FX Daily Strategy: Asia, May 3rd

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

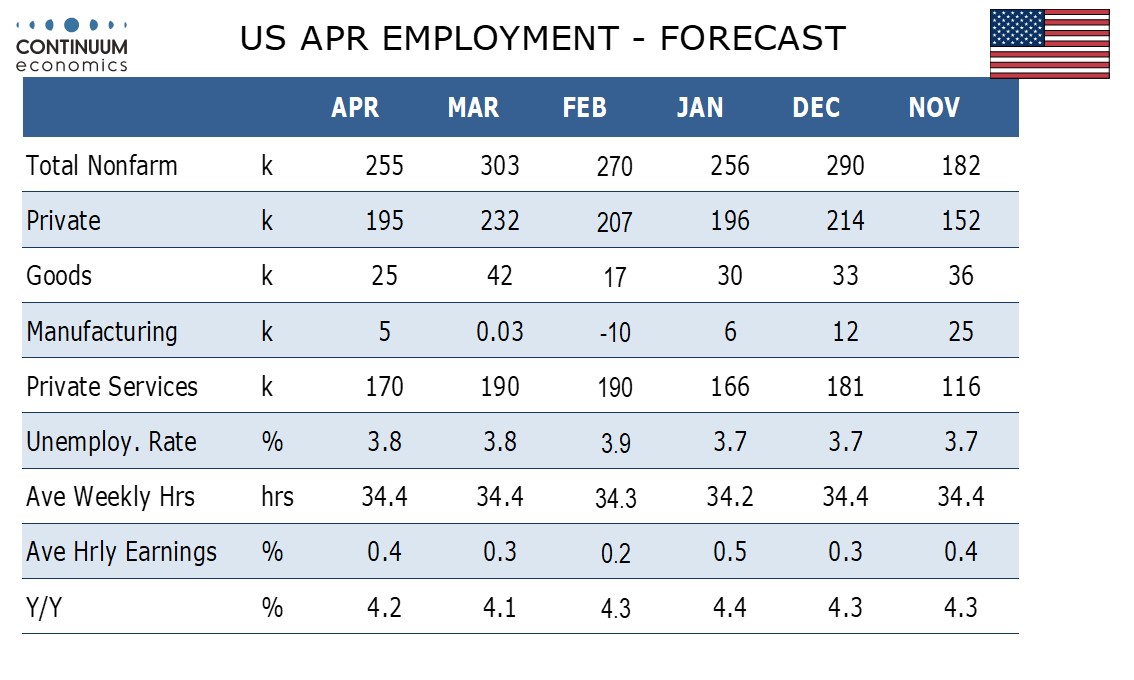

Friday will be dominated by the US employment report, although ISM services will play a supporting role. We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in California. The main difference from the consensus is the 0.4% rise in earnings, with the market median at 0.3%. Our numbers look likely to be USD supportive.

