FX Daily Strategy: Asia, March 5th

Weak risk sentiment dominated on Tuesday

US data will need to be better than expected to slow risk decline

AUD needs good GDP numbers to prevent further losses

JPY remains the most attractive currency based on yield spreads and value

Weak risk sentiment dominated on Tuesday

US data will need to be better than expected to slow risk decline

AUD needs good GDP numbers to prevent further losses

JPY remains the most attractive currency based on yield spreads and value

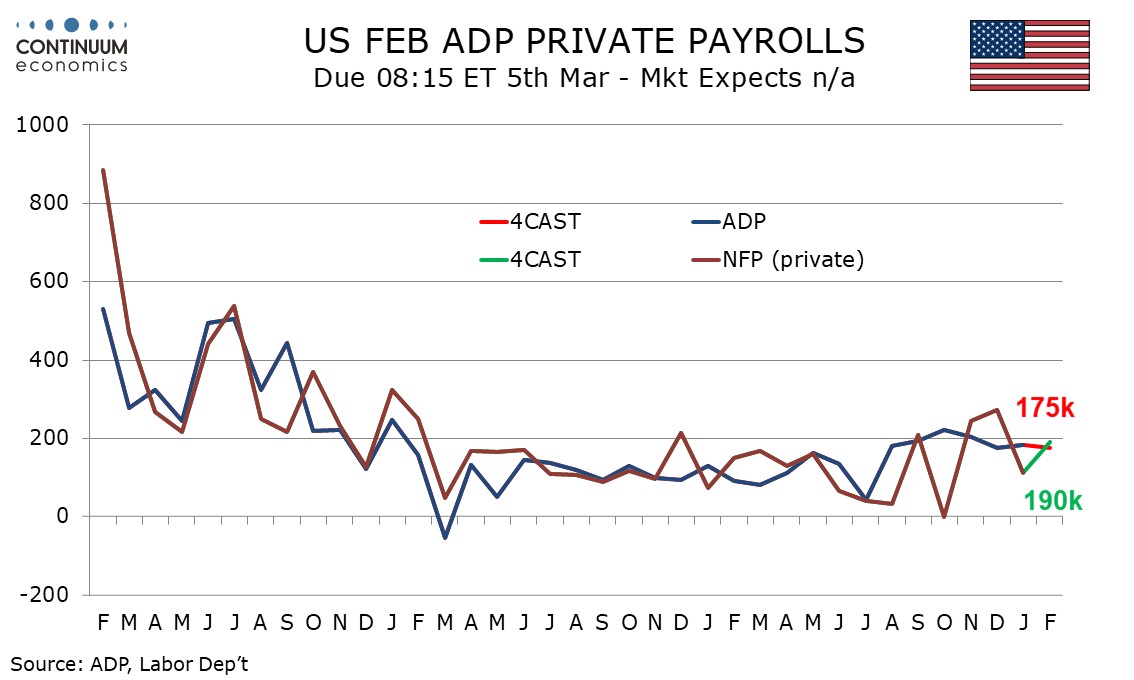

With risk assets generally under pressure, Wednesday’s US data will be more important than usual. Data is always backward looking to some extent, and doesn’t fully address the issues around confidence created by the Trump tariff policies. But the ADP employment data will be watched for any indication that the employment picture was weakening before the latest hit to confidence, while the ISM services index may well pick up some pat of the current concerns around the US economy.

We expect a 175k increase in Februarys ADP estimate for private sector employment growth, similar to January’s 193k and December’s 176k. This is slightly lower than our 190k forecast for private sector non-farm payrolls. We expect overall payrolls including government to rise by 210k. Our forecast is considerably stronger than the 144k expected by the consensus, and although the market doesn’t take ADP too seriously given its variable relationship with the official employment numbers, this might serve to calm market fears slightly in early US trading.

