U.S. June Personal Income and Spending - Core PCE Prices acceptably subdued, Income underperforming Spending

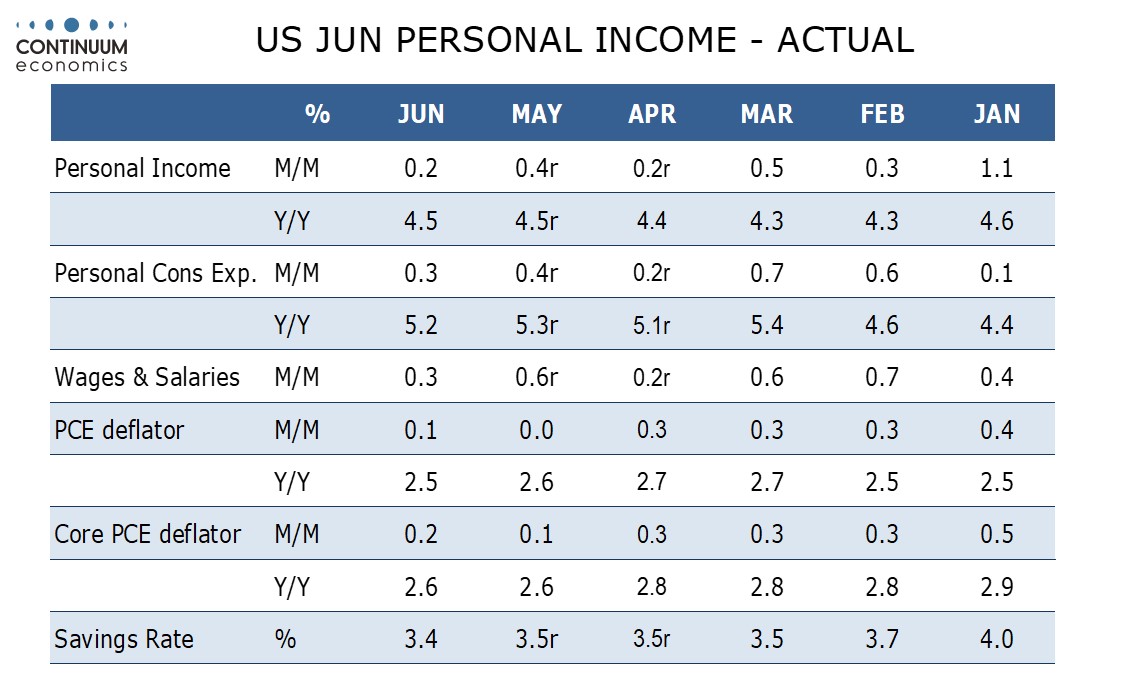

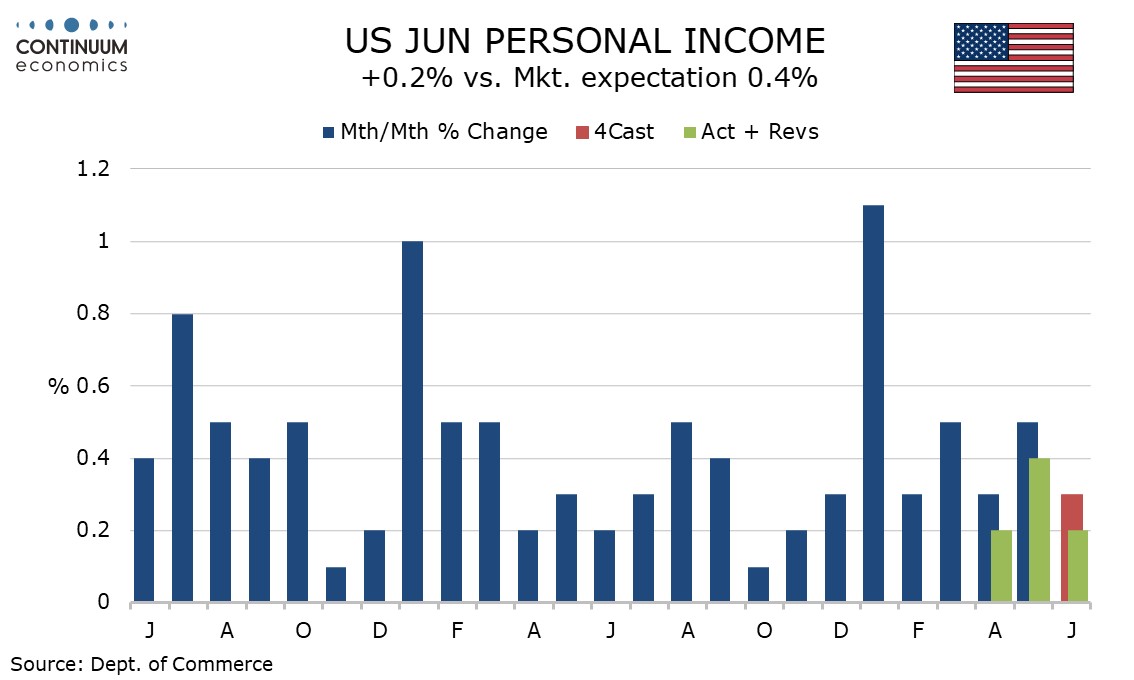

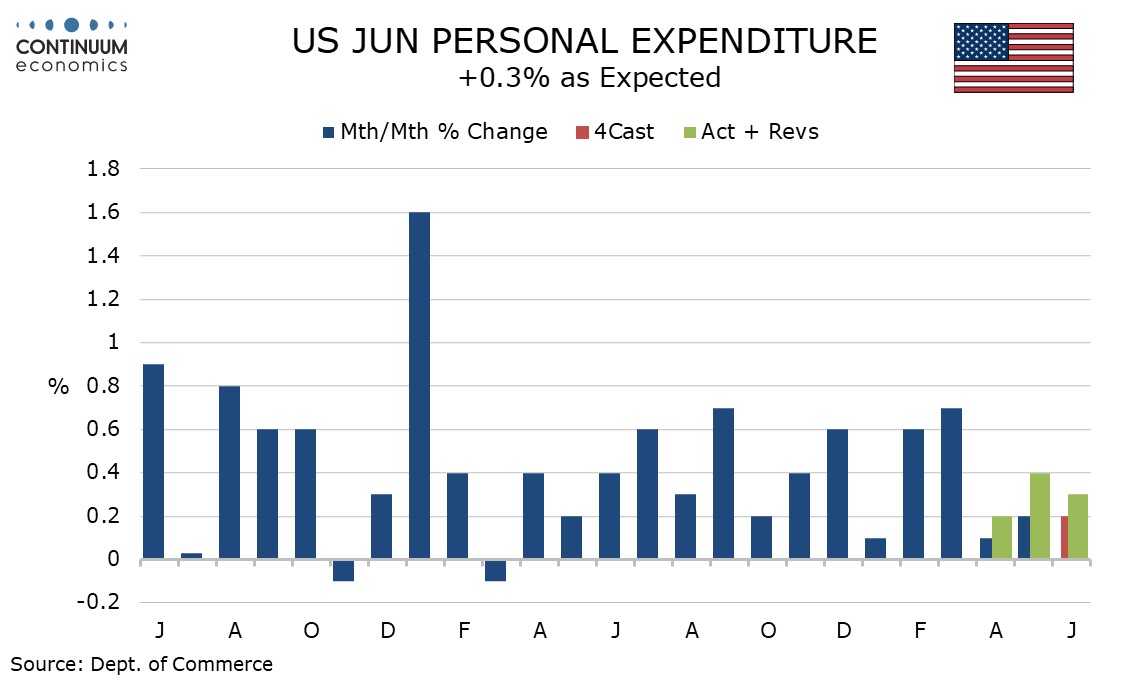

June’s personal income and spending report is largely old news, with Q2 totals seen in the GDP detail. In Q2 income surprised on the downside but spending and PCE prices surprised on the upside. For prices and spending the Q2 surprise came more in back month revisions than June data. For income the Q2 surprise came from a mix of a weak June and negative revisions.

