationale behind this month’s decision to flag possible rate cuts in H1 this year. In Norway, CPI data should see the CPI-ATE measure down a further 0.2 ppt after the surprise drop to 5.5% seen in December, highlighting that the further downtrend was more broadly based.

Japan

The key labor cash earning on Tuesday, Feb 6. All eyes are on the wage data as BoJ openly suggest it to be the key metric in determining sustainable inflation. While the November headline data is disappointing, we expect the cash earning in resume the uptrend in December and inching closer to 2% in the coming months. A beat in this data will be market moving while a miss will be less so as the spring wage negotiation are the critical watch point. Elsewhere, it is mostly tier two data, PMI on Monday and a slate of release on Thursday.

Australia

We will have the RBA rate decision on Tuesday, Feb 6, which is forecasted to be a non-event as the Q4 CPI moderates more than expected, which will allow the RBA to hold rates steady but not enough to spike a cut yet. Looking for cues of changes in forward guidance would be the best bet if one seeks volatility. Yet, it is not our central forecast with CPI significantly above RBA’s target range. Trade Balance and Private Inflation Survey on Monday would also be interesting to see but unlikely to move the Aussie.

NZ

Employment data on Wednesday, Feb 7 and RBNZ inflation Expectation on Thursday, Feb 8 would be closely watched with the later grabbing more eyeballs.