FX Weekly Strategy: January 12th-16th

USD strength looking extreme against the JPY…

…but intervention likely to be needed to turn it

USD gains against the EUR could extend further

GBP vulnerable, NOK undervalued

Strategy for the week ahead

USD strength looking extreme against the JPY…

…but intervention likely to be needed to turn it

USD gains against the EUR could extend further

GBP vulnerable, NOK undervalued

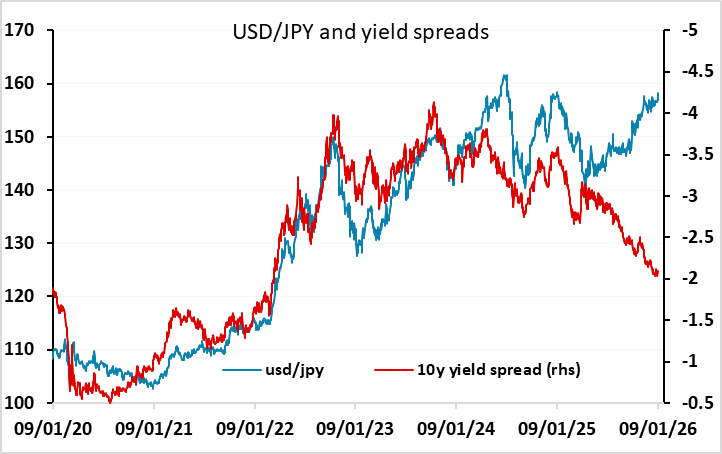

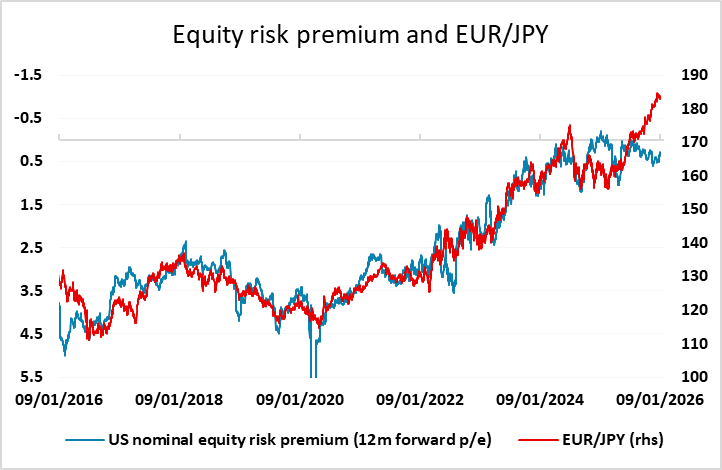

The USD was strong through the last week, gaining ground following the employment report even though it was on the weak side of consensus. Gains were most pronounced against the JPY, helped by reports that PM Takaichi is planning to call a snap Lower House election in February. Of course, while this news item seems to have helped to accelerate USD gains against the JPY, it doesn’t provide any obvious rationale for JPY weakness. It is unclear what difference such an election would make to policy, and even if it did make a difference, the JPY’s weakness over the last eight months shows that higher Japanese yields have in any case failed to prevent JPY weakness. We continue to see the JPY’s decline in recent months as primarily a momentum trade, unsupported by movements in yields or expectations of policy – indeed, moving in opposition to the normal policy drivers.

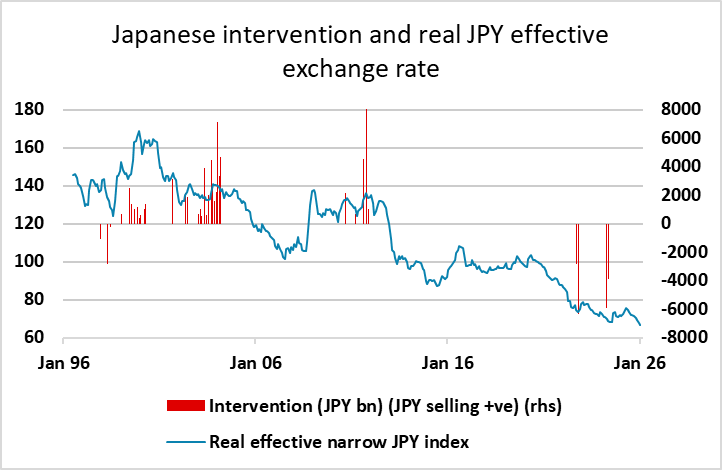

If the Japanese authorities want to halt the trend, we continue to think they will need to do so via physical intervention. Conditions look ripe for such action, with the JPY having weakened to all time lows in real terms, and speculative positioning now no longer long JPY according to the CFTC data. With the market appearing to be driven by momentum and speculation rather than fundamentals, intervention would be appropriate. Whether there is the appetite for such action in the Takaichi administration remains unclear, as up to now they have shied away from physical action with all the intervention being verbal. But in a momentum driven market where JPY bears have not been deterred by narrowing yield spreads or rising risk premia, it is hard to see why the trend would turn without intervention.