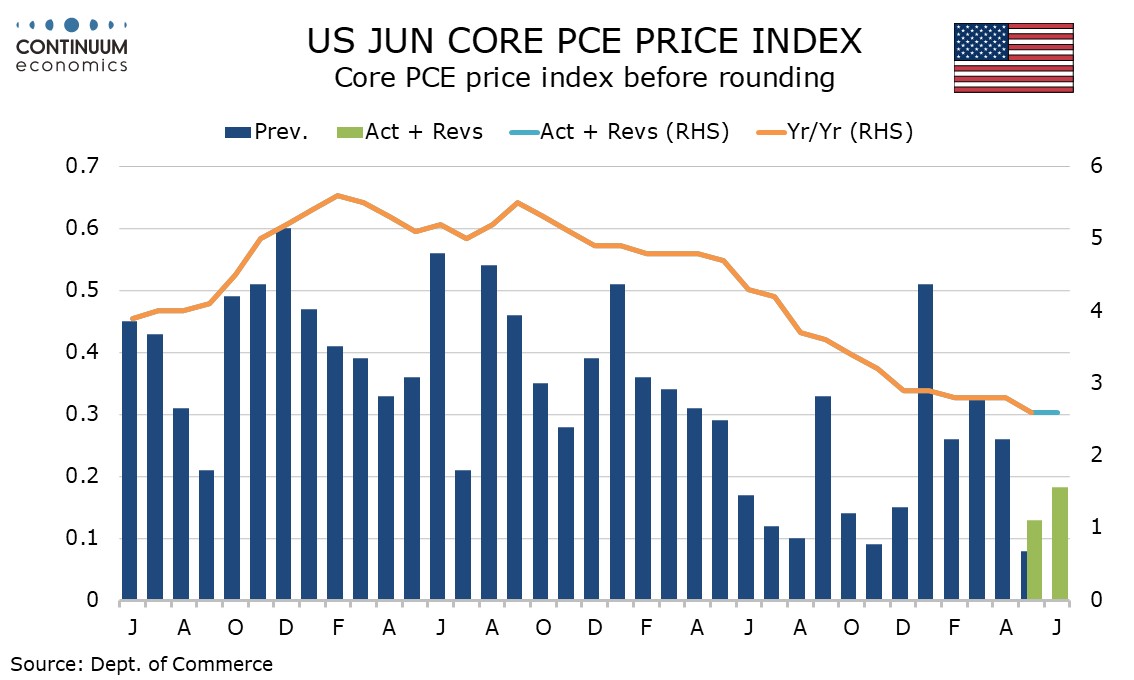

June’s core PCE price index rose by 0.2% (0.182% before rounding) which is in line with expectations and acceptably subdued, but still stronger than the June core CPI which was rounded up to 0.1%. May core PCE prices remain at 0.1% underperforming a 0.2% May core CPI but the firmer were revised up to 0.13% from 0.08%. April core PCE prices were unrevised at 0.26%.

This means we have had two straight acceptably subdued core PCE price indices after a strong first four months of the year, not yet enough for the Fed to declare victory. Yr/yr growth remains at 2.6%, still above target but no longer sharply. Overall PCE prices rose by an as expected 0.1% on the month with yr/yr growth slowing to 2.5% from 2.6%.

Personal spending rose by an as expected 0.3% with May revised to 0.4% from 0.2% and April revised to 0.2% from 0.1%. The spending gain came largely from services which rose by 0.4% in nominal terms and 0.2% in real terms. Retail data showed durables down by 0.2% and non-durables up by 0.2%, with real durables also down by 0.2% but real non-durables up by 0.5%.

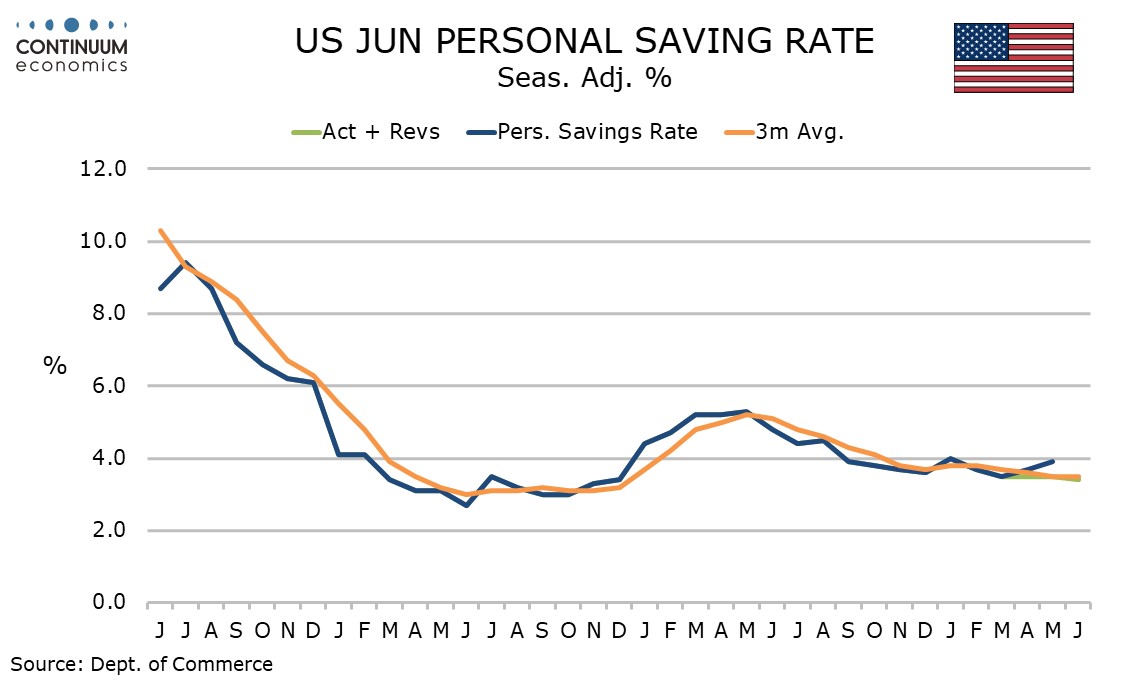

Income significantly underperformed spending in Q2 and the savings rate is down to 3.4%, its lowest since December 2022 when consumers still had accumulated savings during the pandemic to call upon. Now real disposable income, up only 1.0% yr/yr, does not look supportive for the spending outlook. Recent strength in equities is however probably supporting spending currently.