This week's five highlights

FOMC Minutes Cautious Rather Than Hawkish

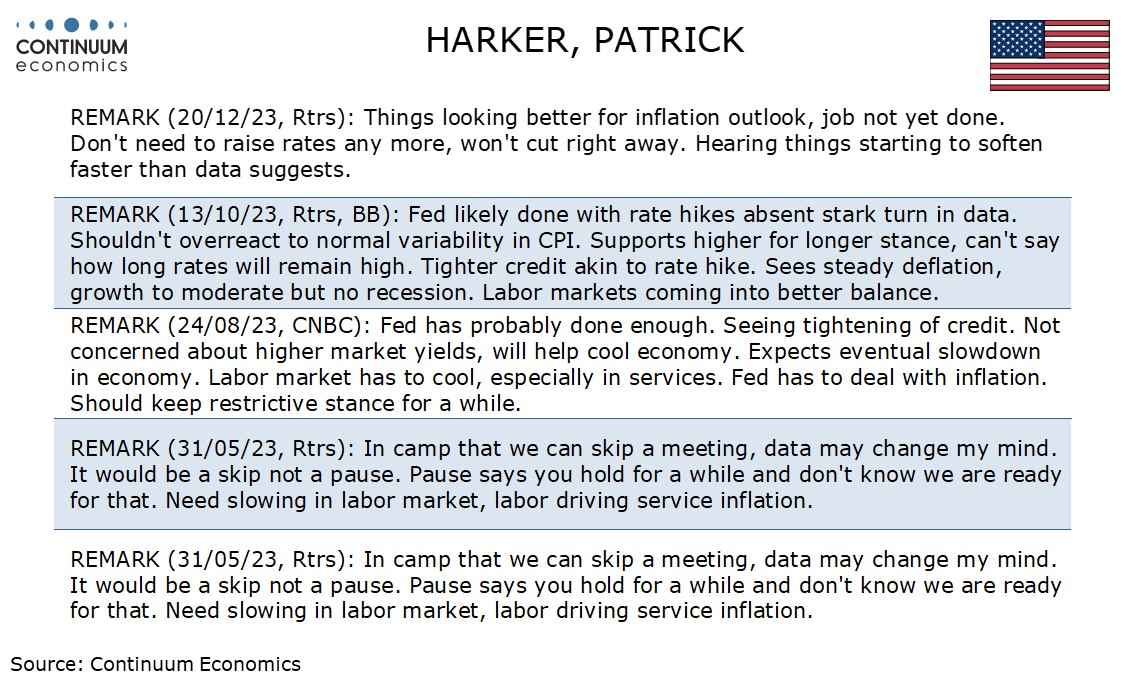

Confirmed by slate of Fed Speakers

USD/JPY Stand Above 150

ECB and its Assessment Price Persistence

China Yuan Outflow Fears Versus Net Exports

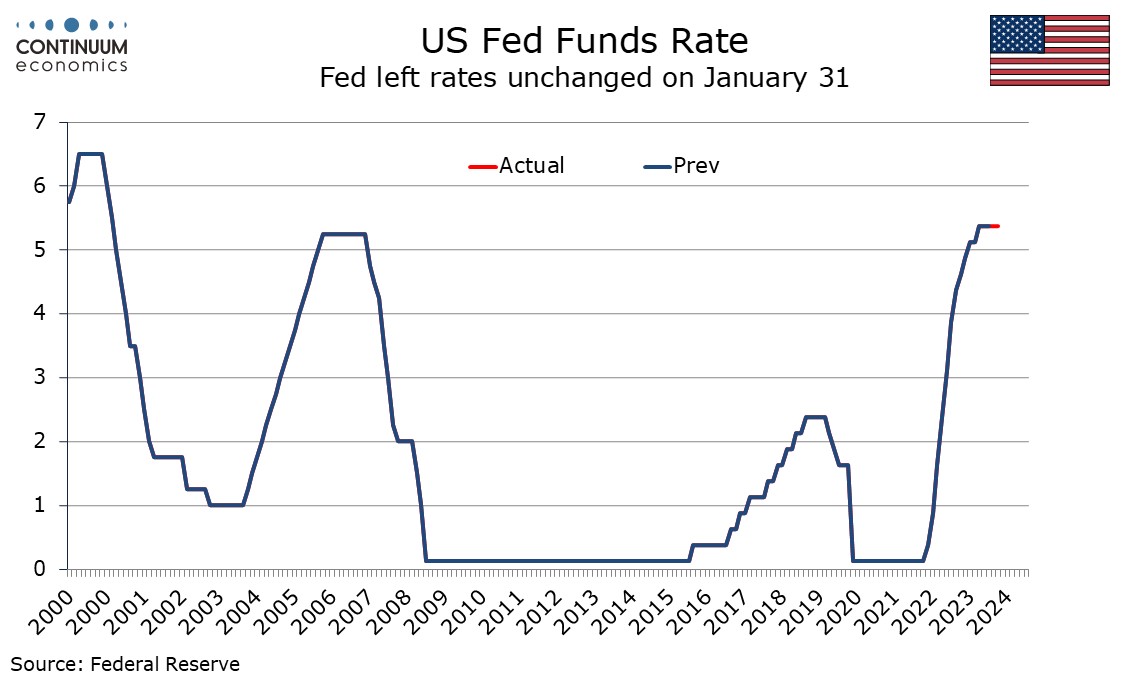

We see the FOMC minutes from January 31 as cautious rather than hawkish, with most noting the risks of easing to quickly, but the strength of Q4’s GDP data seemed to be causing only limited concerns. The discussion took place before strong January non-farm payroll and CPI data were visible. The latter in particular justifies continued Fed caution.

Participants saw the current policy rate as likely to be the peak and there was no sign that any were seriously considering the possibility of further tightening. Lower inflation and growing signs of supply and demand moving into a better balance were noted. However greater confidence that inflation was moving sustainably towards 2% was seen as necessary before easing. Most noted the risks of moving too quickly while only a couple pointed to downside risks of maintaining an overly restrictive stance for too long. The former camp appears to be a comfortable majority.

Stronger than expected Q4 GDP data was however downplayed, seen as boosted by inventories and net exports which are volatile and carry little signal for future growth. That consumer spending had been stronger than expected was noted but a number expected slowing in 2024 as labor income slowed and savings built up during the pandemic diminished. Some signs of stress for lower income consumers were noted. In looking at risks to inflation the potential for both stronger and weaker than expected demand were noted, as well as both less restrictive and persistently restrictive financial conditions, leaving a balanced tone. Upside risks to inflation were seen as having diminished but some noted that progress could stall.