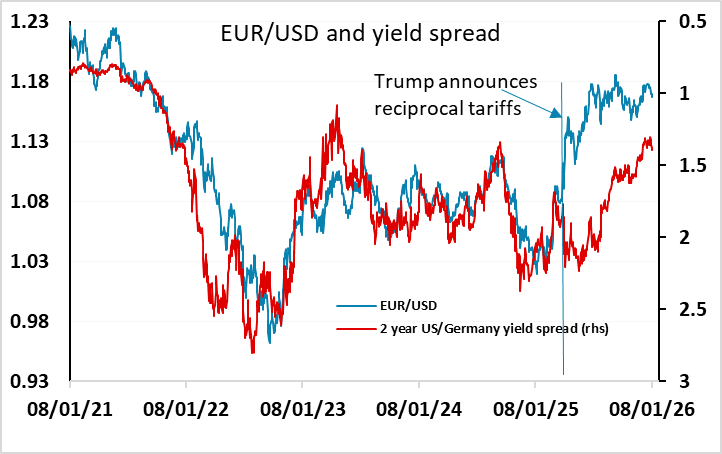

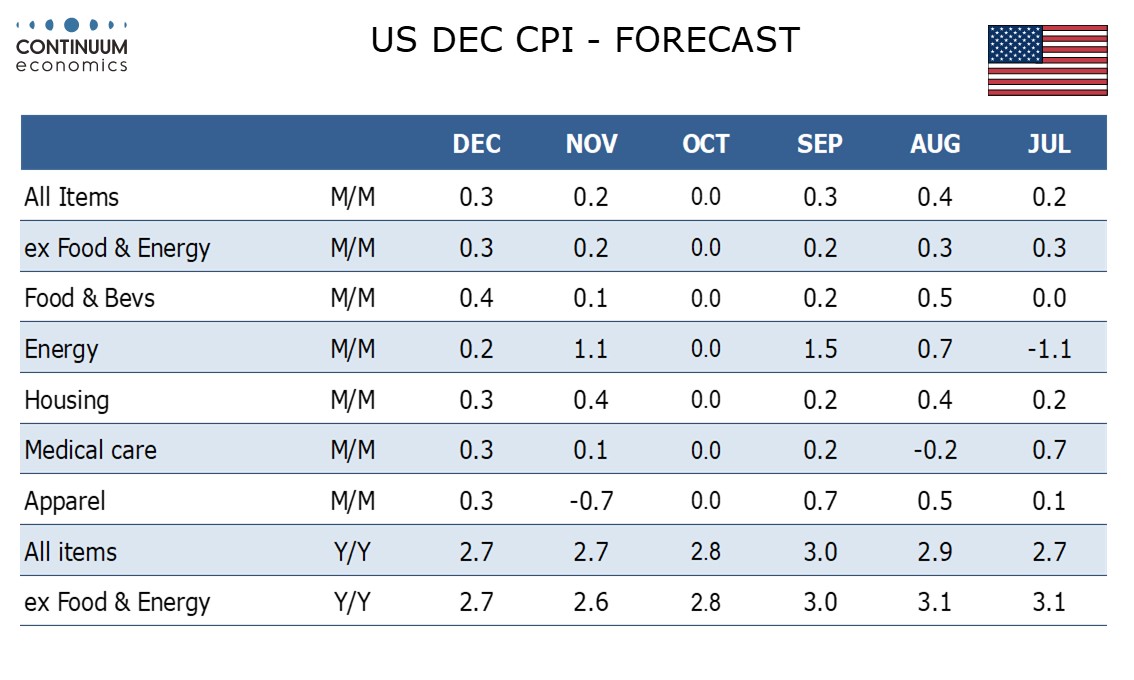

While the JPY saw the most significant declines following the employment report, the USD also managed gains across the board. EUR/USD had a strong 2025, but looks to have topped out above 1.18 and is now threatening support at the 1.16 level. Unlike the JPY, which hugely underperformed its historic relationship with yield spreads in 2025, the EUR outperformed but is now slipping back towards the levels consistent with the historic correlation. There could still be further to go, especially if the US CPI data this week sees what we expect will be a significant bounce from the weak November numbers. There may also be some news on tariffs to deal with, with the Supreme Court expected to deem some of the trump tariff measures as illegal. While this might not have much longer term impact, it could cause some volatility. Since the USD weakened on the initial tariff announcement, it may strengthen if the tariffs are deemed illegal, even if, as we expect, this will make little actual difference given the subsequent trade deals that have been made with the US’s major trading partners.

