FX Daily Strategy: Asia, January 9th

Norway CPI could reignite rate hike fears

NOK/SEK upside favoured with Swedish GDP likely to fall back

EUR/USD unimpressed by firm EUR yields

JPY needs to see a rise in risk premia to make gains on the crosses.

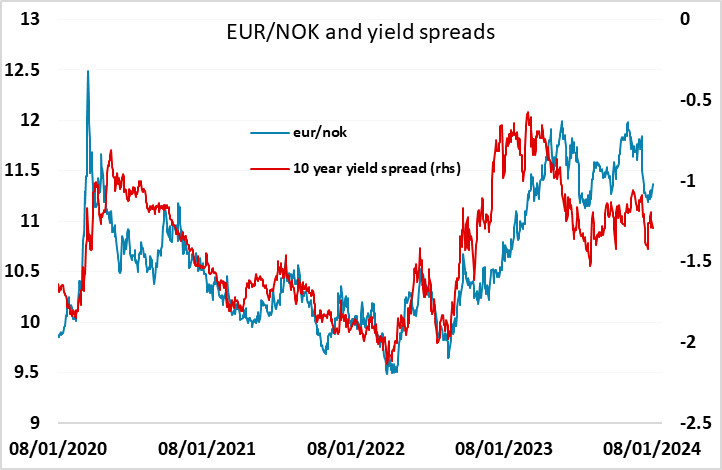

Norway CPI could reignite rate hike fears

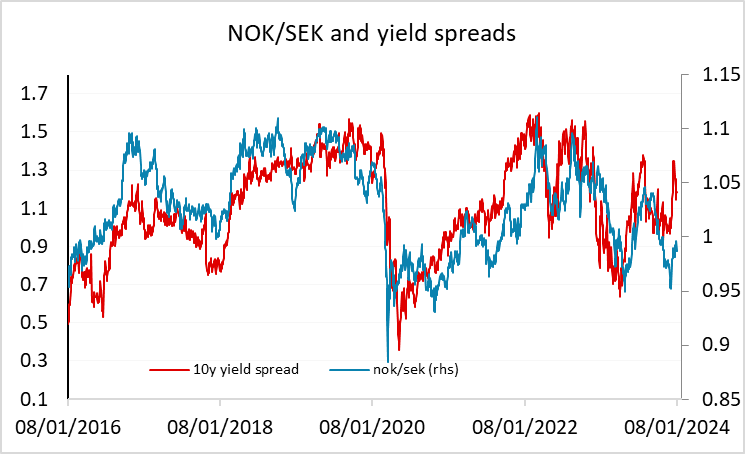

NOK/SEK upside favoured with Swedish GDP likely to fall back

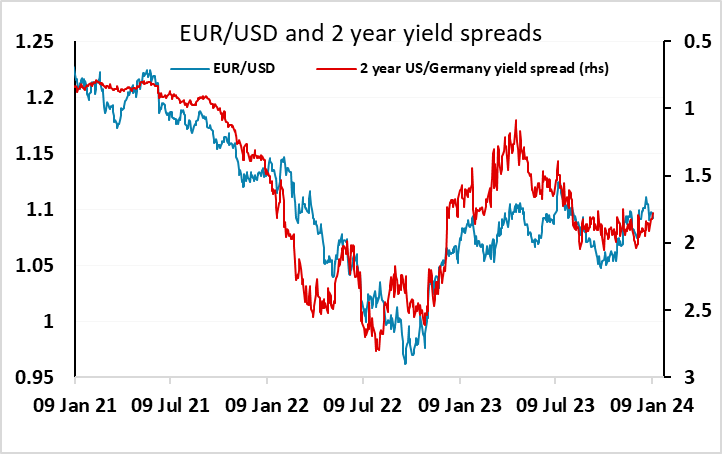

EUR/USD unimpressed by firm EUR yields

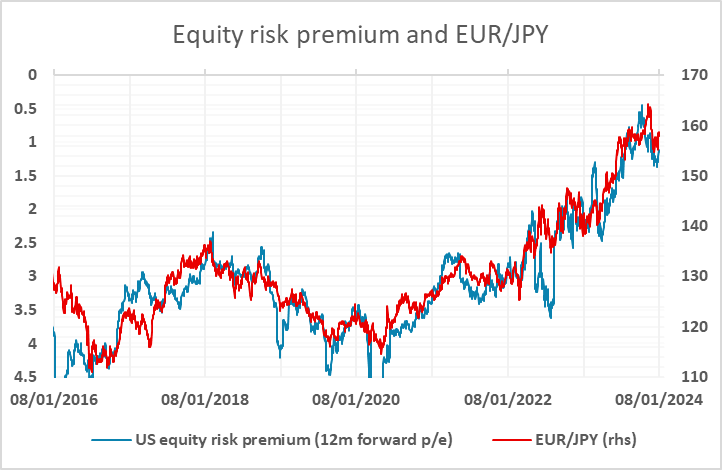

JPY needs to see a rise in risk premia to make gains on the crosses.

Monday kicks off with potentially significant Scandinavian data, with December CPI in Norway, and November GDP, production, orders and confidence data in Sweden. The Norwegian CPI data will have more potential to have an immediate impact, as there is a Norges Bank meeting later this month and the December Monetary Policy Report (MPR) indicated the likelihood that the policy rate would rise in Q1 to 4.5%, after the slightly surprising decision to leave it unchanged at 4.25% in December. The MPR indicates an expected average core inflation rate of 5.8% in Q4, which would be consistent with the market consensus of 5.6% in December. As it stands, the market is not inclined to believe the Norges Bank projection of a further rate hike, with most forecasters seeing 4.25% as a peak. If it does come, it is generally seen as more likely to be with the next MPR in March. But a significantly higher than expected December CPI could change market expectations. EUR/NOK still looks a little high relative to the historic yield spread correlation, so the risks are weighted to the downside.

The case for NOK gains is more clear-cut against the SEK, with the yield spread correlation in NOK/SEK rather more consistent. There is a lot of Swedish data due on Wednesday, but the monthly November GDP data will probably attract the most attention. There was a surprise bounce in October, but the data looked unreliable with the production and use measures of GDP giving substantially different results. November is likely to reverse much or all of the October rise, unless, as is quite possible, the October numbers see a substantial revision. NOK/SEK risks should be n the upside.

There isn’t a lot else on the calendar, and the market focus is shifting towards the US CPI data on Thursday. The USD showed a slightly firmer tone on Tuesday, with EUR/USD pressing towards the bottom end of the recent 1.09-1.10 range, even though EUR yields remained firm and suggested some upside risks. This was in spite of significantly weak German production data on Tuesday, which followed weak orders data on Monday. Admittedly, the Eurozone unemployment numbers were more encouraging, showing a decline in the rate, but we find it hard to trust the firm tone to EUR yields, and would not expect a significant bounce above 1.0950 in EUR/USD.

The JPY managed to make some modest gains on the crosses through Tuesday, but these came more because of soft risk sentiment than any move in yield spreads. Certainly, equity risk premia have been a more reliable guide to EUR/JPY in recent years than the yield spread, with the yield spread clearly suggesting downside risks. However, a significant rise in risk premia may be needed for the JPY to manage gains on the crosses.