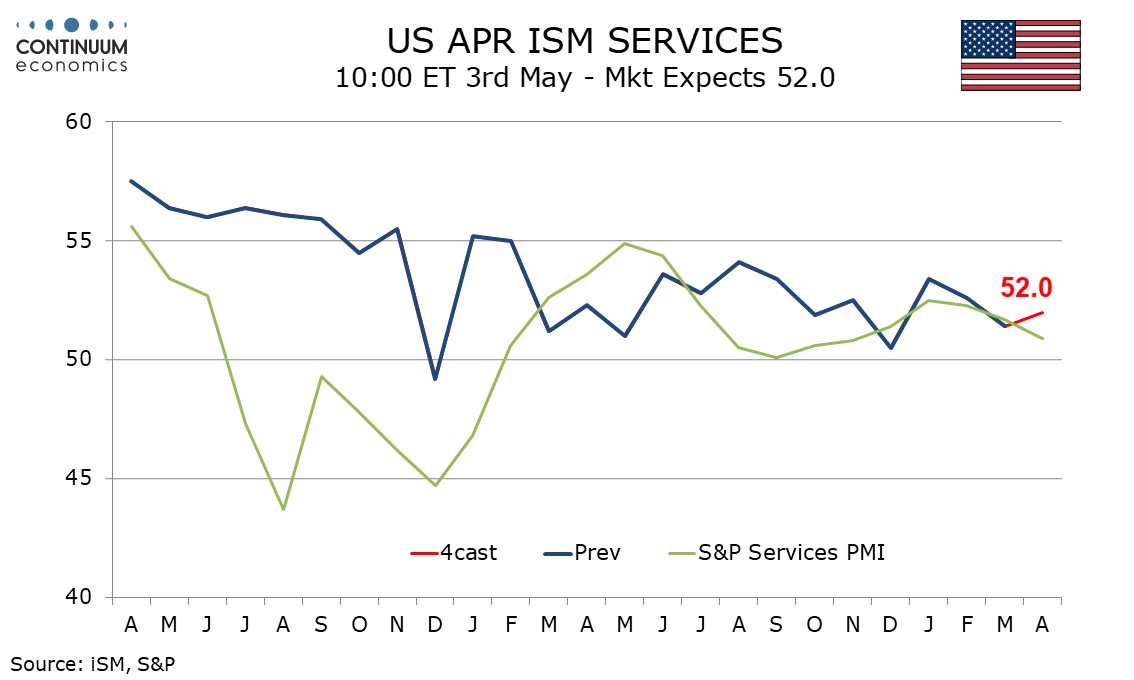

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion. Our forecast is in line with market consensus, and should dispel some of the concerns related to the decline in the S&P services PMI. Coming after the employment report the data will be of lower importance, but weak data in line with the softer S&P number might reverse any impac of a strong employment number.

Thursday was a day of clear JPY strength. The BoJ intervention in Wellington looks to have convinced the market that they are serious and aren’t going to allow the JPY to stay at these exceptionally weak levels. The JPY strengthened through European and US sessions as well as gaining in direct response to the BoJ intervention in Asian time. The US session saw particular weakness in EUR/JPY and other JPY crosses, suggesting a widespread squeeze on JPY short positions. Nevertheless, both USD/JPY and EUR/JPY held above the lows seen in NZ time, and if these lows hold into Friday and there is no further BoJ action, we may see some consolidation in the new range of 153-158 going forward. Bigger picture, we still see scope for substantial JPY strength.

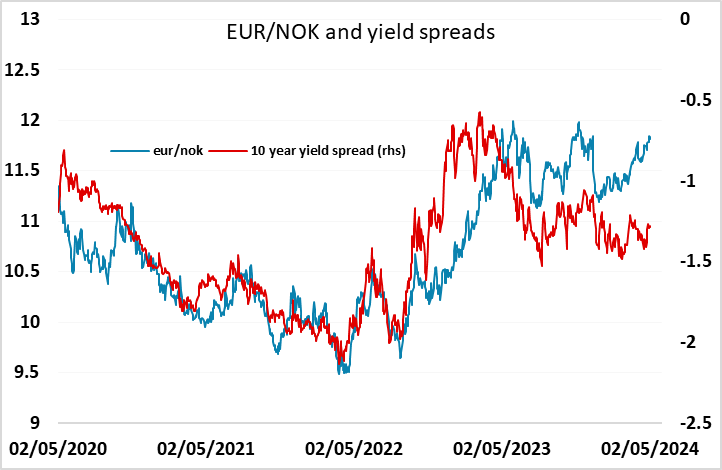

Ahead of the US data there is Norges Bank meeting. There is no expectation of any change in policy, with all 30 of those surveyed expecting unchanged rates. The statement is likely to retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. Currently, the market is pricing around 21bps of easing by the end of the year, and this probably won’t change much on a near unchanged statement. But the NOK has been weak, with its weakness hard to justify by movements in yield spreads. To some extent this may reflect a long term valuation trade as the NOK has been highly valued for some time, and remains well above PPP against the EUR. However, with the ECB likely to ease more than Norges Bank this year, we see EUR/NOK near 12 as good value for NOK buyers.