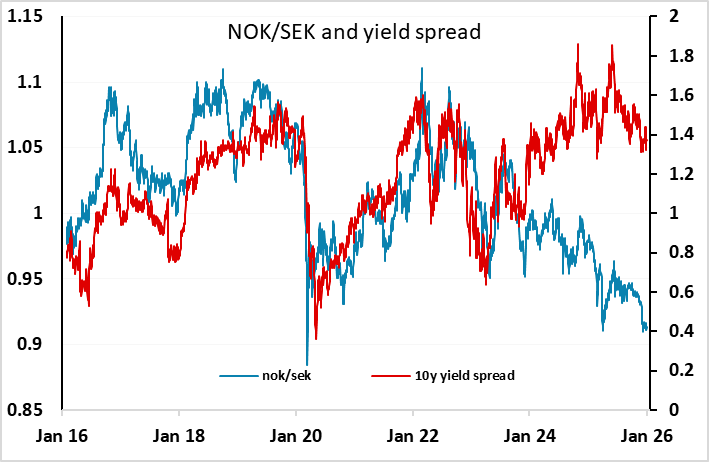

Elsewhere, we see GBP as being vulnerable at current levels having hit and reversed from 3 month highs against the USD and EUR and 17 year highs(!) against the JPY. There is November GDP data out of the UK which seems likely to confirm the sluggishness of growth, and w continue to find it hard to justify GBP strength from here. We also see scope for a NOK recovery, with valuation looking extremely low given the solid economy, relatively tight policy and huge Norwegian current account and budget surpluses, the persistent NOK selling from the government pension fund notwithstanding.

Data and events for the week ahead

USA

The highlight of the US calendar is December CPI on Tuesday, where we expect gains of 0.3% both overall and ex food and energy, to follow November data that was probably misleadingly low. February also sees December’s NFIB survey on small business optimism, December’s budget. New home sales for both September, which we see at 700k, and October, which we see at 750k, are due, which would both be down from a surprisingly strong 800k in August.

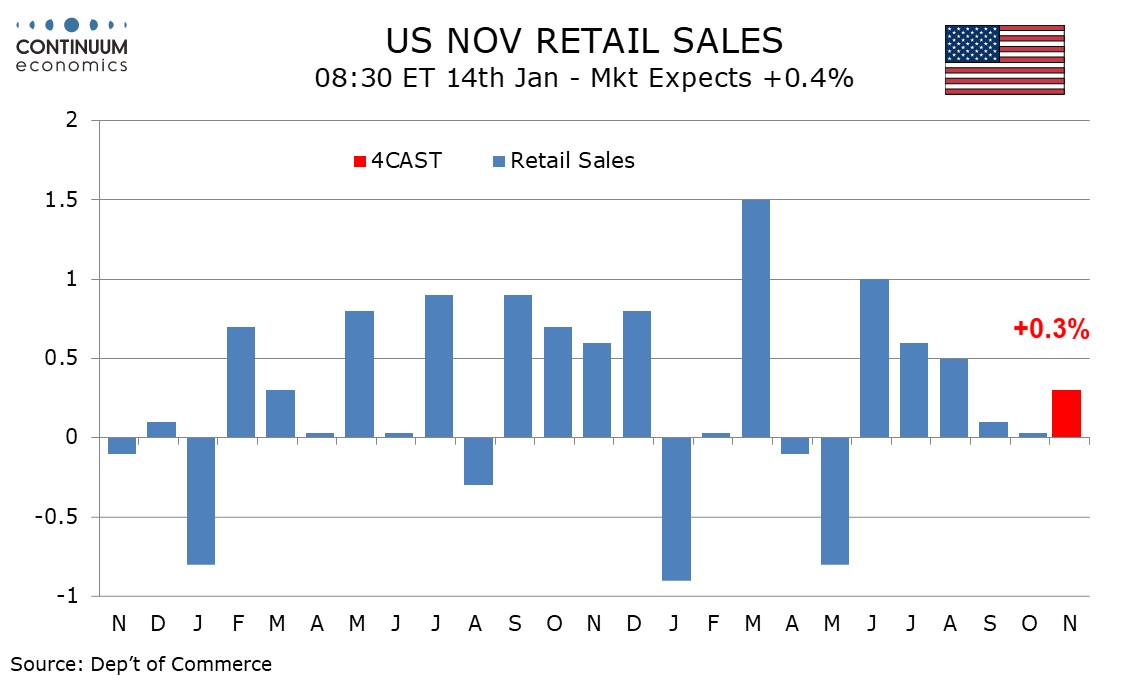

On Wednesday we expect a modest 0.3% rise in November retail sales, with gains of 0.2% ex auto and 0.1% ex auto and gasoline. October and November PPI will both be released. We expect October to rise by 0.1%, with a 0.3% increase ex food and energy, and November to rise by 0.3%, with a 0.2% increase ex food and energy. Q3’s current account is also due. December existing home sales follow, which we expect to rise by 2.9% to 4.25m. October business inventories are due at the same time.