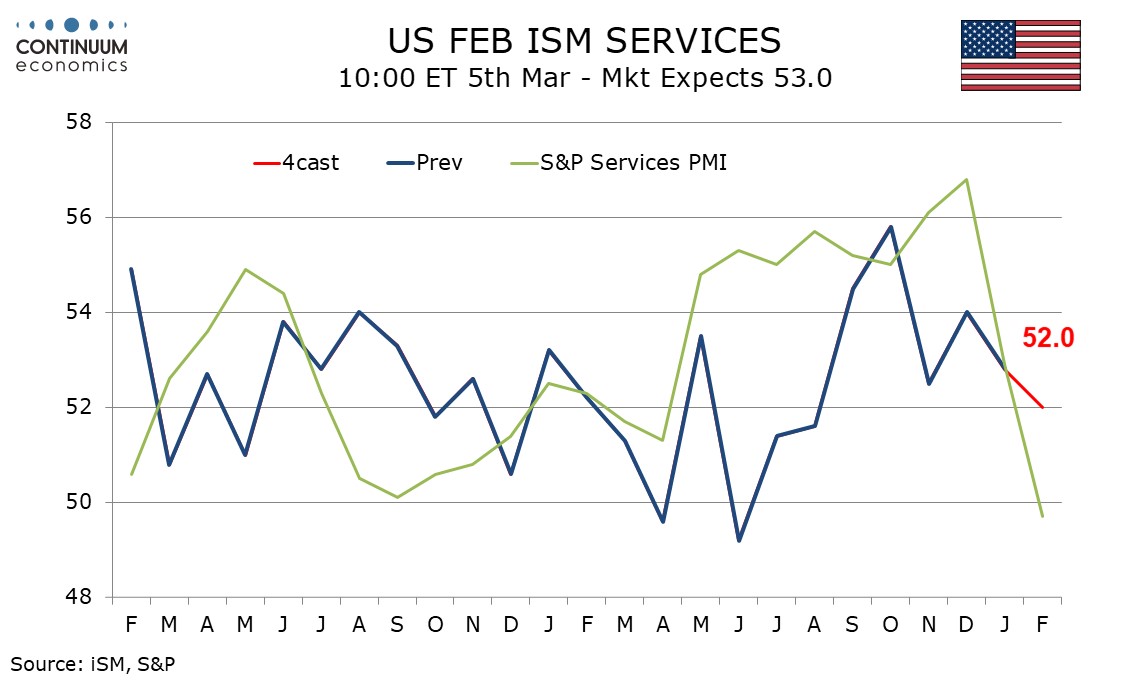

However, we expect February’s ISM services index to slip to 52.0 from 52.8 in January, moving the index to its lowest since August 2024, albeit showing more resilience than the S and P services PMI which slipped below the neutral 50 level. In the ISM services breakdown, we expect a correction higher in new orders after a significant January weakening but modest slowings in the other three contributors to the composite, business activity, employment and deliveries. Although our forecast is less weak than the S and P PMI index might suggest, it is still weaker than the market consensus, so is unlikely to improve market sentiment and may resume the downward pressure on the USD and equities.

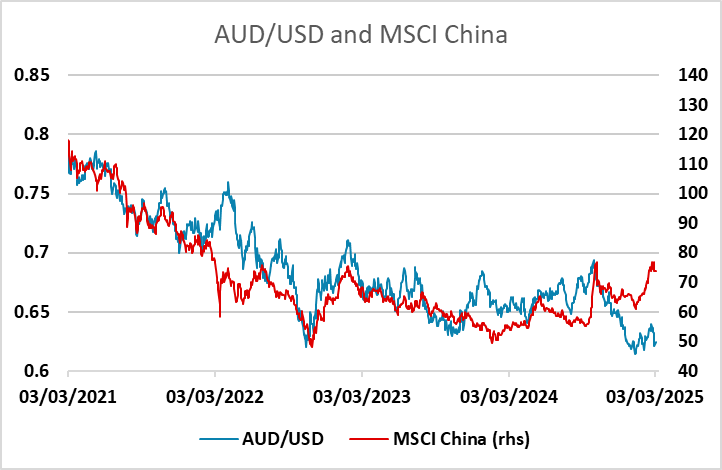

Ahead of the US data there is Q4 Australian GDP data. The AUD suffered from the general risk negative tone seen on Tuesday, losing ground against the USD and on the crosses, and continues to be driven primarily by risk sentiment. However, if the Australian GDP data is at or above the 0.5% q/q gain expected by the consensus, it may prevent any further substantial AUD decline. There should be solid support for the AUD below 0.62, so unless we see a more aggressive equity sell off on Wednesday, the AUD may hold its own against the USD.

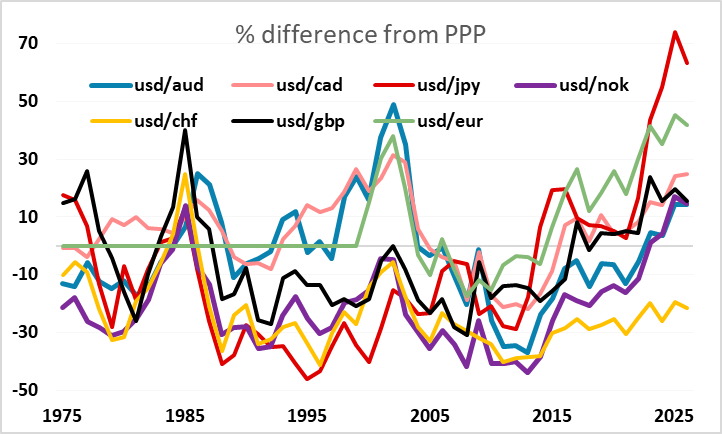

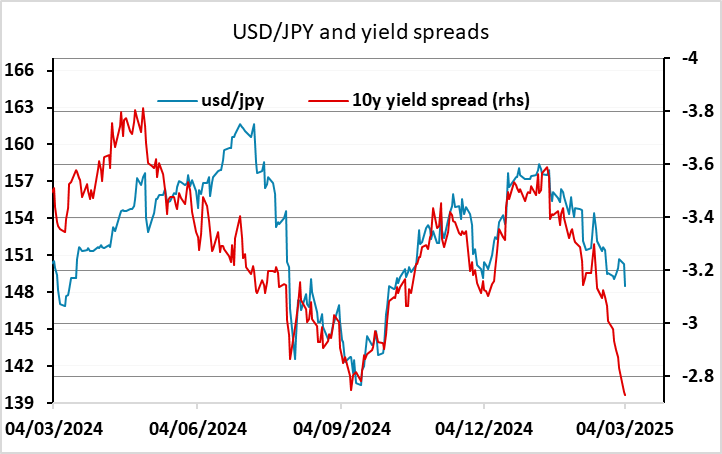

The JPY and CHF were the biggest beneficiaries of the risk sell off on Tuesday, as is usually the case, and we see potential for more JPY gains from here. This partly relates to the declining yield spread in the USD’s favour, partly to the very low JPY valuation, which has been highlighted by Trump’s latest comments about the weakness of the currency. There is no such valuation issue for the CHF, which remains the most highly valued currency around relative to PPP, and is the only one of the G10 currencies that trades above its PPP level against the USD. There should therefore be more scope for JPY gains than CHF gains from here. Swiss CPI data early on in the European session could also affect things, but the risk tone is likely to dominate.r JPY tone, but the risks of a sharp JPY upmove are increasing.