FX Daily Strategy: Asia, February 3rd

RBA To Keep Rates Unchanged, Chance to Change Forward Guidance

The Disappointment Will Trigger Another Leg Lower for Aussie

As both headline and trimmed mean CPI stays above 3%, market participants have increased their anticipation of the RBA hiking rates with around 70% of a hike being priced in and almost fully priced in for the two coming meeting. We believe such is too aggressive after being scared by the strong CPI in Q3/4 2025. The message was clear from the RBA that the easing cycle has ended but it does not mean we will be entering the tightening cycle again. Instead, we will likely be seeing choppy rate changes to end the previous easing cycle.

Our baseline scenario see the RBA to keep rates unchanged in their February meeting. Despite recent uptick in CPI has sway market participant's anticipation of a hike from the RBA, we do not see the urgency of changing rates. The uptick in inflation still needs time to prove whether transitory factors and base effect have boosted the number and how much is left to be sticky. The RBA's forecast expects CPI to be above target range in 2026 and should signal their elasticity in seeing inflation to be above target range briefly. If there is a change in their forecast, we will likely first see a change in forward guidance in the February meeting, before expecting rate change next.

If the RBA only change forward guidance or even there is no change in guidance, it will be a huge disappointment for hawkish market participants as there are seeing a good chance for a hike in the two coming meetings. It will likely trigger another leg lower in the Aussie for AUD/USD has already been beaten in the first day of the week. Dragged by poor sentiment and the sharp correction in metals, the Aussie has lost the wind in its sails compared to early January and could see further correction by another figure before meeting support.

On the chart, the pair is lower at the opening to reach .6920 low before turning higher as prices consolidate losses from the .7094 high. Daily studies are unwinding overbought readings and suggest room for deeper corrective pullback to retrace recent strong gains from the .6660, early-January lows. Break of support at the .6942/.6900, 2024 year high and gap area, will open up room for deeper pullback to .6850/.6800 support. Meanwhile, resistance is lowered to the .7000 level which is now expected to cap and sustain pullback from the .7094 high.

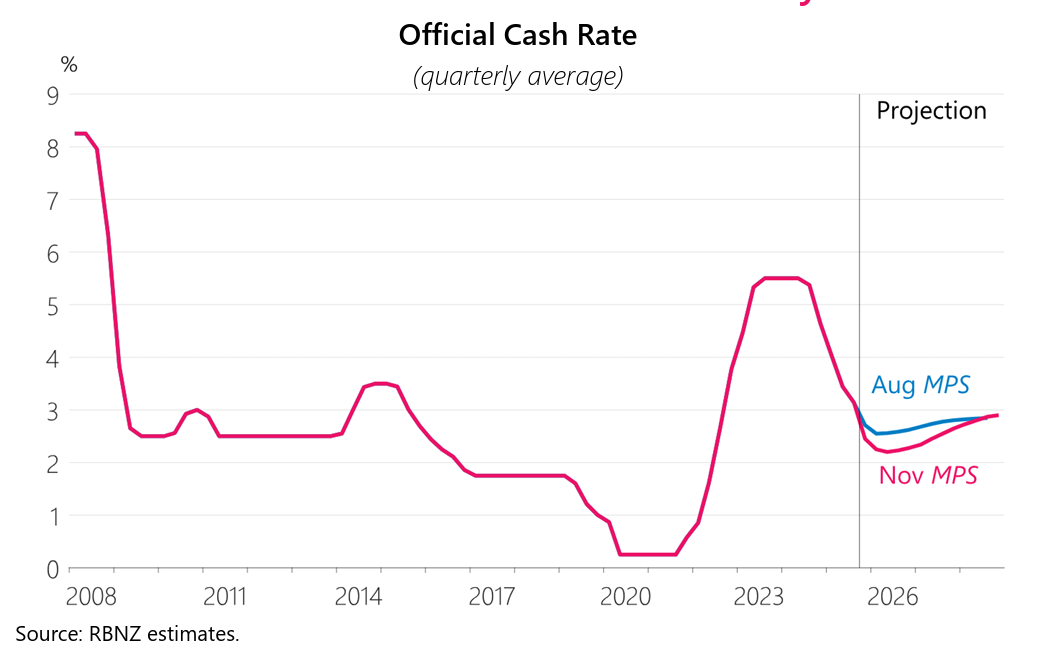

The Q4 Labor data will be released for NZ in late New York session. With little expectation to see a significant hawkish/dovish surprise, the data should not have a sustainable impact towards the Kiwi. Afterall, the RBNZ OCR forecast is seeing no more rate cut from the current 2.25% and first rate hike in late 2026. CPI is also downplayed by attributing the spike in inflation to "higher tradables inflation along with high inflation in household energy costs and local council rates", factors that are deemed to ease in 2026. Their forecast see inflation to moderate towards the mid point of target range in 2026.