Initial claims on Thursday are less at risk of holiday seasonal adjustment problems than were the last two releases. Also due on Thursday are January Empire State and Philly Fed manufacturing surveys, and November import prices. Friday sees December industrial production and January’s NAHB homebuilders’ survey.

The week sees plenty of Fed speakers. Bostic, Barkin and Williams are due on Monday, while Tuesday sees Musalem and Barkin again. Paulson, Miran, Kashkari, Bostic again and Williams are due on Wednesday. Bostic and Barkin both speak again on Thursday, and Jefferson follows on Friday.

Canada

Canada releases December existing home sales on Thursday and December housing starts on Friday. Thursday also sees November manufacturing and wholesale sales, for which preliminary estimates were respectively a decline of 1.1% and an increase of 0.1%.

UK

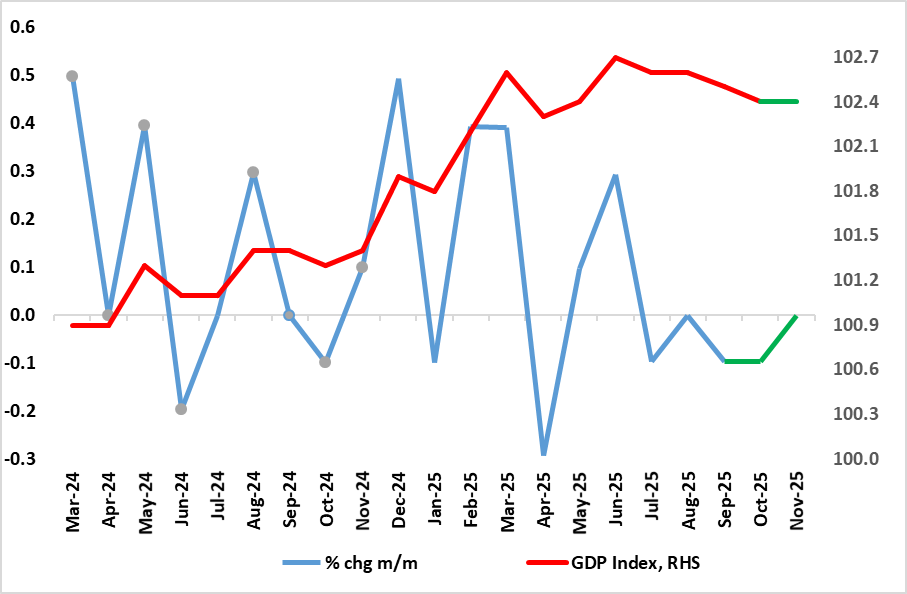

Coming alongside visible trade and production numbers, Thursday sees November GDP figures. As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months of data and where we see no improvement in November numbers with a flat m/m outcome envisaged. Admittedly, a further recovery from a cyber-attack at JLR vehicle manufacturing does provide modest upside risks, but these are offset by wet and warm weather swings, which, alongside pre-budget nerves, seemingly accounted for the already-reported soft November retail sales figure.

GDP Growth Ebbing, If Not Negative?

Source: ONS, CE

Thursday also sees the latest BoE Credit Condition survey which will offer insight into both demand and supply, with possibly weakness in the housing market being the key feature. The day before sees speeches from two MPC doves, Taylor and Ramsden. But earlier in the week will see some initial insight into Xmas consumer spending with the BRC sales survey (Tue).

Eurozone

Visible trade and industrial production numbers (both Thu) will offer little insight, but he ECB Bulletin may highlight some of the keener issues on Council’s radar. The main figure is 2025 GDP data from Germany where we see a 0.3% calendar adjusted result that would imply a Q4 outcome of between zero and 0.3% but where we see a 0.1% result. It may slow show a budget gap having risen to 3% of GDP last year!

Rest of Western Europe

Switzerland sees what may be more weak consumer confidence numbers (Mon). Sweden had detailed CPI figures (Thu) likely to suggest that food was the main factor behind the surprising soft preliminary numbers.

Japan

Clear calendar for Japan next week. Beginning with PPI on Monday, then it is tier two data all the way throughout the week.

Australia

The critical release for Australia will be labor data on Thursday. The headline employment change has been choppy for the past quarters and will likely stay that way. Yet, the Australian labor market is still solid and healthy. We suspect any major misses will be downplayed. However, hawkish surprise may embolden market participants speculation of a potential rate hike from the RBA, though we don’t see that happening anytime soon. On the same day, there is also consumer inflation expectation. There is also private inflation survey on Monday and business confidence on Tuesday.

NZ

We have business confidence on late Monday, building permit on late Tuesday and Business PMI & Food price index on late Thursday. None should be moving market.