Many participants suggested it would be appropriate to begin in-depth discussions of balance sheet issues at the next meeting, some feeling that given uncertainty over the ample level of reserves slowing the pace of runoff would smooth the transition or allow runoff to continue for longer. A few noted balance sheet runoff could continue after easing begins. However slowing the pace of runoff looks likely this year.

With Fed speakers pushing back early rate cut, it looks like the path with less resistance for the USD will be north bound. Within this week, we have heard from Japan Finance Minister Suzuki and BoJ officials that they are closely watching FX level but they do not sound like they are overly concerned about current JPY weakness nor ready to intervene. To the contrary, the tone in their remark seems to suggest they would allow the USD/JPY to go further higher as long as it is not a sharp spike. And for their defense, Ueda did mention trend inflation in Japan is approaching BoJ's target and monetary policy should be adjusting accordingly, which justifies their inaction in JPY as the currency should naturally strengthens with ultra-loose easing ends.

On the chart, the pair is firmer in consolidation above the 150.00 level to approach the 150.88 high. However, mixed daily studies suggest further ranging action below this. Break above this and the 151.00 level will further extend gains from the December low and see scope to retest the 151.91/151.94, the 2023 and 2022 year highs. Meanwhile, support at the 150.00/149.50 area now underpin and break here needed to trigger deeper correction to the strong support at the 149.00/148.80, congestion and January high. This is seen protecting the downside and only break here will fade the upside pressure and see deeper pullback to retrace gains from the late-December low.

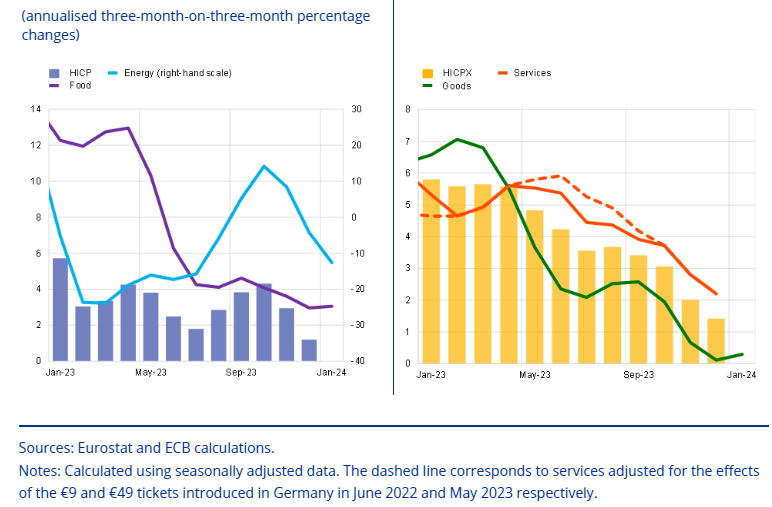

Figure: ECB Uses Adjusted Short-term HICP data to Assess Price Momentum?

