FX Daily Strategy: Asia, September 12th

ECB the main focus with 25bp cut expected

Little forward guidance likely but EUR may be biased higher

EUR/JPY approaching short term fair value

SEK vulnerable with further inflation dip seen

ECB the main focus with 25bp cut expected

Little forward guidance likely but EUR may be biased higher

EUR/JPY approaching short term fair value

SEK vulnerable with further inflation dip seen

The ECB meeting will be the main focus for Thursday. That the ECB will cuts official rates again is near enough certain. Even the hawks on the Council are willing to concede that the discount rate can (and maybe even should) fall another 25 bp (to 3.5%). This will come alongside larger reductions to the two other policy rates thereby fulfilling a shift in the Eurosystem’s operational framework that was laid out six months ago. But markets will be more interested in what is said, aware too that the ECB is likely to adhere to its data dependent guidance, with nothing like any firm pointer to the speed and/or timing of further moves. However, there may be some more reassuring comments on wage and price pressures and a continued below target inflation outlook from late 2005 onwards. But even though the (what we think is an optimistic) GDP outlook may be revised higher on the basis of the marked fall in market rates in the last three months, the debate may be about the extent to which downside risks have grown of late, as is evident in somewhat weaker business survey data.

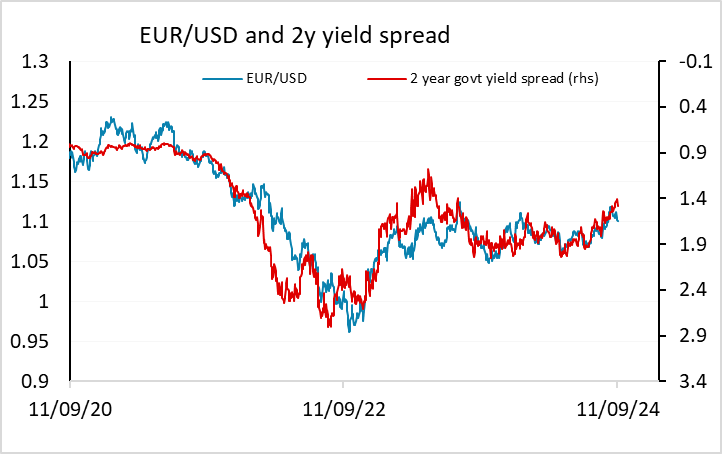

As it stands, the market is fully priced for a 25bp cut this time around, but is priced for a further 40bps of cuts by the end of the year, with around a 40% chance of a further cut seen at the October meeting. With the ECB unlikely to give any clear guidance, pricing will probably stay this way, but if anything the risks is that he market will start to price out the chance of an October cut if there is no hint of further near term action. This suggests the risks for the EUR are slightly on the upside, especially since EUR/USD looks a little cheap relative to current short term yield spreads. The same can be said for EUR/GBP. Elsewhere, while EUR/CHF looks a little cheap on a 0.93 handle a recovery looks dependent on a more positive risk tone emerging after the central bank meetings of the next couple of weeks.

