Preview: Due September 5 - U.S. August ADP Employment - Momentum slowing but not sharply

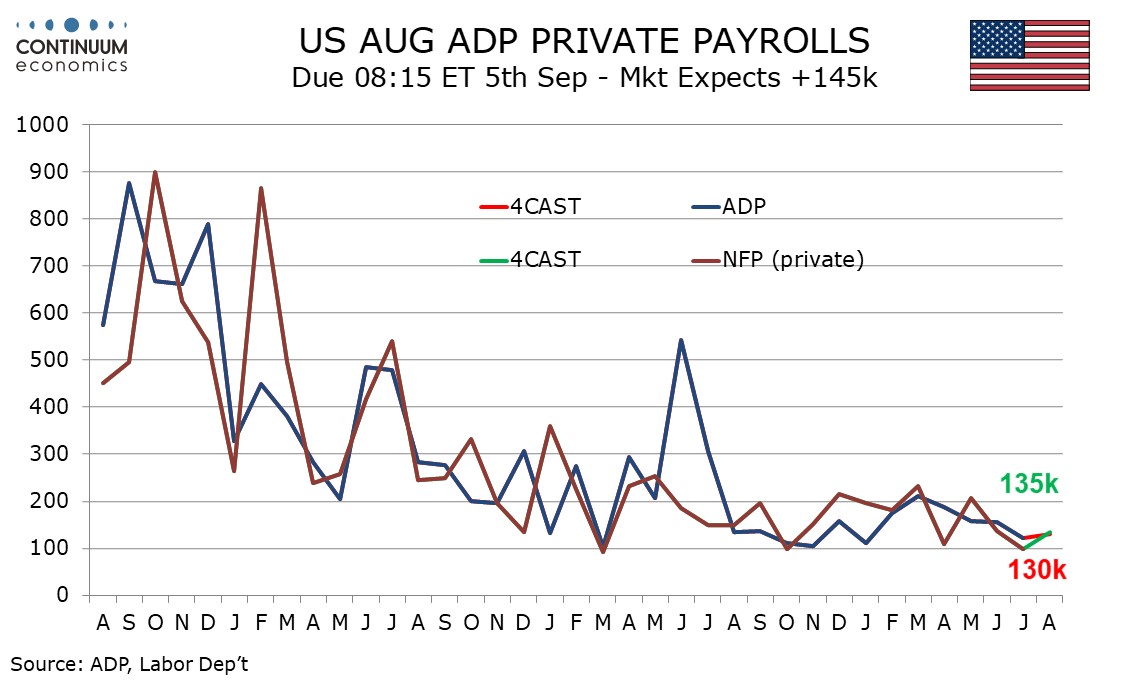

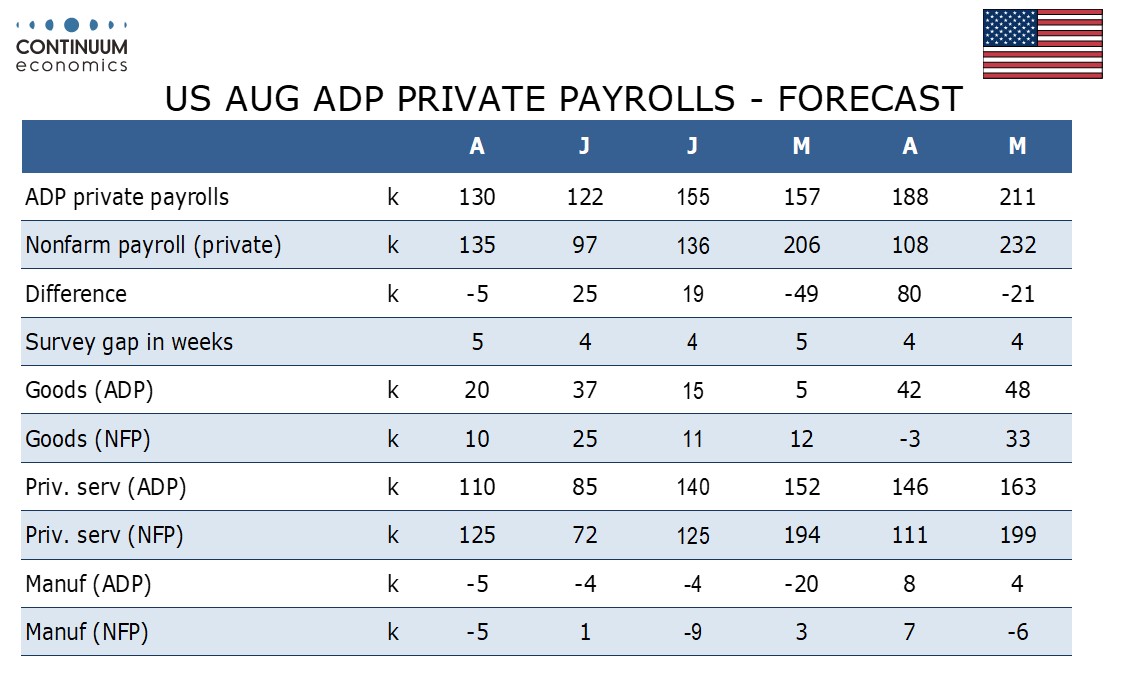

We expect a 130k increase in August’s ADP estimate for private sector employment growth, slightly below the 135k we expect for private sector non-farm payrolls. The two series have become more consistent with each other in recent months. We expect overall non-farm payrolls to rise by 160k. Trend in both ADP and non-farm payroll data appears to be losing momentum, but not sharply.

We are forecasting a modest ADP underperformance in August after two straight modest outperformances, of 19k in June and 25k in