The ECB remit is targeting an inflation rate of 2% over the medium term. Implicit in this is that this is measured on a moving y/y basis. However, there is nothing sacrosanct in this as the ECB is starting to be more open about using shorter-term measures, albeit more as indicators of price momentum (Figure). Regardless, there is also (very much among the more hawkish ECB Council members) a continued explicit focus on the breakdown of overall y/y inflation, even though this is not consistent with the actual remit. In particular, these is a concern that services inflation is still too high and indicative of persistent price pressures. We would argue that recent services inflation is actually running at an underlying rate of half the 4% y/y measure and is thus back in line with its long-term pre-pandemic average. This is backed up by the ECB’s own price persistent measures which have fallen clearly and rapidly below 2% of late and are also running close to the pre-pandemic average (Figure 3). All of which are issues that are fueling a clearer debate within the ECB and one that we feel will lead to the start of official rate cuts by June if not sooner.

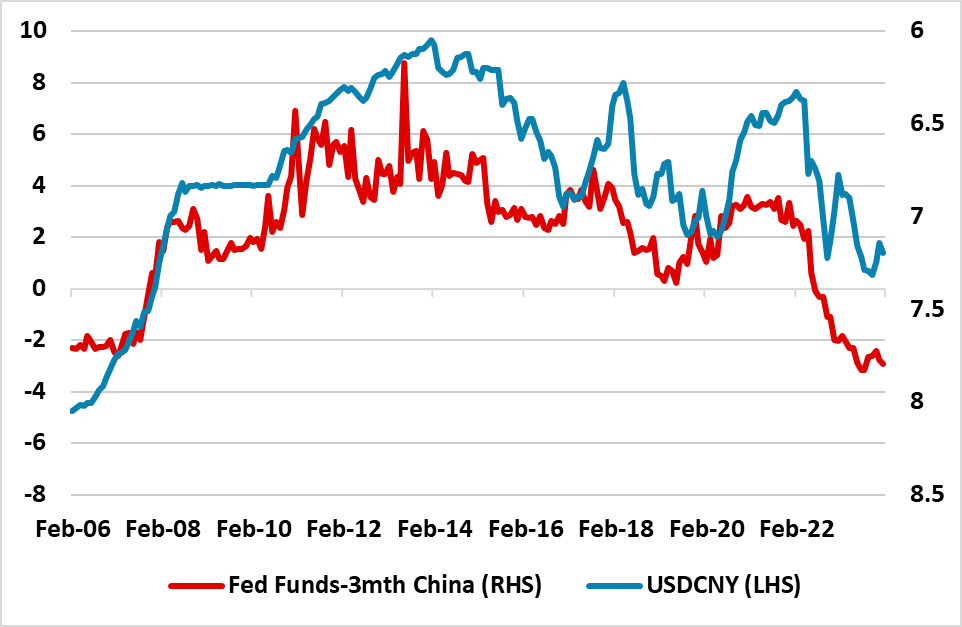

Figure: USDCNY and Fed Funds-3mth China Interbank Rate (%)

Despite a still overvalued Yuan, China authorities are reluctant to accept too much Yuan weakness for fear of causing domestic capital outflows and discontent with China’s government. At some stage, if GDP growth surprises on the downside, China authorities could decide that a controlled Yuan decline could be more important from a net export viewpoint – especially as inflation fears are not a worry.

China authorities remain concerned that adverse interest rate differentials versus the U.S. could not only cause Yuan weakness but accelerate capital outflows. The decision to aggressively cut the 5yr loan prime rate by 25bps (here), despite no cut in the PBOC key 1yr medium-term facility rate is a balancing act to avoid fuelling Yuan weakness. One concern is that cuts in short-dates at the time of still high U.S. interest rates could prompt the Yuan to fall to 7.50. However, perhaps greater is concern that domestic residents could try to circumvent capital controls more aggressively, if they see too weak a Yuan.

Though China authorities are avoiding too large a decline in the Yuan for now, this policy means that China competitiveness is not the best. Looking at the real effective exchange rate (Figure 2) shows that the Yuan is overvalued, despite falling from the 2022 peak. Negative inflation in China versus moderate inflation elsewhere also mean that the real exchange appreciates if the nominal value of the Yuan is steady.