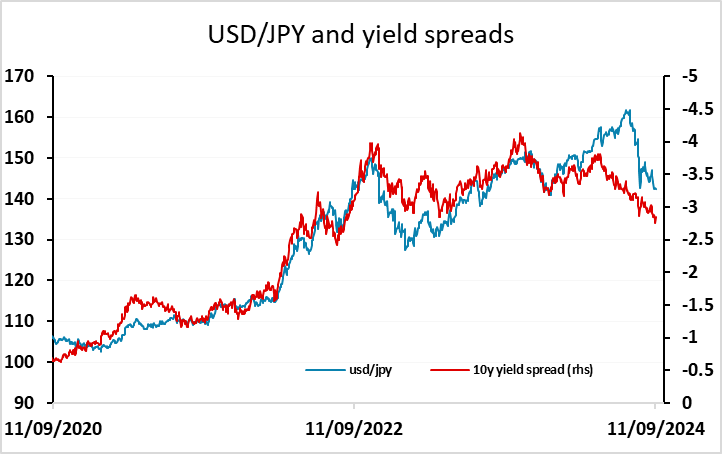

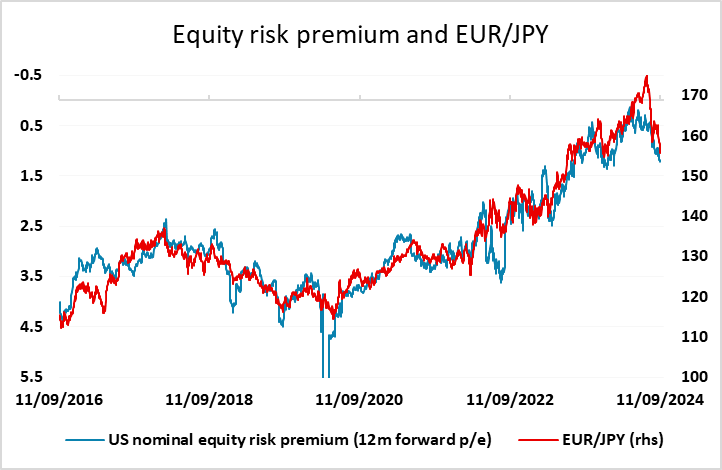

The risk picture soured somewhat after the US CPI data on Wednesday with the core number coming in stronger than expected. A 50bp Fed cut is now seen as less than a 20% chance, and the higher level of US yields weighted on equities. Even so, most of the strength in CPI was in shelter, which many see as lagging other price increases, and we don’t see the slightly higher August data as being likely to prevent the Fed from easing broadly in line with current market pricing. The decline in equities and rise in bond yields left the equity risk premium not much changed, but softer equities nevertheless helped ensure that the JPY was the best performer on the day, recovering initial losses against the USD after the data. We would not that EUR/JPY has tended to move with equity risk premia and the latest decline has now taken it to a level that is broadly consistent with the correlation seen in recent years. Both the EUR and the JPY still look a little cheap against the USD based on the correlation with nominal yield spreads, but the main move in EUR/JPY may now be done unless we see a more significant decline in equities. Having said this, there is still scope for major JPY gains if the market starts to consider the significant real devaluation of the JPY in recent years, rather than focusing on nominal correlations, but this may be a longer term story that will have to wait for a bigger downswing in risk sentiment.

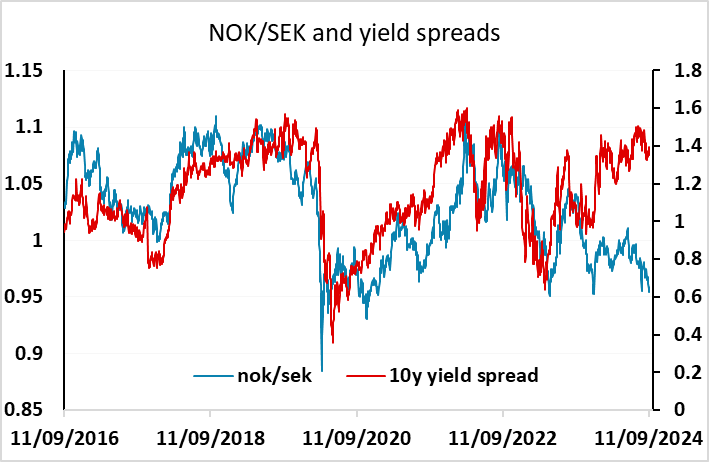

The ECB aside, Swedish CPI is the other main calendar item, with the market consensus looking for a further significant decline in inflation to 2.1% y/y headline and 1.3% y/y core. A Riksbank easing at the September 24 meeting already looks a near certainty, and the market is already priced for a little more than three 25bp cuts in the three meetings this year. In practice, we doubt that we will see more than this, but soft inflation numbers should ensure that the market maintains this expectation. The SEK already looks a little rich here given this policy outlook, both against the EUR and particularly against the NOK, and the risks for the SEK should consequently be on the downside.