July. July’s ADP outperformance may reflect non-farm payrolls being mote sensitive to bad weather than the ADP report.

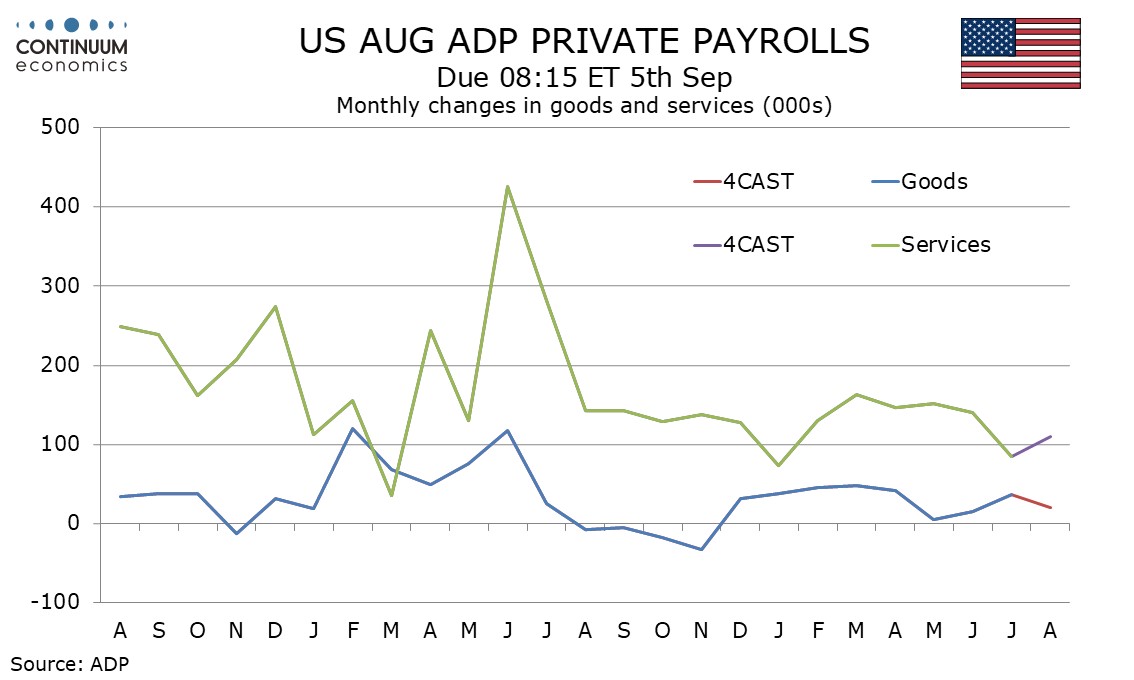

July’s ADP data was less consistent with July’s non-farm payroll in its detail, with most of the growth coming from a 61k rise in trade, transport and utilities and a 39k rise in construction. Education and health with a rise of 22k and leisure and hospitality with a rise of 24k were both below trend.

Overall July ADP data saw an acceleration in goods and a slowing in services. We expect August to see slower gains from goods but stronger growth in services, even with a likely slowing in trade, transport and utilities.